Case interviews can be very difficult, whether you’ve done them before or not. Capital One case interviews, in particular, are known to be heavy on quantitative questions, so that’s an added challenge to the entire process. So, if you’re applying for any role at Capital One that entails a case interview, you’ll want to extensively prepare for it.

But no need to worry. To help you prepare and boost your chances of success, we've put together the ultimate guide to the Capital One case interview, along with an overview of the company’s interview process. We’ve also included useful interview tips, free review resources, and a prep plan you can easily follow.

Here's an overview of what we'll cover here:

- Introduction to Capital One

- Capital One interview process

- Capital One interview questions

- Capital One case interview examples

- Preparation plan

Note: If you're interviewing for a product manager role, you'll want to see our Capital One product manager interview guide instead.

Click here to practise 1-on-1 with case interview experts

1. Introduction to Capital One↑

Capital One is unique. Despite being founded as a single-business bank in 1994, it has grown to become the 9th largest bank ($475.6bn in assets) in the United States as of this writing, behind firms such as JP Morgan Chase and Goldman Sachs. The business was initially focused solely on credit cards but now includes the following 3 verticals:

- Credit Cards

- Consumer Banking

- Commercial Banking

The company's success is driven largely by its clever use of data. It has developed and continues to develop sophisticated strategies and techniques for identifying and directly marketing to profitable customers. This gave the company a competitive advantage over traditional banks, which have historically focused on broad (rather than targeted) marketing.

With its unusual history and focus on technology, Capital One has more of a "tech firm" feel, which is different from what you'd expect from a giant financial institution. It also has its own strategy group, which serves as its internal consulting firm.

If you’re reading this article, you’re most likely interested in applying for a role at Capital One that includes case interviews as part of its application process. Or perhaps you’re already preparing for a case interview with the firm. Either way, before we get into the application and interview process, let’s take a look at how much you stand to earn if you land a spot at Capital One.

