Breaking into investment banking is hard, and the interview process can feel overwhelming if you don’t know where to start.

This guide is designed to be the perfect starting point for your investment banking interview preparation.

Step by step, we’ll show you how to prepare effectively, highlight what top candidates do to stand out, and point you to the best free resources to accelerate your prep.

We’ve helped hundreds of candidates land roles at top firms like Goldman Sachs, J.P. Morgan, Morgan Stanley, Barclays Investment Bank, and Bank of America. Now, we’ve distilled everything into a simple, proven set of steps to help you do the same.

Here’s an overview:

- Step 1: Understand the interview process and timeline

- Step 2: Research your target firm

- Step 3: Prep answers to common questions

- Step 4: Follow tips from expert IB interviewers

- Step 5: Practice, practice, practice

Ready? Let's go!

Click here to practice 1-on-1 with investment banking ex-interviewers

1. Understand the interview process and timeline

You should begin your preparation for investment banking (IB) interviews by familiarizing yourself with the typical interview process. Knowing the stages to expect will help you get into the right preparation mindset.

Here, we’ll focus primarily on Investment Banking Full-time Analyst (senior year or just graduated) and Summer Analyst (internship before junior → senior year) positions.

However, the steps below may also overlap with the hiring processes used for other finance roles at firms such as Goldman Sachs, J.P. Morgan, Morgan Stanley, Barclays, and Bank of America (BofA).

Let’s begin.

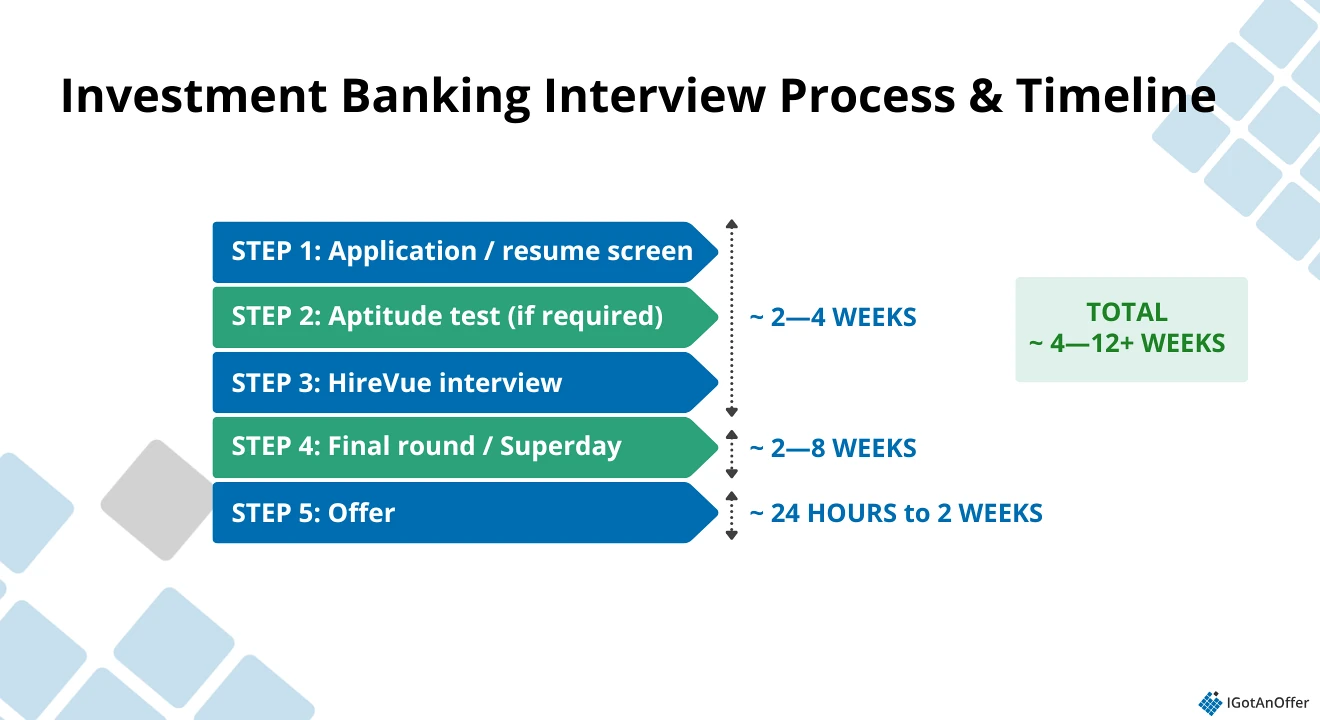

The interview process for IB roles typically takes 4–12 weeks, but timelines vary widely based on the recruiting cycle.

Banks run Final Interviews/Superdays in fixed batches, so your wait time depends on when the next one is scheduled. For instance, if Superdays are held in December, an applicant who applied in April may wait months, while someone applying closer to that date may wait only a few weeks.

Regardless of whether you're applying for a full-time position or an internship program, IB candidates will typically go through five steps:

- Application and resume

- Aptitude test (for some candidates)

- HireVue interview

- Final-round interviews / Super day

- Job offer

Now let’s examine each of those steps in more detail.

