If you’re preparing for a case interview at McKinsey, BCG, Bain, or another top consulting firm, you can expect to face a market sizing question. This could be something like “What’s the market size for take-away coffee in this country?” or “How many bottles of wine are sold in the U.S. every year?”.

The best way to get the hang of these questions is to practise them. To save you hours of research, we’ve collected 21 typical market sizing questions with good quality solutions and listed them below.

Here’s an overview of what we’ll cover:

- What are market sizing questions?

- 21 market sizing questions and solutions

- How to prepare for market sizing questions

Click here to practise 1-on-1 with MBB ex-interviewers

1. What are market sizing questions?

Market sizing questions are typically asked at the beginning of consulting case interviews. They're also sometimes asked at interviews for BizOps roles and investment banking roles.

These types of questions require you to perform rough calculations in order to estimate the size of a particular market without having any data available.

There are two types of market sizing questions. Most commonly, you'll be asked to estimate the value of a market - that is, to calculate its annual revenue. The market could be anything, from soft drinks to ping pong balls, and you’ll need to give an estimate of its annual worth (e.g, £5 billion).

Alternatively, you may be asked to estimate the volume of a market - that is, to calculate the number of units sold (e.g, 5 billion ping pong balls).

1.1 Why do companies ask market sizing questions?

Consulting firms tend to ask market sizing questions for two main reasons:

Firstly, it gives the interviewer the chance to see whether the candidate's basic mathematical and problem-solving skills are of a good standard, and whether they can use them quickly and logically in a high-pressure situation.

Secondly, consultants will often need to provide “guesstimates” and ballpark figures of market size while they’re talking to clients, be it on strategy cases or due diligence cases. Thus, the ability to do a quick back-of-the-envelope calculation, perhaps during or just before a client meeting, is of real practical value.

So, let’s take a look at some examples.

2. 21 market sizing questions and solutions ↑

We’ve researched the questions and solutions available online, and we’ve listed the best ones here for you, including links to video and written resources.

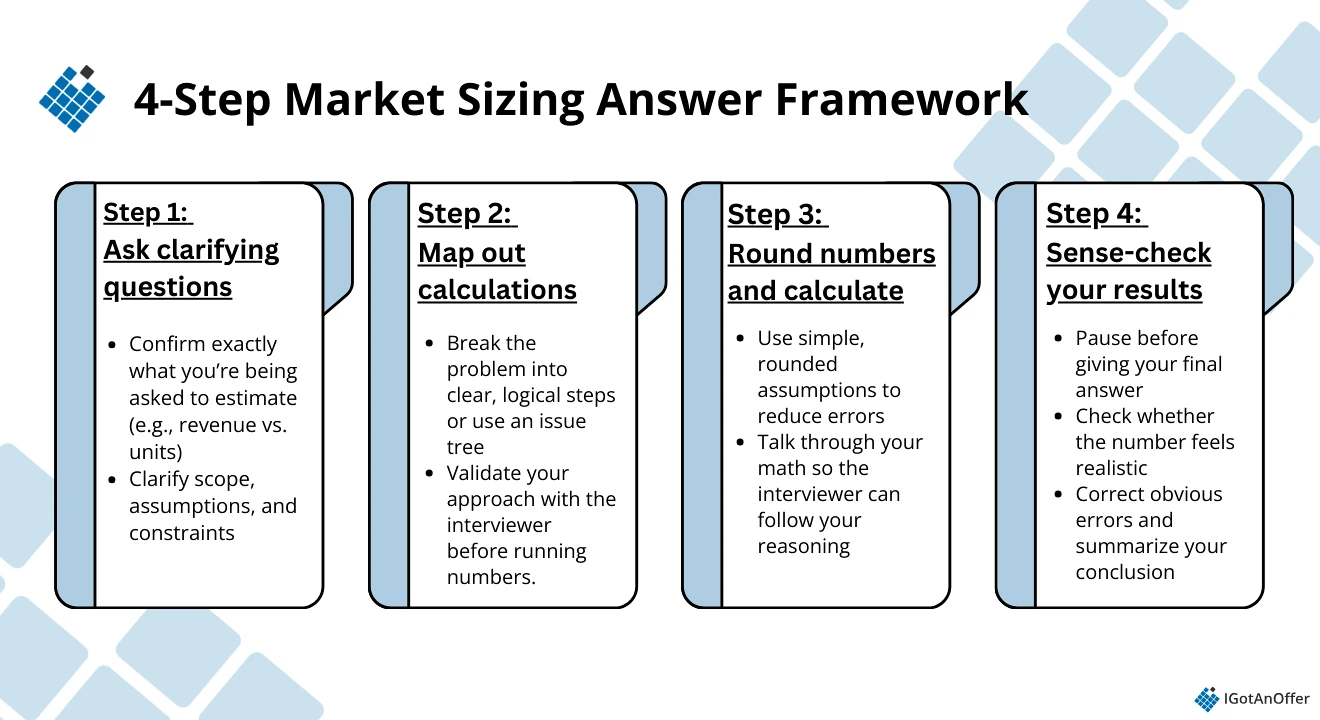

We always recommend using a 4-step framework. Here’s an overview:

Right, let’s get into some sample market sizing questions.