1.1 Capital One roles and salaries

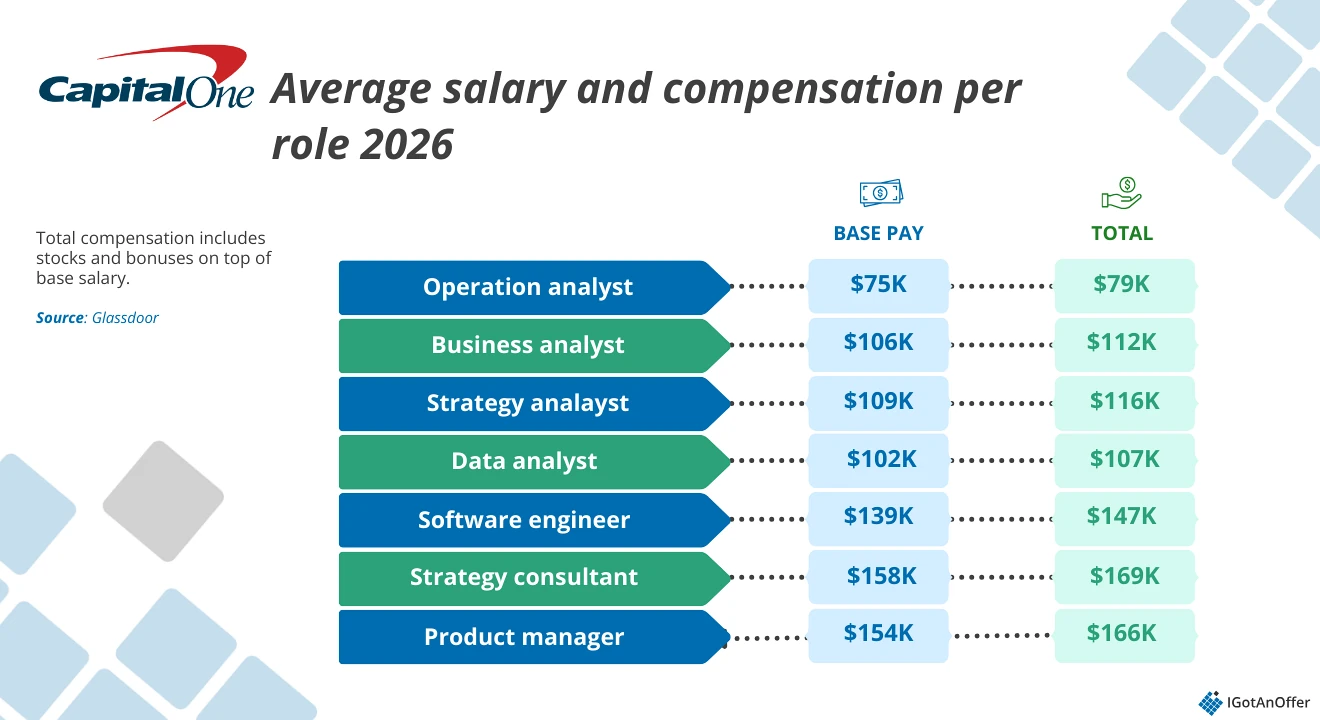

Below we’ve compiled a summary of the average base pay and compensation of Capital One’s analyst and tech positions, based on Glassdoor reports.

Your interview performance will help determine how much you’ll be offered. That’s why hiring one of our case interview coaches can provide such a significant return on investment.

And remember, compensation packages are always negotiable. So, if you do get an offer, don’t be afraid to ask for more. If you need help with salary negotiation, consider booking a salary negotiation coaching session with one of our experts to put yourself in a stronger position.

2. Capital One interview process↑

Capital One hires for roles ranging from call centre reps to software engineers and business analysts. The nature of the interview process you can expect at Capital One depends on the role you’re applying for. Not every role will have a case interview.

Here are the roles that undergo case interviews at Capital One:

- Strategy analyst

- Operations analyst

- Data analyst

- Strategy consultant

- Strategy associate

- Product manager

The application process for these roles includes 5 main stages:

- Resume and cover letter submission

- Virtual Job Tryouts (online assessment tests)

- Recruiter screening

- Mini case interview

- Power Day (3-5 interviews)

The application process for the different roles is more or less the same: largely focused on case interviews. Some roles, like the strategy consultant and strategy associate roles, may include a written case interview, along with the standard ones during the Power Day.

Before we dive more deeply into case interviews, let's take a closer look at each step of the Capital One interview process.

2.1 Resume and cover letter submission

First, recruiters will look at your resume and assess if your experience matches the position you’ve applied for.

To help tailor your application to the position you’re targeting, use our free resume guide and free cover letter guide.

If you’re looking for expert feedback, you can also get input from our team of expert recruiters, who will cover what achievements to focus on (or ignore), how to get more impact from your bullet points, and more.

2.2 Capital One Virtual Job Tryouts

Once you apply, you’ll get email instructions to join the Virtual Job Tryouts (VJT), Capital One’s version of an online assessment. The VJT consists of different tests and tasks, which vary depending on the role. Here are some examples of the modules you may encounter, based on Capital One’s Career FAQs:

- Manage Relationships: Make decisions and respond to scenarios you’ll commonly encounter in the role.

- Work Your Business Case: Review and integrate information from multiple sources about a fictitious business and offer solutions to help it succeed.

- Tell Us Your Story: Talk about your work experiences and background that have helped shape who you are.

- Describe Your Approach: Talk about your preferred style and approach to work.

- Quantitative Assessment (for business analyst candidates): Take a standard quantitative test where you’ll be given a data set and 7 to 11 questions to answer. You'll need to use a spreadsheet to solve mathematical and analytical problems.

Below we’ve gathered a few quantitative assessment questions from the VJT as reported on Glassdoor.

Example Capital One VJT Quantitative Assessment questions

- Ali and Sophie are budding musicians who have been playing Thursday night shows at a local live music venue. The venue told them that over the course of the last four weeks, they’ve had 900 tickets sold for their shows. They are curious to see how many people are repeat fans, coming to more than one show. The venue’s recent customer survey says that 60% of fans have come once, 30% have come twice, 6% have come three times, and 4% have come four times. How many unique people have seen an Ali and Sophie show during this period?

