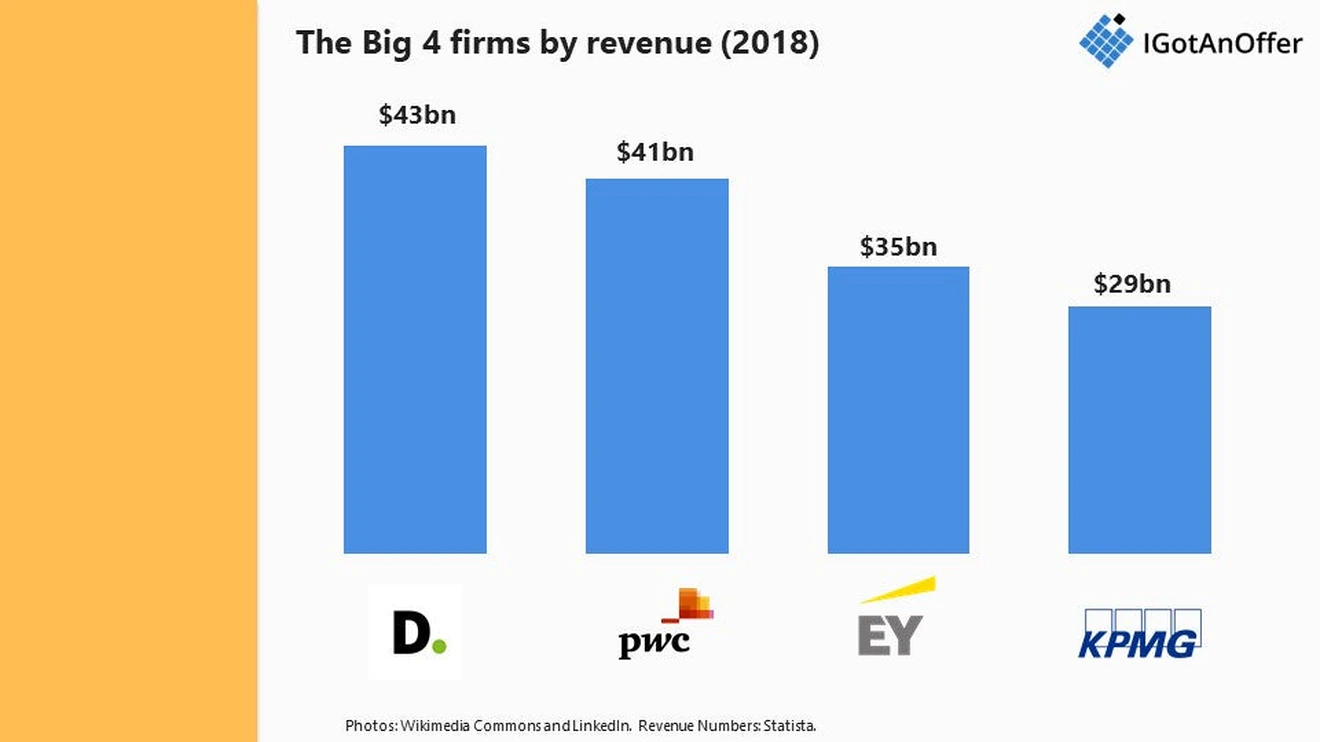

The Big 4 are the titans of the accounting and consulting world. Collectively, they generated over $148 billion in revenue during 2018. To put things in perspective, that’s more than 6X the GDP of Iceland.

In addition to their size, these four firms are prestigious, and highly sought after for career opportunities. Here are the Big 4, ranked by revenue:

The Big 4 are famous but can be tricky to understand. Here are a few common questions that we will answer in this article.

- What do the Big 4 actually do?

- What’s the difference between accounting and consulting services?

- What kind of jobs do the Big 4 offer?

- What’s the avg. starting salary at the Big 4?

- What’s the acceptance rate at Big 4 firms?

- How can I land a job offer at one of the Big 4?

Below you’ll find a snapshot for each individual firm, highlighting key numbers, notable alumni, and more.

Plus, there’s a summary of the 3 primary career paths at the Big 4 (audit, tax, and consulting), and a 4-step guide for locking down a job offer. Let’s get to it!

