Metric questions are common in interviews at big tech companies. Meta has an “analytical thinking” round and Google also has an analytical round at onsite stage.

Metric questions usually ask you to define a metric or find the root cause for a change in metrics. These questions aren't easy. But the good news is that if you know how to approach them they can become fairly straightforward to answer.

Below, we'll give you everything you need to prepare for metric questions: an answer framework, expert tips, example answers, and questions to practice with.

Here’s an overview of what we will cover:

- What is a metric interview question?

- How to answer metric interview questions

- Example metric questions with answers

- List of sample metric interview questions (from Meta, Google, Amazon, etc.)

- Product metric mock interviews

- How to prepare for product metric questions

Click here to practice 1-on-1 with FAANG ex-interviewers

1. What is a product metrics interview question? ↑

Metric interview questions test if candidates can perform data analysis and select key metrics that matter most to the success of a product.

Big Tech companies like Meta and Google use these questions to evaluate analytical thinking and communication skills. One such case is interviews for BizOps roles.

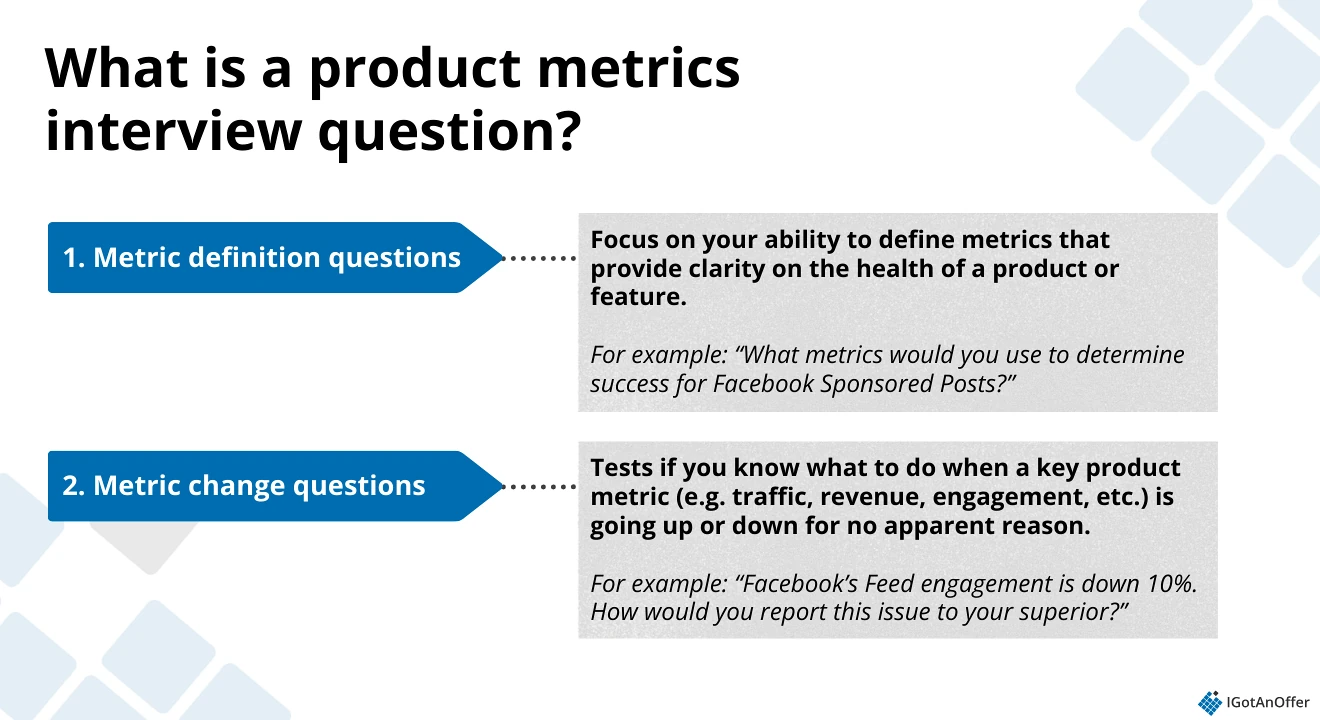

There are two types of metric questions: metric definition questions and metric change questions.

Metric definition questions focus on your ability to define metrics that provide clarity on the health of a product or feature. For example: “What metrics would you use to determine success for Facebook Sponsored Posts?”

