Today we’re going to show you what to expect during Goldman Sachs interviews, and what you should do to prepare.

The information in this guide is based on an analysis of 80 Goldman Sachs interview reports (from real candidates for analyst roles), which were recorded between 2016 and 2021.

And here’s one of the first things you’ll want to know:

Goldman Sachs heavily emphasizes “behavioral” questions (as do JP Morgan and Morgan Stanley). So, if you want to prioritize your preparation, then you’ll want to pay close attention to the questions section below.

Let’s get started.

1. Interview process and timeline

Want to get more interviews? Click here for a 1-to-1 resume review with an ex-investment banker from Goldman Sachs, JP Morgan, etc

Here we’ll cover what you can expect at each stage of Goldman Sachs’ application process. In this article, we’ll focus primarily on investment banking (IBD) roles, but the below process likely has some overlap with the steps for other roles.

The interview process at Goldman Sachs typically takes 3-4 weeks to complete, but in some cases it will take 3 months or more, so you should be prepared for an extensive process.

Let’s begin with an overview of each step you’ll encounter, then we’ll dig deeper into each one.

1.1 What interviews to expect

First, we’ll cover the typical interview process. And later in this article, we have a section dedicated to the application process for experienced hires, which has a few notable differences.

Here are the 4 steps that Goldman Sachs candidates will typically face:

- Application and resume

- Conversation with a recruiter

- HireVue video interview

- Super day / assessment centre

Let’s dig into each of these steps in more detail.

1.1.1 Application and resume

There are three main ways that the Goldman Sachs interview process will begin:

- You’ll apply on their website

- You’ll apply through an event or career fair

- A recruiter will reach out to you

Regardless of which of these starts your application journey, you’ll want to be ready with a polished resume that is targeted to Goldman Sachs.

If you'd like expert feedback on your resume, you can get help from our team of ex-investment bankers, who will cover what achievements to focus on (or ignore), how to fine tune your bullet points, and more.

It’s also important to spend some time learning about the specific division within Goldman Sachs where you intend to apply. If you don’t have a clear perspective on the division where you want to work within the company, then this can be a red flag for recruiters.

You should also understand the teams that exist within your target division. This will demonstrate that you’re highly motivated and familiar with how the firm operates.

If you really want to get your foot in the door, another way to set yourself apart is by attending career fairs or events hosted by Goldman Sachs. Try to make genuine connections with people from the company. Then, when you go to apply, specifically name drop the people you’ve met in your cover letter. You could even write-in a quote you heard from them, or mention what you learned from them about the company.

Need help crafting your investment banking resume? Read our guide.

1.1.2 Conversation with a recruiter

Once your application is accepted, you’ll usually speak to a recruiter and they’ll get you set-up for your next steps.

This step tends to vary depending on the situation. It could be as simple as a recruiter reaching out to you through email with the details of your HireVue interview (see the next step below).

However, you could also have a call with a recruiter at this stage. If they do ask to schedule a call with you, then you should be prepared to answer typical behavioral questions, like “Why Goldman Sachs?” or "Walk me through your resume".

In addition, the recruiter may ask you to take an online aptitude test, which is meant to assess your logic and reasoning skills. This is only used in some situations and most candidates don't have to complete this step. Just be aware of this, so there aren’t any surprises.

After this, your next step will probably be the HireVue interview.

1.1.3 HireVue video interview

HireVue is a digital tool that allows you to record your responses to a series of interview questions, without having an interviewer on the other side of the camera.

You’ll be asked about 5-6 questions during the interview. For each question, you’ll have a few moments to prepare your answer, and then you’ll have a time limit of 2 minutes to give your answer on camera.

You can’t re-record your answers, so we’d recommend preparing answers to common questions in advance. You can get started with the example questions listed later in this article. You can also take unlimited practice questions within HireVue before starting your actual interview, which we strongly encourage you to do.

The HireVue interview mostly contains common behavioral questions like “Why investment banking?” and “Tell me about a time…” style questions. In addition, some candidates get business sense questions or questions specific to the department to which they’ve applied. For example, you might get a question like “tell us about a recent M&A deal”.

For some additional tips on the HireVue interview, check out this video produced by Goldman Sachs:

Assuming everything goes well with your HireVue interview, your final round of interviews is the Super Day (also called an Assessment Centre).

This is a day packed with several back-to-back interviews. The exact number of interviews you’ll encounter varies, but it’s typically 3-5 interviews with each interview taking about 30 minutes.

You’ll speak with a variety of different people during your Super Day, and it’s common for you to have multiple interviewers from Goldman Sachs in each interview with you. You should expect to speak to people who are involved in the specific division to which you’ve applied, though some of your interviewers may not be.