1.1 Application and resume

There are three main ways that the interview process begins:

- You’ll apply on your target firm’s website

- You’ll apply through an event or career fair

- A recruiter will reach out to you

Regardless of which of these starts your application journey, you’ll want to be ready with a polished resume that is targeted specifically to the firm to which you’re applying (more on firm-specific research in Section 2 below).

If you have yet to apply, you can optimize your documents by using our investment banking resume guide. You can also get our IB coaches to review your resume.

Additionally, try attending career fairs or events hosted by your target firm and make genuine connections with people from the company.

Then, when you go to apply, specifically name-drop the people you’ve met in your cover letter. You could even write a quote you heard from them, or mention what you learned from them about the company.

1.2 Aptitude test ↑

If your application meets your target firm’s basic requirements, then you’ll move on to the next round of the process.

For some candidates, that means taking an online aptitude test. Whether or not you’ll be asked to take an assessment like this depends on a few conditions, including the specific firm you’ve applied to and your level of experience.

Either way, it helps to be aware of this step, just in case you are asked to do it.

It’s also worth mentioning that the format of this test varies. For example, Morgan Stanley uses aptitude tests with the following topics:

- Verbal reasoning

- Numerical reasoning

- Logical reasoning

- Accuracy (error-checking)

On the other hand, JP Morgan uses something called a “pymetrics test” that assesses candidates using a series of digital games.

Generally speaking, the best way to prepare for aptitude tests is to practice with similar questions. You can do that using online test providers, like this one. You could also practice with sample GMAT questions, since aptitude tests often have some similarities with GMAT-style questions.

1.3 HireVue video interview ↑

The next step is the HireVue video interview.

HireVue interviews are asynchronous assessments that investment banks use early in the recruiting process to evaluate large pools of candidates. They’re designed to assess your delivery, clarity, and alignment to the role, says Geert (ex-valuation specialist at Deutsche Bank).

During the interview, you'll be asked to record your responses to a series of interview questions. A typical HireVue interview includes 3–6 questions. For each question:

- You’ll get 30-120 seconds of prep time,

- 2–3 minutes to record your response, and

- One chance to re-record (if the firm allows it)

The HireVue interview mostly contains common behavioral questions like “Why investment banking?” and “Tell me about a time…” style questions. You’ll also get economy/market awareness questions like “Tell us about a recent M&A deal”.

In addition, Geert says that “some firms also include role-specific or market-related questions to test awareness, and occasionally curveball questions to assess creativity and thinking.” (More on the question types in Section 2).

HireVue is usually the 2nd or 3rd step of the IB interview process, but can sometimes replace an initial phone screen or the first round of interviews.

For more information, check out our IB HireVue interviews guide. If you’re preparing specifically for J.P. Morgan, you can also refer to our JPM HireVue interview guide for company-specific insights.

We'll go deeper into common IB interview questions asked in Section 3 of this guide.

1.4 Final-round interviews / Super Day ↑

If you do well enough on the previous steps, you’ll be invited to the final round of interviews.

For entry-level positions (internships and graduate hires), this may take the form of a “Super Day” (or “Assessment Centre” in the UK). This is where a large number of candidates spend the day interviewing at the firm’s office or a conference center.

For a Super Day, there are typically 3-6 back-to-back interviews, which should each last around 30 minutes. And in every interview, you’ll usually face at least two interviewers.

In some cases, the Super Day may also include more unique interview formats. For example, Morgan Stanley uses a group exercise and sometimes an individual presentation to evaluate candidates.

If you’re a more experienced hire, you probably won’t be invited to a Super Day. Instead, your final-round interview will consist of at least 3 back-to-back interviews with team members of varying seniority. Each interview should last around 30 minutes.

1.5 Job offer ↑

Finally, once you’ve successfully passed each stage of the interview process, you’ll receive your offer package from the bank.

Most candidates hear back within 24 hours to 2 weeks after their final-round interview or Superday, depending on the firm’s hiring cycle and the number of candidates being reviewed.

At this point, all that’s left is to negotiate your offer. Your recruiter will typically reach out with the details and may schedule a call to walk you through the terms and answer questions. If they don’t schedule a call, you should feel free to request one.

Salary discussions can feel uncomfortable, especially if you’re new to them. Consider booking one of our salary negotiation coaches to get expert advice.

2. Research your target firm ↑

It’s very common for interviewers at leading investment banks to ask questions that test whether a candidate wants to work for THEM over the other firms in the industry.

Be sure to spend some time learning about the specific division within your target company. If you can’t explain why you’re interested in that division, it can be a red flag for recruiters.

You should also understand the teams within that division, as this shows you’re motivated and familiar with how the firm operates.

Here are some questions to expect based on real interview reports on Glassdoor:

- Why do you want to work for Firm X? (e.g., Goldman Sachs)

- What makes Firm X different from other banks?

- How would you describe Firm X and what we do?

- What is something that you recently heard about Firm X? And why is it important?

As you can see from these questions, you’ll need to be prepared to articulate what you like about the specific firm you’re interviewing with, even if you’ve applied for multiple companies.

To help you get ready, we recommend the following steps to research each of your target firms prior to your interviews.

2.1 Prepare a unique answer to the “why Firm X?” question

First, you should outline and rehearse an answer to the “why Firm X?” question. This is the single most common question asked in investment banking interviews, so it’s essential that you do this at some point during your preparation anyway.