Click here for a resume review with an ex-Big 4 consultant

Part 1: Big 4 company snapshots

There's a few things that the Big 4 have in common.

First, they were all created in the 1800s, and were consolidated into larger firms through mergers and acquisitions during the 1900s.

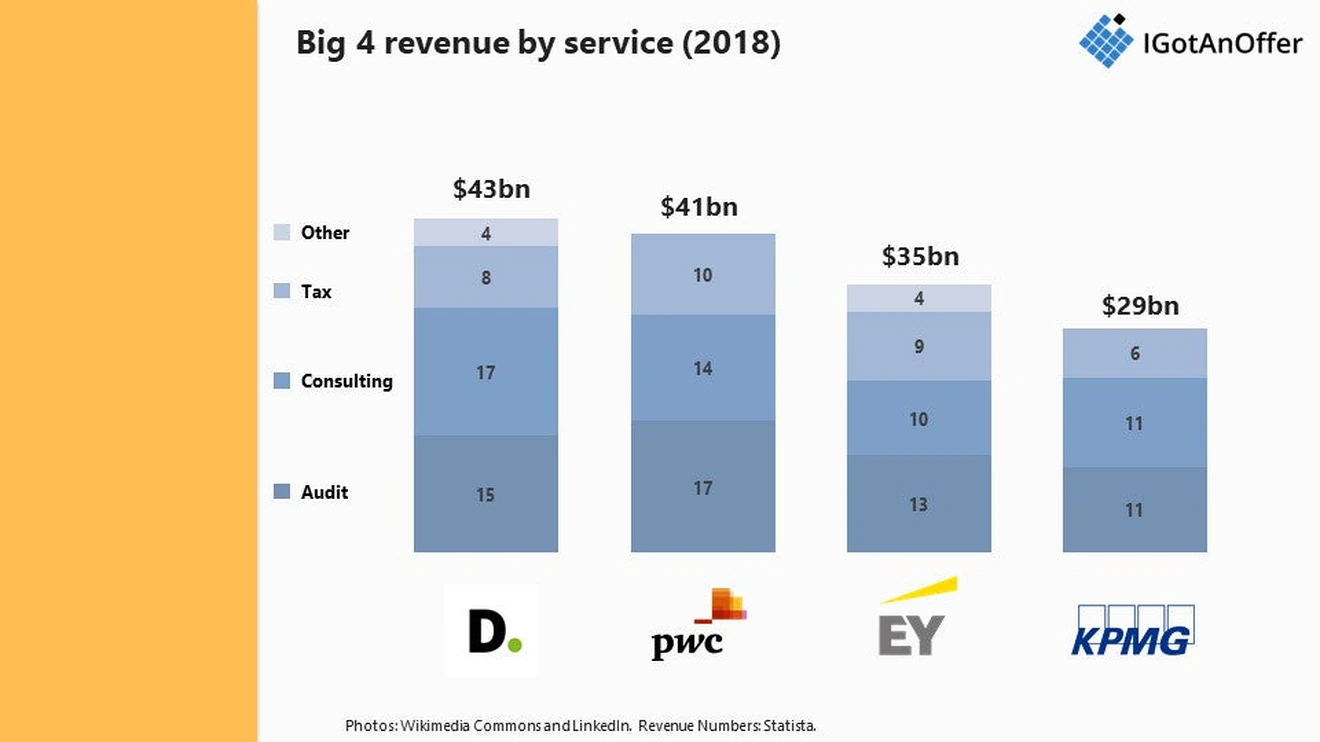

During the 2000s, the Big 4 have made significant investments in their consulting businesses. This includes notable acquisitions of Monitor Group (Deloitte), Booz & Company (PWC), and Parthenon (EY). In 2018, consulting was the first or second largest revenue stream for every Big 4 firm.