The Super Day interviews are often conducted through Zoom, with each individual interview being held in a Zoom “breakout room”. This can sometimes lead to technical difficulties, so be prepared to be flexible, and make sure you are in a quiet place with a stable internet connection.

Learn more in our IB Superday interview guide.

1.2 Process for experienced candidates

Now, if you are applying as an experienced hire at the VP or Associate level, then the Goldman Sachs interview process may be a bit different for you.

First, it’s less likely that you’ll have a HireVue interview. You may still face the HireVue interview if you are early in your career and applying for an Associate position, but if you’re later in your career, then you’ll probably skip this step. For example, VP candidates are usually not asked to do the HireVue interview.

Second, experienced candidates should be prepared for more total interviews, because you’ll likely have 5-10+ before you receive an offer. These interviews will be with a range of different people. This usually includes team members across levels, including people at, above, and below the level to which you’ve applied.

The types of questions you’ll encounter will be the same as we covered above: behavioral, technical, and business sense. However, interviews for more senior candidates (like VPs), tend to focus more on behavioral and business sense questions, and less on technical skills. With that said, we’d recommend preparing for all 3 types of questions for candidates at all levels.

2. Questions

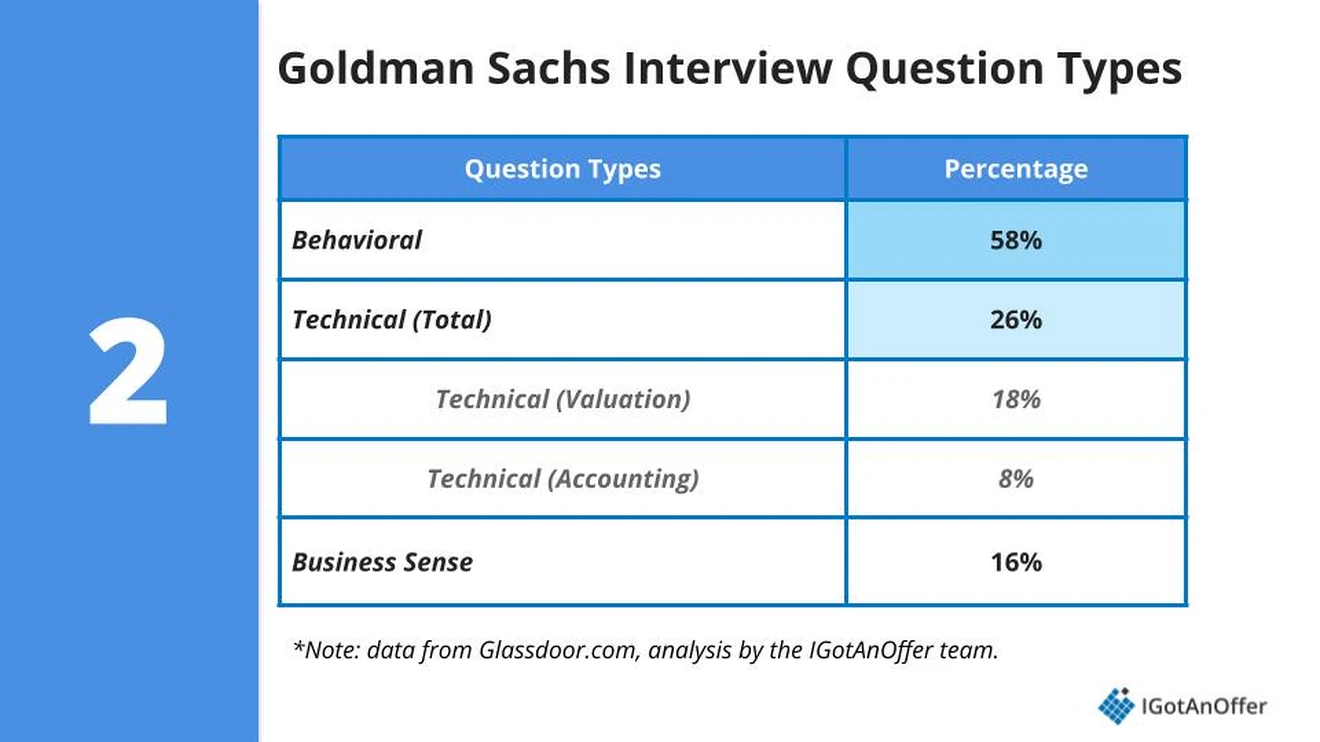

During the interview process at Goldman Sachs, you’ll face the following question types:

- Behavioral

- Technical

- Valuation

- Accounting

- Business sense

But, some of these questions are asked more frequently than others. Here’s a summary of the data:

As you can see, behavioral questions are by far the most common, so we’ll cover that next.

Below, we’ve curated a list of practice questions for each question type.

Note: The questions below were originally posted on Glassdoor, but we have improved the grammar or phrasing in some places to make them easier to understand.