When you begin to outline your answer, you should be very intentional in giving two or three UNIQUE reasons for wanting to work at your target firm. To be clear, that means the reasons you give should be things that ONLY apply to that particular firm.

One good reason to include, are the names of current or former employees of the firm who you know, and what impact they’ve had on you. This is a powerful technique because it is naturally firm-specific, and it makes a real personal connection between you and someone at the company.

Below is an example of a good answer to get you started.

Sample answer to ‘Why firm X’ question

“There are three main reasons I’d like to work for your firm. First, after speaking with [Employee Name] in your [division], I was struck by how much responsibility analysts take on from day one. They described being involved in substantive work that actually influences live deals, and that level of trust and hands-on experience is exactly what I’m looking for as I start my career.

Also, I’ve been consistently impressed by your firm’s leadership in [specific sector or strategic focus]. The way the team executed [Deal A] and [Deal B] shows a clear commitment to long-term client relationships and thoughtful advisory work. I’ve followed these moves throughout my studies and internships, and I’d love to contribute to a platform that shapes industry-defining transactions.

Finally, I’m passionate about [sustainability / innovation / analyst development / another unique firm initiative], so your firm’s work in this area really stands out to me. My goal is to join an institution that not only performs at the highest level but also acts responsibly given its global footprint. That’s why I was immediately excited about this role in your [specific group] when I saw the position.”

To get some more ideas of what to include in your answer, check out the sample answers for this question that we’ve written for each of the below firms:

2.2 Study the strategy or market position of the firm

It’s also helpful to have a broad understanding of the firm, and their position in the investment banking industry.

Reading a strategy report about your target firm is a great way to start familiarizing yourself with this topic. Here are a few good resources:

- Goldman Sachs strategy teardown (by CB Insights)

- JP Morgan strategy teardown (by CB Insights)

- Morgan Stanley vs. Goldman Sachs (by Investopedia)

- Barclays Capital (by Financial Times)

- Strategy Study: Bank of America (by Rancord Society)

Given that we’re talking about investment banking roles, you may also want to get a general feel for the financial statements of your target firm, which are easy to find online for any publicly traded investment bank. This is probably not strictly necessary though, so prioritize other preparation steps first.

2.3 Familiarize yourself with the firm’s values

Most investment banks have a list of values or a mission statement published on their website.

You’re unlikely to be asked specifically about one of the firm’s values, but it can be helpful to know them, because it can help you frame your answers in a way that is aligned with how the firm operates.

Here are relevant pages for the three leading firms:

- Goldman Sachs purpose and values (by Goldman Sachs)

- JP Morgan Chase “who we are” (by JP Morgan Chase)

- Morgan Stanley core values (by Morgan Stanley)

- Barclays core values and purpose (by Barclays)

- Bank of America core values (by Bank of America)

2.4 Analyze one deal by the firm in-depth

At some point during the interview process, you’ll probably encounter a question related to deals. For example, “Tell me about a recent transaction” or something like that.

This is not inherently a firm-specific question. But, if you’re applying to Goldman Sachs (for instance), it would be ideal to be ready to discuss a recent deal that Goldman Sachs completed.

So, you should prepare to discuss at least one recent IB transaction from your target firm in-depth.

Be ready to give your opinion on whether the deal was a good (or bad) move, and memorize some key numbers to back up your analysis.

If you’re applying for a particular group within your target firm, it’s even better to discuss deals relevant to that group.

You can find information about recent deals by reading the Investment Banking section of the Financial Times, which frequently covers stories involving leading firms, like Goldman Sachs, JP Morgan, and Morgan Stanley. We’ve also found this guide on preparing for deal interview questions to be really helpful.

2.5 Brush up on recent news and insights

Finally, being up to speed on recent news or insights related to your target firm can help you avoid getting stumped by questions related to current events. Below are links to some of our favorites:

Company briefs/newsletters

To stay current, consider subscribing to newsletters or insights pages published by your target firms:

- Goldman Sachs newsletter (by Goldman Sachs)

- JP Morgan weekly brief (by JP Morgan)

- Morgan Stanley insights (by Morgan Stanley)

- Barclays insights (by Barclays)

- Bank of America newsletter (by Bank of America)

Publications

If you prefer general news coverage or want alerts for stories involving your target firm, consider following:

Podcasts

For market commentary and deeper dives into companies, strategy, and trends, we recommend:

YouTube channels

To stay up to speed on markets, deal activity, and broader financial trends, here are a few great channels to follow:

- Bloomberg Television

- Wall Street Journal

- Mergers & Inquisitions / Breaking Into Wall Street

- The Plain Bagel (investing, finance, economics)

3. Prep answers to common questions ↑

Now let’s get into what is probably the most important step in your interview preparation: drafting answers to common questions.