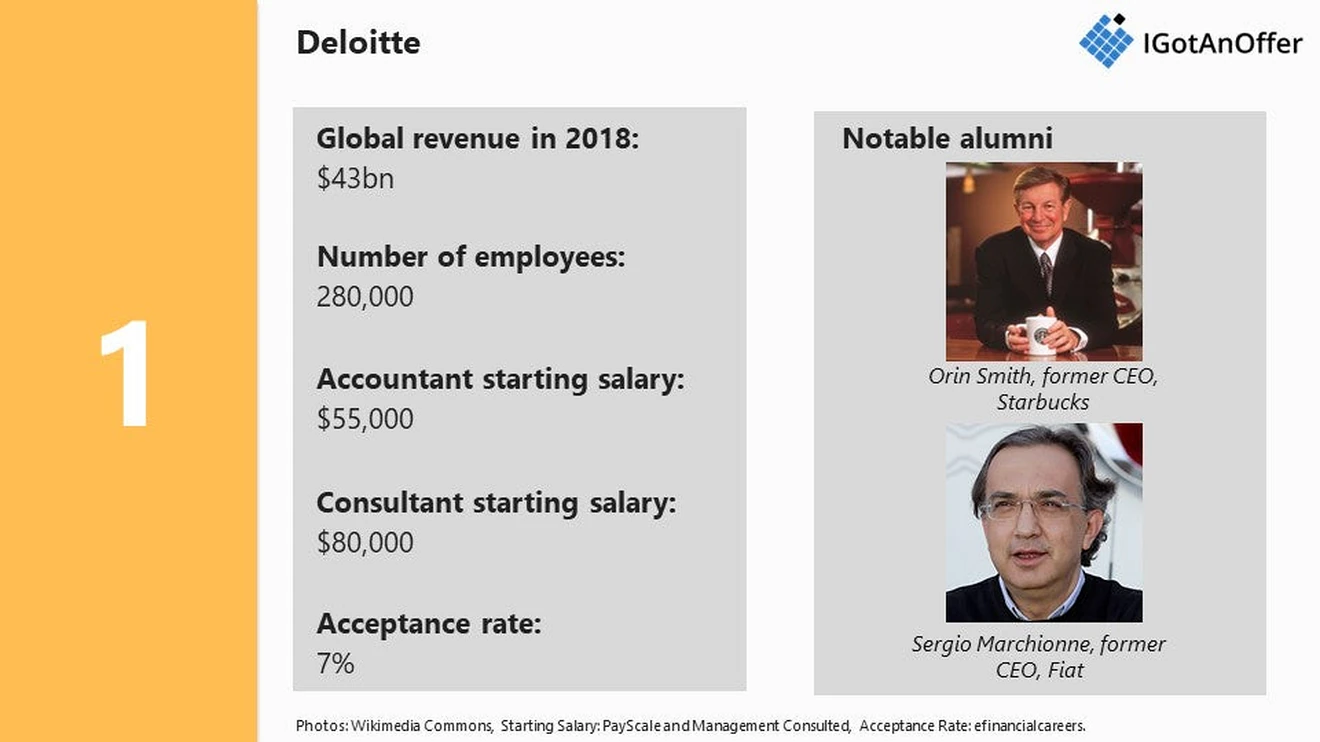

Deloitte

Background

Deloitte is over 170 years old. It was founded in London, by William Welch Deloitte in 1845. Mr. Deloitte is famous for being the first independent auditor ever to be hired by a public firm.

Starting in the mid-1900s, there was a series of mergers which ultimately created Deloitte Touche Tohmatsu Limited, the Deloitte accountancy we have today.

Over the last 10 years, Deloitte has invested heavily in strategy consulting. Deloitte acquired Monitor Group, founded by Michael Porter (famed Harvard professor), in 2013 after the strategy firm filed for bankruptcy.

In 2016, Deloitte became iPhone's ambassador to the business world. Through a deal with Apple, Deloitte opened a new practice with 5,000 employees. The goal of this practice is to increase adoption of Apple technology within enterprise-level businesses.

Today, Deloitte is the largest professional services firm in the world, with higher annual revenue and more employees, than any of its Big 4 competitors.

