Below is a cheat sheet for investment banking interviews.

In section 1, you can get the downloadable PDF, and you should also bookmark section 2 in your preparation notes, because it explains each concept on the cheat sheet in more detail.

You’ll probably also find section 3 to be useful, because it provides a list of the 11 most common IB interview questions, according to over 240 Glassdoor interview reports from REAL analyst candidates for Goldman Sachs, JP Morgan, and Morgan Stanley.

Let’s get into it!

- Investment banking interview cheat sheet (and PDF)

- Cheat sheet concepts explained

- The 11 most common IB interview questions

- Will you get an offer?

Click here to practice 1-on-1 with investment banking ex-interviewers

1. Investment banking interview cheat sheet (and PDF download)

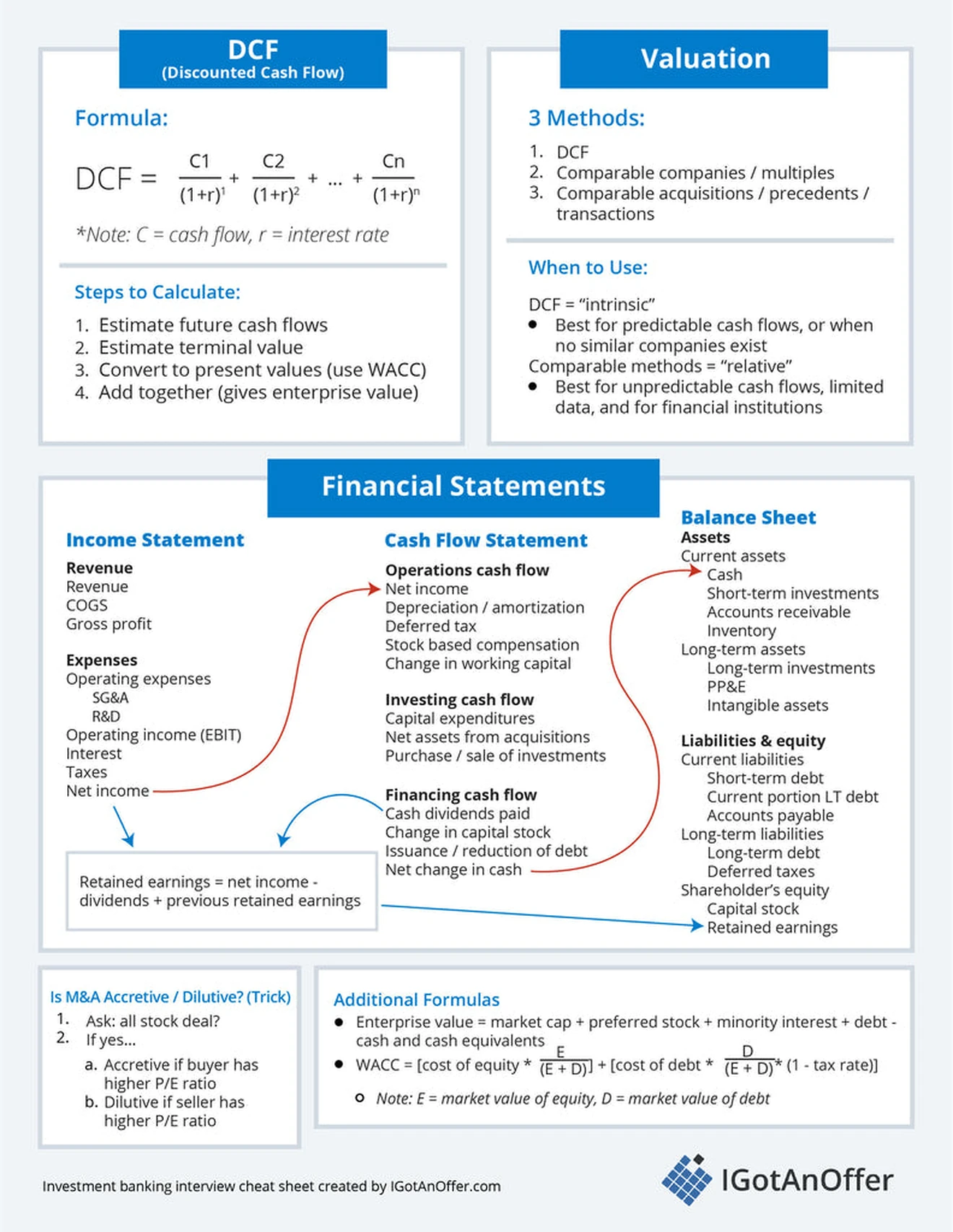

Here's the cheat sheet in JPG format:

Click here to download the investment banking cheat sheet

2. Cheat sheet concepts explained

The items on the cheat sheet are meant as a quick reference, and some of the concepts shown on the cheat sheet are NOT self-explanatory.

