Acceptance rates for investment banking jobs at top finance firms tend to fall under 2%. As you can imagine, it’s highly competitive, and most candidates don’t get past resume screening.

To increase your chances of getting to the interview stage, use this step-by-step guide on how to write a top investment banking resume or CV.

In this article, we offer tips and expert insights from investment banking recruiters, and show you 2 REAL examples of investment banking resumes that earned candidates offers at JP Morgan and Morgan Stanley.

Here’s an overview of what we’ll cover:

- 7 golden rules for investment banking resumes

- 6 key skills for your investment banking resume

- Examples of investment banking resumes

- Investment banking resume template

- How to write an investment banking resume that gets you into top finance firms (section-by-section)

Get expert feedback on your resume from investment banking ex-interviewers

1. 7 golden rules for investment banking resumes (from top recruiters) ↑

We asked James (investment banker and former hiring leader) and Harrshit (credit risk officer) what advice they'd give to someone writing a resume to get into top investment banking firms.

They've worked at top finance firms like Goldman Sachs and JP Morgan and helped plenty of people get job offers, so they know what they're talking about. Here’s what we learned from them:

Tip #1: Answer recruiters' questions immediately

Recruiters want to see if you meet job requirements within the first few seconds. There’s one thing that all recruiters want to know immediately: years of role-relevant experience.

So, if you're applying for an investment banking role, they'll want to see how many years of investment banking experience you already have. Make it easy for them by presenting your key information clearly, and make sure they don’t need to dig to find what they’re looking for.

To do this, you could include some bullet points with this key information at the top of your resume.

Tip #2: Avoid using design features

For finance roles, there is no upside to using a fancy resume design. It won't impress recruiters and, in a worst-case scenario, it could actually prevent your resume from being properly processed.

Design features like pictures, columns, and photos can prevent ATS (applicant tracking systems) from correctly scanning your resume.

You should also avoid including your photo in your resume because this goes against employment and discrimination laws in most countries. It’s also another potential problem for ATS systems.

Tip #3: Cut out all waffle

Recruiters see many resumes with sections for ‘personal statement’ or 'objective' at the top, which take up valuable space without saying much at all.

Resumes should be specific. Personal descriptions like “Experienced investment banker passionate about creating financial transformation” are subjective and don’t tell your recruiter anything.

Instead, be more specific. List quantifiable accomplishments, like how many years of experience you have or what projects you successfully executed in the past.

Tip #4: Start with strong verbs

To make those bullet points even stronger, "always start with strong action verbs: analyzed, modeled, executed, led, etc," says James. These verbs communicate the action you took to achieve your numbers and highlight the exact role you played in a project.

Tip #5: Tell a better story with numbers

This is worth repeating again and again: quantify your achievements. The most effective resumes are packed full of metrics that put achievements in context.

Harrshit’s advice is to “Think like a deal team—clear, concise, and ROI-focused in every bullet. Each bullet should show action, skill, and results in one punchy line. In banking, results speak louder than responsibilities. Let the results do the talking.”

So, if you’ve gotten great results in a past project, share your KPI metrics. Without numbers, your achievements are hard to evaluate.

Tip #6: Cover as much of your deal exposures as possible

Don’t be shy to show off as much of your work experience as possible, and be specific. Showing the breadth of your experience adds personality to your resume and gives recruiters a more vivid snapshot of your professional history.

And yes, this applies even to fresh graduates. James says, “Any deal or client exposure (even if you're an intern) should be included. Yes, even if all you did was prepare some slides for a deck, conduct diligence for a merger, crunch numbers on inbound deal flows, etc. Don't shoot yourself in the foot by copy-and-pasting the generic job description you applied for!”

Tip #7: Use the skills section to include keywords for your role

You don't want to jam your resume full of keywords just for the sake of using them. But with ATS being commonly used in the recruitment process, your resume should mention the skills, tools, and technologies relevant to your target role.

A ‘Skills’ section can help recruiters quickly see if you fit their requirements. It’s also a great way to get keywords into your resume, especially if the job you’re applying for requires experience in specific technologies or proficiency in foreign languages.