There are many different metrics you could be tracking (e.g. impressions, clicks, return on ad spend, etc.) and your interviewer will want to hear you select the most important ones using a rigorous process.

Metric change questions test if you know what to do when a key product metric (e.g. traffic, revenue, engagement, etc.) is going up or down for no apparent reason. For example, “Facebook’s Feed engagement is down 10%. How would you report this issue to your superior?”

There are many different reasons why this decrease could be happening and your interviewer will want to see you take a bulletproof approach to find the root cause of the issue.

2. How to answer metrics interview questions ↑

A common mistake candidates make when answering metric questions is to provide an unstructured answer. In this section, we’ll walk through two step-by-step frameworks you can use to avoid that pitfall — one framework for metric definition questions, and one for metric change questions.

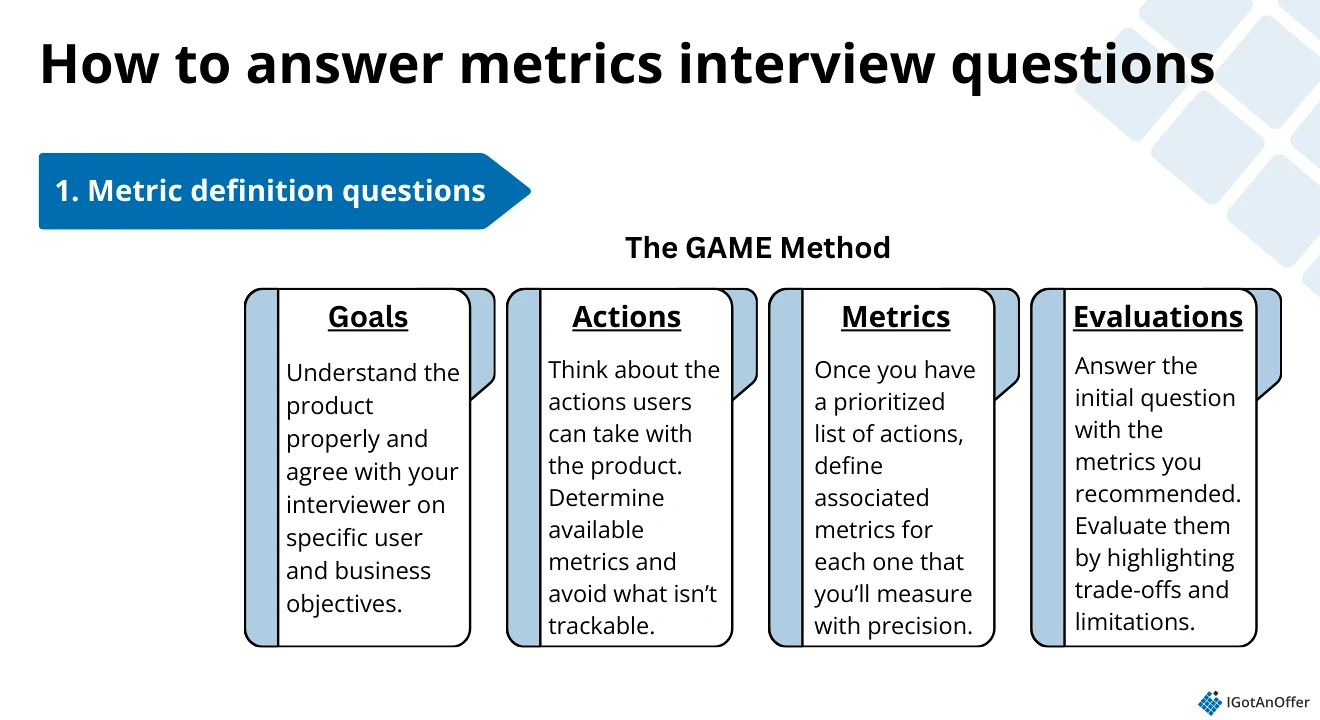

2.1 Metric definition questions: GAME method

Metric definition question example

“What metrics would you use to determine success for Facebook Feed?”

We recommend using the GAME method to answer metric definition questions. Let’s walk through each of the four steps one by one:

- Goals

- Actions

- Metrics

- Evaluations

1. Goals: First, you should start by making sure you understand the product properly and agree with your interviewer on specific user and business objectives.