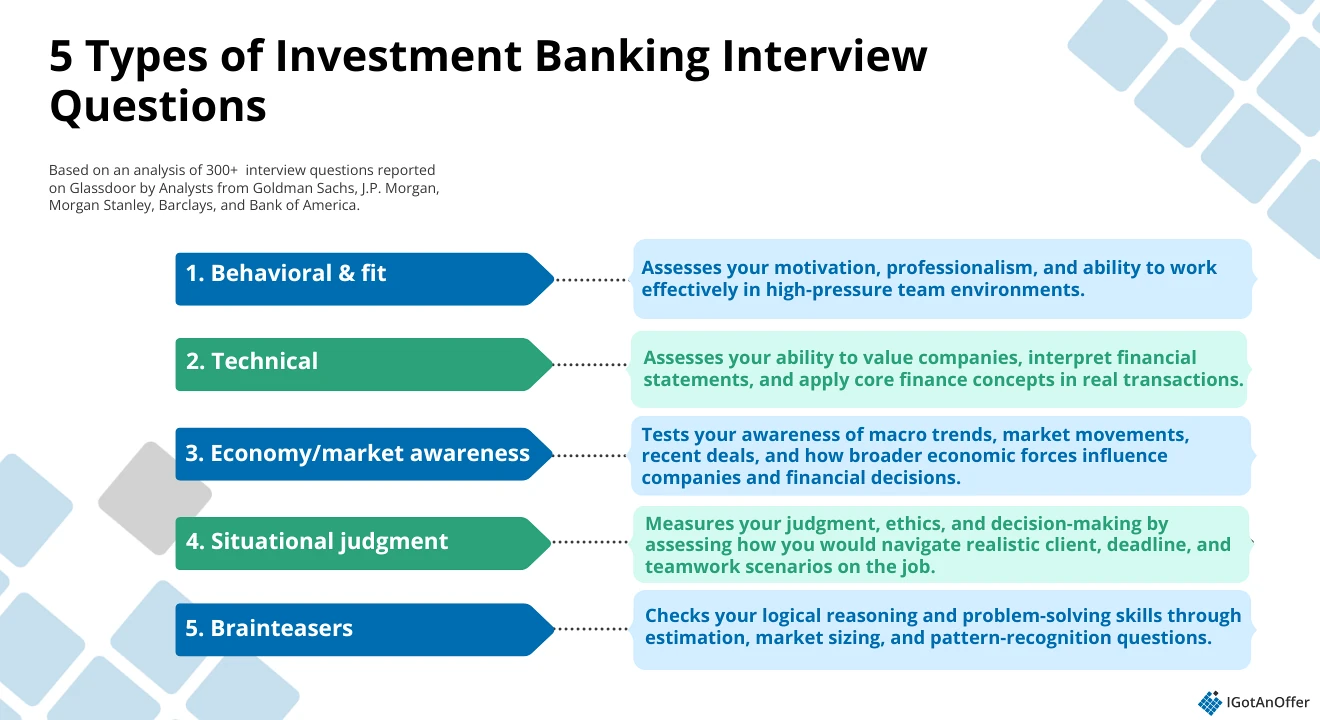

The following are the five broad categories of questions that you’ll face in your investment banking interviews, and how frequently they get asked:

- Behavioral and fit questions

- Technical questions

- Economy/market awareness questions

- Situational judgment questions

- Brainteasers

We’ve listed real interview questions reported on Glassdoor by analyst candidates at Goldman Sachs, J.P. Morgan, Morgan Stanley, Barclays, and Bank of America that you can practice with. We’ve only adjusted the wording slightly to make them clearer.

Now let’s get into it!

3.1 Behavioral and fit questions

Behavioral questions are by far the most common type of question you’ll face in your investment banking interviews.

Interviewers ask these questions to understand whether you have the motivation, temperament, and interpersonal skills needed to handle the demands of investment banking. And, if you would fit within their team and culture.

Behavioral and fit questions are based on the idea that past behavior is one of the strongest predictors of future performance. They prompt you to share real stories about your experiences, so interviewers can evaluate soft skills, such as problem-solving, leadership, communication, and handling conflict.

These questions fall under two formats:

- General questions, such as “why investment banking?” or “why should we hire you?”, which require individualized responses

- Scenario questions that typically begin with “Tell me about a time…” which can be answered using a repeatable framework

For general behavioral questions, you’ll need to prepare personalized responses that reflect your motivation and fit for the role. These should sound natural and not overly scripted.

For scenario-based questions, it helps to use a repeatable framework, such as the traditional STAR method (Situation, Task, Action, Result) or, even better, IGotAnOffer’s SPSIL method (Situation, Problem, Solution, Impact, Lessons). These frameworks make it easier to present your experience clearly and highlight your impact.

If you want a deeper explanation, read our guide on why IGotAnOffer's SPSIL method can be more effective than STAR.

In the meantime, here are some practice questions sourced from real candidates on Glassdoor.

Example behavioral & fit questions asked at IB interviews

- Why Firm X? (i.e., Why Goldman Sachs?)

- Why investment banking?

- Tell me about a time you worked in a team

- Walk me through your resume

- Tell me about yourself

- Why should we hire you?

- Why this job?

- What are your strengths and weaknesses?

- Tell us about a time you had a problem and how you solved it

- What was your greatest challenge?

- Why did you choose your major?

- What are your career goals?

- What is your understanding of the role you will be doing?

- Tell me something about yourself that is not on your résumé.

- What would your co-workers say about you?

- How would your friends and family describe you?

- What do you do for fun outside of work?

- Why wouldn’t I hire you?

- How would you describe yourself in a single word?

