Investment banking interviews are demanding, and to earn an offer, you need to demonstrate that you can handle the technical rigor of the role. If you’re targeting an analyst position at a top bank, technical questions will be a core part of the interview process.

To help you prepare, below is a curated list of technical questions that frequently come up in investment banking interviews. We identified these by analyzing hundreds of Glassdoor interview reports for analyst roles at top firms such as Goldman Sachs, J.P. Morgan, and Morgan Stanley.

From that analysis, we selected the 14 most common technical interview questions and categorized them from easy to hard. For each question, we include clear explanations, sample answers, and tips to help you structure strong responses.

Here’s an overview:

- What to expect in IB technical interviews

- Different types of IB technical interview questions

- Common technical questions asked (with answers)

- How to prepare

Click here to practice 1-on-1 with investment banking ex-interviewers

Let’s get started.

1. About investment banking technical interviews

Before we go through the most common technical questions asked in investment banking interviews, let’s first take a look at what these interviews are and how they work.

1.1 What are investment banking technical interviews?

Investment banking technical interviews assess whether you have a good understanding of core financial concepts and the fundamental skills analysts need to perform effectively.

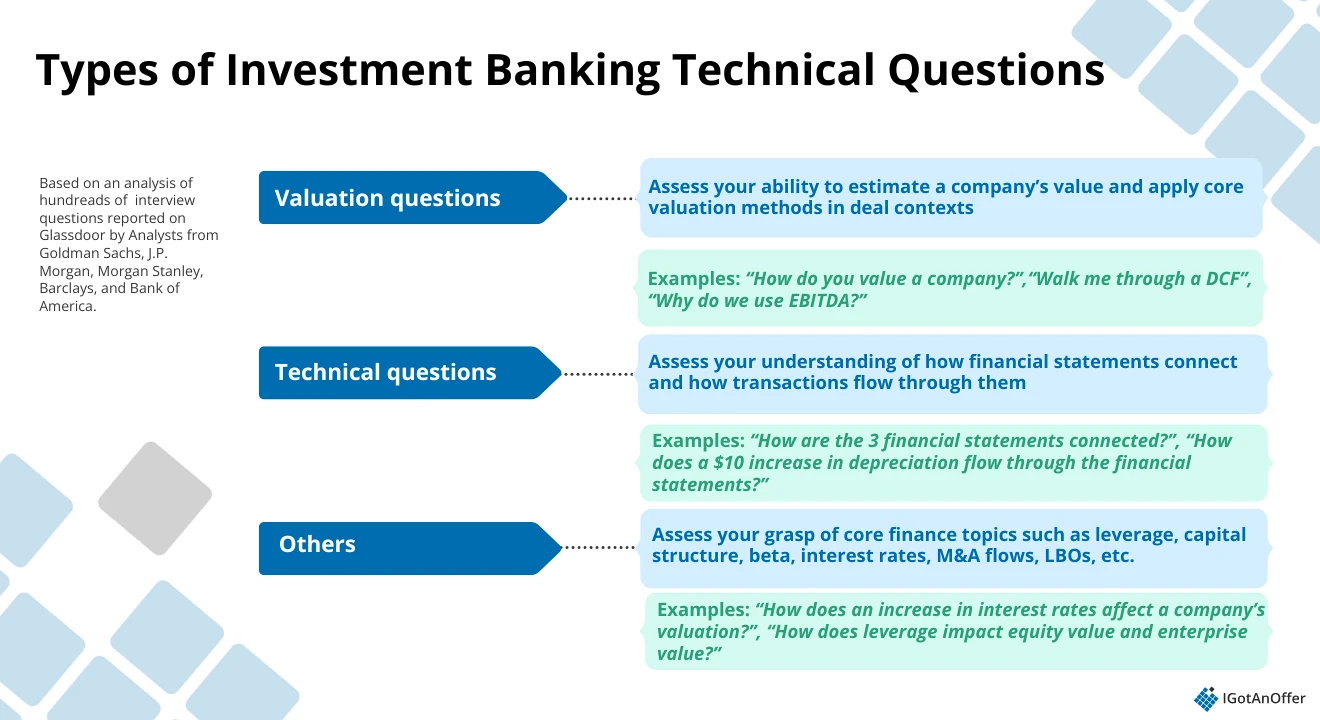

In these interviews, “technical” is an umbrella term that typically refers to valuation, accounting, and a few other (less common) finance topics:

- Valuation questions test your ability to assess the value of a business.

- Accounting questions evaluate your understanding of financial statements and key accounting principles.

- Other technical questions cover topics such as leverage ratios, beta, interest rate impacts, or general finance concepts that don’t neatly fall under valuation or accounting.

We’ll go into each question type in more detail in Section 2.

1.2 When can you expect to be asked IB technical questions?

You can expect IB technical questions in the initial phone screen or HireVue, as well as in the final interviews. The difficulty increases as you move through the process.

In the HireVue or initial phone screens, banks typically ask “light” technical questions to test your understanding of basic accounting and finance concepts. For example, “Walk me through the three financial statements” or “What is a Discounted Cash Flow (DCF)?”

As you move to the final rounds (for entry-level roles, this is the Superday or Assessment Centre in the UK), the technical questions become more complex. You may be asked to think through how different assumptions or transactions affect a company’s financials and valuation.

For example, “How does a $10 increase in depreciation flow through all three financial statements?” or “How would an increase in leverage affect enterprise value?”

1.3 What core competencies are firms testing for?

Different firms have different criteria, but they mainly want to know that you can apply technical concepts to real business problems.

