Profitability issues are every CEO's worst nightmare. Imagine you are leading Walmart and profits have been going down for the past 6 months. Your share price is plummeting as a result and board members are starting to worry that you are not up to the task. Your Chief Marketing Officer is waiting to take over in your shadow. You're working weekends to turn the situation around but are seeing less and less of your family. You're under a lot of pressure.

This description may sound gloom, but profitability problems are an existential threat to companies. In the long term if there are no profits, there's no company. This is why consultants are often brought in to help find the root-cause of profit issues and turn the situation around. And this is why you will come across profitability cases in your consulting interviews.

So let's take a close look at how you should approach profitability case interviews. First, we'll look at the framework we recommend you use for such cases. And second, we will step through an example to show you how you can use that framework.

Click here to practise 1-on-1 with MBB ex-interviewers

1. Profitability framework

In general, we do not recommend using pre-defined frameworks in your case interviews because most interviewers will penalise you for doing this. However, profitability cases are a bit of an exception. Everyone in the consulting industry uses the profitability framework. And it is therefore widely accepted that you will do the same thing in your interviews.

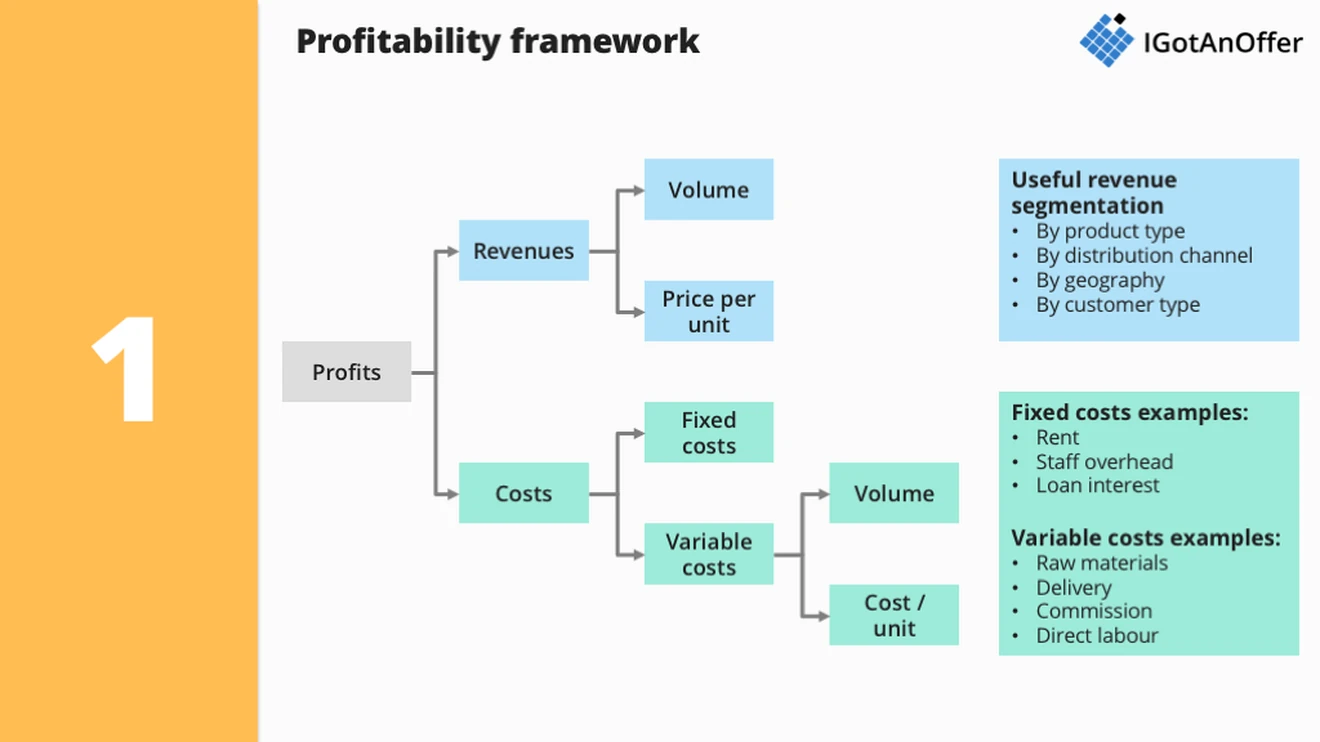

Generally speaking, there are three reasons why a company might be experiencing profits issues: revenues could be declining faster than costs, or costs could be going up faster than revenues, or costs might going up while revenue is going down. The framework we recommend using to analyse profit cases is therefore the following one:

This framework is largely self-explanatory. Revenues can be broken down by the volume of products that's been sold times their price. Costs can be broken down as the sum of fixed and variable costs. By definition, fixed costs do not vary with the volume sold. As a consequence, we would only recommend breaking down variable costs into volume times the cost per unit.