Recent awards

- #11 on Fortune’s 100 Best Companies to Work For (2018)

- #2 Most Prestigious Accounting Firm, The Vault (2019)

- #2 on the 2019 Vault Accounting 50 list (2019)

- #2 on People Magazine’s Companies that Care (2018)

- #52 Forbes’ Best Employers for Diversity (2019)

The gossip

Pros

“Very prestigious, quality firm, known worldwide”

“Challenging work, good compensation”

“Supportive culture, strong support to empower growth”

Cons

“Very poor work/life balance”

“Partners needs come before the needs of employees”

“High demands for quick quality work”

Links

Deloitte case interview free guide (by IGotAnOffer)

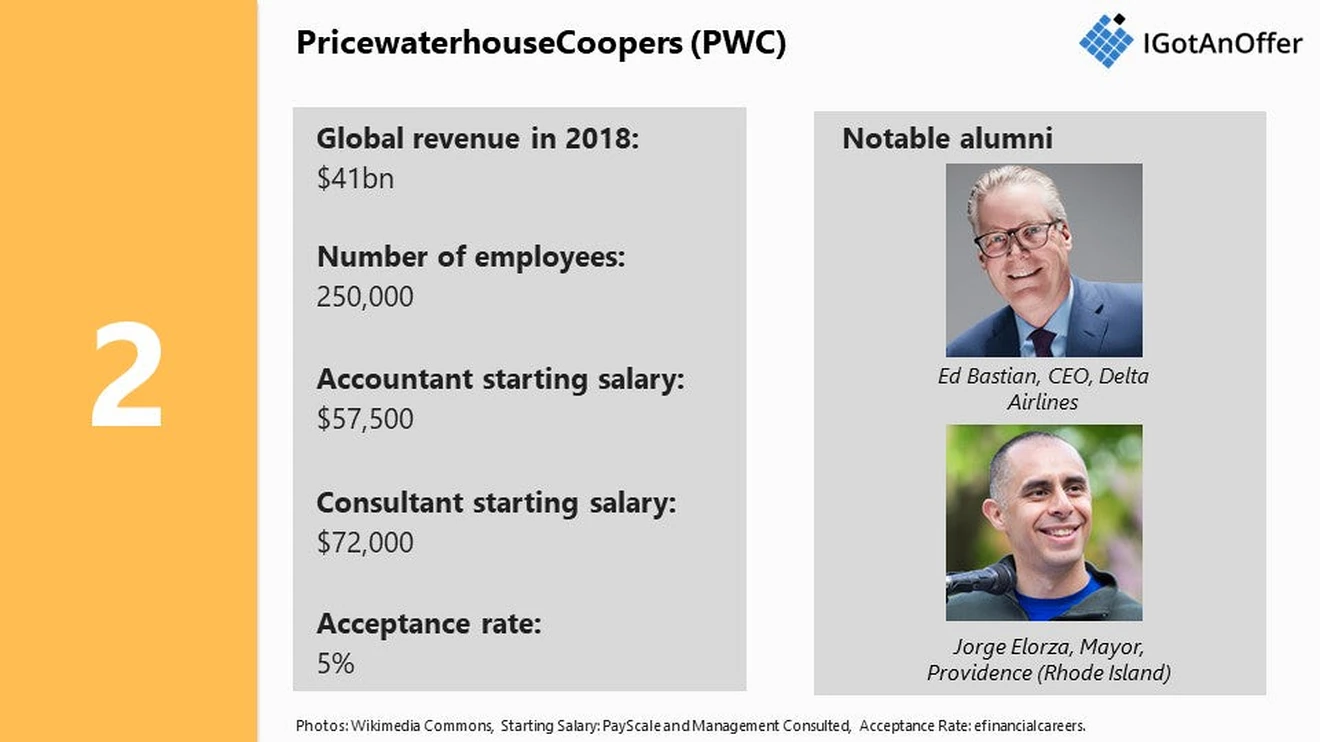

PWC

Background

Price Waterhouse began in 1849, and the accountancy of William Cooper began in 1854. Both were established in London and evolved throughout the 1900s. PricewaterhouseCoopers (PWC) was created in 1998, through a merger of Price Waterhouse and Coopers & Lybrand.

In recent years, PWC has built-up their consulting practice, with a focus on strategy and technology services. You may have heard of Booz & Company, which PWC acquired in 2014, and formed the strategy consulting practice known as Strategy&.

In the technology sector, PWC has been outspoken on crypto-currency and was the first of the Big 4 to accept payment in bitcoin.

Currently, PWC is considered the #1 most prestigious accounting firm, according to The Vault, and is the 5th largest private company in the U.S.