You can expect to be tested on the following competencies:

- Core technical skills: understanding valuation concepts (DCF, comparables, precedent transactions) and the key relationships between the financial statements

- Analytical thinking: reasoning through cause and effect. For example, how a change in revenue, interest rates, or leverage affects cash flow, valuation, and a company’s financial position

- Numerical agility: comfort with mental math, quick estimation, and directional reasoning (e.g., changes in EPS, multiples, or leverage ratios)

- Business intuition: connecting technical mechanics to the broader context, including valuation, financing decisions, M&A outcomes, and investor perspectives

- Attention to detail: explaining concepts and numbers clearly and accurately

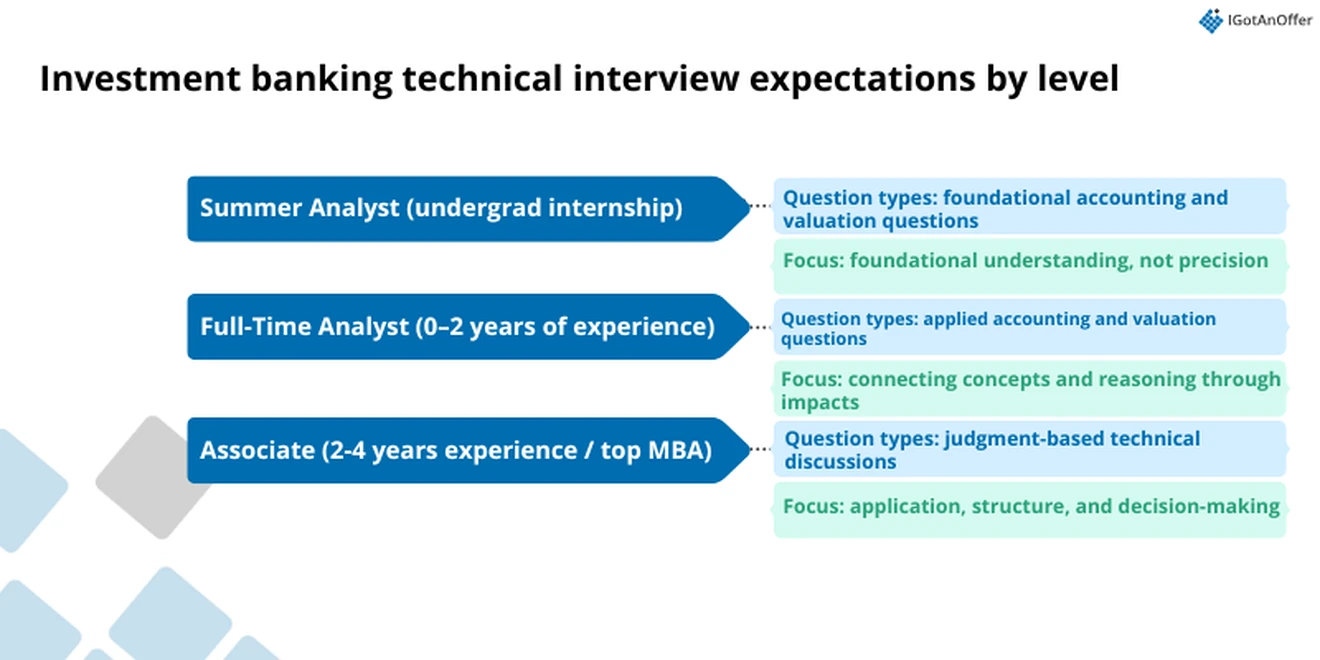

1.4 IB technical interview expectations per level

Technical expectations in investment banking interviews vary by role, but they generally increase with seniority. Based on candidate reports on Reddit and other interview forums, here’s how expectations typically differ by level.

Summer Analyst (internship before junior → senior year)

For summer analyst roles, technical interviews focus on foundational knowledge. Interviewers want to confirm that you understand basic accounting, valuation methods, and how the financial statements link together.

At this stage, you are not expected to build detailed models or make precise assumptions. However, you should be comfortable explaining the logic behind common valuation and accounting frameworks.

You can expect high-level technical questions such as:

- Walking through the three financial statements

- Explaining the main valuation methods

- Describing a DCF at a conceptual level

Full-Time Analyst (senior year or just graduated)

For full-time analyst roles, technical interviews are more applied. You may still be asked foundational questions, but interviewers will often follow up by asking you to explain assumptions, walk through impacts, or reason through how changes affect valuation or the financial statements.

At this level, you may be asked to:

- Explain how changes in assumptions affect valuation or the financial statements

- Reason through deal mechanics such as accretion and dilution

- Walk through valuation approaches for specific companies or situations

Some firms also include a timed modeling exercise or a short case to assess how you think through problems under time constraints.

Associate (post-analyst or MBA hire)

At the associate level, technical interviews focus less on testing fundamentals and more on application and judgment. Interviewers generally assume you already have a solid grasp of accounting and valuation basics.

Instead of standalone technical questions, discussions tend to center on how you would structure an analysis, evaluate key assumptions, or review and challenge an analyst’s work.

2. Different types of IB technical interview questions ↑

The technical questions covered in investment banking interviews can be broad and varied, but you can expect most to fall under valuation and accounting questions.

2.1 Valuation questions

Valuation questions assess your ability to determine a company's economic worth using methods such as the Discounted Cash Flow (DCF) method, Comparable Company Analysis (Comps), and Precedent Transactions.

Interviewers want to see that you can apply these approaches correctly and interpret the results, as these skills are essential when advising on mergers and acquisitions (M&A), capital raising, and strategic decisions.

Example questions:

2.2 Accounting questions

Accounting questions assess whether you understand how the three financial statements (income statement, balance sheet, and cash flow statement) connect and how specific transactions move through them.

You should be able to explain changes in key line items, track their effects across the statements, and relate those movements to a company’s overall financial performance. These skills are also foundational for building models and supporting valuation work.

Example questions:

Check out our IB interview accounting questions guide for more information.

2.3 Other technical questions

These are questions that don’t neatly fall under valuation or accounting but are still essential for the job. They typically include topics such as leverage, beta, interest rate movements, capital structure, M&A accounting flow-throughs, and leveraged buyout (LBO) mechanics.

Example questions:

- “How does an increase in interest rates affect a company’s valuation?”

- “How does leverage (debt) impact equity value and enterprise value?”

Right, now that you know the different types of technical questions, let’s move on to the most common ones.

3. 14 most common technical questions in IB interviews (with sample answers) ↑

The questions below are typical of those asked in investment banking interviews at top firms, such as Goldman Sachs, J.P. Morgan, Morgan Stanley, Barclays, and Bank of America.