- You make a change to your business model and add another employee. Calculate how many weeks it would take for the investment you've made (labour hours, infrastructure changes, training hours, reduced production in the first few weeks, etc.) to pay off and make a profit.

- Two bikers leave from two different locations and try to reach a destination. Calculate to determine which biker will reach the location first and in how many hours. These are not static variables, as the speed of each biker changes throughout the journey.

On average, the VJT online assessment tests take 20 to 45 minutes to complete.

2.3 Recruiter screening

If you pass the VJT, a recruiter will contact you to ask you further questions and to speak more about the company and the role. You can expect ‘getting to know’ questions such as:

- Why Capital One?

- Walk me through your resume.

- Tell me something about yourself that’s not on your resume.

- What’s your biggest accomplishment?

- How did you hear about this position?

- What are your strengths and weaknesses?

This list of 23 common interview questions by Capital One is a good resource to review with example questions you can use when you practise.

2.4 Mini case interview

During your recruiter call, your recruiter will also tell you about your next steps, the first of which will be a mini case interview. This will be conducted via phone or video call. Be ready to hit the ground running in this interview. Don't expect much "getting to know you" discussion because they usually get straight to the case. This interview will normally last 30 minutes to an hour.

Not much information about the mini case interview is available online via Capital One’s website, so we only have candidate reports to go by.

According to several PM candidate reports, the PM mini case will likely be about any one of Capital One’s products: the Capital One Shopping browser extension, the Capital One Venture Card, or the Capital One Mobile app. You could also receive other product questions.

As for the mini case for analyst roles, many candidates report getting a quant-heavy case that lasts for about 45 minutes. Your recruiter will give you information about it beforehand, including a sample case which is likely to be very similar to the actual mini case you’ll be given.

2.5 Power Day

Once you pass all the initial steps, you’ll get an invitation to your Power Day or Super Day. This is the final round which consists of three to five back-to-back interviews.

Capital One has fully transitioned to virtual interviews, so you can expect your Power Day interviews to be conducted online. Each interview may last for up to one hour. You’ll have a 1-hour break somewhere in between.

Here’s a quick look at what a Power Day looks based on the role:

- Business analyst: two case interviews and one product interview, behavioural questions at the start of each interview

- Data analyst: two case interviews, behavioural interview, coding or data challenge interview

- Strategy associate and strategy analyst: one written case interview, two standard case interviews, behavioural interview

Now you know the interview process, let's go deeper into the interview questions you can expect to face.

Want to learn more about Capital One's general interview process? Read our guide.

3. Capital One interview questions↑

In this section, we'll take a look at the type of questions you can expect to face in your Capital One interview. We'll start with the most important, and the most challenging: case interview questions.

3.1 Capital One case interviews

Case interviews are the most important part of the Capital One interview process. The company uses the interviewer-led approach, which is similar to the method used by McKinsey in its case interviews.

Capital One case interviews are not limited to cases in the financial or banking industry. This is because what the company wants to test is how you think, versus what you know about Capital One or finance.

3.1.1 Capital One case interview sections

While the industry or business used in Capital One case interviews may vary, its case interviews will always include three sections:

- Introduction of the business situation and framework

- Calculations based on key concepts and drivers of the case

- Your recommendation and business decision

We've embedded below a short introductory video by Capital One for your reference.

Each section of the case interview has particular things you'll need to prepare for. Let's look at each section, breaking down the mock interview in the Capital One video as our example:

A. Introduction of the business situation and framework

The first several minutes of the interview will cover the business scenario and case framework. During this part, your interviewer will introduce the hypothetical business scenario, laying out the different aspects of the situation.

After introducing the scenario briefly, your interviewer will then ask you a broad question. In the mock interview video, the question is: “Your first task is to increase the profitability of the Giant Bus route from New York City to DC. What factors would you consider to determine profitability?”