Recent awards

- #56 on Fortune’s 100 Best Companies to Work For (2018)

- #1 Most Prestigious Accounting Firm, The Vault (2019)

- #1 on the 2019 Vault Accounting 50 list (2019)

- #42 on People Magazine’s Companies that Care (2018)

- #49 Forbes’ Best Employers for Diversity (2019)

The gossip

Pros

“Great training and learning opportunities”

“Best in the business”

“Flexibility to work in my own time”

Cons

“Stressful unrealistic client demands”

“Long hours sometimes (specifically during busy season).”

“Pressure from peers regarding work style”

Links

PWC case interview free guide (by IGotAnOffer)

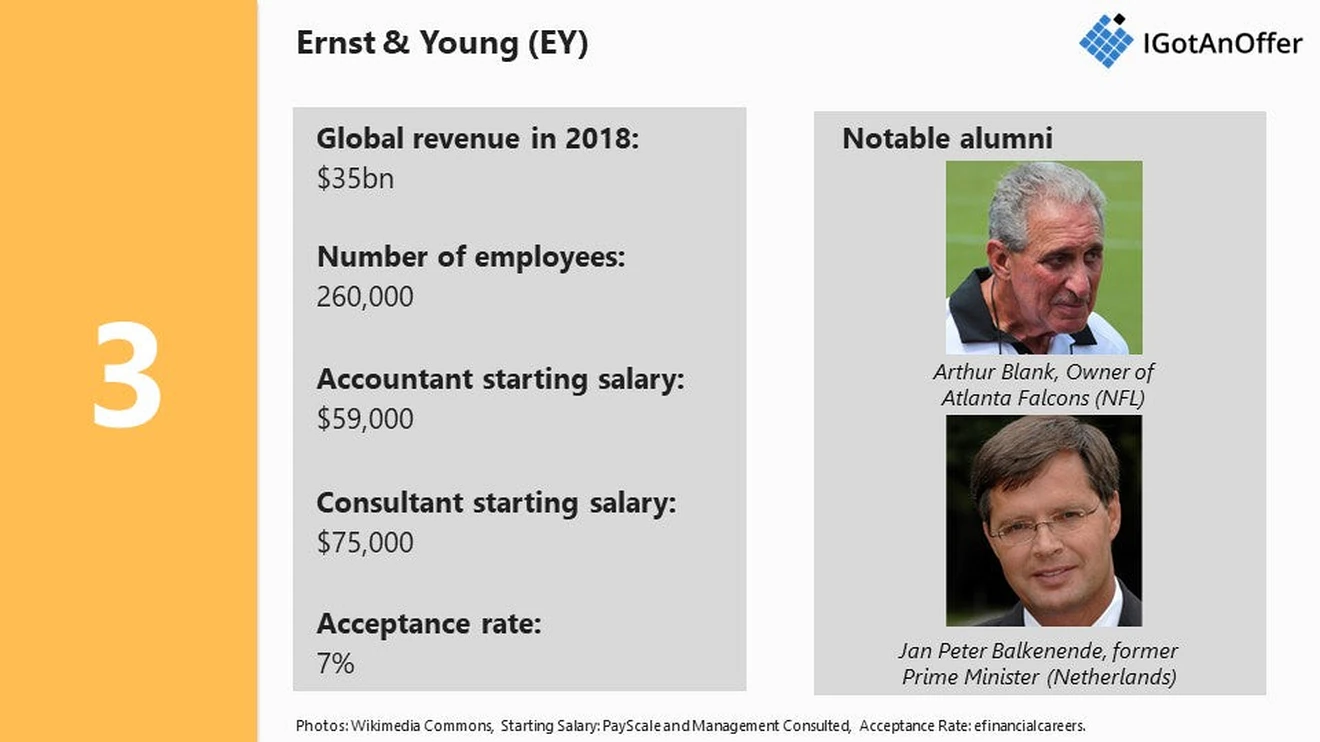

Ernst & Young

Background

Ernst and Young has roots going all the way back to the mid-1800s. It’s earliest parent company was founded in England, in 1849.

EY was eventually created, through a series of mergers. Probably the most significant merger, happened in 1989 between Ernst & Whinney and Arthur Young. At that time, these two companies were the 4th and 5th largest accounting firms in the world.

After the 2002 collapse of Arthur Andersen (formerly a member of the Big 5), EY took over much of the global operations of the dissolving firm.