We analyzed hundreds of technical interview questions from these companies on Glassdoor, identified the ones that appear most frequently, and categorized them from easy to hard.

We recommend reviewing this list ahead of your interview and using the linked explanations to deepen your understanding of each topic.

Feel free to skip to a specific question:

- What are the main methods of valuing a company?

- Walk me through the financial statements.

- What is enterprise value?

- How do you calculate / adjust EBITDA?

- Explain minority interest in layman’s terms.

- What is an LBO, and what are its value drivers?

- Walk me through a DCF.

- How would you value X company?

- How do you calculate WACC?

- When would you use (or not use) DCF instead of other valuation methods?

- How do you calculate cost of debt and cost of equity? How do they impact a company’s value?

- Build an LBO model.

- How does X affect the financial statements?

- Determine if an acquisition is accretive or dilutive.

Let’s get straight to the list.

Easy IB technical questions

At this level, interviewers are checking whether you understand foundational concepts. You may be asked to define key terms or give a high-level explanation of how basic valuation or accounting ideas work.

1. What are the main methods of valuing a company? ↑

This question is also sometimes phrased differently, with the interviewer simply asking, “How do you value a company?” Both versions of this question are quite common, and together they account for 19% of the questions reported.

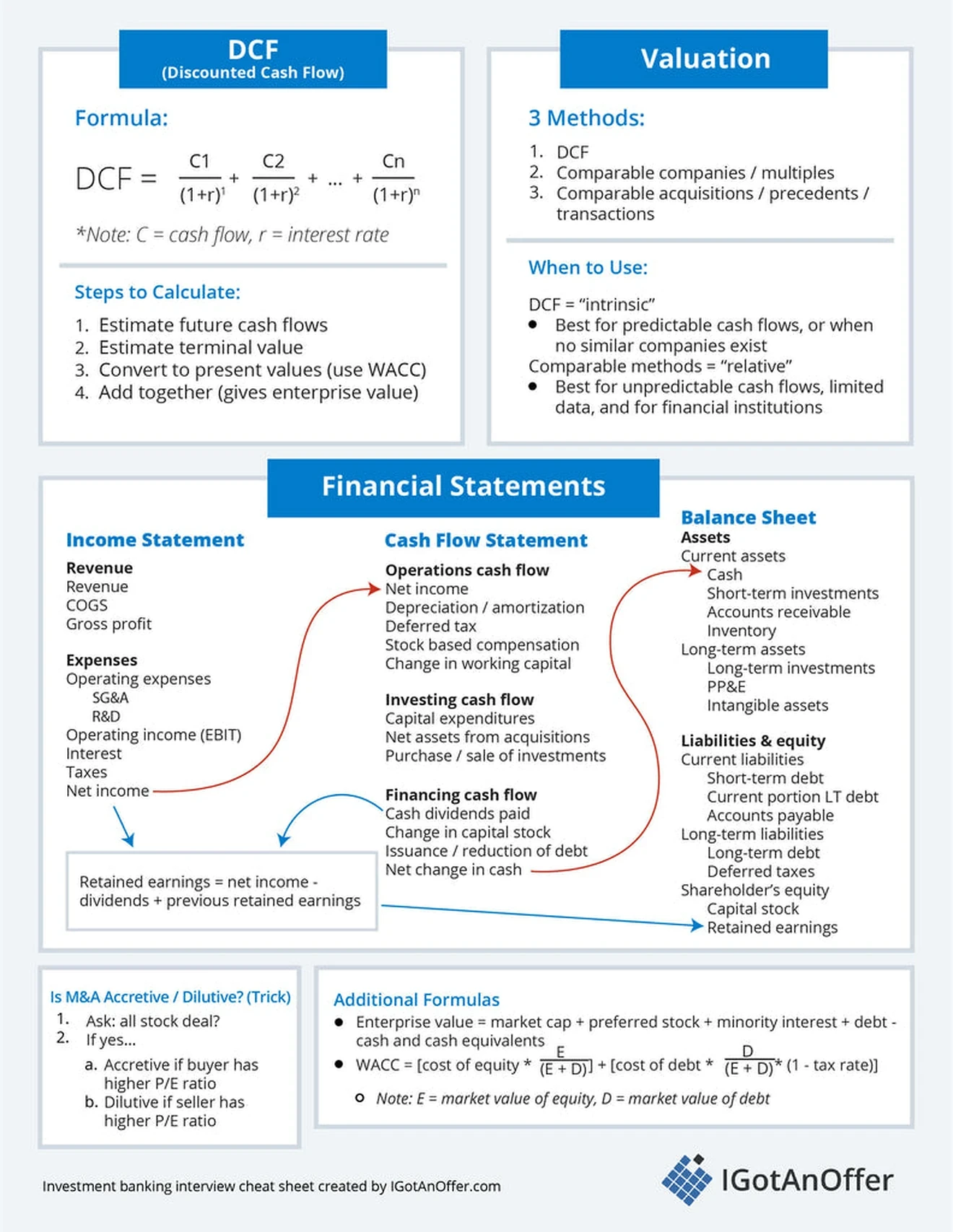

Here’s a quick overview:

- There are 3 main ways to value a company:

- The Discounted Cash Flow method

- The Comparable Companies (also called Multiples) method

- The Comparable Acquisitions (also called Precedents or Transactions) method

The DCF approach calculates the intrinsic value of the company, while the other two methods calculate the relative value of the company.

The Discounted Cash Flow method values a company using the present value of its future cash flows.

The CompCo (Comparable Company) method values a business by comparing its multiples (e.g. the P/E ratio) with similar companies. And the CompAq (Comparable Acquisition) method values a company by comparing it with similar companies that have sold in the past.

Sample answer: How do you value a company?

"There are three primary methods used to value a company: Discounted Cash Flow (DCF), Comparable Companies, and Precedent Transactions.

First, the DCF provides an intrinsic valuation. You project the company’s future free cash flows and discount them back to today using the weighted average cost of capital. This gives you a view of what the business is worth based solely on its ability to generate cash in the future.