For this stage of the interview, you have two objectives:

- Ask clarifying questions to make sure that you understand the situation correctly. Many candidates skip this step, but it's essential because it will help you put together a more relevant framework.

- Put together a simple case framework to answer the interviewer's question. The objective of this framework is to identify and communicate key areas that you will consider to answer the interviewer's main question.

As we’ve mentioned above, Capital One’s case interviews are interviewer-led. You can expect your interviewer to direct the course of the interview with questions along the way. That said, we still recommend that you try and drive the case forward yourself to a certain extent, by communicating the implications of your answer with the interviewer. This will show that you're able to think a few steps ahead and take an active approach to problem-solving.

B. Calculations based on key concepts and drivers of the case

The second stage of the interview is heavily focused on maths skills. The recruiter will provide you with some data, and ask you to perform calculations.

In the mock interview video, the interviewer shows a report of the peak travel time for the bus company, a comparison of three travel methods for the route, and the bus company’s capacity utilisation. While showing the reports, the interviewer asks the candidate to analyse the figures and give their take on the current situation.

At this point, to back up your answer, you’ll need to make a few quick calculations. It's important to ask questions at this stage, as the recruiter may have additional data that they have not yet provided.

Make sure you talk through your logic to show the interviewer your problem-solving skills. This will also help them steer you back on track if you've misread any of the data.

Compared with the case interviews used at consulting firms, the case interviews at Capital One tend to have a greater focus on quantitative questions. So you should expect to spend more time on these types of quant problems during your interview, and less time on other areas, like creative brainstorming.

C. Your recommendation and business decision

In the final stage of the interview, you'll be expected to make a recommendation and defend it. To form your recommendation, draw on the calculations from the previous stage. Consider the numbers, use your intuition, and make a decision.

For example, the candidate in the mock interview’s final recommendation is to move to a 15-minute frequency for the buses during peak hours, mentioning the risk involved in the recommendation.

The specific strategy you suggest is less important than your logic and ability to defend it. During this part, expect the recruiter to question your approach. They may ask you how you would go about identifying other opportunities. You could also take the initiative, like the candidate in the mock interview example, to provide additional ideas to explore to achieve profitability.

3.1.2 Capital One case interview example: Ice Cream Corporation

Here’s a breakdown of another mock case interview by Capital One. It’s a little longer than the latest intro video, but it has a lot of helpful information and shows different interview scenarios. For your reference, we’ve summarised the key takeaways per section.

A. Introduction of the business situation and framework

The interviewer opens the case by introducing the scenario: “You’re the CEO of an Ice Cream Corporation. What are the key factors you would consider when developing a strategy to grow profits for the Ice Cream Corporation?”

In the video, the first candidate asks several clarifying questions about the role of the CEO regarding product and sales. These questions help narrow down the scope of the interview.

After asking these questions and making notes along the way, the first candidate answers the main question regarding the key factors. After discussing these further with the interviewer, the candidate comes up with “pricing” as the key factor, and the key concepts to keep in mind: “role of promotional pricing, temporary to avoid a price war, and risk of the stocking-up effect”.

The video shows other examples of key factors that other candidates might bring up. This shows that there is no right or wrong way to get to an answer. It also shows an instance where the interviewer redirects the candidate’s answer, to show that it’s common for a Capital One interviewer to provide cues and hints to lead you to a specific topic so that you can do a deeper dive into it.

B. Calculations based on key concepts and drivers of the case

What follows is the quantitative section of the interview where the interviewer will present some data and ask you to perform some calculations. As we’ve mentioned above, these calculations form the basis for your final recommendation.

In the sample case, the candidate is asked to calculate the total monthly profit for Ice Cream Corporation, given the following data:

Price per carton = $5

Cost per carton = $1

Demand = 100 cartons/month

As you will see in the video, the first candidate asks how much of the cost is variable versus fixed. Don’t reserve your clarifying questions for the introduction; ask clarifying questions wherever you feel they’re necessary.

