Today, we're going to cover case interview frameworks. We’ll talk about the 7 most common case interview frameworks you should know, and how you can create your own custom framework for whichever type of case interview problem you're given.

Understanding consulting frameworks has always been critical for the thousands of candidates we've helped with case interview preparation.

And one of the first things you'll want to know: you should always create your own custom consulting framework.

Yes, we advise against using pre-made or textbook frameworks, like those recommended in Case in Point and in Victor Cheng's LOMS programme. We’ll touch on this in greater detail below.

Here’s an overview of what we’ll cover:

- What are case interview frameworks?

- Most common case interview frameworks

- Case interview framework cheatsheet

- Why create your own framework?

- How to create your case interview framework

- Tips/strategies for creating your own case interview framework

- Why you shouldn’t use pre-existing case study interview templates

- How to master case interview frameworks to get an MBB offer

Let’s get started!

Click here to practise 1-on-1 with MBB ex-interviewers

1. What is a case interview framework?↑

A case interview framework is a structure you can use to solve business cases in a consulting interview.

With the right case framework, you can break down a business scenario into smaller components, allowing you to efficiently organize your thought process and solution.

1.1 Why do case interview frameworks matter?

“Frameworks give you a clear roadmap when you’re faced with a complex problem,” Louise (Tesla/ex-Deloitte consultant coach) says.

If you have a good understanding of case interview frameworks, you can effectively analyze and solve all types of business problems. “Frameworks also help you reduce the risk of missing an important angle or component (e.g., market, competition, operations),” says Louise.

Using a framework to structure your answer makes it easy for the interviewer to follow your thinking. It prevents you from meandering or appearing disorganized.

Your knowledge of case interview frameworks will serve you well once you do get a consulting job. You’ll find that real-world consulting involves the use of custom frameworks all the time.

2. Most common case interview frameworks↑

Now, let’s take a look at the 7 most common case interview frameworks. You can use these frameworks as a starting point for your own custom framework or mix and match them to suit a particular problem or scenario.

Under each framework, we list a case question where a specific framework would be useful. Practice answering the question using the recommended framework to familiarize yourself with its structure.

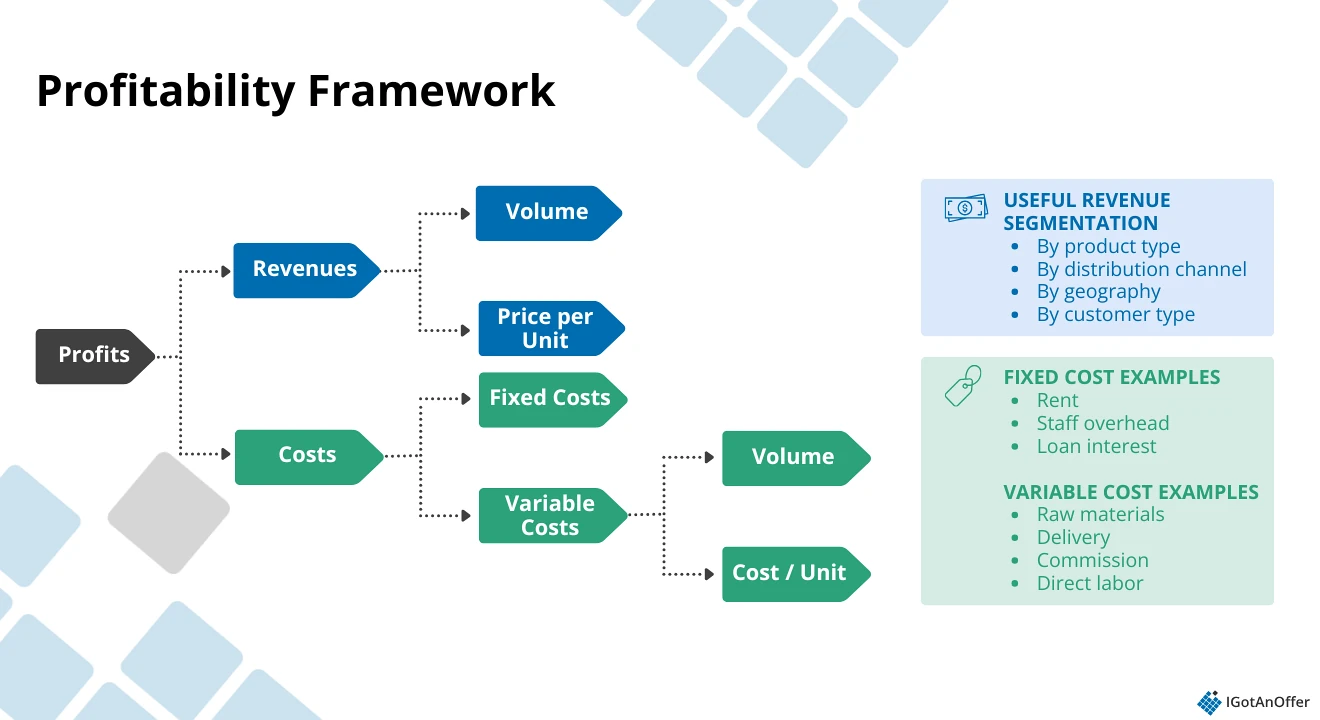

2.1 Profitability framework

The profitability framework is the most basic framework in business analysis. It is commonly used to identify the root cause of profitability issues.

Here are its components:

- Revenue can simply be broken down into the Number of Units Sold x Price Per Unit.

- Costs can be broken down into Variable and Fixed Costs.

- Variable Cost can be further broken down into the Number of Units Produced x Cost Per Unit.

- Fixed Costs, also known as overhead cost, do not rely on the number of units produced/sold. Examples: staff salary, rent/lease, etc.

Case interview example (Profitability framework)

Your client owns a movie theatre in London. The profits of the theatre have been going down over the past 12 months and your clients wants your help to find out why.

Try answering the case scenario on your own using the recommended framework. Then read our profitability framework guide to dive deeper into the framework and check a sample answer.