Today, EY audits more public companies than any other firm, serving nearly 15% of all public firms in the U.S.

Recent awards

- #52 on Fortune’s 100 Best Companies to Work For (2018)

- #3 Most Prestigious Accounting Firm, The Vault (2019)

- #28 on the 2019 Vault Accounting 50 list (2019)

- #13 on Fortune’s 50 Best Workplaces for Parents (2018)

- #58 Forbes’ Best Employers for Diversity (2019)

The gossip

Pros

“Challenging, enjoyable work”

“Great firm, good people, very prestigious”

“Not on PwC’s level but very well respected”

Cons

“Company is highly resistant to change.”

“The hours can get long in some stretches.”

“Takes time to get used to the proactive atmosphere.”

Links

EY case interview free guide (by IGotAnOffer)

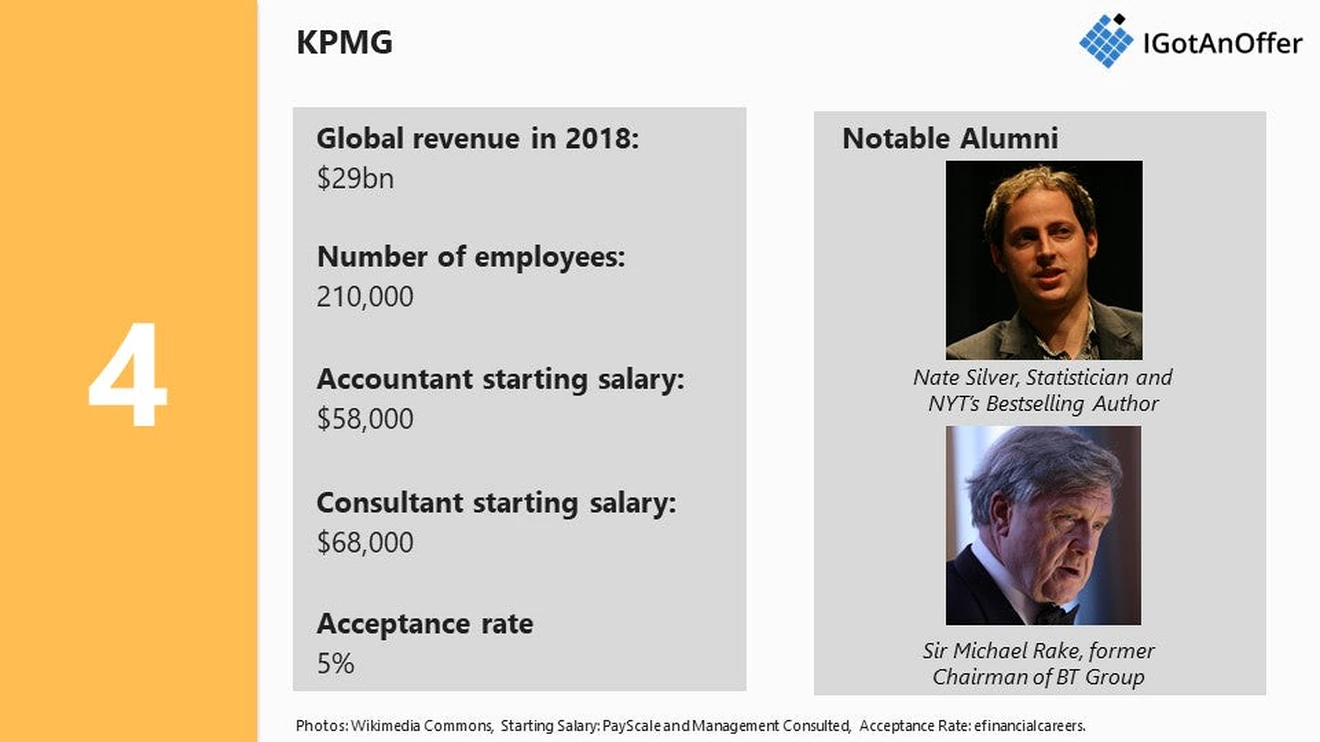

KPMG

Background

KPMG is the oldest of the Big 4, and its earliest parent company was founded in 1818.