Second, Comparable Companies, a relative valuation method, looks at how similar publicly traded companies are valued. You review trading multiples such as EV/EBITDA or P/E and apply the appropriate multiples to the target company to estimate its value.

Third, Precedent Transactions, another relative method, analyzes multiples paid for similar companies in past M&A deals. This approach captures control premiums and real market pricing seen in acquisitions.

In practice, bankers use all three methods to triangulate a valuation range, since each method offers a different perspective depending on the company and the specific situation."

2. Walk me through the three financial statements (and how they’re connected) ↑

This accounting question is almost always guaranteed to come up in any investment banking interview. Interviewers ask it in different ways to test how well you understand the financial statements and the connections between them. The most common versions are:

- “Walk me through the three financial statements.”

- “How are the financial statements linked?”

- “Tell me how the financial statements flow together.”

There are many ways that changes in one statement can affect the others, so there’s really no substitute for a deep understanding of how financial statements work.

A good way to prepare for this type of question is to learn one or two clear “paths” that show how information flows across the income statement, cash flow statement, and balance sheet. Once you understand those links, you’ll be able to give a confident and concise answer every time.

Sample answer: Walk me through the three financial statements (and how they’re connected)

“Sure. The three financial statements are the income statement, the cash flow statement, and the balance sheet, and they’re all tightly connected.

I start with the income statement because it shows the company’s performance over the period. The key output there is net income, which drives the links to the other statements.

Net income flows directly into the cash flow statement as the starting point for cash from operations. From there, you adjust for non-cash items like depreciation and for changes in working capital, then incorporate investing and financing activities to get the net change in cash.

That net change in cash updates the cash balance on the balance sheet. At the same time, retained earnings in the equity section change by the amount of net income minus dividends. The balance sheet then captures the company’s assets, liabilities, and equity at the end of the period.

So overall, the income statement shows profitability, the cash flow statement shows how that profitability converts to cash, and the balance sheet reflects the cumulative impact on the company’s financial position.”

You'll also find our investment banking interview cheat sheet helpful in preparing for this type of question, because it uses arrows to illustrate multiple "paths" that run through the three main financial statements.

Click here to download the investment banking cheat sheet.

3. What is enterprise value? ↑

According to the reported questions we’ve analyzed, this question is only asked in Morgan Stanley interviews. So, if you’re only interviewing with other firms, then you should prioritize the other questions in this list before preparing for this one.

Enterprise value is a method of calculating the valuation of a company that is more comprehensive than the company’s equity value (or market cap). Enterprise value considers a company’s equity, debt, and cash.

Here is the formula for calculating enterprise value:

Enterprise value = market capitalization + preferred stock + minority interest + debt - cash and cash equivalents

During an interview, you’ll typically be expected to explain what enterprise value is (which you can do using the description above) and possibly what numbers are used to calculate enterprise value (which you’ll know if you memorize the formula above).

Below is one way you can structure your answer.

Sample answer: What is enterprise value?

“Enterprise value is the value of a company’s core operations, independent of its capital structure. The way I think about it is: if you were to buy the entire business, EV reflects the total cost to acquire it.

To get to EV, I start with the company’s equity value, then add debt, preferred stock, and minority interest, and subtract cash, since a buyer could use the cash to reduce the effective purchase price.

So the formula is:

EV = Equity Value + Debt + Preferred Stock + Minority Interest – Cash

We use enterprise value because it allows for apples-to-apples comparisons across companies with different levels of leverage. It’s also the basis for valuation multiples like EV/EBITDA, which isolate the value of the underlying operations.”

4. How do you calculate / adjust EBITDA? ↑

This question is typically asked in Goldman Sachs interviews, but it may also come up in interviews for other firms.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is sometimes used as an “anchor” for various accounting interview questions.

In other words, you might be asked how to get to EBITDA from revenue. Or you might be asked how to get to free cash flow from EBITDA. Or you may encounter some other variation.

Answering these questions will require a thorough understanding of EBITDA and the financial statements, not necessarily because the specific question is complex, but because it’s difficult to predict which element your interviewer will ask you to focus on.

Let’s look at how to answer the following example.

Sample answer: How do you get from EBITDA to free cash flow?

- First, confirm which version of FCF the interviewer wants. Let’s assume they want FCFF (free cash flow to the firm, also called unlevered cash flow).

- FCFF = EBITDA - Tax - Change in Working Capital - Capital Expenditures

- If you’ve been provided with data, you can then crunch the numbers.

You can learn more about the relationship between EBITDA and cash flow in this short video:

5. Explain minority interest in layman’s terms ↑

According to the reported questions we’ve analyzed, this question is only asked in Morgan Stanley interviews. So, if you’re only interviewing with other firms, then you should prioritize the other questions in this list before preparing for this one.

In simple terms, minority interest is a person or company that owns less than half of a company.

If you’d like to learn more about minority interest in-depth, you can check out this guide from Investopedia. Here are a few highlights:

- Minority interest is also sometimes called NCI (Non-Controlling Interest) because they typically don’t get to make decisions on behalf of the company.

- There are two subtypes of minority interest:

- Active minority interest: owns 21-49% of the company and has some influence on decision making.

- Passive minority interest: owns 20% or less of the company and has little-to-no influence on decision making

- Minority interest is recorded on the balance sheet of the majority owner as a liability.

Here’s one way you can approach this question.

Sample answer: Explain minority interest in layman’s terms

“Minority interest represents the percentage of a subsidiary that the parent company does NOT own.

For example, if a parent owns 80% of a subsidiary, the remaining 20% held by outside investors is the minority interest. These shareholders benefit from the subsidiary’s results but don’t control major decisions, which is why it’s also called non-controlling interest.

On the balance sheet, minority interest appears in the equity section of the parent company. Even though the parent consolidates 100% of the subsidiary’s financials, this line item ensures the statements reflect the portion that actually belongs to other shareholders.”