- Tell us one thing about yourself that we should not know.

- What is the hardest thing you have experienced, and how did you overcome it?

- Tell me about a difficult time you worked in a team.

- Tell me about a time when a team member wasn’t pulling their weight. What did you do?

- Tell me about a time your team encountered an issue and how you handled it.

- Tell me about a time you had to work under pressure.

- Tell me about a time you had a leadership role. What challenges did you face?

- Tell me about a time you were persuasive.

- Tell me about a time you showed resilience.

- Tell me about a time you showed independent thinking.

- Tell me about a time you had to make a quick decision. What was your thought process?

- Tell me about a time you had to work outside of your normal schedule.

- Tell me about a time you had a positive impact on a project and how you measured success.

- Tell me about a time you dealt with a difficult client and how you handled it.

- Tell me about a time you used data to make a recommendation.

- Tell me about a time you had to present detailed or complex information. How did you ensure your message was clear?

- Tell me about a time you made a significant mistake and how you addressed it.

- Tell me about a time you experienced failure and how you recovered.

- Tell me about a time you had a conflict with someone and how you resolved it.

- Tell me about an ethical or moral dilemma you faced and what you did.

- Provide an example of a time you sought out relevant information and used it to form a plan of action.

- Tell me about a time you worked with someone you disliked. How did you manage the relationship?

For a much more extensive list of behavioral interview questions, including sample answers for many of the above questions, you can check out our investment banking behavioral & fit interview questions guide.

3.2 Technical questions ↑

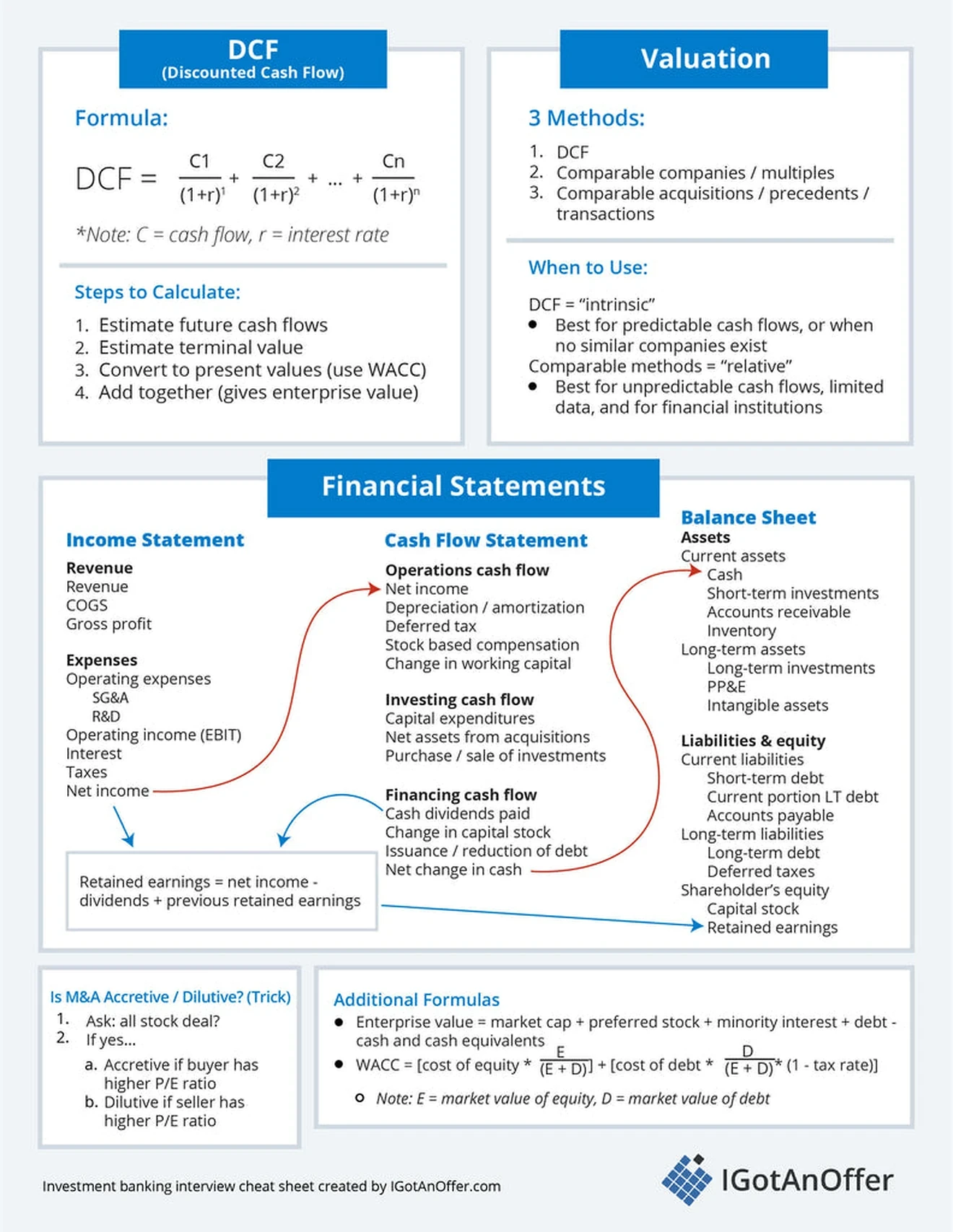

Technical questions can feel intimidating, especially if you’re unsure where to begin. In investment banking interviews, “technical” is an umbrella term that typically refers to valuation, accounting, and a few other (less common) question sub-types.