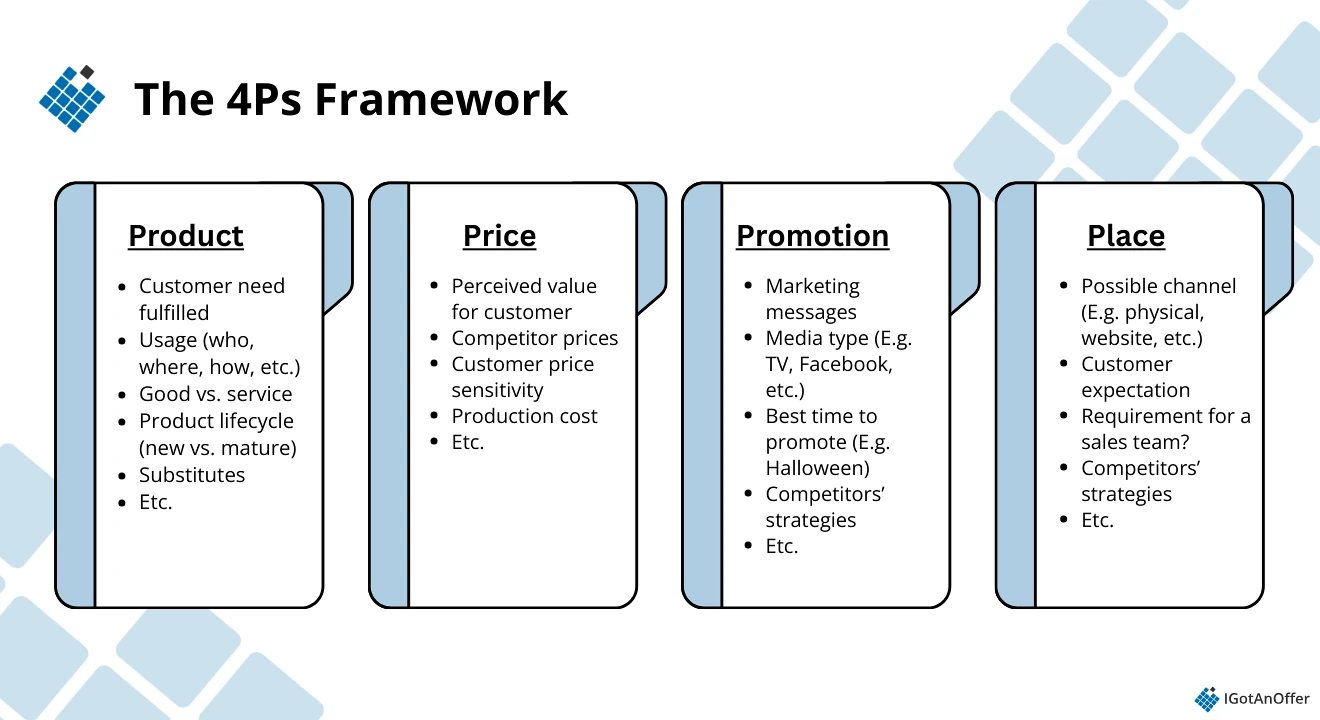

2.2 The 4Ps framework

The 4Ps framework is widely used by company executives to design or audit their marketing strategy, e.g., launching a new product or reviewing the positioning of an existing product.

The framework, also sometimes referred to as the “Marketing mix” framework, has different variations. The 4Ps is the most common one.

4Ps stands for Product, Price, Promotion, and Place.

- Product: What are the characteristics of the product sold?

Key elements to consider: customer need fulfilled by product, product usage (e.g., who, where, how, etc.), good vs. service, product lifecycle (new vs. established), competing products and substitutes, etc.

- Price: At what price should the product be sold?

Key elements to consider: the customer perceived value of the product, the price of competitive products, the customer price sensitivity, the cost of producing the product, etc.

- Promotion: Which promotion strategies should be used to sell the product?

Key elements to consider: promotion messages, media type (e.g., TV, social media, radio, etc.), best time to promote, competitors’ strategies, etc.

- Place: Through which channels should the product be distributed?

Key elements to consider: possible distribution channels (e.g., in-store, web, mail-to-order, etc.), customer expectations in terms of channel, requirement of a sales team or not, competitors’ strategies, etc.

Case interview example (4Ps framework)

From McKinsey: Our client is SuperSoda, a top-three beverage producer in the United States that has approached the consulting company for help designing its product launch strategy.

Try answering the case interview above using the recommended framework. Then read the rest of the sample McKinsey case interview to learn another optimal way to solve the sample problem.

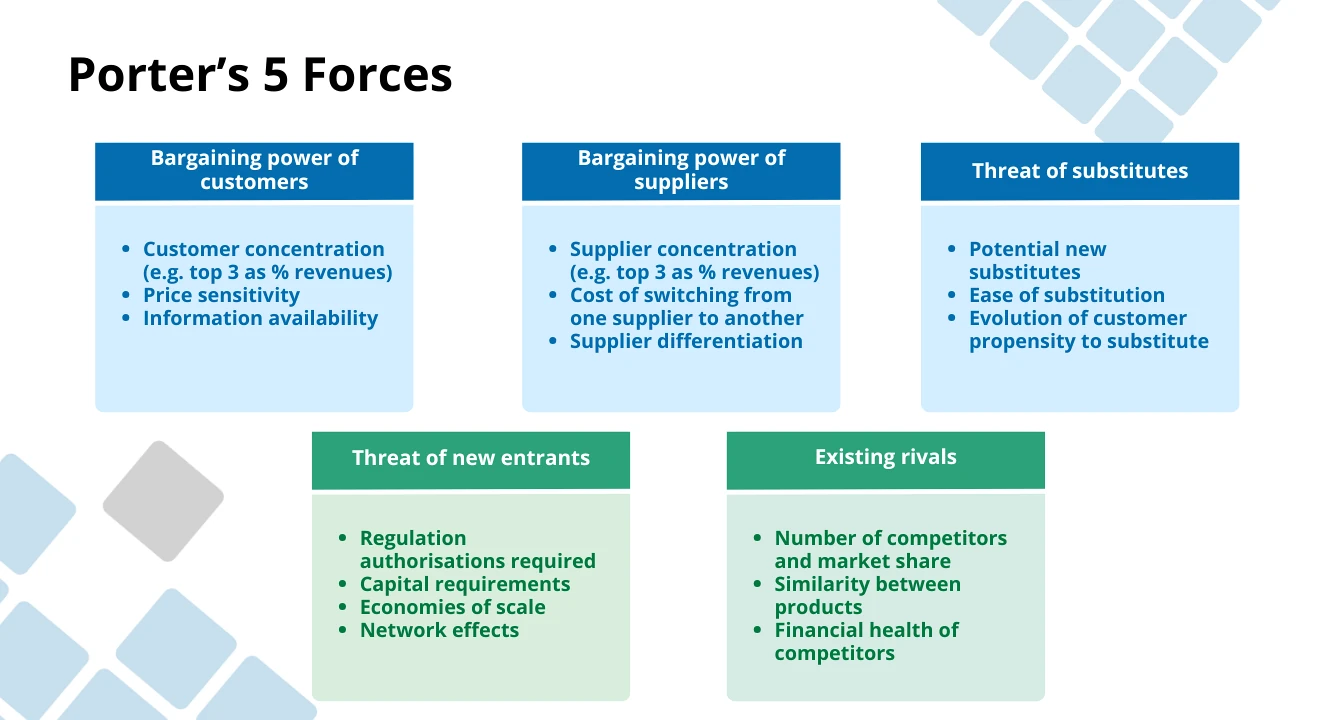

2.3 Porter's 5 Forces

Not all industries are structured the same way. Some industries are hard to get into (e.g., banking) while others have very low barriers to entry (e.g., newspapers). In some industries, suppliers have strong bargaining power (e.g., high-end medical equipment) but little power in others (e.g,. small milk producer), etc.

