Market sizing questions are common in case interviews at consulting firms like McKinsey, BCG, or Bain. They also come up occasionally in investment banking interviews as brainteasers.

For instance, your interviewer might ask: "How many takeaway coffees are sold every day in New York?" This type of question (sometimes referred to as "guesstimate questions") can really feel unsettling at first.

But the good news is that if you know how to approach them, they can become fairly easy to answer. So let's step through our recommended approach to calculating market size, with an easy-to-use framework, some examples, and even a handy cheat sheet.

Alternatively, if you're looking for a long list of market sizing questions with answers, see here.

Right, let's get into it.

Click here to practice 1-on-1 with MBB ex-interviewers

1. Framework ↑

We recommend using a 4-step approach to answer market-sizing questions. Once you've got the hang of it, you should be able to calculate market size in around 3-6 minutes in a case interview situation.

Let's discuss each step one by one.

- Ask clarification questions

- Map out your calculations

- Round numbers and calculate

- Sense-check your results

Step 1: Ask clarification questions

The first thing you should do is ask a few clarification questions to confirm exactly what number you need to calculate.

For instance, let's imagine your interviewer asks: "What's the market size for takeaway coffee in New York?" Here are a few important clarifying questions you would need to ask:

- Do we want to calculate the number of cups sold per year? Or how much money is spent by consumers on takeaway coffee?

- Can I confirm that we are only interested in takeaway coffee, and that we should exclude coffees that are consumed inside coffee shops?

- Are we interested in the whole New York metropolitan area (20m population) or just New York City (8m population)?

These questions are useful to make sure that you calculate exactly what your interviewer wants you to. In addition, they are also a great way to buy yourself some time. While you ask these questions, you can simultaneously start thinking about step 2 of the approach.

Step 2: Map out your calculations

Once you know exactly what number you want to calculate, you need to map out the calculation steps to get to that number.

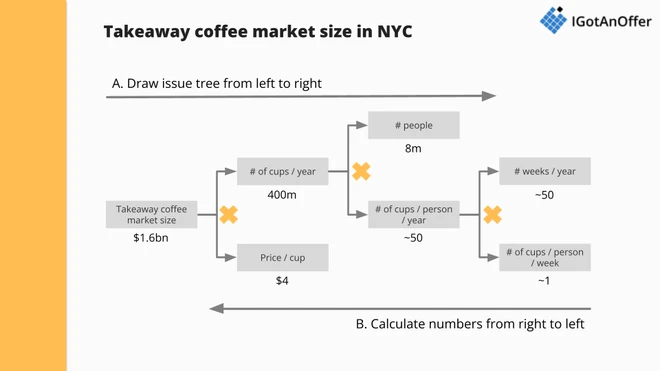

Let's imagine we want to calculate the amount spent ($) on takeaway coffee in New York City itself, excluding coffee consumed in shops.

Here is a step-by-step approach that you could use to get to that number:

- Calculate the number of takeaway cups per week for an average New Yorker

- Calculate the annual number of cups consumed in NYC.

- Calculate the corresponding market size ($ value)

If you find it difficult to naturally list these steps, a more gradual approach is to start from the number you want to calculate and draw an issue tree from top to bottom, as we have below. The advantage of that approach is that the issue tree will force you to be MECE, and it will also give you a starting point.

Both approaches are equally acceptable. But in both cases, you should VALIDATE your approach with your interviewer BEFORE starting to calculate numbers (step 3). This is important because it gives your interviewer a chance to rectify your course of action if they had another plan in mind.

Skipping this validation step is extremely risky because your interviewer might only realise halfway through that you are approaching the problem in a different way than what they want. In our experience, it's almost impossible to recover from that situation.

Step 3: Round numbers and calculate

Once you've agreed on an approach, it's time to start calculating.

You will need various data points (e.g., the average price of a takeaway coffee cup in New York) to get to your final estimate. In most cases, your interviewer will ask you to make your own assumptions to get to the final number. But in some other cases, they might share data with you.

The best way to find out which situation you are in is to say something like: "Okay, now that we agree on the approach, let me start estimating the market size. Shall I make my own assumptions? Or do you have any data that I should use?"

