Today we’re going to show you what to expect during JP Morgan interviews, and what you should do to prepare.

The information in this guide is based on an analysis of over 100 JP Morgan interview reports (from real candidates for analyst roles), which were recorded between 2016-2021.

And here’s one of the first things you’ll want to know:

JP Morgan heavily emphasizes “behavioral” questions (as do Goldman Sachs and Morgan Stanley). So, if you want to prioritize your preparation, then you’ll want to pay close attention to the questions section below.

Let’s get started.

1. Interview process and timeline

Want to get more interviews? Click here for a 1-to-1 resume review with an ex-investment banker from JP Morgan, Goldman Sachs,etc

Here we’ll cover what you can expect at each stage of JP Morgan's application process. In this article, we’ll focus primarily on investment banking (IBD) roles, but the below process likely has some overlap with the steps for other roles.

The interview process at JP Morgan typically takes around 4 weeks to complete, but it can often take 2 months or even longer, so be prepared for an extensive process.

Let’s begin with an overview of each step you’ll encounter, then we’ll dig deeper into each one.

1.1 What interviews to expect

Whether applying for a full-time position or an internship program, JP Morgan candidates will typically go through 4 steps:

- Application and resume

- Pymetrics test (~30min)

- HireVue interview (~20min )

- Final-round interviews / Superday

1.1.1 Application and resume

There are three main ways that the JP Morgan interview process will begin:

- You’ll apply on their website

- You’ll apply through an event or career fair

- A recruiter will reach out to you

Regardless of which of these starts your application journey, you’ll want to be ready with a polished resume that is targeted to JP Morgan.

If you'd like expert feedback on your resume, you can get help from our team of ex-investment bankers, who will cover what achievements to focus on (or ignore), how to fine tune your bullet points, and more.

It’s also important to spend some time learning about the specific division within JP Morgan where you intend to apply. If you don’t have a clear perspective on the division where you want to work within the company, then this can be a red flag for recruiters.

You should also understand the teams that exist within your target division. This will demonstrate that you’re highly motivated and familiar with how the firm operates.

If you really want to get your foot in the door, another way to set yourself apart is by attending career fairs or events hosted by JP Morgan. Try to make genuine connections with people from the company. Then, when you go to apply, specifically name drop the people you’ve met in your cover letter. You could even write in a quote you heard from them, or mention what you learned from them about the company.

1.1.2 Pymetrics test

If your application meets JP Morgan’s basic requirements, you’ll receive an email to complete an online "Pymetrics" test (note: if you’re an experienced hire, expect to be invited to some video-call interviews without having to go through Pymetrics or HireVue).

The Pymetrics test aims to measure your “cognitive, social, and behavioral attributes.” It does this by giving you 12 “games” to play, each taking a couple of minutes to complete. You’ll be assessed on 90 different character traits, and afterwards you’ll receive a report on what your natural strengths and talents are.

As soon as you’ve completed the Pymetrics test, regardless of your performance, you’ll receive an email inviting you to the next stage: the HireVue interview.

Be aware that once you take the Pymetrics test, you can’t take it again for another year. If you apply to another company and they also use Pymetrics, they’ll be given your score from the test you’ve already taken.

1.1.3 HireVue video interview

Soon after you’ve taken the Pymetrics test, you’ll receive an email inviting you to a HireVue video interview. We've actually written a detailed guide on this topic, so feel free to check out our JPM Hirevue interview guide. We'll also provide a summary of Hirevue below:

HireVue is a digital tool that allows you to record your responses to a series of interview questions, without having an interviewer on the other side of the camera. You’ll be asked 3-5 questions during the interview. For each question, you’ll have a few moments to prepare your answer, and then you’ll have a time limit of 2-3 minutes to give your answer on camera.

You’ll only be allowed one opportunity to re-record each answer, so we’d recommend preparing answers to common questions in advance. You can get started with the example questions listed later in this article. You can also take unlimited practice questions within HireVue before starting your actual interview, which we strongly encourage you to do.

Most JP Morgan candidates say they faced the following types of questions in the Hirevue:

- One question about their motivations (e.g “Why JP Morgan?” or “Why investment banking?”)

- One behavioral question (e.g “Provide an example of when you sought out relevant information and used it to develop a plan of action”)

- One question about current economic affairs (e.g "What business deal in the news has interested you recently?”).

We'll go deeper into the questions you'll face in section 2.

For more information and company-specific insights, check out our detailed guide on investment banking HireVue interviews.

1.1.4 Final-round interviews / Superday

If you do well enough in the Pymetrics test and HireVue interview, you’ll be invited to a final round of interviews.