2. 6 key skills for your investment banking resume ↑

The specific skills you highlight will depend on the role and target firm. But across the board, top investment banking firms look for candidates who can combine intellectual rigor with soft skills and a strong work ethic to perform under pressure.

- Leadership skills: Even if you're not applying for a leadership role, recruiters and hiring managers want to see that you have what it takes to become a leader if you're not one already. If you haven’t got many strong examples from your work experience, try to find examples from personal projects or university (if recently graduated).

- Communication and interpersonal skills: Investment bankers often present complex findings to clients and senior leaders. Top firms often seek candidates with “strong verbal and written communication skills” in their job descriptions. Try to include experience working with cross-functional teams, leading presentations, or aligning different shareholders.

- Analytical and quantitative aptitude: Top banks expect analysts to interpret large datasets, evaluate trends, and back up strategic recommendations with numbers. Strong GPAs in quantitative disciplines, internships with data-heavy tasks, or experience in research or finance competitions can all demonstrate this ability on your resume. You can also make your resume data-driven by quantifying success on past projects with key metrics.

- Financial modeling and valuation: Financial modeling is a core skill for investment banking analysts, whether you’re building DCFs, LBOs, or M&A models. Investment bankers are often challenged to develop automated trading algorithms, solve complex business and client problems, and manage risk. They are also responsible for reviewing and validating models to ensure accuracy. Try to highlight specific examples where you built or worked on models with clear business outcomes.

- Technical proficiency: Proficiency in finance technologies is a must for investment banking roles. For example, a position may require you to use Excel or Google Sheets to build models, analyze financials, and prepare client materials. Proficiency in basic tools, like Google Suite and MS Office, is almost always a basic requirement across all banking roles. Familiarity with advanced tools like Bloomberg, Capital IQ, Python, or VBA can further set you apart.

- Strong and dedicated work ethic: Banking hours are notoriously long, and success often depends on your ability to thrive under pressure. Top firms expect you to be capable of managing high-stress, fast-paced environments. Show examples of how you delivered strong results on tight timelines or juggled competing priorities.

3. Two examples of investment banking resumes that worked for JP Morgan and Morgan Stanley ↑

Before we start guiding you on how to write your resume step-by-step, take a look at some real examples that got their owners interviews at top investment banking firms.

You'll notice they both follow different formats, and neither fully follows the guidelines we set out below in section 5. We think this shows two things:

- There are many acceptable ways to write a resume.

- Your resume doesn't have to be perfect, as long as it demonstrates your skills and achievements effectively.

Let's take a look.

3.1 Investment banking resume example 1 (JP Morgan)

The candidate, let's call him Harry, landed a role at JP Morgan as a recent graduate with this resume.

Here's our feedback on this resume:

- Experience: We had to blank them out, but Harry had interned and worked with some notable organizations in his country. Despite having held only two roles, he strengthens it by mentioning the prestigious recognitions and awards he achieved in each role.

- Quantifying impact: Harry frames his impact with real numbers. He specifies details like his high GPA and impressive student rankings, which immediately position him as a strong candidate.

- Leadership: Harry chose to dedicate a section of his resume specifically to ‘Positions of Responsibility’. This is a smart way to highlight his strong leadership skills, which makes him a more attractive candidate.

- Key skills: Harry lists his additional certifications and courses, which include tools like Bloomberg, which were likely listed as requirements in the job description.

3.2 Investment banking resume example 2 (Morgan Stanley)

The candidate, let's call him Alan, landed a role at Morgan Stanley with this resume.

Here's our feedback on this resume:

- Experience: We had to blank them out, but Alan had worked for some notable banks. He has also held managerial positions. This makes him a great candidate for more senior roles.

- Quantifying impact: Like Harry, Alan frames his impact with real numbers. He specifies details like the total valuation of notable transaction experiences, often in the millions and billions range.

- Soft skills: On top of specifying his numerical impact, Alan supports each role with additional bullet points titled ‘Other experience,’ which focus on his leadership and project management achievements. This shows his strong communication and teamwork skills.