Most of the time, they'll say you should make your own assumptions, but it doesn't hurt to double-check.

When making assumptions, it is vital that you pick simple numbers. For instance, you should use 350 days in a year instead of 365. You should assume that the average coffee cup costs $4 instead of $3.50, etc. Rounding numbers will make your calculations easier and decrease your likelihood of making a mistake.

In addition, you should talk out loud when doing calculations so that your interviewer can follow your thought process. Your interviewer is interested in what's going on in your head - not the final result.

Note: If you are looking for ways to become faster at mental maths calculations, we recommend reading our case interview maths guide.

Step 4: Sense-check your results

Finally, most candidates stop talking at the end of step 3. They look up and expect their interviewer to tell them if they got the right result or not. This is a mistake. The best candidates pause and perform a quick sanity check to spot any wrong-looking numbers before giving the interviewer their final answer.

Mental calculation errors happen frequently. If your interviewer spots a mistake in your calculations, you most likely won't get an offer. But if you spot your own mistake, you still have a chance.

2. Market sizing examples ↑

Now that you have a framework to use to answer market sizing questions, let's apply it to an example.

Try answering the question below accurately and as fast as possible.

Try this question:

What's the market size for residential light bulbs in the US?

Answer:

You'll find our proposed answer to the question below.

1. Ask clarification questions

Here are the clarification questions that immediately come to mind for this market sizing example:

- Do we want to calculate the number of bulbs sold every year? Or the amount spent by US customers on bulbs?

- Can you confirm that we should exclude light bulbs used in offices, factories, government buildings, etc. from our estimate?

Let's assume here that we want to calculate the annual amount spent ($) on light bulbs purely for the US residential market.

2. Map out your calculations

We could estimate the market size for residential light bulbs in the US by taking a 3-step approach.

- Calculate the number of light bulbs purchased for EXISTING homes every year.

- Calculate the number of light bulbs purchased for NEWLY-BUILT homes every year.

- Add 1 and 2 and calculate the value ($) of these light bulbs.

In a real interview, you would need to lay out that approach to your interviewer and check that it works for them.

3. Round numbers and calculate

Let's go through this approach step-by-step:

1. Calculate the number of light bulbs in EXISTING homes.

- There are ~325 million people in the US. Let's assume there are 3 people per household, which means that there are 100m households in the country. Let's also assume that about 10% of households have a second home in addition to their main one. That's 110m homes in the US.

- The average US home probably has 2 to 3 bedrooms, a kitchen, a living room, 1 or 2 bathrooms, and a garage. So that's 6 to 8 rooms in total. Let's assume 8 for simplicity.

- Each room has multiple light bulbs. Let's assume an average of 4 per room. The number of light bulbs in existing homes is therefore: 110m homes x 8 rooms per home x 4 bulbs per room = 110m x 8 x 4 = 3,520m light bulbs. This number is the TOTAL number of bulbs. But we're interested in the ANNUAL number of bulbs purchased.

- If we assume that the lifetime of a light bulb is 5 years, then every 5 years, 3,520m light bulbs are purchased. 3,520m / 5 is ~700m. So about 700m light bulbs are purchased every year for EXISTING homes.

2. Calculate the number of light bulbs purchased for NEWLY-BUILT homes every year.

If the number of homes in the US wasn't growing, then the total number of bulbs purchased every year would be ~700m.

But additional new homes are built every year, therefore, the total market size is growing. We're taking this effect into account in this second step.

- The US population is growing at about 1% per year. So let's assume the number of households and residential homes is also growing at 1% per year for simplicity. 1% of 110m homes is about 1m homes.

- There are 8 rooms per average home, and 4 bulbs in an average room, so that's a total of 32m light bulbs for NEWLY-BUILT homes in the US every year.

3. Add 1 and 2 and calculate the value ($) of these light bulbs.

- Bulbs for EXISTING homes + Bulbs for NEWLY-BUILT homes = 700m + 32m = 732m. If we assume an average light bulb costs $2, then the market for residential light bulbs in the US is about $1.5bn per year.