On the revenue side, it is often helpful to segment numbers by product type, geography, etc. On the fixed cost side, typical costs include rent, overhead staff and loan interests. On the variable cost side, typical costs you will come across are raw materials, delivery, commission fees and direct labour.

If you have any doubts about the definition of some of these business concepts, we would encourage you to read our post on the basic business knowledge required for consulting interviews.

Now that you know what framework to use for profitability cases, let's discuss HOW you should use this framework. In our experience, the following 3-step approach works really well:

- Step #1: Pick a branch. The first thing you need to do in a profitability case is to pick a branch of your framework and to make a hypothesis. For instance, you could say: "My initial hypothesis is that the profitability issue is driven by a revenue problem."

- Step #2: Compare to past performance. Once you have picked a branch, you then need to validate if it is the root-cause of the issue or not. The right way to do this is to compare the numbers to the past performance of the company. For instance, profits might have gone down because revenues have decreased by 10% compared to last year. Another comparison that's sometimes useful to make is to competitors.

- Step #3a: Right branch, continue drilling. If you have picked the right branch, you need to continue drilling down until you find the root-cause of the profit decline. For instance, if you established that revenues have gone down, you need to start looking at volume and price per unit. A useful thing to do when you drill down is to segment the data (e.g.: by product, geography, etc.) This will enable you to diagnose the exact business reason for the troubles experienced by the company.

- Step #3b: Wrong branch, switch to another one. If you have picked the wrong branch, you need to switch to another one. For instance, if you established there has been no revenue decrease, you need to update your hypothesis and look at costs. You are then back to step #1 of this approach and can follow the same logic.

At the end of your analysis, you should have looked at all the branches of the framework. A common mistake is to establish that revenues have gone down and to then FORGET to look at costs. In reality costs could have gone up at the same time as revenues have gone down and be part of the profits' issue.

2. Profitability case example

Now that you know how to approach a profitability interview let's look at a case example and apply the approach we have laid out above. We will lay out a business situation and a series of questions below.

Questions

Situation: "Your client owns a movie theatre in London. The profits of the theatre have been going down over the past 12 months and your clients wants your help to find out why."

Q1: How would you adapt the profitability framework to this case? What are the revenue sources for a movie theatre? And what are the main fixed and variable costs?