- Valuation questions test your ability to determine the value of a business

- Accounting questions assess your understanding of financial statements and core accounting principles

- Other technical questions touch on topics such as leverage ratios, beta, interest rate impacts, or other finance concepts that don’t neatly fall under valuation or accounting

If you don’t know where to start, we created an investment banking interview cheat sheet that highlights the most common technical topics you’ll need to know.

Click here to download the investment banking cheat sheet.

Once you’ve reviewed the basics, use the example questions below to practice.

Example technical questions asked at IB interviews

Valuation

- Walk me through a discounted cash flow (DCF) analysis.

- What are the main methods of valuing a company?

- How would you value a company?

- How do you value a company with no revenue or profit?

- How would you value an apple tree?

- When would you not use a DCF to value a company?

- Give me a scenario where a DCF provides more insight than a multiples-based valuation.

- How would a DCF analysis differ for a biotechnology company?

- How would an increase in the corporate tax rate affect a DCF valuation?

- What is your view on price-to-earnings (P/E) versus enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA)?

- What happens to the value of a company if its cost of equity increases?

- What is the difference between enterprise value and market capitalization?

- How do you calculate the market capitalization of a company?

- Walk me from equity value to enterprise value.

- Why do we use earnings before interest, taxes, depreciation, and amortization (EBITDA)?

- What is the effect of a stock split on a company’s price-to-earnings (P/E) ratio?

- How do leasing rules under International Financial Reporting Standard 16 (IFRS 16) affect a DCF?

Accounting

- What are the three financial statements?

- How do the three financial statements link together?

- Walk me through the impact of a $10 increase in depreciation across all three statements.

- What is the effect on all three statements after a non-recurring impairment charge?

- How does goodwill impairment impact the financial statements?

- How do you go from earnings before interest, taxes, depreciation, and amortization (EBITDA) to free cash flow (FCF)?

- How do you calculate levered/unlevered free cash flow?

- Walk me through how purchasing $100 of assets affects the financial statements by the end of the year.

- What is the impact of an increase in accounts payable (AP) on cash flow?

- Walk me through a profit and loss (P&L) statement.

- Walk me through a balance sheet.

- Explain minority interest in simple terms.

- Explain the treasury stock method.

- Walk me through a $10 increase in depreciation and amortization (D&A).

- Explain the post-merger impact on the financial statements of two companies.

- What leverage ratios would you use to evaluate the risk on a company’s balance sheet?

- How do changes in interest rates affect corporate balance sheets?

Others (LBOs, M&As, etc.)

- Walk me through a leveraged buyout (LBO).

- What are the key drivers of an LBO model?

- What is the typical financing structure of an LBO?

- What is the typical timeline for an LBO?

- Would a financial sponsor and a strategic buyer pay the same price for a company if synergies were removed?

- If a buyer trading at 25x price-to-earnings (P/E) acquires a seller trading at 20x P/E, is the transaction accretive or dilutive?

- How do you calculate beta?

- What metrics would you examine to determine whether a company can repay a new loan?

- How are interest rates correlated with real estate investment trusts (REITs)?

- How would you build a sum-of-the-parts (SOTP) valuation for a drug launch?

- What does it mean for cash to have a price-to-earnings (P/E) ratio?

You can learn more about each type of question above and get an overview of how to solve them in our separate investment banking technical questions interview guide.

If you want deeper coverage of accounting questions, refer to our investment banking accounting questions guide.

3.3 Economy / market awareness questions ↑

This category includes questions that fall outside behavioral or technical topics. They assess your understanding of the broader economy, financial markets, current deals, and industry dynamics that are relevant to the team and firm you’re applying to.

To make your preparation easier, we’ve grouped these questions into four sub-categories:

- Economy questions – test your awareness of current events, macro trends, and how economic shifts affect companies, valuations, and markets relevant to your target team

- Deals questions – evaluate whether you understand real M&A or capital markets transactions and the key drivers behind them

- Industry questions – assess your familiarity with the investment banking landscape, what different teams do, and how your target firm is positioned relative to competitors

- Investing questions – gauge your ability to think like an investor by forming a thesis, evaluating opportunities, and explaining how you’d allocate capital

Below, you’ll find example questions from each sub-category.

Example economy/market awareness questions asked at IB interviews

Economy

- Name one story in the news and describe why it’s important to you.

- Tell us about a recent news story and why it sparked your attention.

- What is happening in the current market that has caught your interest, and why?

- What is your opinion of the market right now?

- What do you think is the biggest challenge facing the financial market in the next 5 years?

- Describe how a world event can impact markets.

- Describe the effect of global circumstances on financial markets.

- What are three key themes that UK markets will be focused on over the coming year?

- How would you explain the local economy in layman’s terms?

- How do you expect current trade policy and Federal Reserve policy to impact markets over the next 12 months?

- How will the bond market react to the interest rate drop?

- What do you think the Federal Reserve will do with interest rates?

