Today we’re going to show you what to expect during Morgan Stanley interviews, and what you should do to prepare.

The information in this guide is based on an analysis of over 60 Morgan Stanley interview reports (from real candidates for analyst roles), which were recorded between 2016-2021.

And here’s one of the first things you’ll want to know:

Morgan Stanley emphasizes “behavioral" questions in its interviews. However, unlike its rivals Goldman Sachs and JP Morgan, it also focuses heavily on technical questions. So, if you want to prioritize your preparation, then you’ll want to pay close attention to the questions section below.

Here’s an overview of what we’ll cover:

1. Interview process and timeline

Want more interviews? Click here for a 1-to-1 resume review with an ex-investment banker from Morgan Stanley, Goldman Sachs,etc

Here we’ll cover what you can expect at each stage of Morgan Stanley's application process. Before we start, take a look at this short video by Morgan Stanley for a quick overview on how to approach your interviews.

Now, in this article, we’ll focus primarily on investment banking (IBD) roles, but the below process likely has some overlap with the steps for other roles.

The interview process at Morgan Stanley typically takes around 6 weeks to complete, but it can take 3 months or even longer, so be prepared for an extensive process.

Let’s begin with an overview of each step you’ll encounter, then we’ll dig deeper into each one.

1.1 What interviews to expect

Whether applying for a full-time position or an internship program, Morgan Stanley candidates will typically go through 4 steps:

- Application and resume

- Aptitude test (interns and graduate roles)

- Screening interviews (HireVue or phone)

- Final-round interviews

1.1.1 Application and resume

There are three main ways that the Morgan Stanley interview process may begin:

- You’ll apply on their website

- You’ll apply through an event or career fair

- A recruiter will reach out to you

Regardless of which of these starts your application journey, you’ll want to be ready with a polished resume that is targeted to Morgan Stanley.

If you'd like expert feedback on your resume, you can get help from our team of ex-investment bankers, who will cover what achievements to focus on (or ignore), how to fine tune your bullet points, and more.

It’s also important to spend some time learning about the specific division within Morgan Stanley where you intend to apply. If you don’t have a clear perspective on the division where you want to work within the company, then this can be a red flag for recruiters.

You should also understand the teams that exist within your target division. This will demonstrate that you’re highly motivated and familiar with how the firm operates.

If you really want to get your foot in the door, another way to set yourself apart is by attending career fairs or events hosted by Morgan Stanley. Try to make genuine connections with people from the company. Then, when you go to apply, specifically name drop the people you’ve met in your cover letter. You could even write in a quote you heard from them, or mention what you learned from them about the company.

Need help crafting your Morgan Stanley resume? Read our guide featuring REAL examples.

1.1.2 Aptitude test

Depending on your level of experience and what division you’re applying for, you may be asked to take one or more of the following online aptitude tests:

- Verbal reasoning test

- Numerical reasoning test

- Logical reasoning test

- Accuracy (error-checking) test

The numerical test contains problems of up to 11th grade (GCSE) level difficulty, and if you’re not confident with your numbers it might be worth practicing beforehand with one of the many online test providers.

The other tests should all be reasonably straightforward, but be sure to give yourself the best possible conditions: make sure you’re in a calm, quiet environment with a strong internet connection before you start.

1.1.3 Screening interviews (HireVue or phone)

Once you’ve passed any aptitude tests (if applicable) you’ll be invited to one or more screening interviews. These are now most often done using HireVue, though depending on your experience and where you’re applying, you may be invited for phone interviews instead.

1.1.3.1 Screening interview via HireVue

HireVue is a digital tool that allows you to record your responses to a series of interview questions, without having an interviewer on the other side of the camera.

You’ll be asked 3-5 questions during the interview. For each question, you’ll have a few moments to prepare your answer, and then you’ll have a time limit of 2-3 minutes to give your answer on camera.