- Key skills: In the last section of his resume, Alan includes a simple list of his relevant skills, including technical proficiencies, language proficiencies, and certifications. Many of these were likely requirements listed in the job description.

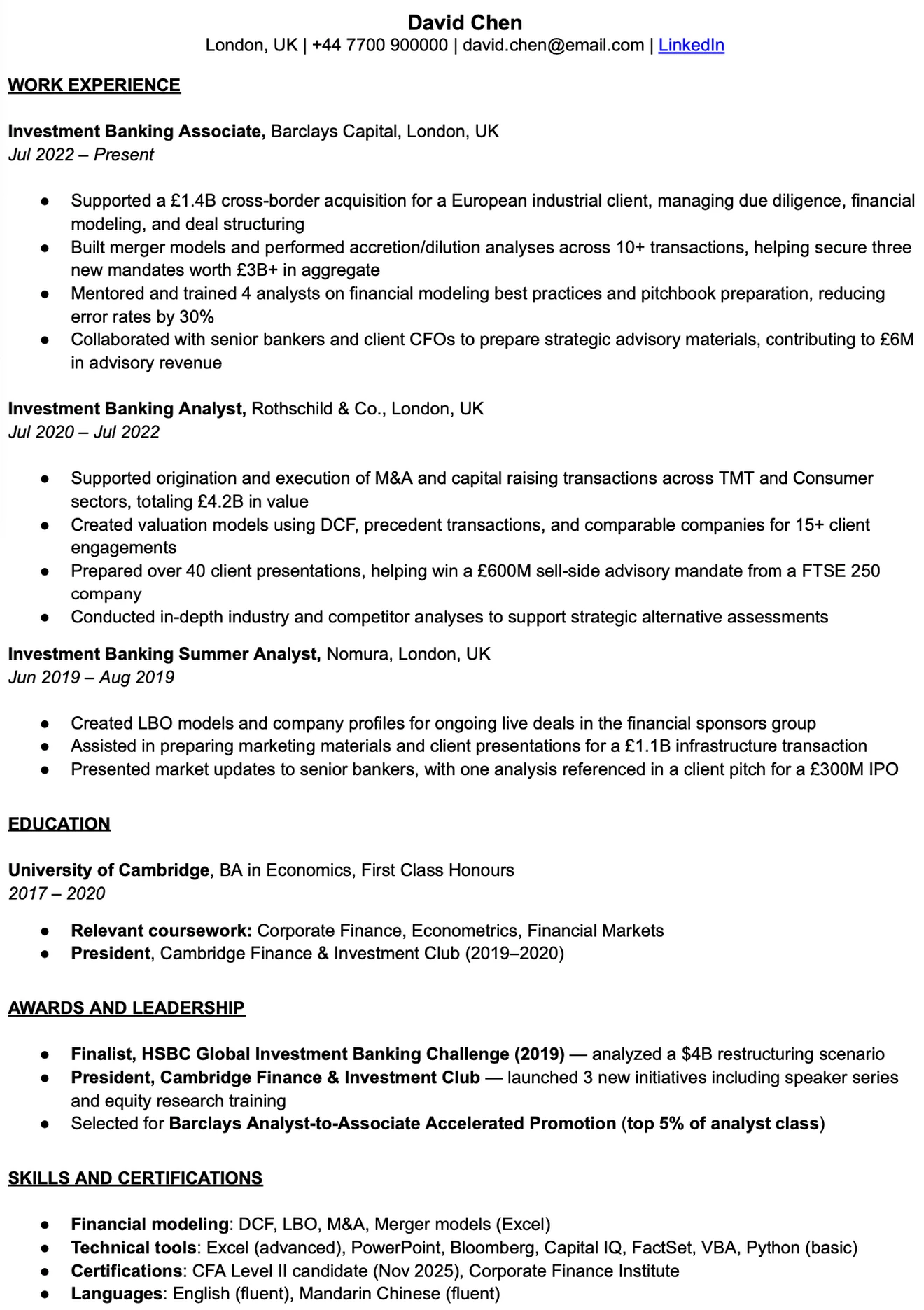

4. Investment banking resume template ↑

Unlike the examples listed above, this is not a real resume. Instead, it's an amalgamation of the high-quality resumes that candidates have shared with us before going on to work at JP Morgan, Goldman Sachs, etc.