Porter’s 5 forces is a good framework for exploring and understanding industry dynamics. It’s useful if your case involves entering a new industry or assessing the dynamics of the industry a company is already in.

Here are the 5 forces:

- Bargaining power of customers: If there is only one buyer but multiple suppliers, then that buyer will be at a strong advantage.

Key elements to consider: customer concentration (percentage of industry revenues from Top 3 buyers), customer price sensitivity, customer information availability, etc.

- Bargaining power of suppliers: Similar to the previous point, if there is only one supplier but multiple buyers, then that supplier will be at a strong advantage.

Key elements to consider: concentration of suppliers (percentage of industry revenues to Top 3 suppliers), difficulty of switching from one supplier to another, differentiation between suppliers, etc.

- Threat of substitutes: What are the substitutes for the product, and are they increasingly popular? As a reminder, water is a substitute for Coke, while Pepsi is a competitive product for Coke.

Key elements to consider: potential new substitutes, ease of substitution, evolution of customer propensity to substitute, etc.

- Threat of new entrants: How difficult is it to enter the industry for potential new players?

Key elements to consider: regulation authorisations, capital requirements, economies of scale, network effects, etc.

- Existing rivals: How competitive are existing rivals in the industry?

Key elements to consider: number of competitors and their market shares, similarity between their products and products of the firm analysed, financial health of competitors, etc.

Case interview example (Porter’s 5 forces)

From Deloitte: The consumer products industry is seeing increasing eCommerce sales from traditional brick-and-mortar retailers, e-tailers and direct-to-consumer manufacturers that is changing how the industry competes. Despite being known for its high-quality performance and lifestyle products, Recreation Unlimited has not successfully reacted to changing customer experience preferences and lags behind competition in e-commerce sales.

Try answering the case interview above using the recommended framework on Deloitte’s official case interview prep site. We also suggest watching Business To You’s video explanation of Porter’s 5 Forces to learn more about the framework.

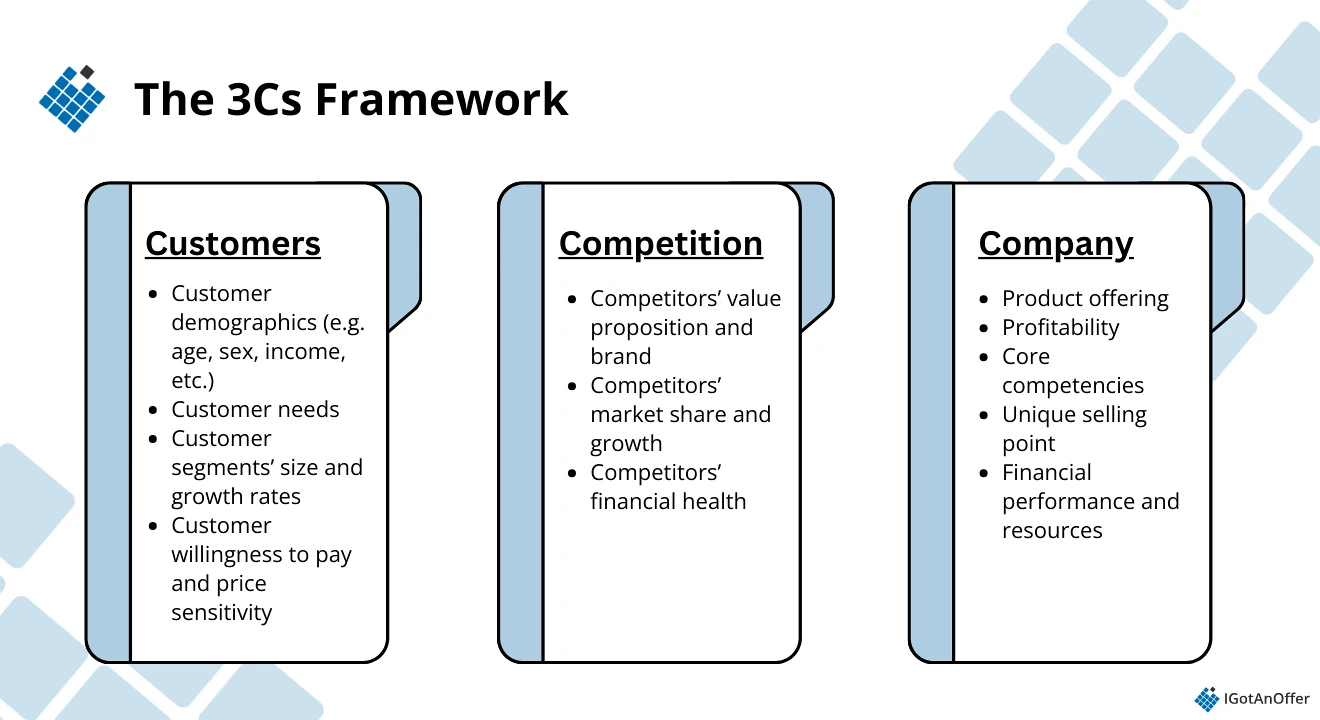

2.4 3Cs framework

The 3Cs framework is also commonly used to put together strategies for companies. As you will notice below, a lot of its components overlap with Porter’s 5 forces.

3Cs stand for Customers, Competition, and Company:

- Customers: Who is the customer?

Key elements to consider: customer demographics (e.g., age, sex, income, etc.), customer needs, customer segments' size and growth rates, customer willingness to pay and price sensitivity, etc.

- Competition: What are the competitive dynamics?

Key elements to consider: competitors’ value proposition and brand, competitors’ market share and growth, competitors’ financial health, etc.

- Company: What defines the company?

Key elements to consider: product offering, profitability, core competencies, unique selling point, financial performance, and resources, etc.

Case interview example (3Cs framework)

From OC&C: Our client runs a major chain of health clubs in the UK, alongside hotels and casinos (which are not the focus of this case). The health clubs are large out-of-town sports centers offering a gym, Jacuzzi, swimming pool, etc. They are relatively expensive, about £30-40 per month for an individual membership. As part of a broader strategy review, the client wants to know what they should do with their leisure clubs division – should they sell it, rapidly build more clubs (if so, what sort), or maybe acquire another player? Your specific task in this case is to look at the market trends and assess competition in the leisure clubs industry.

Click here to read OC&C's full case interview example. Try answering the case interview above using the recommended framework.