You’ll only be allowed one opportunity to re-record each answer, so we’d recommend preparing answers to common questions in advance. You can get started with the example questions listed later in this article. You can also take unlimited practice questions within HireVue before starting your actual interview, which we strongly encourage you to do.

The HireVue interview mostly contains common behavioral questions like “Why investment banking?” and “Tell me about a time…” type questions. In addition, some candidates get business sense questions or questions specific to the department to which they’ve applied. For example, you might get a question like “tell us about a recent M&A deal that interested you.”

For a deeper dive, check out our guide on investment banking HireVue interviews. It includes expert tips, company-specific insights, and a full list of practice questions from top firms.

1.1.3.2 Screening interview via phone

If you are given phone interviews, the first one is likely to be with a single member of the Morgan Stanley recruiting team. It might be a recruiter or someone from the relevant division. You’ll be asked general questions about your resume and motivations, such as “Why Morgan Stanley?” and “Tell me about yourself.”

If you have a second round of screening interviews, it will probably be on a video call with two or three Vice Presidents from the division you’re applying for. Here you can expect more behavioral and situational questions, as well as some technical questions to test your knowledge in the relevant field. Some candidates have reported getting brainteaser questions at this stage, so you should be prepared for that too.

1.1.4 Final-round interviews

If you do well enough in the screening interview, you’ll be invited to the final round of interviews. What this consists of depends on your experience level. Let’s take a look at the different possibilities.

1.1.4.1 Super Day / Assessment Centre

For entry level positions at the firm (internships and graduate hires) this may take the form of a “Super Day” (called “Assessment Centre” in the UK). This is where a large number of candidates spend the day interviewing at a Morgan Stanley office or a conference center, although due to COVID-19 this is now normally done on Zoom.

The Super Day usually consists of:

- 2-5 interviews (~30min each)

- A group exercise

- An individual presentation (some roles)

Let’s go through what to expect in each one.

Interviews: You will likely face at least two people in each interview, and they’ll be of varying levels of seniority across the division you’re applying to (associate, vice-president, managing director, and executive director).

Group exercise: This gives Morgan Stanley the opportunity to see your teamwork and leadership skills in action. One common setup for the task sees candidates being asked to agree on budget allocation at an imaginary firm. One candidate is made head of department while the rest are given projects that they must try and get funds for.

Individual presentation: This is more for people in roles where presentations are part of the job (like Sales) but we have seen reports of banking analysts doing them too. If you’re asked to do a presentation, you’ll be given a short time to research a question before having to present your findings.

1.1.4.2 Experienced hires

If you’re a candidate who has already worked in investment banking, you’re less likely to be invited to a Super Day. Instead, your final round will likely consist of at least 3 back-to-back interviews with different Morgan Stanley team members from across the hierarchy. Each interview should last around 30 minutes.

Now that you know what to expect in the interview process, let’s take a look at the type of questions you can expect to face.