It belongs to an imaginary mid-level investment banker named David Chen, but you can follow the overall structure no matter what you're role is.

Click here to download this investment banking resume template as a PDF.

Click here to open this investment banking resume template as a Google Doc.

Now, let’s take the first step in building an investment banking resume that's good enough to get into a top finance firm.

5. How to write an investment banking resume that gets you into a top finance firm (section-by-section) ↑

Now that you’ve seen examples of what you should be aiming for, plus some key tips, let’s go through the resume-building process step by step.

5.1 Study your target company and job descriptions

Before you start writing or editing your investment banking resume, start by doing some research. This will help steer you in the right direction for what your resume should look like.

First, find a job specification for your target role and read it thoroughly. Use it to shape your resume in the following ways:

- Identify the exact type of finance role you’re aiming for. Investment banking involves a range of roles across seniority levels, such as analysts, associates, VPs, directors, and managing directors.

- Figure out what type of profile the job description is looking for. Identify which skills are most crucial for the role. For investment banking roles, firms typically look for a background in the following areas: accounting, financial analysis, mergers and acquisitions, IPOs, valuations, and buy-side and sell-side research.

- Prepare to adapt your resume accordingly. Look into the keywords of the job description and, as much as possible, use them where they’re applicable. Suppose your previous jobs or internships are not directly related to investment banking. In that case, you can phrase your descriptions to highlight specific finance skills, such as leadership, problem-solving, a service mindset, client relationship management, and any technical expertise you may have, etc. The same goes for your extracurriculars.

- Zoom in on a few of the responsibilities in the job description that you think are most important. Search for specific examples from your past that demonstrate your experience in doing the same thing, or something very similar. Find the numbers to back it up where possible, so you’re ready to include this information in the work experience section later on.

- Take note of the language used in the job description. You can match specific verbs and phrases where you find them appropriate.

- Research the company. For example, imagine you’re targeting an investment banking role at Goldman Sachs. Goldman Sachs has 4 core values, as well as 14 business principles. These values are the foundation of the firm’s culture and articulate what it stands for. Make sure that your resume communicates the same values (or, at the very least, doesn’t contradict them). That could mean including a project in your resume that shows how you’ve "prioritized collaboration” or showing numbers that illustrate how you’ve “provided superior returns” for a shareholder in the past.

Does all this mean you’ll need a different iteration of your resume for every investment banker job you target? Ideally, yes. But there will be a lot of overlap, so you’ll typically only need one version that you can strategically edit for specific job applications later on.

We looked at some of the latest job postings on Goldman Sachs, JP Morgan, and Morgan Stanley, then aggregated the data to find the most common investment banker job requirements for top companies in recent years. Here’s what we found:

Minimum qualifications for investment banker jobs

- Bachelor’s (or in some cases, Master’s) degree in finance, economics, accounting, or a related field from a top-tier school. For example, Goldman Sachs lists a Master’s degree requirement for their Bangalore analyst program. JP Morgan postings consistently require at least a bachelor’s in finance, economics, accounting, or related disciplines.

- Strong academic performance, typically a GPA of 3.2 to 3.5 or higher. Candidates who exemplify intellectual rigor are often considered more desirable. They show a greater aptitude for hard work and consistent dedication, which are essential for demanding investment banking roles.

- Analytical and quantitative skills, ideally with excellent proficiency in Excel, PowerPoint, and Word.

- Relevant experience, such as prior internships or jobs in investment banking or similar finance roles. Work experience in a Big 4 firm is also an advantage.

- Excellent communication and interpersonal skills, both written and verbal. This is essential for interacting with senior bankers and clients.

Preferred qualifications for investment banker jobs

- Professional certifications are frequently listed as advantages. This includes certifications like Chartered Financial Analyst ("CFA"), Certified Public Accountant ("CPA"), and Chartered Accountant ("CA") designations.

- Multilingual ability is a plus and often preferred for regional roles. For example, JP Morgan requires English and Mandarin for certain regional openings and notes additional language skills as a plus.