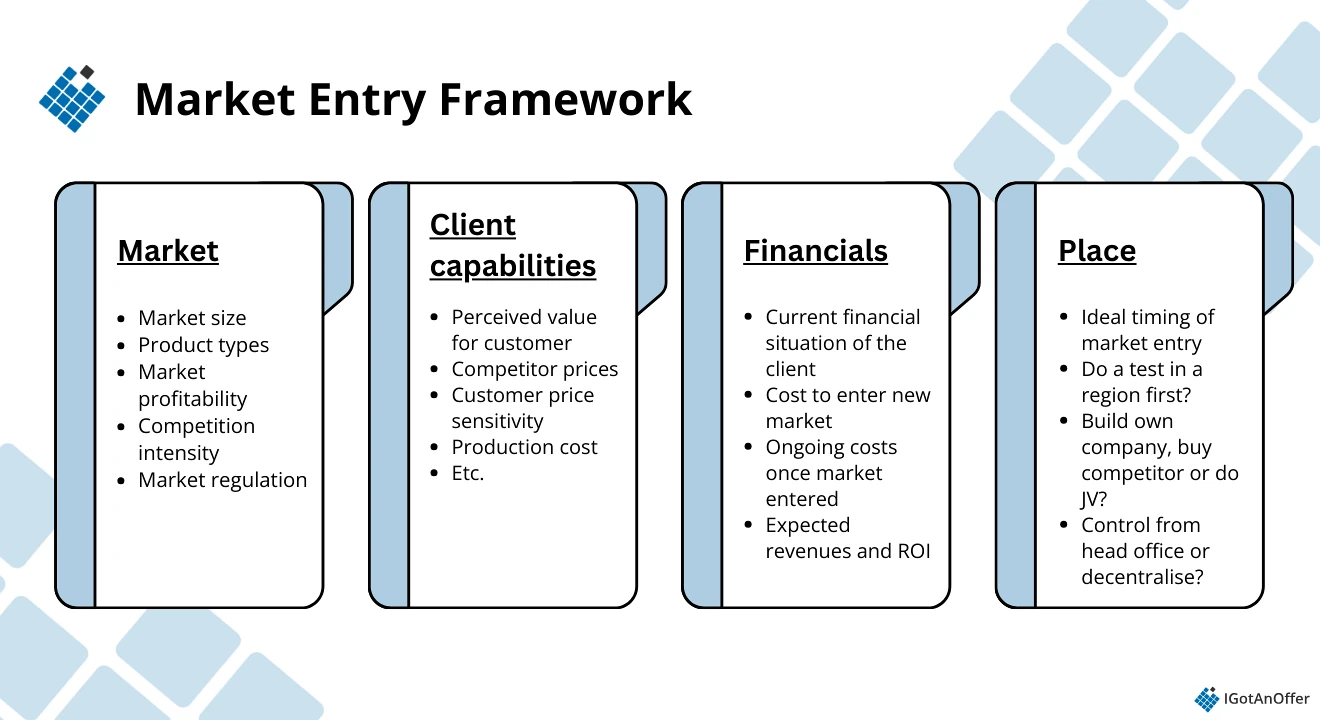

2.5 Market entry framework

The market entry framework is commonly used to make decisions on whether a company should enter a new market or not.

For instance, you could use it to decide if Starbucks should enter the Chinese market, or if Nike should enter the sports broadcasting business.

Here are the components of the framework:

- Market: What are the characteristics of the market we are trying to enter?

Key elements to consider: market size and profitability, products already available in the market, intensity of the competition, heaviness of the regulation, etc.

- Client capabilities: Does the client have the right capabilities to enter that new market?

Key elements to consider: differences between the client's current market and the new one they are now targeting, number of times the client has entered new markets and achieved success, other companies already in the new market, etc.

- Financials: Does it make financial sense to enter the new market?

Key elements to consider: current financial situation of the client, cost to enter the new market, ongoing costs once the market is entered, expected revenues and return on investment, etc.

- Entry strategy: How should the client go about entering the new market?

Key elements to consider: timing of market entry (now vs. delay), speed of market entry (test region vs. whole country), opportunity to buy competitor or do a JV, management approach (control from HQ vs. decentralise), etc.

Case interview example (Market entry framework)

Starbucks in China

For thousands of years, the Chinese have produced and drunk tea. When Starbucks announced it would enter the market in 1999, most people doubted it would be successful. Indeed, coffee had always been a distant second beverage compared to tea in the country.

So how did the American brand manage to grow from 0 stores in 1999 to more than 1,500 today? How did it manage to sell coffee to a nation of tea drinkers?

Try answering the case question above using the recommended framework. Then check out our market entry framework guide to dive deeper into the topic.