For entry level positions at the firm (internships and graduate hires) this may take the form of a “Superday” (or Assessment Centre in the UK). This is where a large number of candidates spend the day interviewing at a JP Morgan office or a conference center, although due to COVID-19 this is now normally done on Zoom. Each interview should last around 30 minutes, and you'll face at least two interviewers in each.

If you’re a more experienced hire, you probably won’t be invited to a Superday. Instead, your final-round interview will consist of at least 3 back-to-back interviews with JP Morgan team members of varying seniority. Each interview should last around 30 minutes.

Learn more in our IB Superday interview guide.

Now that you know what to expect from the interview process, let's take a look at the kind of questions you'll need to answer.

2. Question types

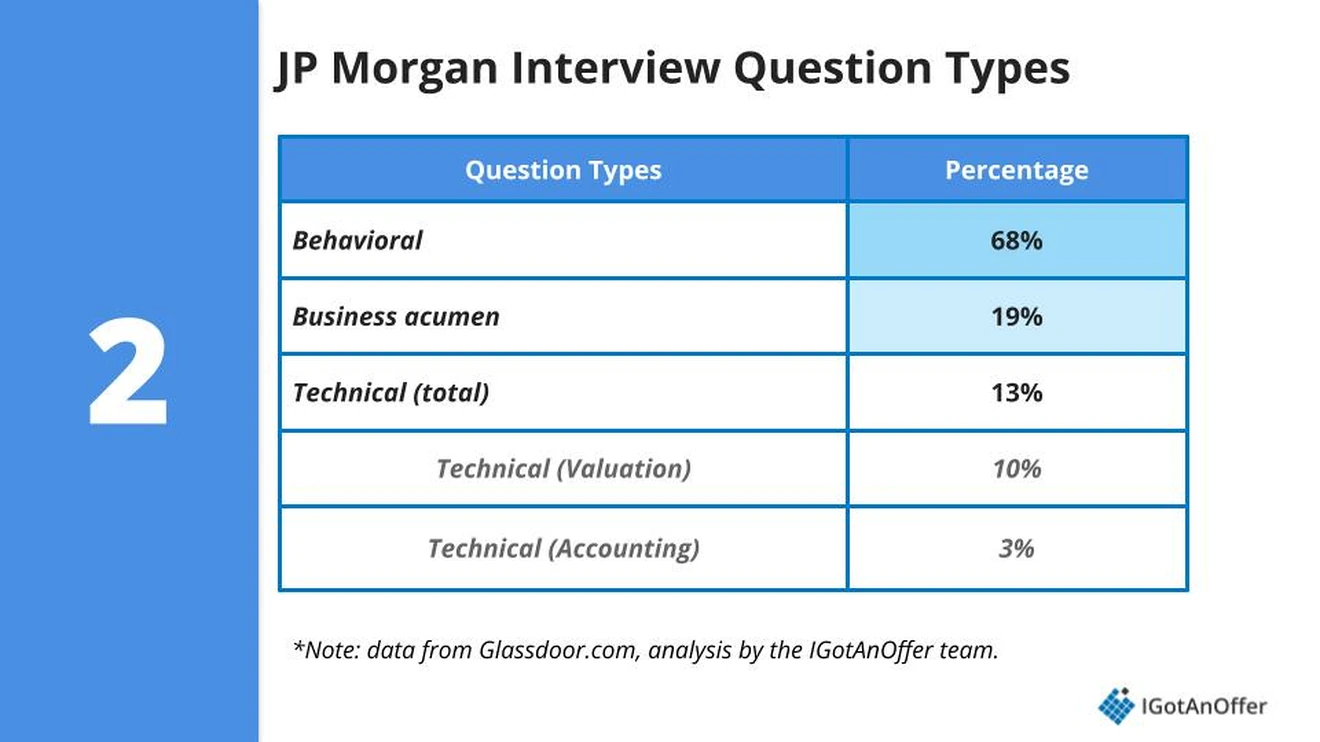

During the interview process at JP Morgan, you’ll face the following question types:

- Behavioral

- Business sense

- Technical

- Valuation

- Accounting

However, some of these questions are asked more frequently than others. Here’s a summary of the data:

As you can see, behavioral questions are by far the most common, so we’ll cover that category next.

Below, we’ve curated a list of practice questions for each question type.

Note: The questions below were originally posted on Glassdoor, but we have improved the grammar or phrasing in some places to make them easier to understand.

2.1 Behavioral questions [69% of questions]

Behavioral questions focus on your motivation for applying to the position, your resume, and scenario based questions (e.g. “Tell me about a time…”).