- Prior investment banking or M&A-specific experience is often mentioned as preferred for higher-tier roles

Common responsibilities

- Financial modeling and valuation: Building DCF, LBO, M&A models, and projections, etc.

- Market and company research: Analyzing financial statements, sector trends, investment-grade deal flow, and thematic events to provide information to clients and internal teams

- Transaction support: Assisting in M&A deals, IPOs, debt issuance, pitchbook preparation, and deal execution

- Client and internal communication: Presenting findings, preparing client pitches that address capital needs, and coordinating across teams

- Collaboration and coordination: Maintaining direct dialogues with client coverage officers, debt and equity partners, the banking syndicate, risk, and legal teams; contributing to due diligence and execution flow

Key traits and soft skills

- Detail-oriented and deadline-driven: ability to manage high-pressure tasks with extreme precision

- High work ethic and resilience: comfortable with long hours and constant learning

- Team player with strong interpersonal skills: “likeability” plays a major role in team fit and retention

- Adaptability and fast learner: necessary for picking up new industries, tasks, and systems quickly

- Professional judgment and integrity: finance roles involve handling confidential and sensitive information

This list of requirements is a good base for your resume. You can later tweak the details based on the specific role you’re targeting.

Once you’re done with your research, let’s get into writing your investment banking resume.

5.2 Choose a design

The design of your resume should have one objective: to convey the right information in a way that is clear, easy to digest, and professional. Use our resume template, and you’ve already achieved that!

Most importantly, make your resume as short and concise as possible. If you’re a fresh graduate with no experience, keep it to one page only. Recruiters won’t have time to leaf through multiple pages when they’re looking through dozens, if not hundreds, of resumes.

Keep it clean, concise, and simple. You should also avoid placing your photo in your resume. It’s a potential problem for ATS, and goes against employment and discrimination laws in most countries.

5.3 Choose your sections

There are lots of ways to write a resume, and the exact sections you include are up to you. We recommend using the following sections for an investment banking resume because we know this approach works for firms like Goldman Sachs and JP Morgan.

- Personal information

- Work experience

- Education

- Awards and leadership

- Skills and certifications (can include courses, certificates, language skills, and technical proficiencies)

You may tweak the order. For example, if you’ve just graduated or have only a year of experience, you can start with your education section.

As for the layout of your resume, here are some best practices to keep in mind:

- Choose a simple, professional-looking font: Size 10-12, black and white. Arial, Calibri, and other plain sans serif or serif fonts are fine.

- Use bullet points: This makes it easier for recruiters to pick up relevant details at a glance. You don’t want to overwhelm your resume with blocks of text.

- Double-check for 100% neat and consistent formatting: Keep the bullet points and margins aligned. Apply font formatting (such as bolded letters) where it’s appropriate, but don’t overdo it.

- Save it as a PDF to make your resume look uniform on any device.

5.4 Start writing

The good news is that you don’t have to get your resume perfect the first time. A strong resume is usually rewritten and tweaked multiple times. Here’s a guide on how to write up each section:

5.4.1 Personal information

The purpose is not the place to try and impress recruiters. Its only purpose is to list your key basic personal details: full name, contact information, location, and your LinkedIn profile if you have one.

Keep the following best practices in mind when writing this section:

DO:

- Place this section at the top of your resume.

- Use a larger font for your name than for the rest of the section to make it stand out.

- Include your full name, email address, phone number, general location (city or country), and your LinkedIn profile if you have one.

- Use a neutral/professional email address. Keep your hilarious email address for friends and family.

- Double-check all your details before sending your resume, as you don’t want to risk missing a recruiter call because of typos.

DON'T:

- Include your street address–this may cause issues with data privacy laws; just your general region will do.

- Title the section or label each item, e.g. “email:”, “tel:”, etc. It’s obvious what they are, so save the space.

- Insert your headshot, date of birth, or gender unless specifically requested by the firm.

Once you’ve listed your basic key details, you can also include a short personal bio that summarizes your experience in a few sentences.

However, this portion is optional and not particularly important, especially if you have plenty of work experience and achievements to list in other sections. If you feel that including a personal statement will just take up unnecessary space, skip this part.