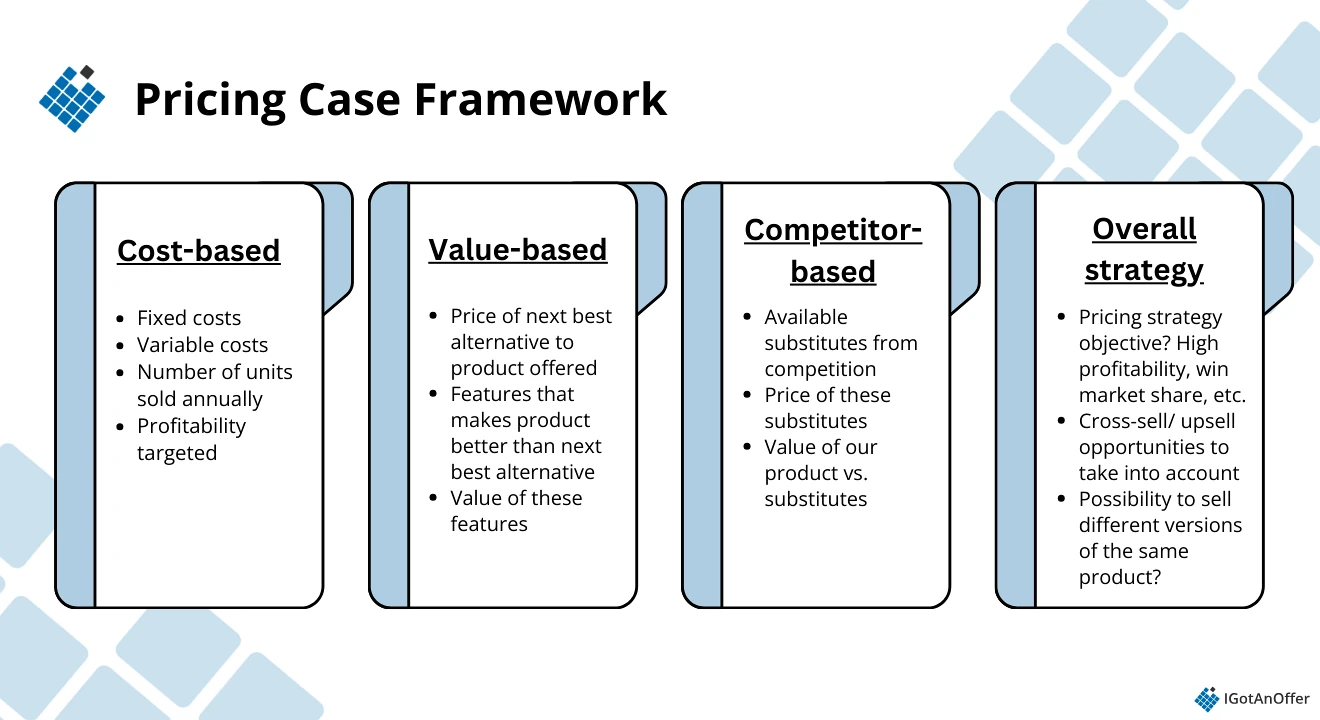

2.6 Pricing case framework

Companies always face the difficult issue of setting the price when launching a new product or service. The pricing framework is extremely helpful for answering that question.

Here are the components of the framework:

- Cost-based: What price do we need to set to cover all our costs?

Key elements to consider: fixed costs and their allocation across products, variable costs and number of units produced / sold, profitability targeted, etc.

- Value-based: How much are customers willing to pay for our product?

Key elements to consider: price of the next best alternative to our product, features that make our product better than the next best alternative, value of these features, etc.

- Competitor-based: What is the competition charging for similar products?

Key elements to consider: available substitute products from the competition, price of these substitute products, value of our product vs. substitutes, etc.

- Overall strategy: Given the elements above, what should our pricing strategy be?

Key elements to consider: objective of the pricing strategy (e.g., high profitability or high market share), opportunities for upsell / cross-sell that should be taken into account (e.g., Kindle and ebooks), possibility to sell different versions of the same product (e.g., iPhone 16 and iPhone 16 Pro), etc.

Case interview example (Pricing framework)

A global pharmaceutical company is set to release a groundbreaking drug that helps prevent deep-vein thrombosis, a specific complication of hip replacement surgery. It is set to compete against another established drug, priced at $4 per dose, with a variable production cost of $1. What price would you recommend for your client’s new drug?

Click here to learn more about the pricing framework and try to answer the examples above after your deep dive.

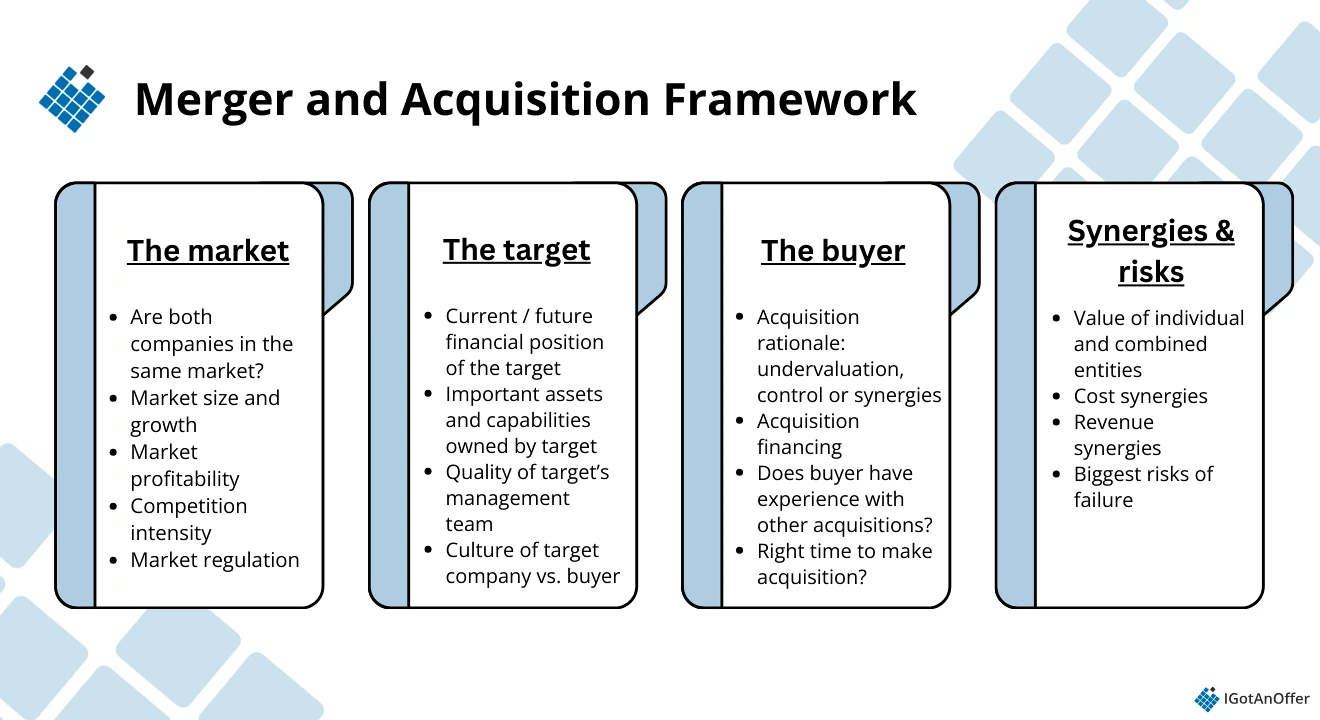

2.7 Merger and acquisition (M&A) framework

Finally, the merger and acquisition framework is used when companies are looking to acquire or merge with competitors.

These situations are not very frequent in a CEO's life. But they are highly stressful, which is why consultants are often called in to support such initiatives.

Here are the components of the framework:

- The market: What are the characteristics of the target company's market?

Key elements to consider: market size and growth, market profitability and intensity of the competition, market regulation, etc.

- The target: How attractive is the target to be acquired?

Key elements to consider: current and future financial position of the target, important assets or capabilities owned by the target, quality of the target's management team, target / buyer culture fit, etc.

- The buyer: What's driving the buyer to make the acquisition?

Key elements to consider: acquisition rationale (e.g., target undervalued, etc.), acquisition financing, buyer's acquisition experience, acquisition timing, etc.

- Synergies and risks: What are the acquisition synergies and risks?

Key elements to consider: value of individual and combined entities, cost synergies, revenue synergies, biggest risks of failure, etc.

Case interview example (M&A framework)

Imagine you are the CEO of a large beer company called AB InBev. What are the reasons you would decide to buy your competitor, SAB Miller?