- What is your view of the European debt crisis?

- What is the difference between monetary and fiscal policy?

- What do you think of quantitative easing?

- What is the trend of the Asia equity market in the last two years?

- Name a major current event happening in the world right now and explain how it affects the markets relevant to this business.

Deals

- Tell me about a recent M&A transaction and what you thought about it

- Tell us about a recent private equity deal

- Tell me about a recent deal you’ve been paying attention to.

- Tell me about a recent deal that the company worked on and what you know about it.

- Tell me about one of the deals on your résumé.

Industry

- What is something you recently heard about our company, and why is it important?

- What makes our bank different from other banks?

- What is investment banking?

- What technology will be trendy in the next 6–12 months?

- How can an investment bank add value?

Investing

- What are the requirements for a good investment?

- Pitch a stock.

- Describe SolarCity’s business model.

- Discuss a stock you’ve been following.

- Pitch me a stock where you would invest $1,000,000. (Morgan Stanley)

- What are the requirements for making a good investment?

- What stock would you long and which would you hedge?

For more information, check out our guide on business sense IB interview questions. It covers more example questions and insights relevant to this category.

3.4 Situational judgment questions ↑

Situational judgment questions assess how you would handle realistic scenarios you may encounter on the job.

Instead of asking about past experiences, as behavioral questions do, these prompts evaluate your judgment, ethics, communication style, and ability to stay composed under pressure.

You’ll be given a hypothetical scenario involving clients, deadlines, or teamwork and asked to walk through how you would approach it.

Example situational judgment questions asked at IB interviews

- The person sitting in front of you during a test begins cheating. How would you handle the situation, and would you respond immediately or wait until afterward?

- You have a deliverable due tomorrow, but are missing a critical component, and your team is asleep. What do you do?

- You are working on a major client deal, and the client makes a request that violates firm policy. What would you do, and who would you escalate it to?

- What would you do if a major client’s request were illegal?

- If you had several urgent tasks to complete but not enough time, how would you prioritize them?

- You gave your manager a piece of work and later realized you made a mistake. What would you do?

- Your previous manager asks you for confidential information about a project you’re working on, claiming it’s needed for an important decision. How do you respond?

- Your team is facing activist pressure because one business segment is underperforming. How would you approach this challenge?

- If part of a company is facing severe headwinds, what steps would you take as an advisor?

- A client or teammate is struggling to understand complex information you need to present. How would you prepare, and how would you communicate it effectively?

- You are asked to support a live deal on the same day as an important personal commitment (e.g., a family event). What do you prioritize, and why?

For a simple framework on how to answer situational judgment questions, check out Section 1.4 of our IB behavioral & fit interview questions guide.

3.5 Brainteasers ↑

Finally, some firms, especially Goldman Sachs, like to throw in a few brainteasers to measure your logical thinking and problem-solving skills. These curveball questions often come in the form of estimation or market sizing questions.

Let’s look at a few sample questions.

Example brainteaser questions asked at IB interviews

Market sizing

- Size the market of the gum industry in the United States.

- How many people do you think speak Bengali in Japan?

- How many cigarettes are sold in the United States each year?

- How would you estimate how many iPhones T-Mobile should order for the next release?

Estimation

- How many tennis balls can you fit into a Tesla?

- How many coins would fit in this room?

- How many light bulbs are there in New York?

Others

- Which number is closest to 272: 600, 700, or 800?

- If you look at a clock and the time is 9:45, what is the angle between the hour and minute hands?

- What is the angle between the hands at 3:15?

- If a piggy bank deposits $100 per year, how much would you pay for it?

For more guidance on how to answer these types of questions, check out our guide on market sizing interview questions. They were written for consulting and product management roles, but they work just as well for IB candidates.

Click here to download IGotAnOffer’s complete list of 150+ IB interview questions.

4. Follow tips from expert IB interviewers ↑

As you can see from the complex questions above, there is a lot of ground to cover when it comes to investment banking interview preparation. So it’s best to take a systematic approach to make the most of your practice time.

Below are five helpful tips to keep in mind when preparing for IB interviews.

4.1 Know your resume inside and out

Working on your resume doesn’t end at the application stage. Questions like “Walk me through your resume” and “Tell me about yourself” were among the most common behavioral questions reported by candidates across Goldman Sachs, J.P. Morgan, Morgan Stanley, Barclays, and Bank of America.

Your response to these questions will set the tone for the interview, and interviewers will often follow up by digging into your past experiences. Everything on your resume is fair game, so come prepared to talk about it in detail.

If you need help crafting your resume, check out our IB resume guide for tips and sample resumes from successful candidates.

4.2 Prepare a compelling opening pitch

Ice-breaker questions like “Why this firm?” or “Why investment banking?” almost always appear at the start of an interview. Unlike resume questions, these prompts test your motivation and whether you’ve done the research needed to show genuine interest in the role/company.

Think of these questions as an opportunity to give your elevator pitch: to tell your story and why this is a good fit for you in one to two minutes.

We’ve written in-depth guides on how to answer the most common ice-breaker and behavioral questions at Goldman Sachs, JP Morgan, and Morgan Stanley, but if you’re short on time, here are the most frequent questions we found in our research:

- Why this firm?

- Why investment banking?