6. What is an LBO, and what are its value drivers? ↑

Leveraged Buyout (LBO) is a less common interview topic, but it’s good to have an understanding of the types of questions you may be asked, especially if you’re applying to a role with an LBO focus.

As a refresher: an LBO is an acquisition made using debt (typically a very high percentage of debt).

The most basic drivers for the success / failure of an LBO are as follows:

- The purchase price

- The amount of debt used and the cost of debt

- The expected exit price

It’s also worth mentioning that the success of an LBO is heavily influenced by the actions the acquiring firm takes to increase the exit price of the target business. For example, successful LBOs typically involve expanding or restructuring the business to increase its value.

Below is one way you can approach this question in an interview.

Sample answer: What is an LBO, and what are its value drivers?

“An LBO, or leveraged buyout, is when a private equity firm acquires a company using a significant amount of debt to finance the purchase. The idea is that leveraging the transaction amplifies equity returns as the company pays down that debt over time.

There are three main drivers that determine whether an LBO is successful.

First is the purchase price. The lower the entry valuation, the greater the potential equity upside.

Second is the amount and cost of debt. Using more debt can boost returns, but only if the company can comfortably cover interest and principal payments with its cash flow.

Third is the exit price, which is the valuation at which the firm ultimately sells the business. Exiting at a higher multiple, or after improving profitability, meaningfully increases returns.

In addition to these financial drivers, operational improvements can also affect the outcome of the LBO. Firms look for opportunities to increase cash flow, whether by cutting costs, improving working capital, or growing revenue. These changes help the company pay down debt more quickly and support a higher exit valuation.

Overall, an LBO creates value by acquiring a company with debt, using the company’s cash flows to reduce that debt over time, and exiting at a higher equity value driven by purchase price discipline, leverage, and operational improvements.”

We’d recommend that you watch the video below to develop a deeper understanding of LBOs and how they work:

Medium IB technical questions

Questions in this category require you to apply technical knowledge rather than just repeat definitions. You’ll be asked to connect concepts across valuation and accounting, reason through cause and effect, and walk through processes step-by-step.

7. Walk me through a DCF. ↑

This is by far the most common investment banking interview question, and it accounts for roughly 23% of all questions reported. As a result, you should be THOROUGHLY prepared for this question before your interviews, since you will almost certainly encounter it.

DCF stands for Discounted Cash Flow, and the basic formula used to calculate this number is as follows:

DCF = C1 / (1+r)^1 + C2 / (1+r)^2 + … + Cn / (1+r)^n

Note: C = cash flow, r = interest rate (WACC is usually used for this)

Here’s a quick overview of how to answer this question:

- Estimate future cash flows (5-10 years into the future)

- Estimate the terminal value of the company

- Convert these numbers to present values using WACC as the interest rate

- Add the numbers together

- The results of this calculation give you the “enterprise value” of the company

Sample answer: Walk me through a DCF

“Sure. A DCF values a company by estimating the cash it will generate in the future and converting those cash flows into today’s value.

I would start by projecting the company’s unlevered free cash flows for roughly 5 to 10 years. These cash flows represent the money the business generates after operating expenses and required reinvestment.

Next, I estimate the terminal value, which captures the value of the business beyond the explicit forecast period. This is usually done using either the Gordon Growth method or an exit multiple.

Once I have both the forecasted cash flows and the terminal value, I discount them back to present value using the weighted average cost of capital, since WACC reflects the risk of the business and the returns required by both debt and equity investors.

Finally, I add the discounted cash flows and the discounted terminal value together to get the enterprise value. From there, I can move to equity value by subtracting net debt and making any other necessary adjustments.

So in summary, a DCF values a company based on its ability to generate cash in the future, adjusted for risk through the discount rate.”

To learn more about each step of performing a DCF analysis, check out this full guide.

8. How would you value X company? ↑

With this type of question, your interviewer would ask how you would value a specific company, rather than about the general valuation methods. They may or may not give you additional details or data about the company.

As an example, you might be asked, “How would you value Morgan Stanley?”

Here’s a quick overview of how you could approach this question:

- Morgan Stanley is a bank

- Banks are typically valued using the Comparable Companies method

- More specifically, I would compare to similar banks using the Price to Book Value multiple

- Price to Book Value is used because a bank’s assets and liabilities are legally required to be “marked to market,” meaning the balance sheet will reflect the bank’s market value.

Sample answer: How would you value X company?

“First, I’d start by understanding the type of business we’re valuing, because the approach can change depending on the industry. For example, if the company is a bank like Morgan Stanley, traditional metrics such as EBITDA or free cash flow are less meaningful since banks generate value through interest income and their balance sheets are marked to market.

In that case, I would rely primarily on a Comparable Companies analysis using industry-specific multiples. For banks, the most common metric is Price-to-Book Value, since book value closely reflects the fair value of their assets and liabilities.

I’d identify a set of comparable banks with similar business models, geographies, and risk profiles, analyze their trading multiples, and apply the appropriate range to the target company. I would also look at Comparable Transactions to see how similar institutions were valued in recent M&A deals, since those multiples often include control premiums.

If additional information were available, I might also consider a dividend discount model or residual income model, which can be more appropriate for financial institutions than a standard DCF.

After reviewing these methods, I’d triangulate a valuation range and explain which approach I would weight most heavily and why.”

9. How do you calculate WACC? ↑

According to the reported questions we’ve analyzed, this particular question was only asked in Goldman Sachs interviews, although you will probably still need to understand WACC to answer questions for other firms (including DCF questions).

WACC (Weighted Average Cost of Capital) is the weighted average of a company’s cost of debt and cost of equity.

WACC is also usually the discount rate used in the DCF formula.

In other words, WACC is used to put the “Discounted” in “Discounted Cash Flow,” because it’s the rate used to discount the future cash flows to their present value.

Here’s an overview of how you could answer this question:

- Give the high-level explanation: WACC is the weighted average of a company’s cost of debt and their cost of equity.

- If the interviewer wants to dig deeper, you can discuss the formula in more detail:

- WACC = [Cost of Equity * E/(E + D)] + [Cost of Debt * D/(E+D) * (1 - Tax Rate)]

- Note: E = market value of equity, D = market value of debt

Here is a version you can use if the interviewer also asks you to walk through the formula.