Try answering the case interview question above using the recommended framework. Then check the quality of your answer by reading our merger and acquisition framework guide

3. Case interview framework cheatsheet↑

Familiarizing yourself with the most common case interview frameworks is a great starting point for learning how to structure your problem-solving approach.

By understanding how to break down complex problems using existing frameworks, you’re one step closer to learning how to customize the appropriate approaches to different problems.

To help you study more efficiently, we’ve gathered the top 7 frameworks in one downloadable case interview framework cheatsheet. Use the cheatsheet to understand the elements of each framework and how you can adapt them to different scenarios. Put them into practice by answering case interview questions on your own.

4. Why create your own framework?↑

Now that you are generally familiar with common consulting frameworks, the question becomes: how do you actually use frameworks in case interviews? And why should you create your own?

There are many schools of thought as to how you should use frameworks in case interviews. But the best method, we believe, is creating your own, based on the scenario at hand.

So then, you might be wondering: why should you familiarize yourself with common case interview frameworks if the best method is creating your own?

Because, these existing frameworks provide great building blocks for custom case interview frameworks. We recommend using the frameworks above as a starting point for creating your own. Mix and match, borrow from, and adapt whichever framework/s you think suit the scenario presented in your case interview.

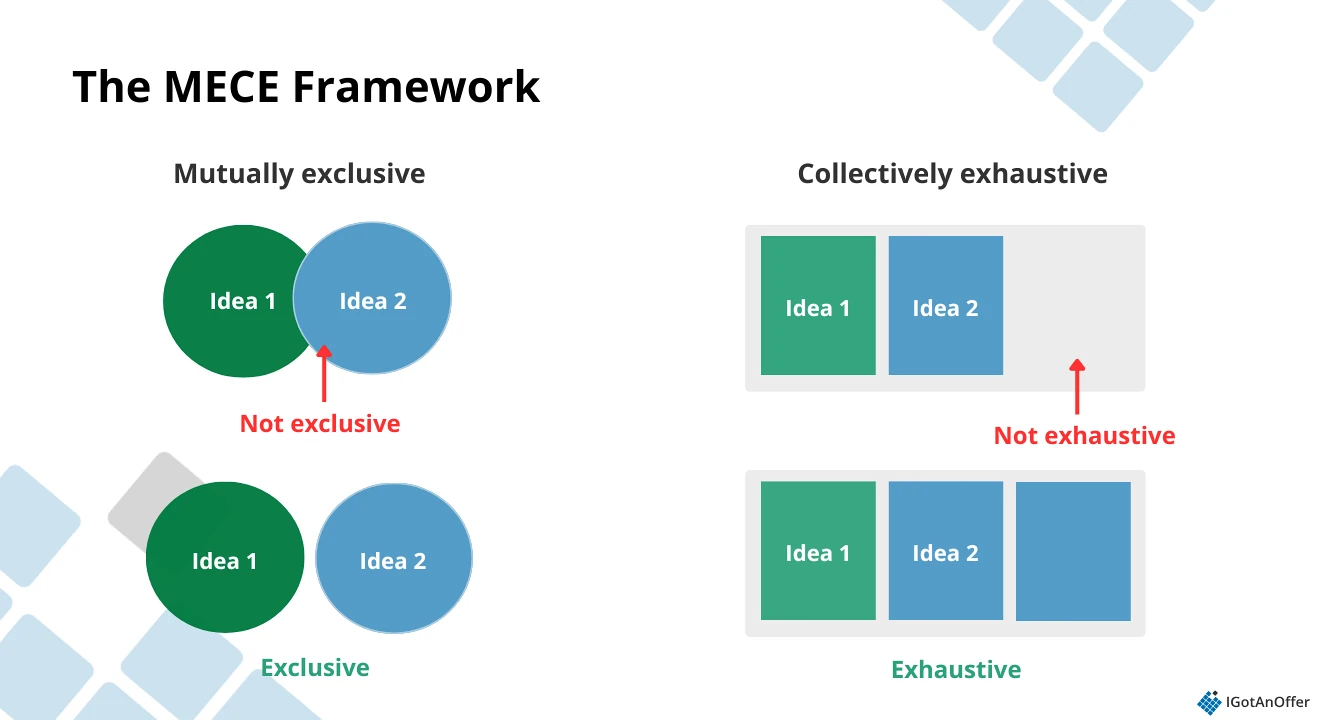

A good framework is adapted to the problem you are trying to solve, the company, and the industry. It is also as MECE as possible. If you use pre-existing frameworks, you run the risk of missing important elements of the specific problem you are trying to solve.

In real life, consultants rarely use pre-defined frameworks. They are familiar with them, but they do not directly reuse them as-is on projects.

Instead, they create a custom framework or issue tree that addresses the specific details of each case. To do so, they rely on conversations with their client as well as past experiences.

This might sound intimidating, but the good news is, creating custom frameworks is much simpler than you might think. Let’s look at one way you can do it in the next section.