2. Question types

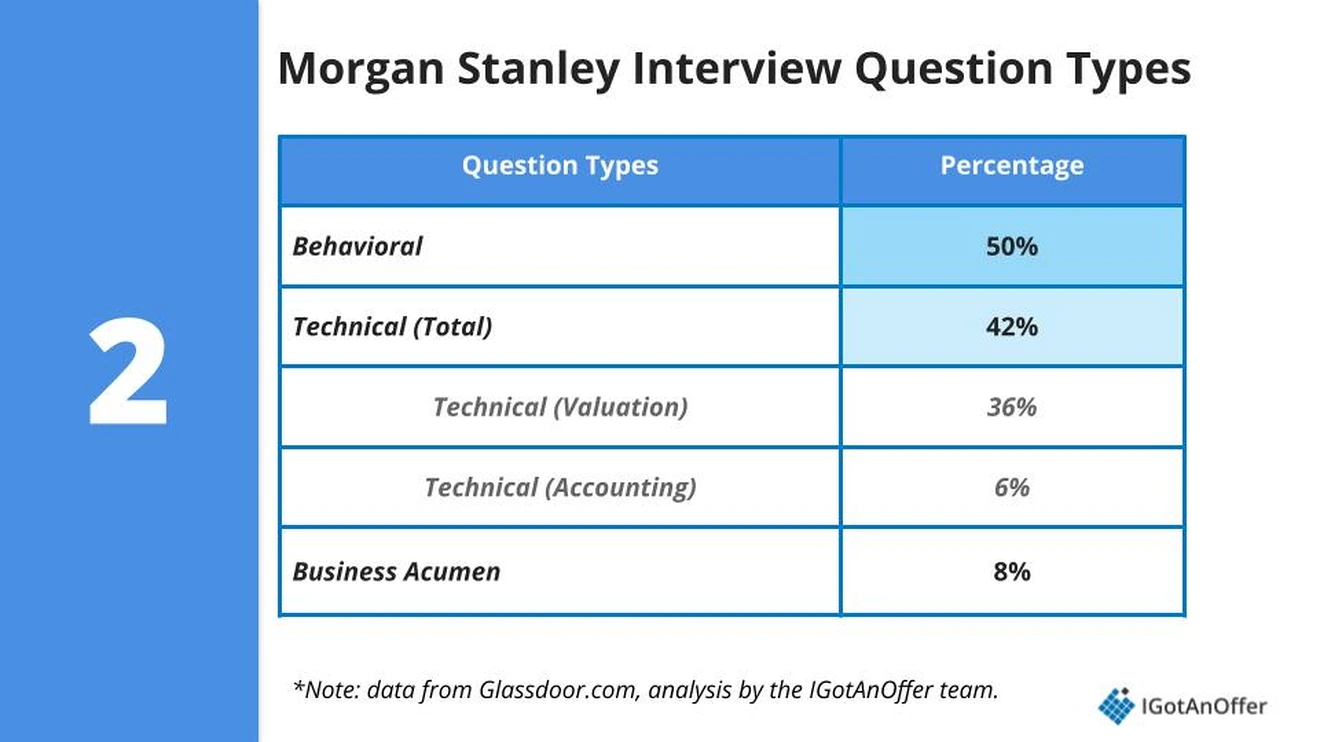

During the interview process at Morgan Stanley, you’ll face the following question types:

- Behavioral

- Technical

- Business sense

However, some of these questions are asked more frequently than others. Here’s a summary of the data:

As you can see, around half the questions you’ll face are likely to be behavioral questions, so we’ll cover that category next.

Below, we’ve curated a list of practice questions for each question type.

Note: The questions below were originally posted on Glassdoor, but we have improved the grammar or phrasing in some places to make them easier to understand.

2.1 Behavioral questions [~50% of questions]

Behavioral questions focus on your motivation for applying to the position, your resume, and scenario based questions (e.g. “Tell me about a time…”).

Below is a list of behavioral interview questions that have been asked in Morgan Stanley investment banking interviews in the last few years. These are excellent questions to practice with because many of the same questions tend to come up repeatedly. We've split them into three groups to make them easier to digest.

You’ll want to pay special attention to the first three questions (bolded below), because they are extremely common. You should definitely have an answer prepared for each of them before your interview.

Example behavioral questions at Morgan Stanley

- Tell me about yourself

- Why do you want to work in investment banking?

- Why Morgan Stanley?

- Walk me through your resume

- What was the hardest thing you have experienced in life? How did you overcome it?

- What are your career goals?

- What is your understanding of the job you will be doing at Morgan Stanley?

- How would your friends and family describe you in 3 words?

- What do you do for fun outside of work?

- What would you major in if the financial services industry didn't exist?

- Tell me about a time you worked in a team

- Tell me about when you handled a problem in a team

- Tell me about a time you demonstrated superior leadership skills

- Tell me about a time when you were persuasive

- Tell me about a time you used data to make a recommendation

- Tell me about a time you did the right thing

- Describe a time you made a big mistake and how you dealt with it

- Why wouldn't I hire you?