4. Sense-check your results

As mentioned above, it is crucial that you spend some time sense-checking your results. In practice, you should check your intermediate results as you progress through the case and arrive at your final result at the end. But here we are checking all numbers in one place, so it's easier for you to keep track of what we are doing.

- Intermediate result: If 732m light bulbs are purchased for the residential market in the US every year, that means the average household buys ~7 light bulbs in a single year (732m / 100m), and the average person buys ~2 light bulbs per year (732m / 325m). That sounds reasonable.

- Final result: Similarly, if $1.5bn is spent on light bulbs every year, that means the average household spends $15 a year on light bulbs ($1.5bn / 100m), and the average person $5 ($1.5bn / 325m). Again, that sounds reasonable.

Other market sizing questions

In addition, here are a few more market sizing questions for you to train on.

- Number of school buses in the US?

- Number of weddings celebrated in the US every year?

- Number of gas stations in the US?

- Number of boxer shorts / briefs sold in the US every year?

- Number of ski / snowboard kits sold in the US every year?

- Number of drills sold in Latin America every year?

- Market size for Pringles in the US every year?

- Market size for t-shirts in the US every year?

- Market size for taxis / Uber in the US every year?

- Market size for disposable baby diapers in the US every year?

- Market size for takeaway coffees in the US every year?

- Number of underground stops in London / Paris?

- Weight of the International Space Station?

- Daily quantity of food consumed by a Tyrannosaurus?

- Number of books published in the US every year?

- Revenues for an average bicycle repair shop in New York?

If you'd like to see a whole lot more questions, complete with links to answers, check out our comprehensive list.

3. Market sizing cheat sheets ↑

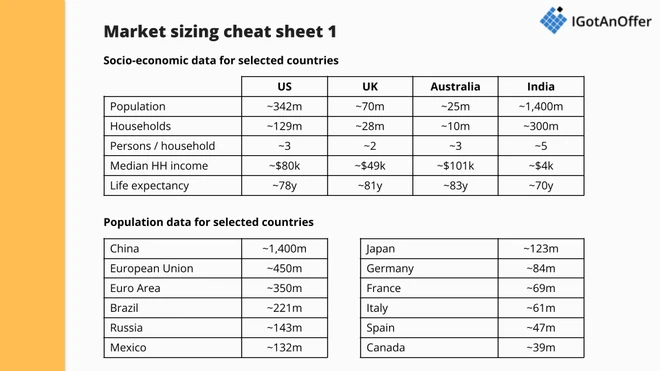

3.1 Demographics cheat sheet

Before your interview, it's a good idea to memorize some common assumptions, such as population and life expectancy, as they will often come up in market sizing questions. We've created a cheat sheet for the US below, and we encourage you to find and learn these numbers for the main countries you are applying for.

It's also worth knowing population data for countries that often come up in estimation questions.

As recommended earlier, we've rounded the numbers to make calculations more straightforward.

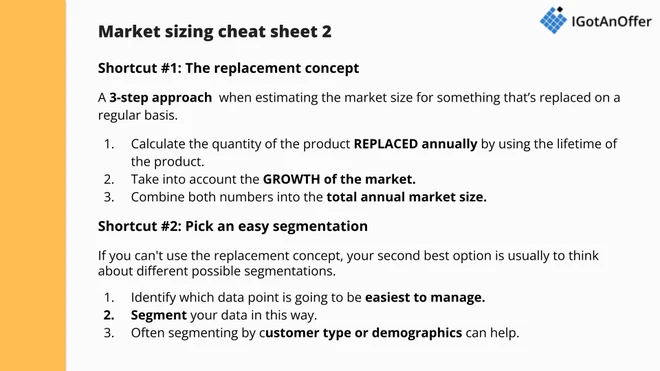

3.2 Shortcut cheat sheet

When you're answering market sizing questions, you should always try to make your approach as simple as possible. There are a couple of shortcuts that can come in handy in this regard.

Shortcut #1: Use the replacement concept

A 3-step approach that’s extremely useful when estimating the market size for anything that's replaced on a regular basis, e.g smartphones, cars, jeans, light bulbs, etc.