Agreeing on the goals upfront is extremely important because what you measure will change entirely depending on what you’re trying to achieve with the product.

For instance, imagine your interviewer has asked you, “What metrics would you use to measure the success of Meta’s Facebook Feed?” The Feed is one of Facebook’s main features and it fulfills many objectives for the business.

It’s a primary driver of user engagement, a strong revenue generator, and the main place where Facebook can test new personalization features. So, how do you determine what the most important objective is?

There’s no single right answer to this question but you could begin by saying, "My understanding is that there are several use cases for the Feed including engaging users, generating ad revenue, and testing new personalization features. To stay healthy, Facebook needs strong user engagement, so I would assume that this is the primary business goal. Is that what you have in mind, too?"

2. Actions: Next, you should think about all the actions users can take in the product. Listing each action will help you focus on available metrics and avoid those that aren’t trackable.

The easiest way to do this is to think about what it really means for a user to be “engaged.” You should aim to list every relevant action (e.g. creating a post, viewing a post, commenting, liking, sharing, etc.).

However, it’s also a good idea to avoid going into too much detail. For example, simply list “liking” as a category of action instead of “liking a friend’s post, liking a group’s post, liking an event, liking a comment, etc.”

Next, you need to prioritize your list of actions. Remember to use the goals you established in the previous step to explain your thinking.

For instance, you might say something like, “There are a number of user actions which reflect engagement but I think the three most important ones are likely to be posting, commenting, and sharing.”

3. Metrics: Once you have a prioritized list of actions, it’s time to define associated metrics for each one. In this step it’s important that you define the metrics you will measure with precision.

Let’s imagine that in our previous step, after discussing with your interviewer, you prioritized the “comment” and “share” actions. Talking about “comments” and “shares” isn’t sufficient as there are many different ways in which you can track these actions.

In order to measure engagement based on these actions, here are some metrics that would make sense to track:

- "Comment" metrics

- Comments per thousand sessions

- Comments per thousand posts seen

- Comments per thousand posts clicked

- "Share" metrics

- Shares per thousand sessions

- Shares per thousand posts seen

- Shares per thousand posts clicked

4. Evaluations: After defining metrics, you should conclude the discussion by answering the initial question with the metrics you recommend. Finally, evaluate the metrics you have selected by highlighting trade-offs and limitations.

For the Facebook Feed example, you could summarize by saying something like, “So, in order to increase Feed engagement, I would first look at comments and shares per thousand sessions. These metrics would give us an idea of meaningful engagement for the average user.”

The last key step is to show that you understand the strengths and weaknesses of your recommended metrics.

So you could wrap up your answer by saying something like:

“We should keep in mind that not all commenting and sharing is positive. Perhaps we should monitor the sentiment of these actions to make sure we're creating a positive experience overall. Also, commenting and sharing represent deep engagement. If we are interested in shallower engagement we might need to consider other metrics (e.g. number of sessions per user per day, number of likes per user, etc.) to measure engagement for users who don't comment or share but still use the product frequently.”