Price per carton = $5

Variable cost per carton = $1

Fixed cost per carton = $0

Demand = 100 cartons/month

At this point, the calculation is straightforward.

($5-$1) X 100 cartons = $400 profit

Talk through your calculations as the candidates do in the mock interview. This doesn’t just highlight your maths skills but also your problem-solving skills.

Most calculations at Capital One case interviews tend to be simple. But based on this mock interview sample, you’ll see that you might encounter calculations that vary in terms of complexity, like elasticity of demand and break-even calculations. These require a little extra work, but your approach should be the same:

- Understand the data provided

- Ask for more information when necessary

- Lay out your approach

- Perform the calculations

If you’re not familiar with a concept, don’t be afraid to ask for further clarification.

C. Your recommendation and business decision

The mock interview examples show different recommendation approaches. You can go conservative or bullish. There’s no right or wrong answer, as long as you can defend your recommendation, as the candidates in the mock interview video do.

Another thing that interviewers do in the mock interview is challenge the candidates further by questioning their approach or asking them how they might address their own apprehensions about the strategy.

3.1.3 Additional tips for your Capital One case interview↑

Here are a few more helpful tips to keep in mind during your case interview at Capital One.

#Expect to be given a case from outside the finance industry

As we mentioned above, Capital One likes to use cases from different industries. It’s because what they want to test you on is how you think and not how much you know about the finance industry or Capital One as a company. It’s also a preview of the scope of work you might do at Capital One if you do land a job there.

#Brush up on your maths and bring a calculator

Capital One case interviews are known for being more quantitative-focused compared to other companies. For this reason, you’ll want to brush up on your maths.

Here are some common calculations that might occur during your Capital One case interview:

- Break-even

- Profit

- Weighted average

- Expected value

- Contribution margin

Capital One allows you to bring a calculator during your case interview, so be sure to bring one that’s easy to use.

#Take notes

As the interviewer describes the case, be sure to take notes so you have all the information you need as you answer each question and make your final recommendation.

#Pause before you speak

Don’t be afraid to ask for a moment to gather your thoughts whenever you need to. Give yourself a minute to look back at your notes to make sure you understand everything before speaking out.

#Listen carefully and ask clarifying questions

Your first task during the case interview is to make sure you understand the situation correctly by asking the right clarification questions.

This is what analysts at Capital One and other consulting firms do with clients. They sit down with them, listen carefully to the problem they have, and ask clarification questions before trying to solve the problem. They do this because it's impossible to solve a business problem you don't understand in detail. Therefore, you should follow a similar approach in your cases.

Additionally, if there are any concepts brought up that you don’t understand, don’t be afraid to ask for clarification. It’s also good practice to repeat the explanation in your own words so you interviewer can validate your understanding.

#Talk through your thought process, show your work as you do it

What Capital One wants to see in your case interview is your approach to solving business problems. They want to see how you think, so you’ll need to show them.

Talk through your decision-making process and calculations and state any assumptions you’re making. Show them your notes while you’re at it. Capital One conducts virtual interviews, so you may want to use the Whiteboard function or Screenshare function over Zoom.

#Listen for hints and cues

Capital One’s case interviews are interviewer-led, so your interviewer will often steer the conversation to a specific topic or focus if they deem it necessary. Listen carefully for such hints and cues. This might sound obvious but candidates sometimes get so stressed that they don't pick up on the hints interviewers give them.

#Avoid talking about your resume or qualifications

You only have an hour to showcase your skills during your case interview, so focus on the case itself instead of trying to insert your credentials. You’ll have a chance to do this in the behavioural parts of your Power Day interviews.

3.2 Capital One behavioural and fit interview questions↑

In addition to case interviews, Capital One also uses behavioural questions/interviews, as most companies do. If you’re applying for a business analyst role, you may not get a whole interview devoted specifically to behavioural questions. Instead, you can expect to face them at the start of your case and product interviews.

Behavioural interview questions asked at Capital One fall into two main categories:

- Fit questions. These are generic questions such as “Why financial services?” or “Why Capital One?”