- Why Morgan Stanley and not Goldman Sachs?

- If you could be any animal what would it be?

- If your sister’s wedding was tomorrow and a live deal was closing tomorrow, which event would you prioritize?

For a complete list of practice questions, including sample answers and an answer framework, take a look at our guide to Morgan Stanley behavioral interview questions. If you’re applying to other firms like Goldman Sachs and J.P. Morgan, you can also refer to our investment banking behavioral & fit interview guide, which includes the top 14 most commonly asked questions.

2.2 Technical questions [~42% of questions]

Technical questions help your interviewers evaluate whether you have the knowledge and skills to perform on-the-job tasks.

These technical questions can be split into two main categories:

- Valuation

- Accounting

Valuation questions at Morgan Stanley focus on your ability to calculate the value of a business and your familiarity with DCFs, whereas accounting questions focus on your knowledge of financial statements and accounting principles. Morgan Stanley asks valuation questions much more frequently, but you should prepare for both.

Below is a list of example questions from each category for you to practice with. The two questions in bold are extremely common, so you should definitely have a strong answer prepared for them.

Example technical questions asked at Morgan Stanley

Valuation- Walk me through a DCF

- What are the ways to value a company?

- Explain minority interest in layman terms

- What is enterprise value?

- What items flow into the Enterprise Value formula?

- How would you value a private company?

- Give me a scenario for when a DCF is more valuable than the multiples method

- What is an LBO and how does it work? What are its primary value drivers?

- A buyer with P/E ratio of 25x acquires a seller with P/E ratio of 20x. Is it accretive or dilutive?

- How do these three financial statements relate to X transaction?

- Walk me through Profit & Loss

- Walk me through a balance sheet

- What happens on the financial statements when Goodwill impairment increases by 100?

- Explain how to create a cash flow analysis

You can learn more about common technical questions in our technical questions guide, and you can also find helpful summaries in our investment banking interview cheat sheet.

If you want more practice specifically with accounting questions, we also recommend checking out our investment banking interview accounting questions guide. It includes a list of accounting questions from top firms, along with sample answers and expert tips to help you structure strong responses.

2.3 Business sense [~8% of questions]

The final type of questions you can expect to encounter during your Morgan Stanley interviews are business sense questions.

These tend to be fairly general, open-ended questions that test whether you have a good understanding of the finance industry and Morgan Stanley’s place within it.

Although these questions only make up a small portion of the questions you’ll face, you should be ready to get asked one or two at any stage.

Let’s take a look at some examples below. You can also learn more about this kind of question in our separate business sense questions guide.

Example business sense questions asked at Morgan Stanley

-

- Tell me about a recent deal done by this Morgan Stanley office

- Name one story in the news and how it is important to you

- How would you describe Morgan Stanley and what we do?

- What market sector are you interested in?

3. How to prepare

Before you spend weeks (or months) preparing for Morgan Stanley interviews, you should pause for a moment to learn about the company’s culture.

This is important for two reasons.

First, it will help you to clarify whether Morgan Stanley is actually the right fit for you. Morgan Stanley is prestigious, so it can be tempting to apply without thinking more deeply. But, it's important to remember that the prestige of a job (by itself) won't make you happy in your day-to-day work. It's the type of work and the people you work with that will.

Second, having a clear understanding of Morgan Stanley’s culture will give you an edge in your interviews, because it will help you frame your skills and experiences to align with what the company values. In addition, you will almost definitely be asked about your specific motivations for applying to Morgan Stanley.

If you know any current or former Morgan Stanley employees, see if you can chat with them about the company’s culture for a few minutes. In addition, we would recommend checking out the following resources:

- A culture driven strategy (by Morgan Stanley)

- Insights (by Morgan Stanley)

- Comparison Morgan Stanley vs Goldman Sachs (by Investopedia)

For some fascinating insights into how Morgan Stanley works from the person at the very top, plus plenty of talking points that you can refer to in your interviews, we recommend watching some of this conversation with the CEO, James Gorman.