2.1 Behavioral questions (~58% of questions)

Behavioral questions focus on your motivation for applying to the position, your resume, and scenario based questions (e.g. “Tell me about a time…”).

Below is a list of behavioral interview questions that have been asked in Goldman Sachs interviews. These are excellent questions to practice with, because many of the same questions tend to come up in current Goldman Sachs interviews.

You’ll want to pay special attention to the first four questions (bolded below), because they are extremely common. You should definitely have an answer prepared for each of them before your interview.

Example behavioral questions asked at Goldman Sachs

- Why do you want to work in investment banking?

- Why do you want to work for Goldman Sachs?

- Walk me through your resume

- Tell me about yourself

- Tell me about a time you failed and how you overcame it

- Imagine you gave your boss paperwork and later realized you made a mistake. How would you handle the situation?

- What are your strengths?

- Tell me about a time when a team member wasn’t pulling their weight in a project. What did you do?

- Why did you choose your college major?

- Why would you be a good addition to the team you’ve applied for?

- Tell me about a difficult time you’ve had working in a team

- Tell me about a time you had a problem and how you solved it

- Tell me about a time your manager questioned your decision

For a complete list of practice questions, including sample answers and an answer framework, take a look at our guide to Goldman Sachs behavioral interview questions. If you’re applying to other firms, you can also refer to our investment banking behavioral & fit interview guide, which includes the top 14 most commonly asked questions.

2.2 Technical questions (~26% of questions)

The technical questions help your interviewers evaluate whether you have the knowledge and skills to perform on-the-job tasks.

These technical questions can be split into two main categories:

- Valuation

- Accounting

Valuation questions focus on your ability to calculate the value of a business, whereas accounting questions focus on your knowledge of financial statements and accounting principles. Valuation questions tend to be asked more frequently, but you should prepare for both.

Below is a list of example questions from each category for you to practice with.

Example technical questions asked at Goldman Sachs

1. Valuation questions

- Walk me through a DCF

- Explain WACC and how to calculate it

- What happens to the WACC of a company in debt?

- What are the main methods of valuing a company?

- How do you value a company with no revenue or profit?

- If cost of equity increases how does the value of the company change?

- If you could choose a PE ratio of 8 or 10 which would you pick?

- Determine if an acquisition is accretive or dilutive

- How do you calculate the market capitalization of a company?

- How would you value X company?

2. Accounting questions

- If a not-for-profit company raises debt, how does it flow through the financial statements?

- How do you get to FCF from EBITDA?

- What is the effect on all three statements after a non-recurring impairment charge?

- How does depreciation move throughout the financial statements?

- What are the adjustments between EBITDA and adjusted EBITDA in a healthcare company?

You can learn more about common technical questions in our technical questions guide, and you can also find helpful summaries in our investment banking interview cheat sheet.

If you want more practice on accounting questions specifically, we also recommend checking out our investment banking interview accounting questions guide. It includes a list of accounting questions from top firms, along with sample answers and expert tips to help you structure strong responses.

2.3 Business sense questions (~16% of questions)

The final type of questions you can expect to encounter during your Goldman Sachs interviews are business sense questions.

These questions cover a few different areas, but generally, these questions will be focused on assessing your industry knowledge, business sense, and critical thinking skills.

To make it easier to organize your practice time, we’ve grouped the below questions into a few subcategories. You should be prepared to answer questions from each subcategory, and you can learn more about these questions in our separate business sense questions guide.

Example business sense questions asked at Goldman Sachs

1. Economy

- What are three key themes that UK markets will be focused on over the coming year?

- How do you expect current trade policy and federal reserve policy to impact the markets over the next 12 months?

- How would you explain the local economy in layman’s terms?

- What are today's 10-year treasury bond returns?

2. Deals

- Tell me about a recent M&A transaction and what you think of it

- Tell me about a recent private equity deal

3. Industry

- What is something that you recently heard about our company? And why is it important?

- What is investment banking?

- How can an investment bank add value

4. Investing

- What are the requirements for making a good investment?

- Describe [X company’s] business model

- What stock would you long and hedge?

- If you had $1 million to invest tomorrow, what would you do with it?

5. Brainteasers

- How many tennis balls can you fit into a Tesla?

- Which number is closest to 27 squared: 600, 700, or 800?

- T-Mobile is planning on placing orders for the new iPhone, how would you estimate how many phones they should order?

3. Preparation

3.1 Learn about Goldman Sachs’ culture

Before you spend weeks (or months) preparing for Goldman Sachs interviews, you should pause for a moment to learn about the company’s culture.

This is important for two reasons.

First, it will help you to clarify whether Goldman Sachs is actually the right fit for you. Goldman Sachs is prestigious, so it can be tempting to apply without thinking more deeply. But, it's important to remember that the prestige of a job (by itself) won't make you happy in your day-to-day work. It's the type of work and the people you work with that will.