1. Calculate the quantity of the product REPLACED annually by using the lifetime of the product.

E.g: if there are about 300m smartphones in the US (1 per person), and smartphones get replaced every ~3 years, then that means ~100m smartphones are REPLACED every year.

2. You also need to take into account the GROWTH of the market.

E.g: people increasingly own 2 smartphones (let's say 2% growth per year). So, in addition to the 100m smartphones that are replaced, the total number of smartphones would also grow by 2%. 300m x 2% = 6m.

3. Combine both numbers into the total annual market size. Here for smartphones in the US: 100m + 6m = 106m. Assuming an average selling price of $500, the market size for smartphones in the US is therefore $53bn.

In our experience, this 3-step approach is the most efficient way to calculate market sizes for consumer products that are replaced on a regular basis.

Shortcut #2: Pick an easy segmentation

If you can't use the replacement concept, your second-best option is usually to try to think about different possible segmentations and to use the one that looks easiest to manage.

For instance, let's imagine you need to calculate the market size for taxi services in London. The replacement concept won't be helpful here, so here are three ways in which you could segment the market:

- Taxi types: Uber vs. traditional Black cabs

- Journey types: Airport journeys vs. London journeys vs. Inter-city journeys

- Customer types: 20-30 year-olds vs. 30-60 year-olds vs. 60+ year-olds

The difficult thing about calculating a market size for taxis is estimating how many journeys happen in an average week. Segmenting the market and looking at Uber vs. traditional Black cabs won't make that estimate easier. Same thing applies to journey types.

However, segmenting the market by customer types can help in this case. For instance, 20-30s might take a cab once per week when they go out on the weekend. And the 30-60s might take a cab twice per week for work. This is more helpful than the previous two segmentations.

The lesson? When you lay out your approach, you should identify which data point is going to be hard to estimate. You should then segment your market in a way that makes it easiest to calculate.

You can download the complete market sizing cheat sheet here.

4. How to prepare for market sizing questions↑

You should now have everything you need to start practicing market sizing questions. We've laid out the prep process in four simple steps:

4.1 Learn the framework

First of all, you need to learn the 4-step approach we covered in Section 1. This is the most important part of your preparation, as following this approach properly will ensure that your calculations are logical and well thought out. Make sure you know how to use the shortcuts, too.

4.2 Memorize the cheat sheet

Knowing the relevant starting point data for a market sizing question (e.g population of the USA) helps you start on the right foot and makes a good impression on your interviewer.

Spend a little bit of time memorizing the data on the demographics cheat sheet in Section 3.

4.3 Practice on your own

The best way to prepare for market sizing questions is to work through lots of them until each step of the approach becomes natural. Use the list of example questions in Section 2 or in our longer list, and as you get better at it, time yourself to add an extra element of pressure.

We also recommend talking through your calculations out loud. This may sound strange, but it will help you be more methodical and will significantly improve the way you communicate your calculations during an interview.

However, by yourself, you can’t simulate thinking on your feet or the pressure of performing in front of a stranger. Plus, there are no unexpected follow-up questions and no feedback.

That’s why many candidates try to practice with friends or peers.

4.4 Practice with peers

If you have friends or peers who can do mock interviews with you, that's an option worth trying. It’s free, but be warned, you may come up against the following problems:

- It’s hard to know if the feedback you get is accurate

- They’re unlikely to have insider knowledge of interviews at your target company

- On peer platforms, people often waste your time by not showing up

For those reasons, many candidates skip peer mock interviews and go straight to mock interviews with an expert.

4.5 Practice with experienced MBB interviewers

In our experience, practising real interviews with experts who can give you company-specific feedback makes a huge difference.

Find a consulting interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Learn how to tell the right stories, better.

- Save time by focusing your preparation

Landing a job at a top consulting company often results in a $50,000 per year or more increase in total compensation. In our experience, three or four coaching sessions worth ~$500 make a significant difference in your ability to land the job. That’s an ROI of 100x!

Click here to book case interview coaching with experienced MBB interviewers.