So, we’ve written this section to explain all of the cheat sheet concepts in more detail.

Before we dive in, there are a couple of things you should know about what we’ve included on the cheat sheet:

- We’ve focused the cheat sheet on the most common technical questions. That's because technical questions require you to understand definitive facts, whereas behavioral and business sense questions are more dependent on you.

- We’ve covered 9 of the 14 most common technical questions in the cheat sheet, which covers about 73% of all technical questions asked in IB interviews. For a more complete understanding, study our technical interview guide and IB accounting interview questions guide.

With those points covered, let’s jump into the first topic on the cheat sheet.

2.1 Answering DCF questions

You are almost guaranteed to run into DCF questions during your investment banking interviews.

“Walk me through a DCF” is the 3rd most common question in IB interviews (see the top 11 questions below).

So you’ve got to know the steps for answering DCF questions THOROUGHLY.

Here is the basic formula, which is mentioned in the cheat sheet:

- DCF = C1 / (1+r)^1 + C2 / (1+r)^2 + … + Cn / (1+r)^n

- Note: C = cash flow, r = interest rate

And here’s a more detailed version of the calculation steps covered in the cheat sheet:

- Estimate future cash flows

- Note: usually spans 5-10 years into the future

- Estimate the terminal value of the company

- Note: this is done by either assuming a constant growth rate in perpetuity after the cash flows from step 1, OR based on the firm’s expected sale price

- Convert these numbers to present values using WACC as the interest rate

- Note: In most cases WACC is used for “r” (the interest rate) in the formula above

- Add the numbers together

- Note: The results of this calculation give you the “enterprise value” of the company

To learn more about each step of performing a DCF analysis, check out this full guide.

2.2 Answering valuation questions

Valuation questions are another frequent topic for investment banking interviews.

There are a few different topics within valuation that you may be asked about, so we’ll explore 3 different types of valuation questions below.

Let’s start with the most common valuation question (by far):

2.2.1 What are the main methods of valuing a company?

If/when you’re asked this question, your interviewer will usually expect you to name these 3 valuation methods:

- DCF method

- Comparable companies (also called multiples) method

- Comparable acquisitions (also called precedents or transactions) method

The DCF approach calculates the intrinsic value of the company, while the other two methods calculate the relative value of the company. You’ll find these three methods in the “valuation” section of the cheat sheet.

As we covered in the previous section, the Discounted Cash Flow method values a company using the present value of its future cash flows (including its terminal value).

The CompCo (Comparable Company) method values a business by comparing its multiples (e.g. the P/E ratio) with similar companies. And the CompAq (Comparable Acquisition) method values a company by comparing it with similar companies that have sold in the past.

2.2.2 When would you use (or not use) DCF instead of other valuation methods?

It’s also important to know WHEN it’s most appropriate to use each of these valuation methods, as this sometimes also comes up during interviews.

This concept is briefly summarized in the valuation section of the cheat sheet, but here is a more detailed explanation:

- A relative valuation method would usually be better than DCF, when…

- The business has really unpredictable cash flows, because DCF is dependent on the numbers you have for future cash flows.

- There is not enough financial data available to use the DCF method. For example, if you only have the company’s revenue, you could make a relative valuation, but you wouldn’t be able to use DCF.

- The business is a financial institution, because they operate differently than a typical cash flowing business (e.g. by profiting on the spread on debt).

- Note: this is not a comprehensive list of examples, but it will probably be enough for answering the above interview question.

- DCF would work better than a relative valuation, when…

- The business is well established and has highly predictable cash flows.

- There are no companies similar enough to the business in order to create a good relative valuation. This could be the case for companies with really varied revenue sources (e.g. they sell muffins and jet turbines).

2.2.3 How would you value X company?

Taking these valuation concepts one step further, your interviewer may ask how you would value a specific company, rather than about the general valuation methods. They may or may not give you additional details or data about the company.

As an example, you might be asked “how would you value Morgan Stanley?”

Here’s a quick overview of how you could approach this question:

- Morgan Stanley is a bank

- Banks are typically valued using the comparable companies method

- More specifically, I would compare to similar banks using the price to book value multiple

- Price to book value is used because a bank’s assets and liabilities are legally required to be “marked to market,” meaning the balance sheet will reflect the bank’s market value.

2.3 Answering financial statement questions

The largest section of the cheat sheet covers the 3 financial statements.

It’s quite common during IB interviews to be asked questions like “Tell me how the financial statements flow together.” This tests your understanding of the financial statements AND the connections between them.

The 3 main financial statements are as follows:

- Income statement

- Cash flow statement

- Balance sheet

And there are many ways that changes to one statement will affect the others, so there really is no substitute for a deep understanding of how financial statements work.