5. How to create your case interview framework↑

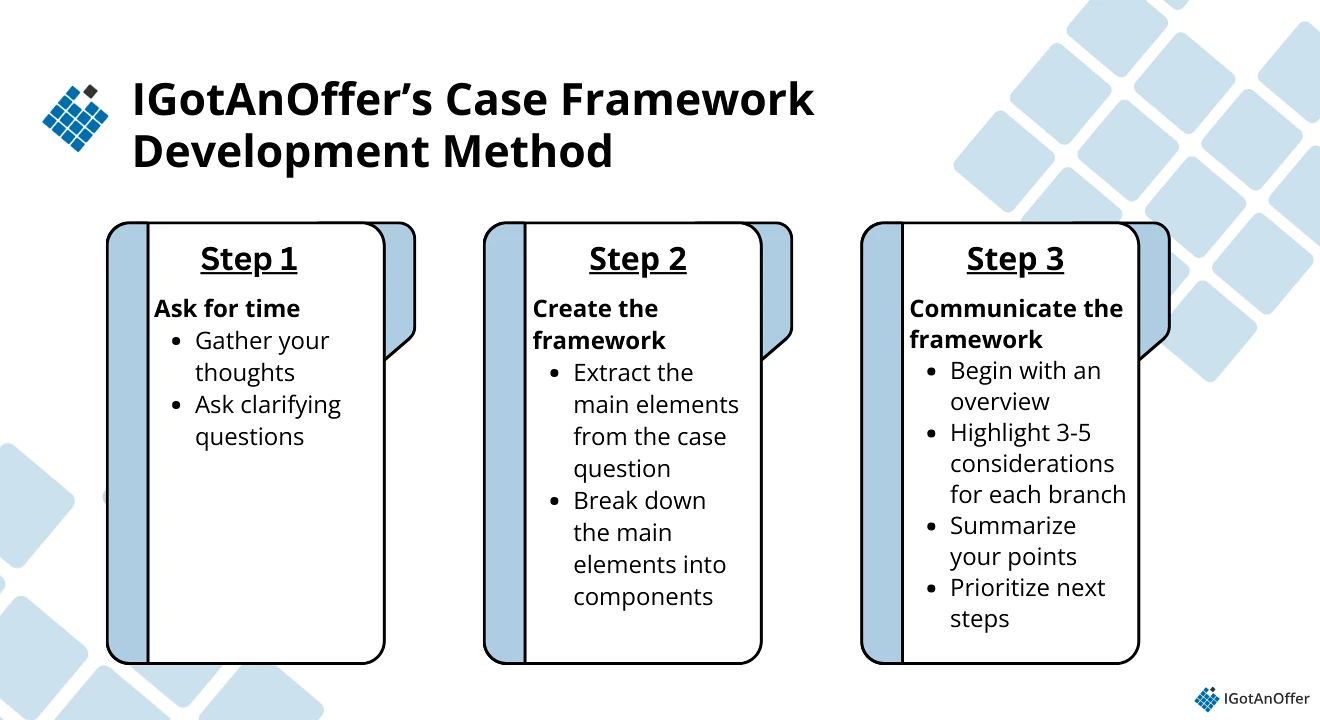

We’ve developed a method to help you create custom frameworks for your case interview. Let’s take a look at it in detail:

To illustrate the framework development process, let’s dig into a real case example below:

5.1 Ask for time to gather your thoughts

Regardless of the case you get, you should always ask your interviewer for some time to gather your thoughts before developing a framework.

This is a normal part of the interview process. Your interviewers will expect you to ask, and they'll almost always give you this time.

But don't get carried away!

As a rule of thumb, you should only take 30-60 seconds to quietly think through your framework.

We recommend that you also sketch out your framework on a piece of paper during this time, as that will help you organise your thoughts more clearly.

Without practice, it's really difficult to estimate how long 30-60 seconds is. We highly recommend practising with a stopwatch. This will help you get a clear idea of how much time you're actually using.

5.2 Create the framework

During that 30-60 second time window, you'll need to do the real work of crafting your framework.

The essence of framework creation is quite simple. A framework takes the business situation presented in the case, and breaks it into smaller pieces.

By isolating the various components of a case, you'll be able to better identify the root cause of an issue or find the best opportunities for improving the business.

The best way to develop your framework creation skills is with practice on realistic case problems. Let's walk through an example together.

Star Production case example

Star Production is a start-up that produces low-cost movies. Two university friends created the company after watching “Paranormal Activity”, a low-budget movie that attracted a larger-than-expected audience.

Very few low-cost movies end up being very successful. Star Production is hoping to generate profits by producing a large number of low-budget movies, betting that some of them will succeed.

The company forecasts that most of its movies will be loss-making, but that a few of them will be big financial hits.

Considering the high up-front cost of production and the low probability of success of low-budget movies, the two friends are evaluating the best ways to finance the company.

They have hired you to help them develop a business plan to convince investors that their model is sustainable.

What areas would you look at to determine if Star Production’s business model can be sufficiently profitable to recoup initial investments in the short term?

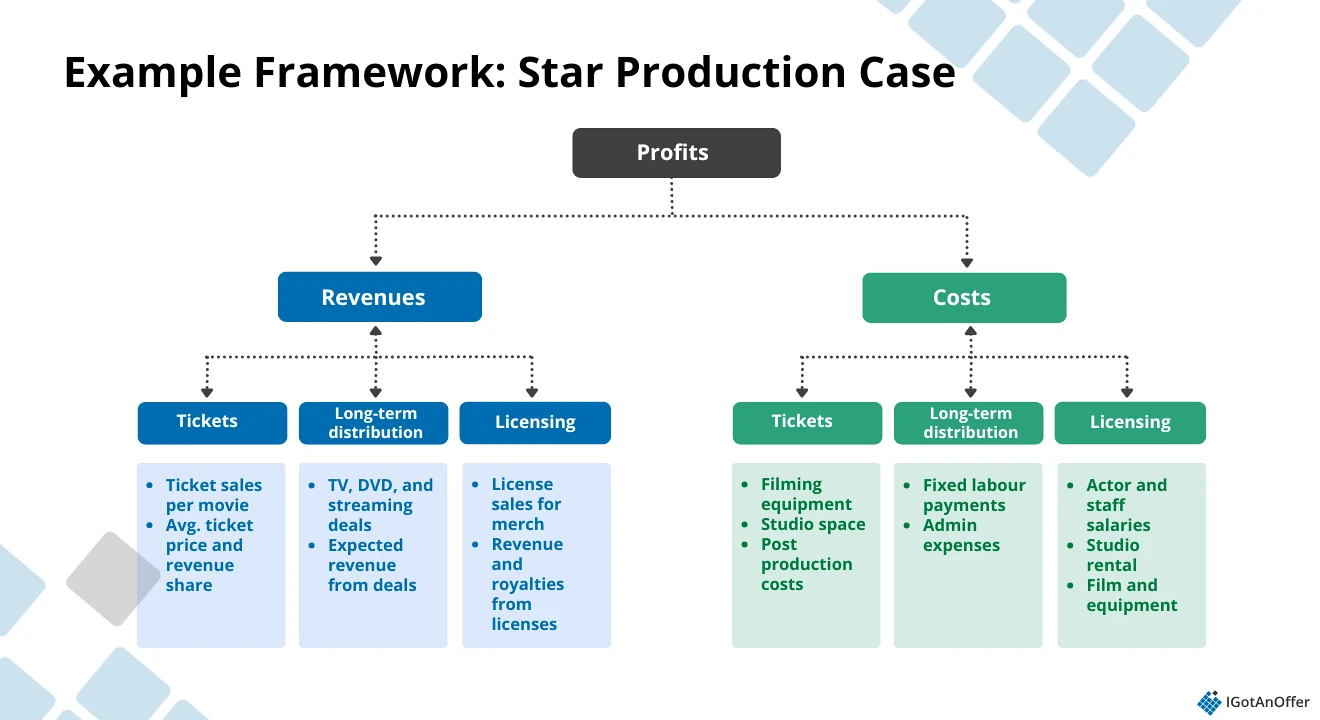

In this case, we need to analyse the short-term profitability of a movie production company.

So, you would begin crafting your framework by thinking about the different factors that could contribute to the company's overall profits.

The first two components of this framework are fairly straightforward: revenues and costs. That's because the profitability of any company is determined by a combination of its revenues and costs.

Then, we can further deconstruct both revenues and costs based on our knowledge (or perhaps some assumptions) of the movie production business.

As you break down the components further, it's important to consider the concept of MECE, which stands for Mutually Exclusive Collectively Exhaustive.