2.1 Medium-level market sizing questions

There's a whole list of examples below, but first, let's work through an example together so that you can see how we recommend approaching a market sizing question.

2.1.1 How many t-shirts are purchased in New York City in a given year?

Step 1: Ask clarification questions

Market sizing questions are usually ambiguous. Make sure you’re calculating the right numbers before you start. This also buys you some thinking time. You could ask:

- “Does this include NYC only (8m) or the greater metropolitan area (20m)?"

- "Does 'shirts purchased' mean just in-store? Would an online purchase by someone in New York using a provider outside NYC count?"

- "Does this include sportswear, or is it restricted to regular-use t-shirts?”

Let’s imagine that in this case, the interviewer says they’re interested in NYC only. They clarify that online purchases can be included as long as the buyer is in NYC at the time of purchase, and that sportswear should be excluded.

Step 2: Map out your calculations

We always recommend telling your interviewer your approach to the problem before you start making calculations. You could lay out these five steps:

- Estimate the population of NYC

- Estimate the number of t-shirts the average man in NYC buys each year

- Estimate the number of t-shirts the average woman in NYC buys each year

- Adjust estimates for age group differences

- Find average and multiply by population of NYC

Hopefully, the interviewer is on board with your approach, so you can get started.

Step 3. Round numbers and calculate

Calculation step 1:

Estimate the population of NYC.

Let's imagine that you live in London. You know that London has about 8 million inhabitants, and you think that NYC must be fairly similar.

Estimate: 8 million

New York is a fashion capital in a world of fast fashion, and also a relatively wealthy city where people have disposable income for clothes shopping. These factors will push your estimates up.

Now, onto the trickier estimates. If you’re a man, start with men, so you can use yourself as a base of reference. If you’re a woman, vice versa. For argument's sake, let's say you're a man.

Calculation step 2:

Estimate the number of t-shirts the average man in NYC buys each year.

You can tell the interviewer that here you're using personal experience to make assumptions. Let's imagine that tees are your main item of clothing and you buy around 4 per year. You might say that you think this might be a bit under the NYC average, as you’re not interested in fashion and don’t have much time for shopping. Also, you want to count t-shirts given to men by someone else (their partners, for instance), and so this increases your estimate slightly.

Estimate: 5 t-shirts per year.

Calculation step 3.

Estimate the number of t-shirts the average woman in NYC buys each year.

Let's imagine that, drawing from personal experience, your perception is that women don’t wear t-shirts as often as men, but then again, they tend to buy more clothes than men. You consider that they may also buy a lot of clothes for men, but as you've already mentioned, you counted these in the male estimate.

Estimate: 3 t-shirts per year.

Calculation step 4.

Adjust estimates for age group differences.

You may want to consider children differently, because children go through a lot of clothes as they grow, make a mess of them, etc. However, you could also factor in that children often wear a lot of passed-on clothing (from siblings, etc). You could conclude that these factors balance each other out, and so 3 for girls and 5 for boys seems about right to you.

Calculation step 5:

Find average and multiply by population of NYC.

Clearly, the average of 5 and 3 = 4.

4 x 8 million = 32 million.

Step 4. Sense check your results

Your calculations have been fairly simple, so there shouldn’t be any surprises. 32 million t-shirts sold per year in a population of 8 million? It seems reasonable.

You can give the interviewer your final answer:

Total number of t-shirts sold in NYC each year: 32 million

Now you've seen how to approach this type of question, have a go at the ones below.

2.1.2 Provide an estimate for the number of dentists currently working in the UK

2.1.3 Estimate the market size for sofas in the UK

How did you get on? We've listed some more helpful examples below.