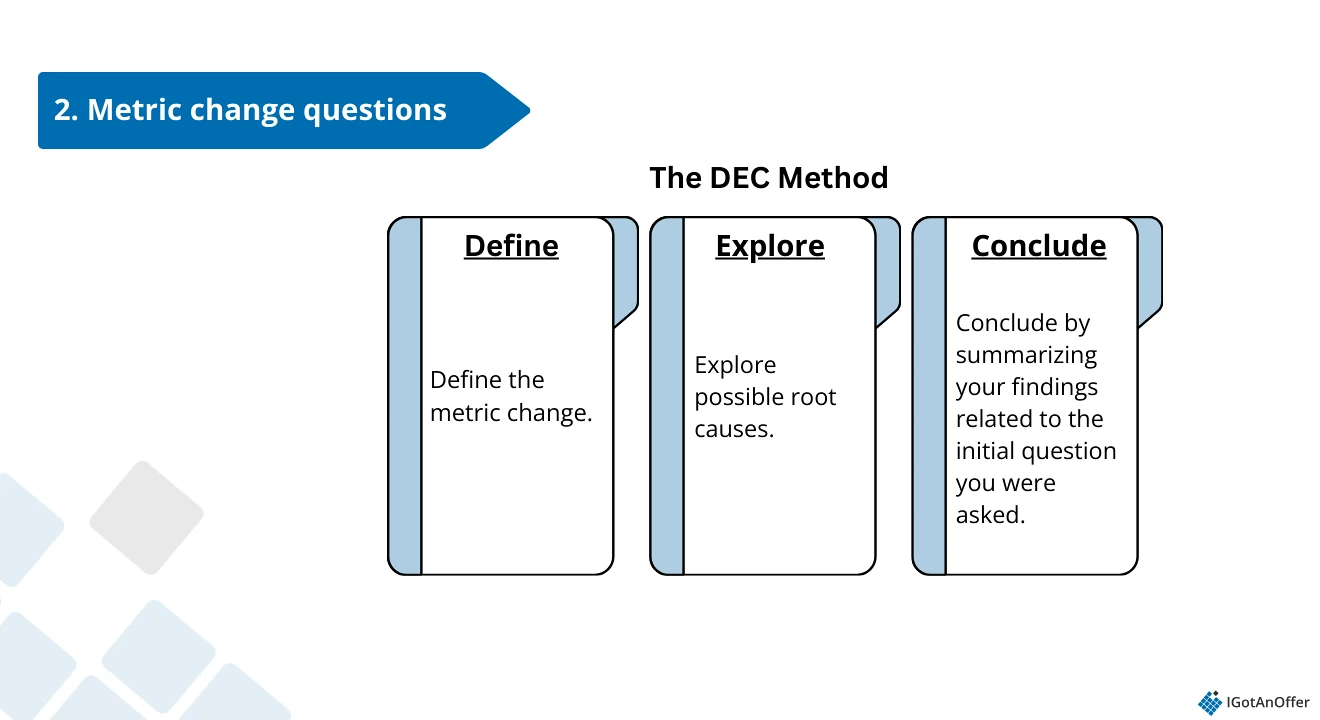

2.2 Metric change questions: DEC method

Metric change question example

“Facebook Feed engagement is down 10%. How would you report this issue to your superior?”

We developed the DEC method below to help you give a clear and thorough answer to metric change questions. Let’s walk through each of the three steps one by one:

- Define the metric change.

- Explore possible root causes of the change.

- Conclude.

1. Define the metric change: Many candidates skip this step and start listing ideas in an unstructured way. This is a big red flag for interviewers. Before starting to answer the question you need to define the metric change in detail. This often entails asking for three pieces of information:

- The exact definition of the metric we’re talking about

- The time period over which the metric has changed

- The characteristics of the user segment impacted by the change (e.g. device type, country, etc.)

Let’s imagine your interviewer asks, “Facebook Feed engagement is down 10%. How would you report this issue to leadership?”

To clarify your understanding, you might then ask something like, “What exactly do we mean by engagement here? Is that a direct measurement like the number of sessions, or a combination of more detailed metrics (e.g. likes + comments + shares per user, etc.)? And over what time period has that change occurred? Finally, do we know if all users are impacted or only a particular segment?”

Here let’s imagine your interviewer tells you that the number of Feed sessions for all users has gone down 10% since yesterday.

Only after you’ve clarified this information should you start exploring possible root causes.

2. Explore possible root causes: Interviewers want to see that you’re thinking of every possible problem that could cause the metric change you are investigating.

To ensure you’re thinking comprehensively and communicating clearly, you should:

- Create a MECE framework for possible root causes.

- Brainstorm potential root causes of the problem within this framework.

- Discuss the different root causes identified with the interviewer.

For our drop in engagement example, you could split your investigation between internal and external factors:

- Internal factors: possible problems internal to Facebook that can explain the drop in sessions

- External factors: possible problems external to Facebook that can explain the drop in sessions

Note that the framework above is MECE or Mutually Exclusive and Collectively Exhaustive. The root cause of the problem has to be internal OR external, as there is no other option.

Once you’ve created your framework you need to brainstorm ideas and possible causes within each of the areas you identified. For example here you could populate your framework with the following points:

- Internal factors:

- Data accuracy (e.g. This metric change was measured incorrectly)

- We broke the product (e.g. Someone in the organization made a change that broke the Newsfeed)

- We made the product worse (e.g. The quality of content in the Feed has degraded)

- Other internal factors

- External factors:

- User habits (e.g. User changed habits overnight for some reason, like a protest)

- Referrers (e.g. Google had an outage)

- Competition (e.g. TikTok released a new feature that captured a portion of our normal Feed traffic)

- Other external factors

The interviewer will most likely ask you to talk about some of your proposed root causes, which is perfectly normal. Listen carefully to what they say, as they will often provide clues that will point you in the right direction.