In simple terms, MECE means that you should aim to have a framework where the branches do NOT overlap with each other, and where the framework is comprehensive (i.e., no branches are missing).

You can learn more about this in our separate MECE guide.

Now here's an example of what your draft framework might look like for the Star Production case:

As you can see in the example above, we've broken down the revenues and costs into specific components that would make sense for a movie production business.

We've used bullet points to highlight the information we need to determine how each item contributes to the overall revenues or costs of the business.

For example, to calculate the total ticket revenue, we would need to know the following:

- expected ticket sales

- average ticket price

- Star Production’s share of the ticket revenue

Once you've drawn out a rough framework like the above example, your next task will be to explain your framework to your interviewer.

5.3 Communicate the framework

Creating the world's best framework won't get you an offer if you can’t explain it in a clear and structured way.

Here's how we'd recommend you communicate your framework during your interviews:

Spin your paper around

Start by showing your interviewer the framework that you've drawn on paper. Having this visual structure will make it much easier to explain (and understand).

Start with an overview

Before jumping into the details, start with an overview of the framework.

In our example above, you could simply explain that the profitability of Star Production will be determined by the expected revenues and costs of the business, which can be broken down into more specific categories.

Tell your interviewer the order in which you plan to walk through each branch, so they'll know what to expect.

Highlight 3-5 considerations for each branch

Go through each branch of your framework. Mention considerations that came to mind while you were drafting the framework.

For example, for the "upfront costs" branch of the Star Production case, you could explain that you'd want to find out what costs the company could incur before releasing movies: filming equipment, studio space, and post-production expenses.

5.4 Summarise your points

Throughout your explanation of the framework, you should pause periodically to summarise your key points, and to check in with your interviewer.

You're likely going to be covering a lot of ground in your framework. You want to make sure that your logic doesn't get foggy in the details.

For example, you could summarise the most important considerations that impact the revenues of Star Production, after walking through each sub-branch under revenues.

5.5 Prioritise next steps

Finally, after walking through your full framework, you should tell your interviewer the 2-3 next steps you would recommend, in order of priority.

There are a variety of ways you could rank next steps. Three good options would be based on importance, ease, or speed.

Returning to the Star Production example, you could recommend the following next steps in priority order:

- Identify the biggest cost drivers. Star Production's business model is focused on producing a high volume of low-cost movies, so controlling costs is essential to the profitability of the company.

- Develop a production process that minimises costs. Once the primary cost drivers are identified, we should develop a process that keeps those costs as low as possible.

- Look for opportunities to increase the hit rate. Star Production is counting on a few box office hits to drive revenues. As a result, increasing the percentage of movies that succeed could be a big win.

6. Tips/strategies for creating your own case interview framework↑

We’ve shown you one method you can use to create your own consulting framework. We highly recommend doing case interview drills using this method, or even coming up with your own.

Here are some tips and strategies for creating your case interview framework, with insights from our consulting coach, Louise (Tesla/ex-Deloitte).

6.1 Always start from the business objective

No matter what framework creation method you use, your north star should always be the specific business objective of your case.

Listen in closely for the objective and make sure you understand it completely. Ask clarifying questions if you must.

Understanding the problem properly should help you avoid the common pitfall of creating buckets that are not relevant to the case at hand.

6.2 Get used to MECE thinking

“Use MECE thinking to keep your structure clean and avoid overlap,” Louise says.

The only way to get used to the MECE method is to practise using it consistently. Use it on real case prompts, and try refining your structure with practice.

6.3 Make your framework more relevant with specific industry details

After understanding the problem and applying the MECE method to create your framework, dive deeper into it by supplying industry-specific information.

Some examples:

- Declining profits in a retail chain? Start with “Revenue – Cost,” then adapt to include foot traffic, store footprint, and local competitors.

- Entering a new healthcare market? Start with “Market Attractiveness vs. Capability Fit,” then add regulatory hurdles and patient adoption barriers.

6.4 Don’t over-engineer your framework

Louise says that one of the most common mistakes consulting candidates make is “over-engineering the structure and leaving too little time for insights.”

Customising case frameworks to a problem is important, but you shouldn’t overdo it. Your framework is there as a guide to help you get to your recommendations.

6.5 Create your own core toolbox

Louise’s advice is to build your own core toolbox of frameworks that you can flex in real time.

Having a good understanding of the common case frameworks is a great place to start for building a case toolbox. This way, you can mix and match them to adapt to the unique scenarios of the cases you’re presented with.

7. Why you shouldn’t use pre-existing case interview templates↑

Creating your own case framework may sound like a lot of work. So you might still be tempted to use pre-existing templates like Marc Cosentino’s Case In Point and Victor Cheng’s LOMS.

But based on our experience, both methods share the same flaw: they try to force pre-defined frameworks onto cases, often leading to average results.

It’s because all cases are unique, and therefore cannot be pigeonholed into rigid frameworks, as these schools of thought advise.

Still not convinced? Let's cover each of these methods in detail:

7.1 Case in Point framework

In Case in Point, Marc Cosentino attempts to classify case interviews into 10+ categories. His advice is for candidates to memorise a specific framework for each of them.

This is an interesting exercise. It exposes you to a range of business problems and helps you think about them in different ways.

However, in our experience, learning 10+ frameworks is difficult and time-consuming.

More importantly, in live case interviews, trying to recognise one of the 10+ case categories and then remembering the associated framework is a real nightmare!

Instead of focusing on solving the problem at hand, you could lose valuable time trying to remember a framework which might not even be suited to the case you’re solving.

7.2 Victor Cheng framework

In his LOMS (Look over my shoulder) programme, Victor Cheng advocates for learning only two frameworks:

- profit framework for profitability cases

- general framework for all other cases (Product, Consumer, Company, Competition)

The benefit of this approach is its simplicity. It gives you a starting point that’s easy to remember when you are putting a framework together.

However, in practice, there aren’t that many profitability cases. You basically always end up using the general framework.

Even if you adapt this general framework, it won't be perfectly tailored to the case you are trying to solve.

More importantly, your interviewer will quickly realise that you are using a pre-made framework and that will reflect negatively on you.

8. How to master case interview frameworks to get an MBB offer↑

Now that you’ve reviewed the most common case interview frameworks and know how to create your own, it’s time to put your learnings into practice.

Start by creating custom frameworks for real case prompts. Then, once you’ve gotten used to customising frameworks, take the time to do mock interviews.

In our experience, practising real interviews with experts who can give you company-specific feedback makes a huge difference.

Find a consulting interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Learn how to tell the right stories, better.

- Save time by focusing your preparation

Landing a job at a top consulting company often results in a $50,000 per year or more increase in total compensation. In our experience, three or four coaching sessions worth ~$500 make a significant difference in your ability to land the job. That’s an ROI of 100x!