5.4.2 Work experience

This is probably the most important part of your resume to get right, but the easiest to get wrong. Many candidates think their work experience speaks for itself and will simply list their roles, with a few main responsibilities.

However, we recommend a much more powerful approach.

The work experience section should include previous work positions you’ve held, as well as your main achievements in these roles. Here are some more important points to help you put this section together.

Instead of simply listing your responsibilities per role, you need to talk about actions. This means starting each bullet point with an action verb. These verbs should relate to the key skills from section 2 that top firms look for in investment banking resumes (leadership, communication, financial modeling, analysis, etc). Each bullet should begin with relevant and powerful verbs, e.g., “Executed,” “Structured,” “Developed,” or “Conducted.”

Here are some examples of strong wording in bullet points:

- “Structured and executed M&A transactions valued at $500 M+”

- “Developed and pitched investment theses to senior management and clients…”

Choosing actions that are relevant to the essential finance skills will also mean that your resume contains the keywords that recruiters (and sometimes ATS) will be looking for.

Next, include numbers to show the scale and results of your work whenever possible. Quantifying results (like deal size, revenue growth, cost savings, or efficiency gains) makes your contributions more tangible.

For example, you might write something like:

- “Led financial modeling for a $500 million acquisition and boosted client revenue by 20%”

- “Conducted a comprehensive financial analysis for a $500 million merger, identifying key synergies that led to a projected 15 % increase in annual revenue”

- “Executed 10+ M&A transactions with an aggregate value of $2B+”

- “Developed models that increased deal profitability by 20%”

If your target role is multi-faceted, such as a managerial position, balance may also be an important consideration. If so, try to demonstrate a range of skills in this section. For instance, some bullet points can focus on leadership skills, and others focus on problem-solving results.

Finally, don’t be shy or humble in your ‘Work experience’ section. Now is not the time! Communicate your impact and be specific to make sure each bullet point counts.

DO:

- List previous roles in reverse chronological order (most recent first).

- Include key details like position title, firm, dates, and location.

- Limit details to 3-4 bullet points per role (each line should be 1-2 lines at most)

- Start with strong, industry-relevant action verbs. Use present tense verbs (e.g. "Lead, Coordinate, Execute") in your current position (except for completed achievements), and past tense verbs for past positions and completed achievements (e.g. "Led, Coordinated, Executed")

- Quantify results whenever possible, but don’t go overboard with numbers that could make it look like a math problem. It still needs to be easy to read.

- Study the language of the job description and match it where appropriate.

- Highlight technical and deal-specific skills

- Mirror keywords from job postings, but don’t include lots of buzzwords just for the sake of it.

- Maintain consistent tense, concise structure, and clarity

By following this structured, metrics-driven format, your ‘Work experience’ section will communicate both your technical abilities and real-world impact. Both are important to show recruiters that you have exactly what top firms are looking for.

5.4.3 Education

This section should be extremely concise and clear. Hopefully, your educational achievements can do the talking for you. All you can do here is present the necessary information with the right level of detail.

Follow the tips below to make sure you get it just right.

DO:

- Write a subsection for each degree, if you have multiple degrees (e.g., a BA and an MBA). Start with your highest level of education first (e.g,. your MBA).

- For each degree, include the name of the degree, university, and dates in the headline. If you’re a recent graduate, you can also list any subjects you’ve taken that are relevant to investment banking (e.g., accounting).

- List your grades (e.g,. GPA), as well as results of other standardized tests you’ve taken (e.g., SAT, GMAT, etc.) that demonstrate your intellect.

- Detail any awards and scholarships you received at the university level, and most importantl,y how competitive they were (e.g,. two awards for 1,000 students)

- If you don’t have much work experience, you might want to include positions of responsibility you’ve held at extracurricular organizations or extra courses/certifications.

DON'T:

- Include high school experience if you've already graduated

- Include your thesis or dissertation unless you're a fairly recent graduate, in which case you should summarize the topic in a way that's as easy to understand as possible.