3. Conclude: Finally, you should conclude by summarizing your findings related to the initial question you were asked.

Let’s imagine that you discovered Facebook suffered an outage which caused the drop in sessions.

In this case, you might summarize by saying something like, “Based on what we’ve talked about, I would explain to leadership that Feed sessions dropped 10% since yesterday because of a major outage this morning. I would also make it clear that we came to this conclusion by ensuring it could not be any other cause, and double-checked that the duration of the outage aligns with the 10% drop.”

2.3 Expert tips

Now you've learned a couple of simple frameworks, let's dive deeper into how you can give a high-quality answer. The tips below are from some ex-FAANG product managers who now work with us as PM interview coaches.

#1 Show data-driven decision-making

Your goal with metrics questions is to demonstrate how you make decisions based on data. Mark, a former Meta and Google senior product manager, advises:

"Be prepared to answer questions that require data interpretation and making data-driven decisions. Have a few methodologies in mind for tackling growth, engagement, and scalability issues."

#2 Know key product metrics inside out

Different companies prioritize different metrics, but you should have a solid grasp of the core activation metrics.

"You should be schooled on all the activation metrics - adoption, engagement, quality...etc. - there are dozens of metrics in there and you need to be solid on them all," says Mark.

Mark also warns us not to forget about retention. "Often, I think people don't think enough about retention—especially at Meta, that's a huge metric, and it's becoming more important at different companies too."

#3 Use a funnel approach to map the user journey

When analyzing product metrics, visualize a user’s journey step by step.

"Imagine a funnel in your mind by following that user journey, and have 1-2 metrics for each user step. This ensures you think through the metrics systematically and not randomly. Tie it back to overall company strategy and goals." Dessy, Head of Product at TikTok, formerly senior PM at Amazon.

#4 Consider different stakeholders’ perspectives

Products serve multiple types of users, and each group will have different key metrics.

"In an eCommerce business, consider different metric sets for each type of user: Buyers (e.g., new buyers, active users, spend per user), Sellers (e.g., active sellers, active listings), and the Company itself (e.g., revenue, profitability)" says Dessy.

The same logic applies to other industries, such as ads, where users, advertisers, influencers, and the company all have distinct success metrics.

#5 Be aware of metric trade-offs

No metric is perfect—each comes with limitations. Khalid, a former product manager at Facebook, Twitter, and DoorDash, explains:

"The aim isn’t to find a perfect metric, but a good enough metric that encapsulates the business/user goal while being aware of its potential downside."

For example, different products have different engagement expectations. "If you are building a payroll processing app, you can’t expect people to log in daily. Payroll processing is usually a biweekly habit, with occasional logins for issue resolution."

#6 Differentiate between input and output metrics

When choosing metrics, consider whether they are input metrics (things you control) or output metrics (results reported to leadership). Khalid explains:

"If you’re running an ads team focused on improving ad interfaces and your goal is increasing revenue, ‘revenue’ is an output metric. But an input metric like ‘advertiser growth’ may be a better focus for your team’s efforts."

#7 Think out loud and justify your choices

Lastly, always walk your interviewer through your thought process. Explain why you are choosing specific metrics, how they relate to business goals, and any trade-offs involved. Clear reasoning is just as important as the final answer.

3. Example metrics questions with answers ↑

Now that you know how to approach metric questions, let's look at some full examples.

3.1 YouTube traffic went down 5% — how would you report this issue to the executive team?

This is a metric change question, so we’ll use the IGotAnOffer method described above.

Step one: Define the metric change

First, we want to completely understand the question and define the metric, as “traffic” is a bit vague.

Here are some questions that immediately come to mind and will help confirm our understanding:

- What exactly do we mean by traffic here? Website visits, plays on videos, or time spent watching? etc.

- Is this impacting all user segments? Or maybe only a particular device type, country, or browser? etc.

- When did the dip start and how long did it last?

For the rest of this example let’s imagine the interviewer tells us that the average time spent watching per session is down 5% month-over-month worldwide on mobile only.