Sample answer: How do you calculate WACC?

“WACC, or the weighted average cost of capital, measures the return that equity and debt investors expect from the company. It is the company’s blended financing cost and serves as the discount rate in a DCF since it shows the riskiness of the cash flows.

To calculate it, I start with the cost of equity, typically estimated using the Capital Asset Pricing Model. That is the risk-free rate plus beta multiplied by the equity risk premium.

Next, I determine the cost of debt, which is the company’s current borrowing rate adjusted for the tax shield because interest is tax-deductible.

Once I have both components, I weigh them according to their share of the company’s capital structure. The formula is cost of equity multiplied by equity over total capital, plus cost of debt multiplied by debt over total capital, and adjusted for one minus the tax rate.

The result is a single rate that shows the return required by all investors, which is why it is used to discount future cash flows in a DCF.”

10. When would you use (or not use) DCF instead of other valuation methods? ↑

As we’ve mentioned previously, DCF questions are extremely common in investment banking interviews. And this is an additional DCF question variation that you could encounter.

This type of question is also similar to question number 1 above, because your interviewer will probably be expecting you to compare DCF to the other valuation methods (i.e. CompCo and CompAq).

Here’s an overview of this concept:

- A relative valuation method would usually be better than DCF, when…

- The business has really unpredictable cash flows, because DCF is dependent on the numbers you have for future cash flows.

- There is not enough financial data available to use the DCF method. For example, if you only have the company’s revenue, you could make a relative valuation, but you wouldn’t be able to use DCF.

- The business is a financial institution, because they operate differently than a typical cash-flowing business (e.g. by profiting on the spread on debt).

- Note: this is not a comprehensive list of examples, but it will probably be enough for answering the above interview question.

- DCF would work better than a relative valuation, when…

- The business is well established and has highly predictable cash flows.

- There are no companies similar enough to the business, in order to create a good relative valuation. This could be the case for companies with really varied revenue sources (e.g. they sell muffins and jet turbines).

You can structure your answer as follows:

Sample answer: When would you use (or not use) a DCF instead of other valuation methods?

“That’s a good question. I would use a DCF when a company has stable and predictable cash flows, and there is enough information to build a reliable forecast. In those cases, the DCF gives you an intrinsic view of value based on the business’s ability to generate cash over time.

A DCF is also helpful when there are few close comparables or when you want to understand value drivers more clearly than a multiples-based approach allows.

I would avoid relying on a DCF when cash flows are volatile or highly uncertain. Early-stage companies, cyclical businesses with large earnings swings, or companies undergoing major transitions are typically better valued using trading comps or precedent transactions. Those methods rely on market data rather than long-term forecasts.

I’d also be cautious using a DCF for financial institutions. Their cash generation and capital structures work differently, so book-value-based metrics and comparables tend to provide a more accurate picture.

In practice, I would look at both intrinsic and relative valuation, then lean more heavily on the method that best aligns with the company’s business model and the quality of the available data.”

11. How do you calculate the cost of debt and cost of equity? How do they impact a company’s value? ↑

It can be important for a company to know its cost of debt and cost of equity for the purpose of making investment decisions.

Cost of debt is basically the average amount of interest a company pays on all its debt. And the cost of equity is the average rate a company returns to its shareholders.

Here is a brief overview of how to calculate them:

- There are 2 main ways to calculate cost of debt

- The pre-tax approach: Cost of Debt = Total Annual Interest on Debt / Total Debt

- The after-tax approach: Cost of Debt = Pre-Tax Cost of Debt x (1 - Tax Rate)

- Alternative: Cost of Debt = (Risk Free Rate + Credit Spread) x (1 - Tax Rate)

- The primary method for calculating cost of equity is using CAPM

- CAPM = Capital Asset Pricing Model

- Cost of Equity = (Risk Free Rate + Beta) x (Expected Market Return - Risk Free Rate)

- Note: to learn more about Cost of Equity calculations, visit this guide.

Now, regarding the impact of these two metrics on the valuation of a company:

A company with a high cost of debt is typically riskier and would often have a lower valuation than a comparable company with a low cost of debt.

Similarly, a company with a low cost of equity will likely have a higher valuation than a comparable company with a high cost of equity, because they can get capital for cheaper today to generate more profit in the future.

Sample answer: How do you calculate the cost of debt and cost of equity? How do they impact a company’s value?

“The cost of debt is the effective interest rate a company pays on its borrowings. You can calculate it by taking the total annual interest expense divided by total debt, then adjusting for taxes since interest is tax-deductible.

The cost of equity is typically estimated using the Capital Asset Pricing Model. Under CAPM, the cost of equity equals the risk-free rate plus beta multiplied by the equity risk premium. That represents the return investors expect for taking on the risk of holding the company’s stock.

Together, these feed into the company’s overall cost of capital, so they directly influence valuation.

A higher cost of debt usually signals more credit risk and tends to lower valuation. A lower cost of equity generally increases valuation because it means the company can raise capital more cheaply and reinvest those funds at attractive returns.

So, in short, understanding both metrics matters because they shape the discount rate used in valuation and help determine how investors assess the business.”

Hard IB technical questions

More advanced technical questions call for multi-step reasoning, modeling intuition, and an understanding of how real transactions work. You should be able to break problems into components and use sound judgment to reach a defensible conclusion.

12. Build an LBO model. ↑

A leveraged buyout (LBO) is the acquisition of a company using a significant amount of debt. The idea is that leverage amplifies returns. If the business performs well, debt increases equity returns. If performance or the exit valuation disappoints, leverage also magnifies losses.

When interviewers ask you to “build an LBO model,” they are usually testing whether you understand the structure and key drivers of an LBO, not whether you can build a full spreadsheet from scratch, unless it is a formal modeling test.

At a high level, an LBO model evaluates whether a company can generate enough cash flow to service its debt and deliver an attractive return to equity investors.