Second, having a clear understanding of Goldman Sachs’ culture will give you an edge in your interviews, because it will help you frame your skills and experiences to align with what the company values. In addition, you will almost definitely be asked about your specific motivations for applying to Goldman Sachs.

If you know any current or former Goldman Sachs employees, see if you can chat with them about the company’s culture for a few minutes. In addition, we would recommend checking out the following resources:

- Goldman Sachs’ purpose and values (By Goldman Sachs)

- Goldman Sachs Briefings newsletter (By Goldman Sachs)

- Goldman Sachs strategy teardown (by CB Insights)

Looking for more tips on how to set yourself apart in an investment banking interview? Take a look at our list of 15 essential IB interview tips.

3.2 Practice by yourself

As we mentioned above, you’ll face 3 main types of questions in your Goldman Sachs interviews: behavioral, technical, and business sense questions.

And you’re going to want to do specific preparation for each question type.

3.2.1 For behavioral questions

For behavioral questions, we recommend that you use a repeatable method for delivering your answers. You may have heard of the STAR method before, but we recommend a slightly different approach, which is explained in this guide.

Once you’ve learned a method for structuring your answers, we recommend that you practice answering all of the example questions we provided above and in our IB behavioral & fit interview questions guide.

It’s best to rehearse the answers to these questions out loud, so that you’ll get comfortable giving good, concise answers. It may feel weird to practice answering questions out loud without an interviewer across from you. But trust us, this will dramatically improve how you communicate your answers.

In addition, it’s helpful to prepare a few “stories” that highlight your past experiences and accomplishments, so that you have examples to use for unexpected interview questions. For example, if you have a good example of a time you handled a team conflict, rehearse this story and you could potentially use it for a variety of different questions during your interviews.

3.2.2 For technical questions

For technical questions, we recommend that you start by brushing up on the key valuation and accounting concepts used in investment banking.

For valuation, we recommend reading Street of Wall’s valuation overview guide.

And for accounting concepts, we recommend using this free guide as a quick refresher and our IB accounting interview questions guide. Then, you can study accounting topics more deeply with this free course.

Once you’ve refreshed your memory on the fundamental concepts, then go ahead and practice with the technical questions we’ve provided above. Again, we’d recommend that you practice answering questions out loud, because this more closely replicates the conditions of a real interview.

3.2.3 For business sense questions

For business sense questions, there are a few different areas you’ll need to cover.

First, it’s important for you to be up to speed on current events related to Goldman Sachs, the investment banking industry, as well as the broader economy.

To help you stay current, we recommend developing a habit of reading the Investment Banking section of the Financial Times, which frequently covers stories specifically about Goldman Sachs amongst the rest of the news from the banking industry. For broader economic news, you can use your favorite news publication. If you don’t have one, consider giving The Economist a try.

To take this a step further, it’s a good exercise to “quiz” yourself on these current events by reframing them in the form of a question. For example, if you read a story about an M&A deal, ask yourself something like: “Is this really a good deal? Why?” We’d recommend that you analyze and develop an opinion on at least a couple of recent deals, because it’s likely to be useful during your interviews.

Finally, Goldman Sachs sometimes also asks “brainteaser” questions which test your math and critical thinking skills. This would be something like “how many golf balls would fit in a one gallon milk jug?” To prepare for this type of question, we recommend learning the approach covered in this market sizing guide.

And of course, practicing the above example questions (out loud) will go a long way in preparing you for your interviews.

For a high-level overview of the entire IB process, you can also check out our investment banking interview prep guide.

3.3 Practice with peers

Practicing by yourself is a critical step, but it will only take you so far.

One of the main challenges of interviewing at Goldman Sachs is communicating your answers in a way that is clear and leaves a strong impression.

As a result, we recommend that you also do some mock interviews. This is much closer to the real interview experience. Plus, the feedback you get from an interview partner could help you avoid mistakes that you wouldn’t notice on your own.

You can practice with a friend or family member to start. This will help you polish your “stories” and catch communication mistakes. However, if your interview partner isn’t familiar with investment banking interviews, then practicing with an ex-interviewer will give you an extra edge.

3.4 Practice with ex-interviewers

If you know someone who runs interviews at Goldman Sachs or another investment bank, then that’s amazing! They'll be a great person to practice interviews with.

But most of us don’t, and it can be REALLY tough to make a new connection with an investment banker. And even if you do have a good connection already, it might also be difficult to practice multiple hours with that person unless you know them extremely well.

Here's the good news. We want to help you make these connections. That’s why we’ve launched a coaching platform where you can find ex-interviewers at Goldman Sachs to practice with. Learn more and start scheduling sessions today.