Below is a list of behavioral interview questions that have been asked in JP Morgan investment banking interviews in the last few years. These are excellent questions to practice with because many of the same questions tend to come up repeatedly.

You’ll want to pay special attention to the first three questions (bolded below), because they are extremely common. You should definitely have an answer prepared for each of them before your interview.

Example behavioral questions at JP Morgan

-

Why do you want to work in investment banking?

-

Tell me about yourself

-

Walk me through your resume

-

What's your career plan within five years?

-

Why are you a good fit for this position?

-

What’s one of your biggest weaknesses?

-

What is the biggest challenge you have faced, and how has that made you a better person?

-

Tell me about a recent achievement

-

Tell me about a time you worked in a team

-

What would your co-workers say about you?

-

Provide an example on when you sought out relevant information and used it to develop a plan of action

-

Tell me about a time when you encountered a difficult client and describe how you handled the situation

-

Tell me about a time during which you had a positive impact on a project, and how did you measure your success?

-

Name a time you had to make a quick decision, then describe your thought process and what the final decision was

-

Make a sales pitch for something you're interested in

For a complete list of practice questions, including sample answers and an answer framework, take a look at our guide to JP Morgan behavioral interview questions. If you’re applying to other firms, you can also refer to our investment banking behavioral & fit interview guide, which includes the top 14 most commonly asked questions.

2.2 Business sense [19% of questions]

The second type of questions you can expect to encounter during your JP Morgan interviews are business sense questions.

These questions cover a few different areas, but generally, these questions will be focused on assessing your industry knowledge and critical thinking skills.

To make it easier to organize your practice time, we’ve grouped the below questions into a few subcategories. You should be prepared to answer questions from each subcategory. And you can also learn more about this type of question in our separate business sense questions guide.

Example business sense questions asked at JP Morgan

1. Economy

- Tell us about a recent news story and why it sparked your attention

-

What is going on in the current market right now that has interested you and why?

-

What is the biggest challenge facing the financial market in the next 5 years?

-

What current issues will affect the sustainability of investments in future

-

How will the bond market react to the interest rate drop?

- What's your view on the European debt crises?

- What do you know about public finance?

2. Deals

- What deals has our group done that you liked and why?

- Tell me about a recent deal you've been paying attention to

3. Industry

-

What makes JP Morgan different from other banks and the financial industry as a whole?

-

What's the biggest threat to J.P. Morgan?

4. Investing

-

How would you compare X company with Y company (e.g. GE and GM)?

-

What interests you about IPO's?

- How many coins would fit in this room?

- How many cigarettes are sold in the US each year?

2.3 Technical questions [12% of questions]

Technical questions help your interviewers evaluate whether you have the knowledge and skills to perform on-the-job tasks.

These technical questions can be split into two main categories:

- Valuation

- Accounting

Valuation questions at JP Morgan focus on your ability to calculate the value of a business and your familiarity with DCFs, whereas accounting questions focus on your knowledge of financial statements and accounting principles. Valuation questions tend to be asked more frequently, but you should prepare for both.

Below is a list of example questions from each category for you to practice with. The questions in bold are extremely common, so you should have a strong answer prepared for them.

Example technical questions asked at JP Morgan

1. Valuation

- Walk me through a DCF

-

What are the ways to work out a company's value?

- Talk to me about some leverage ratios you may use to value the risk on the company's balance sheet

- Value Airbnb using DCF, LBO, and Comps

- When would you not use a DCF to evaluate a company?

- How would a DCF change for a company in the biotechnology space?

- How do interest rate changes transmit to corporate balance sheets?

- Walk me through a depreciation expense, in year 0 and then in year 1, of a $100,000 purchase of a building

- A shoemaker in New York makes shoes for his clients. Give me your scenario of his balance sheet this season. Now link his balance sheet, income statement, and cash flows together.

You can learn more about common technical questions in our technical questions guide, and you can also find helpful summaries in our investment banking interview cheat sheet.

If you want more practice specifically with accounting questions, we also recommend checking out our investment banking interview accounting questions guide. It includes a list of accounting questions from top firms, along with sample answers and expert tips to help you structure strong responses.

3. How to prepare

Before you spend weeks (or months) preparing for JP Morgan interviews, you should pause for a moment to learn about the company’s culture.

This is important for two reasons.

First, it will help you to clarify whether JP Morgan is actually the right fit for you. JP Morgan is prestigious, so it can be tempting to apply without thinking more deeply. But, it's important to remember that the prestige of a job (by itself) won't make you happy in your day-to-day work. It's the type of work and the people you work with that will.