- Personal Experience Interview (PEI) questions. These are questions such as “Tell me about a time when you led a team through a difficult situation” Or “Tell me about a time when you had to manage a team conflict.”

We've written extensively about fit / PEI questions in other guides. But in summary here are the top five fit and PEI questions you should prepare for at Capital One or other firms.

Example Capital One behavioural questions: fit

- Why Capital One?

- Walk me through your resume.

- Why financial services?

- Tell me something about yourself that’s not on your resume.

- Tell me about your greatest accomplishment.

Example Capital One behavioural questions: PEI (Tell me about a time when…)

- You failed at work.

- You worked in a team and had to manage a conflict.

- You had a disagreement with a colleague / boss.

- You had to change someone's / a group's mind

- You led a team through a difficult situation.

Capital One is known to favour the STAR method when it comes to answering behavioural questions. So, for your interview, plan to answer behavioural questions using the following format:

S - Situation

T - Task

A - Action

R - Result

This approach will help you to answer each question in a clear, and methodical way, which are great qualities to demonstrate when interviewing with Capital One.

For a deeper dive, check out our guide to Capital One behavioral questions.

3.2.1 "Why Capital One?" interview question↑

You're almost guaranteed to be asked this question, so let's dive a bit deeper into how you should answer it. Here are three ways to make your answer stand out:

Name-drop: Before the interview, make an effort to meet with or call one or more current employees of the firm. Ask them what it’s like working there, why they chose Capital One and what’s unique about it. This will give you specific talking points for your answer, and mentioning their names shows the interviewer that you’ve put in effort to get to know the company.

Be specific. Test out your answer by swapping another bank’s name with the one you’ve got in mind. If your answer could also apply to this other bank, then you need to fine-tune it.

Keep up with recent activity: Being aware of the latest deals and developments in the department you’re applying to will give you an idea of what kind of projects you’ll get to work on, and whether they sound interesting to you. Bringing them up in the interview will show the interviewer that you’ve done your research and stay up to date on market news.

Example answer: "Why do you want to work at Capital One?"

“I want to work at Capital One for three main reasons. First, I want to work in a very data-driven environment and to have access to a vast amount of data when working strategically. I've been really impressed with Capital One's pioneering use of data and machine learning in the banking sector, which has helped the company gain market share across its verticals.

Second, I've been impressed with Capital One's strategy regarding its banking-as-a-service model and embedded finance. I saw an interview with CEO Richard Fairbank talking about how all banks needed to collaborate with fintech apps to provide instantaneous results for customers, rather than working in silos, and I thought he articulated a really strong vision.

Finally, I’ve had a few conversations with Seth White and Tamara Grey, associates in the McLean office, and they gave me a great impression of the firm as a whole. Seth in particular encouraged me to apply to the Travel team, as we share a similar educational background, and he was complimentary of the opportunities he’s been given to succeed."

Read our guide on how to answer the "Why this company?" interview question.

3.3 Product questions

If you're interviewing for a business analyst role, one of your Power Day interviews will be a product interview. Compared to the very quantitative case interviews, the product interview is a lot more qualitative, meaning you'll need to demonstrate creative thinking.

In almost all the interview reports we've seen, the candidate was asked to improve a product in some way. We recommend you read our article on how to answer product improvement questions to help you structure your response.

Example Capital One product questions from business analyst candidates:

- Describe 12 uses for an alarm clock.

- How would you redesign an alarm clock?

- What is the customer base for this product?

- Describe 10 ways to improve an umbrella.

- How would you improve this water bottle?

- What's your favorite product and how would you improve it?