You can structure your answer by walking through the following steps:

- Set transaction and operating assumptions, including purchase price, capital structure, interest rates, and growth

- Build a sources and uses schedule

- Adjust the balance sheet for the transaction

- Project cash flows and debt repayment

- Assume an exit multiple and calculate IRR and money-on-money returns

Sample answer: Build an LBO model

“An LBO model evaluates whether a company can be acquired using a large amount of debt and still generate attractive returns for equity investors.

I would start by making assumptions around the purchase price, capital structure, cost of debt, and key operating drivers like revenue and growth margins.

Next, I’d build a sources and uses schedule to show how the deal is financed and how the purchase price is allocated across debt, equity, and any rollover from existing shareholders. I’d then adjust the balance sheet to reflect the new capital structure and any goodwill created.

From there, I’d project the company’s cash flows and determine how much debt can be repaid each year based on free cash flow generation, since debt paydown is a major driver of equity returns in an LBO.

Finally, I’d assume an exit multiple, calculate the exit equity value, and use that to compute the IRR and the money-on-money multiple.”

13. How does X affect the financial statements? ↑

This question usually comes up early in the technical round, right after basic accounting questions.

Before moving on to this, we recommend perfecting your answer to “Walk me through the three financial statements,” since understanding how the statements connect is the foundation for nearly every accounting question that follows.

This question can be phrased in several ways, but the most common versions focus on depreciation or impairment charges.

For example, you might be asked, “How does a $10 increase in depreciation affect the three financial statements?” or “What is the effect on all three statements after a non-recurring impairment charge?”

In any case, your interviewer wants to see whether you can clearly explain how a single change moves through all three statements and what it means for the company’s financial health.

Below is an example of how you can approach this question.

Sample answer: How does a $10 increase in depreciation affect the three statements?

When answering this question, we recommend starting with the income statement, then moving to the cash flow statement, and finishing with the balance sheet.

This order follows the natural flow of information among the three statements:

Net income (Income Statement) → Cash (Cash Flow Statement) → Assets and Equity (Balance Sheet).

So, you might say:

“Starting with the income statement, depreciation goes up by $10, which reduces pre-tax income by $10. Assuming a 20% tax rate, net income decreases by $8.

On the cash flow statement, net income is down by $8 under cash flow from operations. However, because depreciation is a non-cash expense, you add back the $10 increase in depreciation. That means cash flow from operations increases by $2. There are no changes to cash flow from investing or financing, so the net change in cash increases by $2.

On the balance sheet, cash increases by $2 under assets, while PP&E decreases by $10 due to the higher depreciation. Total assets are therefore down by $8.

Finally, on the liabilities and equity side, retained earnings decrease by $8 because of the lower net income, and the balance sheet balances.”

You can learn more about how a $10 depreciation flows through the three financial statements in the video below.

14. Determine if an acquisition is accretive or dilutive. ↑

This is an important question any time a company is considering an acquisition.

Fundamentally, any deal that increases the Earnings Per Share of the buyer is accretive.

Whereas any deal that decreases the Earnings Per Share of the buyer is dilutive.

Here’s a quick overview of how to answer this question:

- Ask your interviewer if it’s an all-stock deal

- If it is an all-stock deal, then it’s easy to determine if it’s accretive/dilutive:

- If the buyer has a higher P/E ratio, it’s accretive

- If the seller has a higher P/E ratio, it’s dilutive

If the transaction involves stock, debt, and cash, then you can use the rule of thumb approach presented in this guide as an interview substitute to building the full model.

Let’s take a look at a REAL practice question you might get in your interview.

Sample answer: If a buyer trading at 25x price-to-earnings (P/E) acquires a seller trading at 20x P/E, is the transaction accretive or dilutive?

“Given that this is framed as a stock-for-stock comparison, the quickest way to assess accretion or dilution is to compare earnings multiples.

A deal is accretive when the buyer is issuing stock with a higher P/E multiple to purchase earnings priced at a lower P/E multiple, because the buyer is effectively exchanging ‘expensive’ equity for ‘cheaper’ earnings.

Here, the buyer trades at 25x, and the seller at 20x, so the buyer’s stock is valued more richly. Converting these to earnings yields makes the logic even clearer: the buyer’s yield is 1/25, or 4%, while the seller’s yield is 1/20, or 5%. Since the seller’s yield is higher, the buyer receives more earnings per share issued, which makes the transaction accretive, all else equal.

Of course, in a full model, we would factor in the purchase price, synergies, financing mix, and any write-ups. But based purely on the relative P/E multiples, this transaction would be accretive.”

These questions come from our analysis of REAL technical interview questions reported on Glassdoor by analyst candidates at Goldman Sachs, J.P. Morgan, Morgan Stanley, Barclays, and Bank of America.

4. How to prepare for IB technical accounting interviews ↑

As you can see from the complex questions above, there is a lot of ground to cover when it comes to investment banking interview preparation. So it’s best to take a systematic approach to make the most of your practice time.

Below are links to free resources and a plan to help you prepare for your IB technical interviews:

4.1 Research the company you’re applying to

In many cases, investment banking accounting interview questions will be tied to the company’s actual deals and client base. If you’re applying to a specific team, study their recent transactions, industry coverage, and priorities.

Take the time to understand which types of clients or projects you’d most likely be working on based on the job description, and research them thoroughly. Look up relevant deal announcements, investor presentations, and press releases so you can speak confidently about the company’s recent activities and how you would contribute to similar transactions.

If you want to learn more about your target firm, check out the resources below.

Goldman Sachs

- Goldman Sachs’ purpose and values (By Goldman Sachs)

- Goldman Sachs Briefings newsletter (By Goldman Sachs)

- Goldman Sachs strategy teardown (by CB Insights)

J.P. Morgan/J.P. Morgan Chase

- Who we are (By JP Morgan Chase)

- JP Morgan weekly brief (By JP Morgan)

- JP Morgan strategy teardown (by CB Insights)

Morgan Stanley

- A culture-driven strategy (by Morgan Stanley)

- Insights (by Morgan Stanley)

- Comparison Morgan Stanley vs Goldman Sachs (by Investopedia)

Barclays Investment Bank

- About Barclays

- Barclays’ three-year plan (by Barclays)

- Barclays strategy teardown (by the Financial Times)

- Barclays’ official interview prep guide (by Barclays)

Bank of America

- Bank of America's core values (by Bank of America)

- BofA Insights (by Bank of America)

- BoFa strategy teardown (by Rancord Society)

4.2 Familiarize yourself with deals related to the company

You should be prepared to discuss recent investment banking transactions, especially those involving your target firms or sectors. Interviewers often use deal-related questions to assess whether you follow the market and understand how valuation, structure, and strategy come together in real transactions.