As with all the Big 4, the firm grew in the 1800s and 1900s through a series of mergers. In 1987, the first large-scale merger in the accounting industry took place between KMG and Peat Marwick which formed KPMG as we know it today.

Currently, KPMG is the smallest of the Big 4, with 2018 revenues of $29 billion. It is the only member of the Big 4 with its headquarters outside of London, and is based in the Netherlands.

Recent awards

- #29 on Fortune’s 100 Best Companies to Work For (2018)

- #4 Most Prestigious Accounting Firm, The Vault (2019)

- #3 on the 2019 Vault Accounting 50 list (2019)

- #14 on Fortune’s 50 Best Workplaces for Parents (2018)

- #12 Forbes’ Best Employers for Diversity (2019)

The gossip

Pros

“Amazing people and inclusive family-like culture”

“Learning and growth opportunities”

“Interesting, intellectually stimulating, challenging work”

Cons

“Smallest of the Big 4”

“Large, complex clients”

“Recent scandals”

Links

Controversies

The Big 4 have faced scrutiny for tax avoidance, and for conflicts of interest between their auditing and consulting businesses over the past few decades.

Tax avoidance

The Big 4 advise on tax policies, and on business strategy. In practice this often means helping them to minimise their tax bill which has been the source of controversies and legal battles in the past.

For example, KMPG agreed to pay over $450 million in penalties for creating fraudulent tax shelters. It’s estimated that their clients avoided $2.5 billion in taxes, as a result of the fraud.

Conflicts of interest

In addition, the Big 4 have been criticised for conflicts of interest. In simple terms, they were paid to improve the profitability of clients, while also being responsible for auditing the financial records of those clients.

During the early 2000s, there were massive accounting scandals at Enron and WorldCom, which led to the collapse of Arthur Andersen (previously one of the Big 5). Shortly afterwards, the U.S. government passed the Sarbanes Oxley Act to regulate corporate accounting practices.

This led to the sale, or separation, of internal consulting businesses for most of the Big 4. However, in the last decade, the Big 4 have been re-investing heavily in consulting.

Part 2: What do the Big 4 actually do?

The services provided by the Big 4 can be grouped into 3 categories:

- Audit (accounting)

- Tax (accounting)

- Consulting

Here’s a break-down showing the portion of each firm’s annual revenue that comes from these services.

The first two (audit and tax) are generally considered different types of accounting. The 3rd service provided by the Big 4 is consulting. This can take a variety of forms, such as management consulting, technology consulting, and more.

If you’re planning to apply to a Big 4 firm, then you’ll need to begin by choosing which of these services you want to provide. Are you interested in being an auditor, a tax accountant, or a consultant?

Looking at each one will help you make an informed decision. You'll find more information for each career below, including a brief description, the industry average starting salary, and a list of pros/cons.

What do auditors do?

The Big 4 are best known for their auditing services. Auditors can serve a variety of roles, but generally an auditor’s objective is to determine whether a company’s financial records are accurate.

Let’s look at an example. Say you just landed a job at Deloitte as an auditor (congrats!). Now let’s imagine Deloitte is hired by Coca-Cola to audit their annual reports, balance sheets, etc.

You’d probably find yourself examining records, speaking with clients, and preparing reports to summarise your findings.

Average starting salary: $53,000 (PayScale)

Pros of auditor jobs

- High job availability

- Better career mobility vs. tax

- Broad exposure to financial operations

- Long-term executive opportunities (i.e. CFO)

Cons of auditor jobs

- Lower starting salary vs. consulting

- Frequent travel

- High client interaction

What do tax accountants do?

Tax accountants are much more specialised than auditors. Where auditors have general financial expertise, tax accountants have deep knowledge into the specifics of tax legislation.

A tax accountant’s objective is to help a firm prepare, submit, and save money on taxes. As a tax accountant, you would conduct research into tax procedures, government regulations, and how they apply to your firm’s (or client’s) situation. You’d also provide advice on tax strategy.

Average starting salary: $53,500 (PayScale)

Pros of tax jobs

- Slightly higher starting salary vs. auditors

- Greater specialization

- Less travel

- Long-term opportunities for a private tax business

Cons of tax jobs

- Less job availability

- Less career mobility

- Harder path to executive positions

What do consultants do?

Tax and auditing are closely related, but consulting is a different ballgame.