Second, having a clear understanding of JP Morgan’s culture will give you an edge in your interviews, because it will help you frame your skills and experiences to align with what the company values. In addition, you will almost definitely be asked about your specific motivations for applying to JP Morgan.

If you know any current or former JP Morgan employees, see if you can chat with them about the company’s culture for a few minutes. In addition, we would recommend checking out the following resources:

- Who we are (By JP Morgan)

- JP Morgan weekly brief (By JP Morgan)

- JP Morgan strategy teardown (by CB Insights)

Looking for more tips on how to set yourself apart in an investment banking interview? Take a look at our list of 15 essential IB interview tips.

3.2 Practice by yourself

As we mentioned above, you’ll face 3 main types of questions in your JP Morgan interviews: behavioral, technical, and business sense questions.

And you’re going to want to do specific preparation for each question type.

3.2.1 For behavioral questions

For behavioral questions, we recommend that you use a repeatable method for delivering your answers. You may have heard of the STAR method before, but we recommend a slightly different approach, which is explained in this guide.

Once you’ve learned a method for structuring your answers, we recommend that you practice answering all of the example questions we provided above and in our IB behavioral & fit interview questions guide.

It’s best to rehearse the answers to these questions out loud, so that you’ll get comfortable giving good, concise answers. It may feel weird to practice answering questions out loud without an interviewer across from you. But trust us, this will dramatically improve how you communicate your answers.

In addition, it’s helpful to prepare a few “stories” that highlight your past experiences and accomplishments, so that you have examples to use for unexpected interview questions. For example, if you have a good example of a time you handled a team conflict, rehearse this story, and you could potentially use it for a variety of different questions during your interviews.

3.2.2 For business sense questions

For business sense questions, there are a few different areas you’ll need to cover.

First, it’s important for you to be up to speed on current events related to JP Morgan, the investment banking industry, and the broader economy.

To help you stay current, we recommend developing a habit of reading the Investment Banking section of the Financial Times, which will give you the main news from the industry as well as frequent stories specifically on JP Morgan. For broader economic news, you can use your favorite news publication. If you don’t have one, consider giving The Economist a try.

To take this a step further, it’s a good exercise to “quiz” yourself on these current events by reframing them in the form of a question. For example, if you read a story about an M&A deal, ask yourself something like: “Is this really a good deal? Why?” We’d recommend that you analyze and develop an opinion on at least a couple of recent deals, because it’s likely to be useful during your interviews.

Finally, JP Morgan very occasionally also asks “estimation” questions, which test your math and critical thinking skills. This would be something like “how many golf balls would fit in a one gallon milk jug?” To prepare for this type of question, we recommend learning the approach covered in this market sizing guide.

And of course, practicing the above example questions (out loud) will go a long way in preparing you for your interviews.

3.2.3 For technical questions

For technical questions, we recommend that you start by brushing up on the key valuation and accounting concepts used in investment banking.

For valuation, we recommend reading Street of Wall’s valuation overview guide.

And for accounting concepts, we recommend using this free guide as a quick refresher and our IB accounting interview questions guide. Then, you can study accounting topics more deeply with this free course.

Once you’ve refreshed your memory on the fundamental concepts, then go ahead and practice with the technical questions we’ve provided above. Again, we’d recommend that you practice answering questions out loud, because this more closely replicates the conditions of a real interview.

For a high-level overview of the entire IB process, you can also check out our investment banking interview prep guide.

3.3 Practice with peers

Practicing by yourself is a critical step, but it will only take you so far.

One of the main challenges of interviewing at JP Morgan is communicating your answers in a way that is clear and leaves a strong impression.

As a result, we recommend that you also do some mock interviews. This is much closer to the real interview experience. Plus, the feedback you get from an interview partner could help you avoid mistakes that you wouldn’t notice on your own.

You can practice with a friend or family member to start. This will help you polish your “stories” and catch communication mistakes. However, if your interview partner isn’t familiar with investment banking interviews, then practicing with an ex-interviewer will give you an extra edge.

3.4 Practice with ex-interviewers

If you know someone who runs interviews at JP Morgan or another investment bank, then that’s amazing! They would be a great person to give you interview feedback.

But most of us don’t, and it can be REALLY tough to make a new connection with an investment banker. And even if you do have a good connection already, it might also be difficult to practice multiple hours with that person unless you know them extremely well.

Here's the good news. We want to help you make these connections. That’s why we've launched a coaching platform where you can find ex-interviewers at JP Morgan to practice with. Learn more and start scheduling sessions today.