Note that if you’re a recent graduate with internship experiences instead of relevant work experience, this section should follow the ‘Personal information’ section, and you may want to go into more detail. Otherwise, you can place this section after the ‘Work experience’ section.

5.4.4 Awards and leadership

The more experience you have, the easier it should be for you to find 2-3 strong bullet points that demonstrate leadership (outside your day-to-day work), awards, and other notable achievements.

DO:

- Put awards in context, e.g., "1st out of 22 applicants"

- Consider leaving this section out if you're lacking content

DON'T:

- Use awards from school or university if you graduated more than 10 years ago

- Include weaker achievements (e.g., "employee of the week") just to fill up space

If you haven't won any awards or can't think of any strong leadership examples outside your day-to-day role, then consider omitting this section entirely.

5.4.5 Skills and certifications

Your investment banking resume needs to show that you're adept at using a relevant range of tools, methodologies, and techniques. Listing them here makes it easier for a recruiter to quickly check if you meet their requirements.

If you're applying for a highly technical investment banking role, stick to skills that are directly relevant to the role. This can include finance software proficiencies (such as “Bloomberg” or “Deal Logic”) and certifications.

You can also include skills that signify soft skills and add personality to your resume. This can be your foreign language proficiencies, entrepreneurial projects, etc.

If you need to save vertical space, list your skills in sentence form and separate them by commas, rather than individual bullet points.

Lastly, don’t include generic or irrelevant interests that everyone likes doing, like “watching Netflix” or “spending quality time with friends.”

5.5 Proofreading and feedback

Don’t skip this step! Use a grammar-checking tool and then proofread until it’s perfect. This is harder than it sounds because multiple revisions after the initial proofread can easily create new, hard-to-spot errors. The only solution is to proofread again after each tweak.

We recommend saving your resume as a PDF file (unless the job description says otherwise) and checking that it opens properly with the correct formatting on a Mac or PC.

Receiving feedback is also important. Share it with a trusted friend or partner, and they’re more likely to see mistakes that you haven’t noticed. Of course, if you can share it with an experienced investment banking recruiter / interviewer, that can give you a big advantage over other applicants.

DO:

- Proofread from top to bottom and then read it in reverse to check spelling

- If you’ve tweaked it, proofread it again before sending

- Check that the file opens properly on Mac and PC

- Get feedback on it before sending

DON'T:

- Send it with typos. This can signal a lack of attention and professionalism. Your resume is your product!

6. Your investment banking resume checklist ↑

Almost ready to send your investment banking resume? Use this checklist to make sure you’re following all the best practices we’ve recommended above.

If you can answer “Yes” to every question, then you’re ready to hit "Apply.”

General

- Does your resume present you as the type of candidate the job description is looking for?

Layout

- Does it fit on one page? If not, do you have the experience to merit 2 pages?

- Is the formatting 100% consistent and neat?

Personal information

- Are your contact details spelled correctly?

Work experience

- Have you talked about your actions rather than your responsibilities?

- Have you quantified the impact of your actions?

- Have you demonstrated a range of relevant skills?

Awards and leadership

- If you graduated over 10 years ago, are your examples post-university?

- Are the awards relevant and make you stand out in some way?

Skills and certifications

- Have you listed the relevant tools you’re familiar with?

- Have you listed any languages you speak and your level of proficiency?

- Have you added any additional skills or competencies that could add value?

- Do your interests make you stand out from the crowd in some way?

Proofreading and feedback

- Have you proofread it since your last revision?

- Have you received any feedback on your resume and updated it?

- Have you saved it as a PDF to make sure it displays correctly on all devices?

If you’ve used all the tips in this article, then your resume should be in good condition and give you a fighting chance of getting a job at a top financial firm.

7. Is your resume good enough for a top investment banking firm? ↑

If you're going for one of the top investment banking jobs, having a resume that's "fine" may not be enough. Getting your tech resume from "fine" to "outstanding" usually requires feedback from someone who knows the industry, such as an ex-recruiter or manager with experience hiring within your target company.

We know it's hard to get access to industry insights from experienced experts. That's why we've created a resume review service that allows you to get immediate feedback from the top recruiter/coach of your choosing.