With that said, we recommend that you choose one or two “paths” that run through the financial statements, and learn them really thoroughly. That way you’ll always be ready with a confident and concise answer to this type of interview question.

To help with this, we’ve highlighted two different “paths” on the cheat sheet. They are marked with the red and blue arrows, and we’ll call them path A (red) and path B (blue).

Let’s take a look…

2.3.1 Path A (how the financial statements flow together)

Refer to the red arrows on the cheat sheet. These show the connections between the statements for path A.

Starting on the income statement, the company’s net income flows from the end of the income statement to the net income line of the cash flow statement.

On the cash flow statement, net income is part of the operating cash flow section. The overall change in the company’s cash is also affected by their investing cash flows and financing cash flows. All of these cash flows come together to provide the company’s overall “net change in cash”, which then flows to the cash line on the balance sheet.

On the balance sheet, cash is listed as one of the company’s current assets. And you can calculate the value of cash on the balance sheet for a given period (e.g. 2021) by adding the net change in cash from their cash flow statement to the cash amount held on the prior period’s balance sheet (e.g. 2020). In other words:

- 2021 B cash = 2021 C net change in cash + 2020 B cash

- Note: B = balance sheet, and C = cash flow statement

To get a little practice, you can verify this using the financial statements for publicly available companies. For example, Microsoft.

2.3.2 Path B (how the financial statements flow together)

Next, refer to the blue arrows, which indicate the connections between the statements in path B.

In preparation for your interviews, it’s probably best to pick one path and learn it really thoroughly. That way you can confidently explain how the statements flow together. And honestly, path A is probably easier to explain.

With that said, it’s a good idea to prepare a “back-up” path just in case you get follow-up questions or want to further demonstrate your understanding. So, here’s another way that the statements connect:

The retained earnings on the balance sheet can be calculated using the net income from the income statement, the dividends from the cash flow statement, and the retained earnings from the previous period’s balance sheet. In other words:

- 2021 B retained earnings = 2021 I net income - 2021 C dividends + 2020 B retained earnings

- Note: B = balance sheet, C = cash flow statement, I = income statement

As a note, this is the most commonly used version of the retained earnings formula. However, if you test the formula with the financial data for a real company (e.g. Microsoft’s 2021 data), you may find that the data doesn’t perfectly add up.

Here’s why: the retained earnings are sometimes also impacted by the repurchase of common stock, and/or by accounting changes that the company made. If this is the case, you can still find the necessary information, but you actually have to refer to the 4th accounting statement (the Stockholder’s Equity Statement).

For example, you can see exactly how this calculation works for Microsoft by reviewing their 2021 Stockholders’ equity statement here. We recommend using your browser’s search bar (CTR or CMD + F) to search for “Stockholders’ equity statement,” as the page is quite long.

2.3.3 Other connections between the financial statements

The two examples above (paths A and B) are NOT comprehensive. There are several other ways in which the statements are connected.

For example, the change in working capital listed in the cash flow statement will impact the cash, accounts receivable, inventory, and accounts payable on the balance sheet.

As you might be able to guess, there’s also a connection between the capital expenditures line on the cash flow statement, and the PP&E line on the balance sheet.

It’s important to have a deep understanding of the financial statements to ultimately succeed in your IB interviews, because you’ll probably face other more complex financial statement questions, like “How does X change affect the financial statements?”.

And to help with that, we recommend studying the below tutorial as a starting point:

3. The 11 most common IB interview questions

Consider this section a different type of “cheat sheet,” one that gives you a boiled down list of the most common investment banking interview questions (across categories, not just technical).

This list was generated using over 240 interview reports that were posted on Glassdoor, by candidates who interviewed at Goldman Sachs, JP Morgan, or Morgan Stanley.

If you just master the 11 questions below, that will actually go a long way in helping you prepare for your IB interviews as a whole. In fact, these 11 questions alone accounted for about 55% (i.e. over half) of all the questions reported.

To help you prepare, we’ve also linked to a corresponding preparation resource for most of the questions below in parentheses.

Now here’s the list:

- Why firm X? (Learn more)

- Why investment banking? (Learn more)

- Walk me through a DCF (Learn more)

- What are the main methods of valuing a company? (Learn more)

- Tell me about a time you worked in a team? (Learn more)

- Walk me through your resume (Learn more)

- Tell me about yourself (Learn more)

- Why should we hire you?

- Why this job?

- Tell me about a recent deal (Learn more)

- How does X affect the financial statements? (Learn more)

4. If your interview was today, would you get an offer?

Find out where you’re at and what you need to improve by doing a mock interview with an ex-interviewer from Goldman Sachs, Morgan Stanley, JP Morgan, etc.

Mock interviews are also a great way to prepare yourself for unexpected situations, or follow-up questions, which are often overlooked by candidates. Learn more and start scheduling sessions today.