2.1.4 More medium-level market sizing questions

- How many bottles of wine are sold in the US every year? (video solution)

- How many windows are in NYC? (video solution)

- What is the market for coffee in Cambridge, England? (Bain: video solution, written solution)

- How many gas stations are there in the US? (video solution)

- What is the market size for cars in the USA? (video solution)

- What is the market size for takeaway tea in Bangalore? (written solution)

- How many smartphones are sold in the US each year? (video solution)

- Estimate the market size for televisions in Poland (video solution)

- How many croissants are sold in Paris every year? (video solution)

Remember, there is often more than one valid way of approaching a market sizing question, so if your solution is different from the ones we've linked to, it doesn't necessarily mean it's wrong. However, it is worth learning an approach that works and sticking to it.

2.2 Hard market sizing questions

You can't predict how difficult your market sizing question will be, and so you should be prepared for it to be a little bit more complex. Let's apply our 4-step framework to a slightly trickier question.

2.2.1 Calculate the market size for weddings in the UK

Step 1: Ask clarification questions

Make sure of the actual number you need to calculate. You could ask the interviewer:

- “Are we talking volume (number of weddings) or value (amount spent on weddings)?"

- "If we’re talking value, do you want to take into account linked expenditure - stag and hen parties, engagement rings, etc, or are we just focusing on the cost of the actual wedding day itself?"

- “Are we including guest expenditure, or just how much the wedding day costs the hosts?”

The interviewer tells you that they want the total direct spend on the wedding day, including guest spending at the venue. They’re not interested in related spend such as hen parties and guest transport, etc.

Right, now you’re ready for the next step.

Step 2: Map out your calculations

Here, you could explain to the interviewer that you're going to do some segmentation. Why? Because people can get married at any adult age, but there is a huge difference in marriage rates between age groups.

To keep it simple, you could segment the population into age groups spanning 20 yo, and assume even population distribution across those. You can estimate the % of each segment to get married in a year, thus finding the total people getting married in the UK.

- Segment population and estimate % of each that will marry in a given year.

- Use % to calculate number of people estimated to marry in each segment, and add them together to find total number of people marrying.

- Two people marry at each wedding, so we’ll halve the number of people marrying to find the number of weddings.

- Estimate cost per wedding by estimating host spend and guest spend and adding together.

- Multiply total spend per wedding by the total number of weddings to find the market size.

You lay out this approach to the interviewer, and hopefully, they’re on board with it, so you can start calculating.

Step 3: Round numbers and calculate

Calculation step 1:

Segment population and estimate % of each that will marry in a given year

If you've memorised your cheat sheet, you know the UK population is roughly 70 million.

0-20 years - 17m (rounded from 17.5)

20-40 years- 17m

40-60 years - 17m

60-80+ years - 17m

You could tell the interviewer that you’re going to make some assumptions based on your personal experience of living in the UK.

If you're from another country, base it on your own experience and adapt. E.g., if you're from the US, you’ll decrease the percentages a little because you know that the UK is less religious than the US, and therefore marriage rates should be lower.

- 0-20 years: Most of this age group is below the legal age of marriage, and even at the legal age, we know that it’s fairly rare for people to get married before 20 in the UK. We calculate that it’s less than 1 in 100 - let’s say 0.5%.

So, 17m / 100 = 170k / 2 = 85k. You round this to 90k.

- 20-40 years: You estimate that you have around 100 friends and relatives that you're on reasonably close terms with, and probably just over half of these are in the 20-40 age group. You say that you tend to be invited to two weddings a year, with one of the newlyweds coming from outside this pool: you estimate that 3 people out of 60 in this age group marry each year - that’s 5%.

You already know that 0.5% is 90k. So you multiply by 10 to get to 5% = 900k.

- 40-60 years: You estimate that weddings in this age group are around one-third as common as the 20-40 segment, perhaps a little more due to second marriages. You call it 2%.

90k x 4 = 360k

- 60-80 years: Probably not as rare as the first segment, given that all ages are applicable, but still fairly rare. You estimate 1%.

90k x 2 = 180k

Calculation step 2:

Use % to calculate the number of people estimated to marry in each segment, and add them together to find total number of people marrying.

TOTAL: 90k + 900k + 360k + 180k = 1.530m people getting married. You round it to 1.5m

Calculation step 3:

Two people marry at each wedding, so you halve the number of people marrying to find the number of weddings.

Divide 1.5m / 2 = 750k weddings per year.

Total number of weddings in the UK each year: 750k.

Calculation step 4:

Estimate cost per wedding by estimating host spend and guest spend and adding them together.

You could tell the interviewer that, from what you’ve heard in the media, the average wedding in the UK costs the hosts £20k.

You need to add guest expenditure. Estimating 70 guests at each wedding, you estimate an average spend of £30. 70 x 30 = £2.1k per wedding, rounding it to £2k.