4. Capital One case interview examples↑

Now that you know how case interviews at Capital One work, it’s time to get some practice. One of the best ways to do so is to study case interview examples. There are many free examples online, and we’ve listed a few here for your reference:

- Magazine publishing case interview (by Capital One)

- Sandwich shop case interview (by Capital One)

- Case interview playbook (by Capital One)

- Independent coffee shop case interview (by Capital One)

- Phone card case interview (by TBS Education)

Check out our list of case interview examples from other top consulting firms. The companies listed here are consulting companies rather than banks, but it’s helpful to study them as Capital One uses examples from all sorts of industries

5. How do I prepare for a Capital One case interview?↑

Practising case interview examples is an important part of your preparation, but it’s not the only thing you can do. Here’s how we recommend structuring your Capital One case interview prep plan, with links to resources to help you round out your preparation:

5.1 Use Capital One real case study examples for research

Case interviews require no prior knowledge. However, you can bet that overall your interviews at Capital One will go a lot better if you go in having done some research on the company and the wider financial industry.

Capital One shares case studies on its website, such as this one on real estate treasury management, which are well worth looking over. You might also want to take a look at some of the articles on Capital One's insights center. This piece about Capital One’s pioneering work with data analytics and AI provides a good overview of the company’s tech-forward approach to banking.

If you're coming from a finance background, you may already have a good knowledge of Capital One's place in the sector. If not, check out Investopedia for a brief summary.

5.2 Become really confident with your maths skills

You don't have to have a perfect GPA or GMAT score to succeed at case interview maths. And in any case, during your Capital One interviews, you will be allowed to use a calculator. That said, it will help if you're confident performing mental maths quickly and accurately.

In order to do this, it’s essential to know the formulas for common metrics such as:

- Break-even

- Profit

- Weighted average

- Expected value

- Contribution margin

it’s also useful to know a few shortcuts to help you solve problems more quickly. To learn more about these topics, check out our free guide to case interview maths.

In our experience, the most successful applicants start their interview preparation by practising maths skills, so make sure you prioritise this step.

5.3 Develop a consistent method to crack cases

One of the biggest challenges of interviewing with Capital One is solving cases that you’ve never seen before. Each case can be difficult, and you’ll have to perform well across multiple case interviews to get an offer.

That’s why it’s critical for you to have a consistent approach to solving cases. Capital One uses interviewer-led case interviews, which can be broken down into the following types of questions:

- Situation

- Framework development

- Quant question – Data provided

- Creativity question

- Recommendation

If you can crack each type of question (within a case), then you can crack the overall case.

Check out our suggested structured method for answering case interviews or come up with your own. Choose a method that you can consistently incorporate when practising solving case interviews.

5.4 Learn from every mistake you make

During case interview preparation, the quality of your preparation is just as important as the quantity of time that you dedicate. It's better to do 20 cases thoughtfully than to rush through 40 cases.

We recommend keeping a notebook where you record improvement opportunities and specific things you did well for each case.

The notebook and self-evaluation will help you become more strategic and efficient with your preparation. It's also a good idea to go back and redo old cases. For example, after you have done case #20, you could go back to case #1, to make sure you are not repeating the same mistakes.

The minimum preparation time required to succeed in case interviews is probably around 30 hours. However, if you don't prepare thoughtfully, it may take much longer. So take notes, be strategic, learn from your mistakes, and keep practising!

5.5 Practise with peers

Once you're in command of the subject matter, you'll want to start practising cases. But by yourself, you can’t simulate thinking on your feet or the pressure of performing in front of a stranger. Plus, there are no unexpected follow-up questions and no feedback.

If you have friends or peers who can do mock interviews with you, that's an option worth trying. It’s free, but be warned, you may come up against the following problems:

- It’s hard to know if the feedback you get is accurate

- They’re unlikely to have insider knowledge of interviews at your target company

- On peer platforms, people often waste your time by not showing up

For these reasons, many candidates skip peer mock interviews and go straight to mock interviews with an expert.

5.6 Practise with experienced case interviewers

In our experience, practising real interviews with experts who can give you company-specific feedback makes a huge difference.

Find a consulting interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Learn how to tell the right stories, better.

- Save time by focusing your preparation

Landing a job at a top consulting company often results in a $50,000 per year or more increase in total compensation. In our experience, three or four coaching sessions worth ~$500 make a significant difference in your ability to land the job. That’s an ROI of 100x!