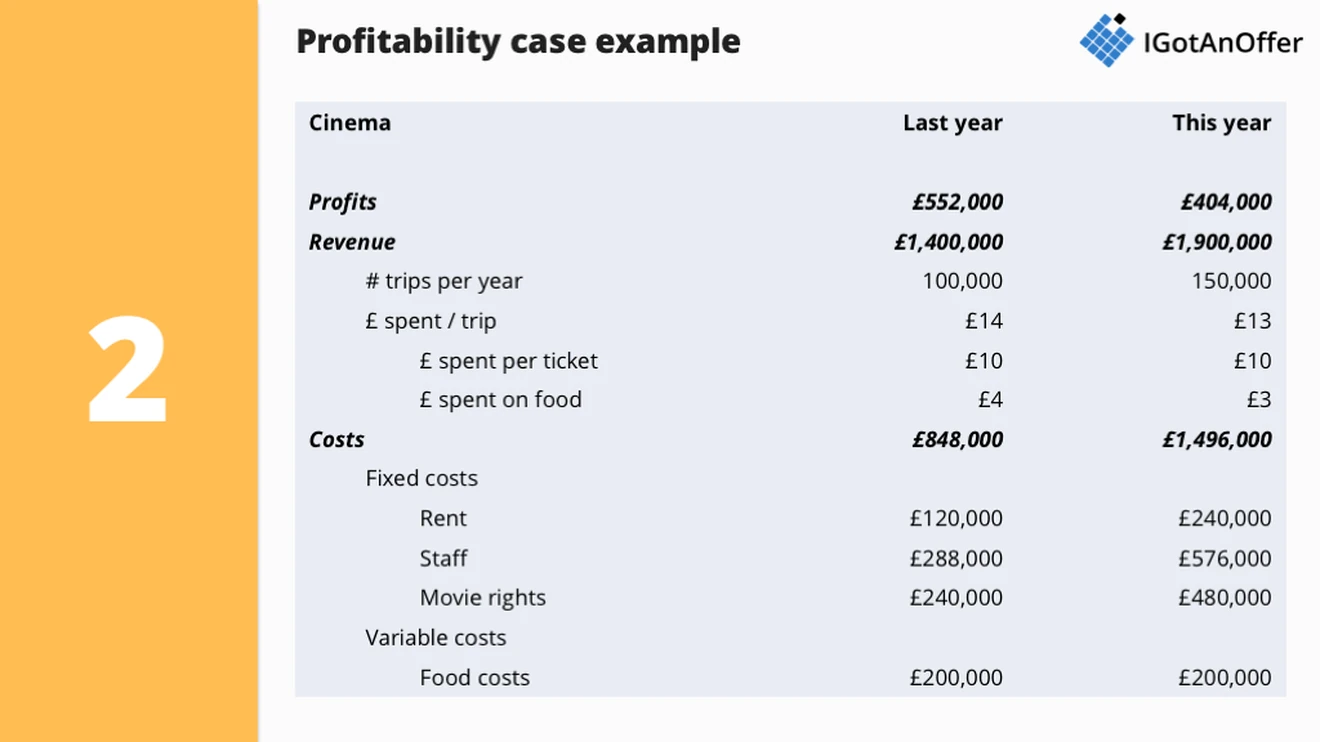

Q2: You decide to explore the revenue branch of the framework and the interviewer gives you the data points below. What's your conclusion and what would you do next?

- Profits have gone down from ~£550k last year to ~£400k this year.

- Revenues have gone up from ~£1,400k last year to ~£1,900k this year.

Q3: The interviewer provides you with the cost information below. What's your conclusion and what would you do next?

- Costs have gone up from ~£850k last year to ~£1,500k this year.

- This was mainly driven by an expansion project. Your client started renting an adjacent building to double the capacity of the movie theatre.

Q4: The interviewer provides you with the table below. What's the final conclusions you can draw?

Answers

You will find our proposed answers to the questions below. Before taking a look at them, make sure you go to the bottom of the page and answer the question by yourself in the comments section. There are only so good many opportunities to prepare for case interviews.

Q1: Here is one possible adaptation of the profitability framework for a movie theatre:

- Revenue

- # of trips per year

- £ spent per trip

- £ spent per ticket

- £ on food and drinks

- Costs

- Fixed costs

- Rent

- Staff

- Movie rights

- Variable costs

- Cost of food / drinks

- Fixed costs

Q2: Based on the information provided, it looks like revenues have gone up while profits have gone down. At this stage, a natural hypothesis would therefore be that the profits issue experienced by the company is driven by costs.

Q3: At this stage it looks like profits have gone down because costs have risen more rapidly than revenues. A natural next step here is to drill one level down both on the revenues and cost side. This should enable us to understand why revenue growth hasn't kept up with cost growth over the past 12 months.

Q4: We can draw the following conclusions from the data provided.

- Although the capacity of the movie theatre has doubled, the number of trips seems to only have increased by 50% compared to last year. Here are a few reasons why this might be the case:

- The cinema might not have scheduled enough screenings to attract sufficient demand

- The cinema might not have advertised its increased capacity sufficiently

- There might not be enough demand in the area where the movie theatre is located to cover for the doubling in capacity

- The average spend per trip for food and drinks seems to have gone down by about 25% compared to last year, from £4 per trip to £3. In addition, the cost of the food seems to have remained the same. Here are a few reasons why this might be the case:

- It looks like the additional visitors are not buying as much food. This could be because there is no food bar in the new extension the cinema is renting

- The decrease might also be driven by a change in the type of food and drinks offered at the movie theatre

- All fixed costs seem to have doubled which would make sense as doubling the capacity would be expected to roughly double the rent, the number of staff needed to manage the theatre and the number of movies projected.

To conclude this case, you would then look at why the number of visitors hasn't increased as much as expected and why the average spend on food has gone down over the period in which we are interested.

How to prepare for profitability case interviews

We've coached more than 15,000 people for interviews since 2018. There are essentially three activities you can do to practise case interviews. Here’s what we've learned about each of them.

Learn by yourself

Learning by yourself is an essential first step. We recommend you make full use of the free prep resources on our consulting blog and also watch some mock case interviews on our YouTube channel. That way you can see what an excellent answer looks like.

Once you’re in command of the subject matter, you’ll want to practice answering cases. But by yourself, you can’t simulate thinking on your feet or the pressure of performing in front of a stranger. Plus, there are no unexpected follow-up questions and no feedback.

That’s why many candidates try to practice with friends or peers.

Practise with peers

If you have friends or peers who can do mock interviews with you, that's an option worth trying. It’s free, but be warned, you may come up against the following problems:

- It’s hard to know if the feedback you get is accurate

- They’re unlikely to have insider knowledge of interviews at your target company

- On peer platforms, people often waste your time by not showing up

For those reasons, many candidates skip peer mock interviews and go straight to mock interviews with an expert.

Practise with experienced MBB interviewers

In our experience, practising real interviews with experts who can give you company-specific feedback makes a huge difference.

Find a consulting interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Learn how to tell the right stories, better.

- Save time by focusing your preparation

Landing a job at a top consulting company often results in a $50,000 per year or more increase in total compensation. In our experience, three or four coaching sessions worth ~$500 will make a significant difference in your ability to land the job. That’s an ROI of 100x!

Click here to book a mock case interview coach with an experienced MBB interviewer.