So, total direct costs of the average wedding come to 22k.

Calculation step 5:

Multiply total spend per wedding by the total number of weddings = market size.

22k x 750k = 16.5 billion

Step four: Sense-check your results

It’s hard to have much sense of how many billions weddings should be worth. Instead, let’s check the calculation before that - the number of weddings in the UK:

750K weddings per year in a population of 70 million people, does that sound right? Yes, it’s roughly 2% (1% doubled for the two people marrying) of the population marrying each year, which seems reasonable.

You confirm to the interviewer your estimate:

Total market size of weddings in the UK: £16.5billion

In fact, you’re a little over. The current market size for UK weddings is around $9 billion, with fewer weddings than you estimated. But the interviewer will be evaluating you more on the logic of the thought process than on how close your final result is to the real one.

Right, let's take a look at some more questions.

2.2.2 Estimate how many women in the USA play golf (solution from 4'45)

2.2.3 What is the market size for hotel toiletries (shampoo, conditioner, and shower gel) in the client’s hometown for the first year? (solution from 1'28)

2.2.4 What is the market size for baby formula in Canada? (solution from 2'16)

2.2.5 More hard market sizing questions

- How many students in the U.S. apply to consulting jobs each year? (video solution)

- How many petrol stations are there in the UK? (video solution)

- What’s the market size for residential light bulbs in the US? (written solution)

- What is the total number of automobile tires sold in the US every year? (written solution)

- What is the size of the sandwich market in India? (written solution)

3. How to ace market sizing questions ↑

The market sizing questions and calculations we’ve gone through here aren’t rocket science, but they require a calm head and can be tricky to pull off smoothly in a high-pressure situation. And of course, they’re even trickier if you’re not used to answering them!

However, if you prepare using the simple steps below, you should put yourself in a great position to crack them. Here we go:

3.1 Learn a framework

Having a framework will help you structure your answer logically and minimize your potential for mistakes.

We recommend using the case study framework we laid out in the two solutions we walked you through above. See it in more detail in our ultimate guide to market sizing.

3.2 Take time to structure your thinking

Jumping straight into calculations without first organizing your thoughts or laying out an equation is a common mistake candidates make too often.

According to Malin (McKinsey management consultant), you should “take a couple of minutes to structure the problem.” This makes it easier for the interviewer to follow your reasoning and see how you’re approaching the problem step by step.

3.3 Memorise some basic data

Market sizing questions are not general knowledge or "lucky guess" tests, and you’re not expected to be able to quote all sorts of population demographics and industry stats.

That said, to make a good impression, we recommend brushing up on some basic facts, such as the rough population of the country you’re interviewing in.

In our ultimate guide to market sizing, we've put the most important data all together for you in a cheat sheet.

3.4 Don’t overcomplicate the math

Interviewers understand that you won’t have perfect data in a case interview. The goal isn’t accuracy down to the decimal but showing that you can make a “logical, defensible estimate”.

Malin recommends keeping equations clear and easy to follow, then closing your argument with something like: “In a real project, I’d further test X, Y, and Z.”

This shows that you understand the limits of your estimate and know how to refine, given the right data.

3.5 Course-correct as needed

Even well-prepared candidates can get thrown off by nerves and lose their way in the middle of a case interview. If this happens, be candid about it.

Malin suggests asking for a quick “reset” and explaining how you’d re-approach the problem. “Interviewers usually know when you’re drifting, and they’ll respect the maturity to recalibrate.”

3.6 Practise on your own

Once you’ve learned the framework, we recommend answering lots of questions until the approach starts to come naturally. The question list in Section 2 above is, as far as we can tell, the best resource available in terms of lists of questions and solutions.

3.7 Practise with peers

If you have friends or peers who can do mock interviews with you, that's an option worth trying. It’s free, but be warned, you may come up against the following problems:

- It’s hard to know if the feedback you get is accurate

- They’re unlikely to have insider knowledge of interviews at your target company

- On peer platforms, people often waste your time by not showing up

For those reasons, many candidates skip peer mock interviews and go straight to mock interviews with an expert.

3.8 Practise with experienced MBB interviewers

In our experience, practising real interviews with experts who can give you company-specific feedback makes a huge difference.

Find a consulting interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Learn how to tell the right stories, better.

- Save time by focusing your preparation

Landing a job at a top consulting company often results in a $50,000 per year or more increase in total compensation. In our experience, three or four coaching sessions worth ~$500 make a significant difference in your ability to land the job. That’s an ROI of 100x!

Click here to book case interview coaching with experienced MBB interviewers.