Looking for more tips on how to set yourself apart in an investment banking interview? Take a look at our list of 15 essential IB interview tips.

3.2 Practice by yourself

As we mentioned above, you’ll face 3 main types of questions in your Morgan Stanley interviews: behavioral, technical, and business sense questions.

And you’re going to want to do specific preparation for each question type.

3.2.1 For behavioral questions

For behavioral questions, we recommend that you use a repeatable method for delivering your answers. You may have heard of the STAR method before, but we recommend a slightly different approach, which is explained in this guide.

Once you’ve learned a method for structuring your answers, we recommend that you practice answering all of the example questions we provided above and in our IB behavioral & fit interview questions guide.

It’s best to rehearse the answers to these questions out loud, so that you’ll get comfortable giving good, concise answers. It may feel weird to practice answering questions out loud without an interviewer across from you. But trust us, this will dramatically improve how you communicate your answers.

In addition, it’s helpful to prepare a few “stories” that highlight your past experiences and accomplishments, so that you have examples to use for unexpected interview questions. For example, if you have a good example of a time you handled a team conflict, rehearse this story, and you could potentially use it for a variety of different questions during your interviews.

3.2.2 For technical questions

For technical questions, we recommend that you start by brushing up on the key valuation concepts used in investment banking. We recommend reading Street of Wall’s valuation overview guide.

And for accounting concepts, we recommend using this free guide as a quick refresher and our IB interviews accounting questions guide. Then, you can study accounting topics more deeply with this free course.

Once you’ve refreshed your memory on the fundamental concepts, then go ahead and practice with the technical questions we’ve provided above. Again, we’d recommend that you practice answering questions out loud, because this more closely replicates the conditions of a real interview.

3.2.3 For business sense questions

For business sense questions, there are a few different areas you’ll need to cover.

First, it’s important for you to be up to speed on current events related to Morgan Stanley, the investment banking industry, and the broader economy.

To help you stay current, we recommend developing a habit of reading the Investment Banking section of the Financial Times, which will give you the main news from the industry as well as frequent stories specifically on Morgan Stanley. For broader economic news, you can use your favorite news publication. If you don’t have one, consider giving The Economist a try.

To take this a step further, it’s a good exercise to quiz yourself on these current events by reframing them in the form of a question. For example, if you read a story about an M&A deal, ask yourself something like: “Is this really a good deal? Why?” We’d recommend that you analyze and develop an opinion on at least a couple of recent deals, because it’s likely to be useful during your interviews.

And of course, practicing the above example questions (out loud) will go a long way in preparing you for your interviews.

For a high-level overview of the entire IB process, you can also check out our investment banking interview prep guide.

3.3 Practice with peers

Practicing by yourself is a critical step, but it will only take you so far.

One of the main challenges of interviewing at Morgan Stanley is communicating your answers in a way that is clear and leaves a strong impression.

As a result, we recommend that you also do some mock interviews. This is much closer to the real interview experience. Plus, the feedback you get from an interview partner could help you avoid mistakes that you wouldn’t notice on your own.

You can practice with a friend or family member to start. This will help you polish your “stories” and catch communication mistakes. However, if your interview partner isn’t familiar with investment banking interviews, then practicing with an ex-interviewer will give you an extra edge.

3.4 Practice with ex-interviewers

If you know someone who runs interviews at Morgan Stanley or another investment bank, then that’s amazing! They'll be a great person for you to practice with.

But most of us don’t, and it can be REALLY tough to make a new connection with an investment banker. And even if you do have a good connection already, it might also be difficult to practice multiple hours with that person unless you know them extremely well.

Here's the good news. We want to help you make these connections. That’s why we've launched a coaching platform where you can find ex-interviewers at Morgan Stanley to practice with. Learn more and start scheduling sessions today.