The Big 4 all provide consulting services, but they are better known for accounting. So if you want to pursue a career in consulting, then be sure to check-out our list of the most prestigious consulting firms in the world. You may have also heard of the MBB consulting firms, so here's our guide that compares the Big 4 to MBB.

Consultants are generally hired to improve the business strategy and operations of their clients. There are a lot of different consulting specialisations, but as a consultant you would typically meet with clients, understand their challenges, analyse potential approaches, and provide recommendations. You might also be involved in the implementation of solutions.

Average starting salary: $76,000 (PayScale)

Pros of consultant jobs

- Highest starting salary ($20,000+ higher on average)

- Best career mobility

- Broad exposure to business strategy

- Long-term executive opportunities (CEO, CSO, etc.)

Cons of consultant jobs

- Lower acceptance rate (hard to get in)

- Frequent travel

- High client interaction

Part 3: How to land a Big 4 consulting job

As you can tell from the acceptance rates above, it’s not easy to land a job at a Big 4 firm. Out of a hundred applicants, 5 to 7 typically get offers.

The most competitive (and highest paying) roles at the Big 4, are in consulting services. For consulting roles, candidates are assessed through a rigorous interview process.

This can be intimidating, but good preparation can give you a huge leg-up on the competition. Below, we’ve broken down the 4 key steps to landing a consulting role at a Big 4 firm.

Become really confident at maths

You have a calculator on your phone, we get it. But unfortunately, you won’t be able to use it in your Big 4 interview. Your recruiter will expect you to do mental maths calculations quickly and accurately.

In our experience the best candidates brush up ahead of their interview, so they can have confidence in their maths skills. If you do the same, this will give you a polished reaction during interviews, which recruiters will notice.

This refresher is well worth it. We’ve helped over 30,000 applicants, and those who get offers in consulting usually begin with maths preparation.

Develop a consistent method to crack cases

One of the hardest things about interviewing with companies like the Big 4, are the case interviews. Depending on the specific job, you might have as many as 5-10 interviews!

As a result, it’s critical for you to have a consistent approach for cracking cases. Case interviews can be broken down into very specific types of questions, including the following:

- Situation.

- Framework development.

- Framework exploration.

- Quant question (with and without data).

- Creativity question and recommendation.

If you can crack each type of question (within a case), then you can crack the case.

Practice cases out loud

Thinking about your answer, is only half the battle in case interviews. The second half is communicating your answer in a clear and structured way.

A great way to practice this, is to do case interviews with friends or with former consultants who do coaching interviews. However, this isn’t always possible.

So we encourage you to practice out loud. Play the role of both the candidate and the interviewer. That means you should ask questions and answer them (out loud), in the same way two people would do in an interview.

This will feel odd at first. But trust us, in our experience candidates who use this approach are much more likely to get an offer.

Learn from every mistake you make

Successful candidates find it more valuable to do 20 cases thoughtfully, than to rush through 40 cases.

Sure, there is a minimum number of hours you need to put-in, to develop good case interview habits (probably ~30h+). However, you should go for quality over quantity.

A great way to do this, is by keeping a notebook, where you write down mistakes and improvement opportunities after each case. Then you can check your progress by re-doing old cases. For example, after you have done case #20, you could go back to case #1, to make sure you are not repeating the same mistakes.

This will help you make sure you’re headed in the right direction.

Do mock interviews

If you have friends or peers who can do mock interviews with you, that's an option worth trying. It’s free, but be warned, you may come up against the following problems:

- It’s hard to know if the feedback you get is accurate

- They’re unlikely to have insider knowledge of interviews at your target company

- On peer platforms, people often waste your time by not showing up

For those reasons, many candidates skip peer mock interviews and go straight to mock interviews with an expert.

Practise with experienced MBB interviewers

In our experience, practising real interviews with experts who can give you company-specific feedback makes a huge difference.

Find a consulting interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Learn how to tell the right stories, better.

- Save time by focusing your preparation

Landing a job at a top consulting company often results in a $50,000 per year or more increase in total compensation. In our experience, three or four coaching sessions worth ~$500 will make a significant difference in your ability to land the job. That’s an ROI of 100x!

Click here to book case interview coaching with experienced MBB interviewers.