- Tell me about yourself.

- Walk me through your resume.

- What are your strengths and weaknesses?

4.3 Network, network, network

Talk to as many people from your target firm as possible before interviewing. It’s a great way to learn more about the firm from an inside perspective.

You can also give yourself an advantage by name-dropping the people from the firm with whom you’ve made connections during the interviews. This shows the interviewers that you’ve gone the extra mile to get to know the firm and that you already have connections with your future teammates.

If you don’t already know anybody at your target firm, you can use LinkedIn to reach out to current employees. Search for people with a connection to you: alumni of your university or high school, people from the same hometown, a mutual connection, etc.

This will help you find a common ground to start the conversation and get to know each other with less of the awkwardness of a cold email.

For more tips, see our networking guide for landing a job. It’s geared toward consulting candidates, but the advice works just as well for IB.

4.4 Ask original questions

Not asking questions is a huge red flag for interviewers. Investment banking requires gathering information to make high-stakes decisions, so interviewers expect candidates to do the same when evaluating a role.

Come prepared with a few thoughtful questions, and aim for ones that are specific to the firm or team you’re applying to. This shows genuine interest and helps you get meaningful insight into the role.

For example, if you’re applying to a team/office that specializes in the Energy industry, you could ask the interviewer what they think the unique challenges in the Energy industry are over the next 6 months.

4.5 Connect with your interviewer

This tip may seem obvious, but it’s easy to forget in the context of an interview. Remember that the interview is first and foremost a conversation, so that the interviewer can find out if you’re right for the job, and for you to decide whether or not you want to work there.

Don’t forget to smile here and there and to make eye contact as you speak. Investment bankers work long hours, so your interviewer is looking for someone they would enjoy working with on the longer days. Try to make a personal connection.

For more tips on how to set yourself apart in an investment banking interview, take a look at our list of 15 essential IB interviewing tips.

5. Practice, practice, practice ↑

The tips above are a great starting point, but real improvement comes from consistent practice. The more you rehearse your answers and simulate interview conditions, the more confident and ready you’ll feel on interview day.

Below are links to free resources and a plan to help you prepare for your IB interviews.

5.1 Learn by yourself

To practice effectively, you need the right tools. IB interviews can feel intimidating at first, but having good resources will make your preparation much more manageable.

Here are a few links that you may find useful. They’re a mix of our own deep dive guides and some that we highly recommend from other sources.

General

- Investment banking interview prep guide (by IGotAnOffer)

- 15 investment banking interview tips (by IGotAnOffer)

- Investment banking interview cheat sheet (by IGotAnOffer)

- How to answer “Why X company” question (by IGotAnOffer)

- Investment banking interview accounting questions guide (by IGotAnOffer)

- Investment banking behavioral & fit interview questions guide (by IGotAnOffer)

- IB technical interview questions guide (by IGotAnOffer)

- Business sense IB interview questions guide (by IGotAnOffer)

- Investment banking HireVue interviews (by IGotAnOffer)

Goldman Sachs

- Goldman Sachs interview prep guide (by IGotAnOffer)

- Goldman Sachs behavioral interview guide (by IGotAnOffer)

J.P. Morgan

- JP Morgan interview prep guide (by IGotAnOffer)

- JP Morgan behavioral interview guide (by IGotAnOffer)

- JP Morgan HireVue interview guide (by IGotAnOffer)

Morgan Stanley

- Morgan Stanley interview prep guide (by IGotAnOffer)

- Morgan Stanley behavioral interview prep guide (by IGotAnOffer)

Barclays Investment Bank

- Barclays interview skills & preparation guide (by Barclays)

- Virtual interview practice tool (by Barclays)

Bank of America (BofA)

- BofA official interviewing guide (by Bank of America)

5.2 Practice your answers out loud

A great way to practice your answers is to interview yourself out loud. This may sound strange, but it will significantly improve the way you communicate during an interview.

You should be able to deliver each answer naturally, without missing key details or memorizing your stories word-for-word. Use a timer while you practice to simulate the pace of a real interview and keep your answers concise.

For HireVue, recording yourself is also helpful as it lets you review your delivery, pacing, and presence on camera.

Play the role of both the candidate and the interviewer, asking questions and answering them just like two people would in an interview. Trust us, it works.

5.3 Practice with peers

If you have friends or peers who can do mock interviews with you, that's an option worth trying. It’s free, but be warned, you may come up against the following problems:

- It’s hard to know if the feedback you get is accurate

- They’re unlikely to have insider knowledge of interviews at your target company

- On peer platforms, people often waste your time by not showing up

For those reasons, many candidates skip peer mock interviews and go straight to mock interviews with an expert.

5.4 Practice with investment banking ex-interviewers

In our experience, practicing real interviews with experts who can give you company-specific feedback makes a huge difference.

If you know someone who runs interviews at an investment bank, then that’s amazing! They'll be a great person to practice interviews with.

But most of us don’t, and it can be REALLY tough to make a new connection with an investment banker. And even if you do have a good connection already, it might also be difficult to practice multiple hours with that person unless you know them extremely well.

That’s where mock interviews come in.

Find an investment banking interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Save time by focusing your preparation

Click here to book investment banking mock interviews with experienced finance interviewers.