When reviewing a deal, focus on the buyer and seller, the strategic rationale, valuation, deal structure (cash vs. stock, leverage), and how market conditions influenced the outcome.

Below are reliable sources to stay current on recent deal activity:

Deal coverage

Databases and deal-focused platforms

- PitchBook News

- MergerMarket (subscription-based)

A good rule of thumb is to be ready to discuss at least one or two recent transactions in detail, including why the deal happened, how it was priced, and what risks or synergies were involved.

4.3 Be ready to discuss the economy and financial markets

Understanding the broader economy is essential for investment bankers because market conditions directly affect a company’s financial performance and, by extension, how its financial statements are interpreted.

You should be ready to explain how changes in global and regional markets might affect a company’s revenue, expenses, financing costs, valuation, etc.

Below are resources that help you stay current on market conditions, which frequently come up as follow-ups in technical interviews.

Company briefs/newsletters

To stay current, consider subscribing to newsletters or insights pages published by your target firms:

- Goldman Sachs newsletter (by Goldman Sachs)

- JP Morgan weekly brief (by JP Morgan)

- Morgan Stanley insights (by Morgan Stanley)

- Barclays insights (by Barclays)

- Bank of America newsletter (by Bank of America)

Publications

If you prefer general news coverage or want alerts for stories involving your target firm, consider following:

Podcasts

For market commentary and deeper dives into companies, strategy, and trends, we recommend:

YouTube channels

To stay up to speed on markets, deal activity, and broader financial trends, here are a few great channels to follow:

- Bloomberg Television

- Wall Street Journal

- Mergers & Inquisitions / Breaking Into Wall Street

- The Plain Bagel (investing, finance, economics)

4.4 Refresh your memory with a cheat sheet

When it comes to technical questions in particular, a cheat sheet is useful for a quick refresher on technical concepts.

Of course, bringing one to in-person interviews is not the best idea, and even using one for video interviews would not look great. However, it can be useful to reference during initial phone screens (assuming you won’t be on video), while answering practice questions, and as a refresher immediately before an interview begins.

You can check out our investment banking interview cheat sheet, with information around DCF, valuation, the financial statements, and a few additional formulas.

Or, click here to download the investment banking cheat sheet.

4.5 Be comfortable performing quick mental math

Calculators are not usually allowed in investment banking interviews. The good news is that you won’t need to perform complex modeling, only basic mental arithmetic and ratio logic.

If you’re out of practice with doing calculations by hand, start by reviewing the fundamentals. Khan Academy has several helpful resources for refreshing your arithmetic skills. Here are a few we recommend:

Once you're feeling comfortable with the basics, you'll need to regularly exercise your mental math muscle to become as fast and accurate as possible.

You might want to use some of the following resources. We haven't tested all of them, but some of the candidates we work with have used them in the past and found them helpful.

- Preplounge's math tool. This web tool is very helpful to practice addition, subtraction, multiplication, division, and percentages. You can both sharpen your precision and estimation math with it.

- Mental math cards challenge app (iOS). This mobile app lets you work on your mental math easily on your phone. Don't let the old-school graphics deter you from using it. The app itself is actually very good.

- Mental math games (Android). If you're an Android user, this one is a good substitute for the mental math cards challenge one on iOS.

You can also check out our case interview maths guide for practice questions and more tips to improve your mental math.

4.6 Practice with real financial statements

As we’ve discussed, a large portion of IB technical interview questions focus on the financial statements. For that reason, it’s essential to gain hands-on experience by reviewing actual company filings.

For example, you can analyze Microsoft’s public financials to see how the income statement, balance sheet, and cash flow statement connect in practice. This matters for two reasons:

- First, examples in interview prep guides are often simplified, which means they leave out many real-world details. Reviewing actual filings helps you understand how complex statements really look.

- Second, studying large public companies gives you a better sense of the types of financials you’d work with when advising clients at firms like Goldman Sachs or J.P. Morgan.

You can also practice building spreadsheets with the company’s data and manipulating the information yourself. Doing so will help you internalize how accounting movements flow through each statement.

4.7 Prepare for other types of IB interview questions

In addition to technical questions, you’ll also encounter other types of questions in your investment banking interviews that you’ll need to prepare for. Below are several of our guides that you may find particularly useful as you prepare:

General

- Investment banking interview prep guide

- 15 investment banking interview tips

- Investment banking interview cheat sheet

- 14 most common IB behavioral & fit interview questions guide

- How to answer “Why X company” question

- Investment banking HireVue interview guide

- Investment banking Superday interview guide

-

How to network your way into investment banking (by ex-Merrill Lynch director Mike)

-

How to make your LinkedIn profile more visible to IB recruiters (by ex-Merrill Lynch director Mike)

Goldman Sachs

J.P. Morgan

- JP Morgan interview prep guide

- JP Morgan behavioral interview guide

- JP Morgan HireVue interview guide

Morgan Stanley

Get feedback from ex-investment banking interviewers ↑

In our experience, practicing real interviews with experts who can give you company-specific feedback makes a huge difference.

If you know someone who runs interviews at an investment bank, then that’s amazing! They'll be a great person to practice interviews with.

But most of us don’t, and it can be REALLY tough to make a new connection with an investment banker. And even if you do have a good connection already, it might also be difficult to practice multiple hours with that person unless you know them extremely well.

That’s where mock interviews come in.

Find an investment banking interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Save time by focusing your preparation

Click here to book investment banking mock interviews with experienced finance interviewers.