Step two: Explore possible root causes

Now that we know the exact problem we can create a framework to identify the root-cause of the time spent watching per session decrease:

- Internal factors: possible problems internal to YouTube that can explain the drop in average time spent watching per session

- External factors: possible problems external to YouTube that can explain the drop in average time spent watching per session

Within this Internal / External framework, let’s brainstorm different root causes that could drive down the average time spent watching per session:

- Internal factors:

- Data accuracy (e.g. We should confirm our reporting tool is working as expected)

- Context (e.g. This could be an expected seasonal drop)

- Access to the product (e.g. We might have had a major outage)

- Product changes (e.g. We could have shipped some code that introduced a bug)

- Product quality (e.g. Recent content might have been bad enough to drive away traffic)

- External factors:

- User habits (e.g. Video consumption is down across the industry)

- Referrers (e.g. Facebook made a change to limit linking to YouTube videos)

- Competition (e.g. Instagram TV released a new feature that captured our users)

- Society (e.g. There are fewer active users because of civil unrest in a country that typically drives a lot of traffic)

We can also dive deeper into some of the root causes. Here’s an example of how the conversation could go.

- Data accuracy: Have we checked this dip compared to a similar metric — for example, time on page? Is there anything else indicating that our reporting tool might be broken?

Let’s imagine the interviewer confirms that we’re seeing a similar dip with time on page that leads us to believe the data is accurate. They also confirm that we’ve double-checked that our reporting is working as expected.

- Context: Is there any history of a similar dip? We’re close to major holidays, perhaps that could lead to less product usage overall.

The interviewer lets us know the only time we’ve seen a drop of more than 1% this time of year was due to major outages, but we have had 100% uptime in the past few months. This information also addresses our next factor, as access to the product hasn’t been disrupted.

- Product changes: Is it possible we shipped some code that introduced a bug? Or, did we release any significant feature changes?

Let’s imagine the interviewer says that the user interface for the video player was recently changed on mobile. We would then ask questions to explore this such as, “What exactly was changed in the UI and was any drop to be expected as a result?”

After discussing with the interviewer, we learn that the UI change involved making the “Send video to device” button two times larger, and reducing the “Full screen” button by half its original size. The interviewer also explains that the “Send video to device” button can be used to play a video that’s on your mobile phone on another device such as a Chromecast, Roku, SmartTV, etc.

This is interesting, but we need to investigate further. At this point, we could form a hypothesis and say something like, “Have we noticed a change in the frequency at which the ‘Send video to device’ and ‘Full screen’ buttons are being used on mobile? Maybe mobile users are having a harder time tapping the ‘Full screen’ button now that it’s smaller, and are tapping the ‘Send video to device’ button by accident because it’s too big? Tapping ‘Send video to device’ would end the session and therefore decrease the average time per session. And if the smaller ‘Full screen’ button is harder to tap, it might frustrate some users and lead them to end their session early.”

Let’s imagine that the interviewer confirms that this is likely one of the drivers of the decrease. Before making any final conclusion, we would continue exploring the remaining elements (i.e. product quality and external factors) to confirm that they aren’t also a driver of the change we are observing. Let’s imagine we quickly discuss this with our interviewer, and they confirm there’s nothing significant to report related to those remaining possible factors.

Step three: Discuss and conclude

Now that we’ve stepped through our framework, we would conclude by saying something like, “Based on what we’ve talked about, I would explain to the executive team that our time spent watching per session has dropped by 5% month-over-month on mobile because of a change in the video player UI, which has negatively affected the user experience. Mobile users are having a hard time tapping the new, smaller ‘Full screen’ button and are ending their session prematurely. They are also now more often tapping the larger ‘Send video to device’ button unintentionally which also ends their session early.”

Finally, we could enrich our answer by saying something such as, “We’ve also double-checked that no other drivers were causing this engagement dip. A good next step here would probably be to revert the UI changes, think through why we made these changes in the first place, and brainstorm how we can achieve the goals we were aiming for in a different way.”

3.2 Example mock interview metric question: "Instagram engagement is down 10%. What do you do?"

Watch how Damien, ex-Facebook PM, has a clear flow of questions to tackle this problem. Pause the video as you go along to construct your own answer.

3.3 Example metric question mock interview: "Pick 3 key metrics for YouTube"

Watch how Mark, ex-senior product manager at Google turned interview coach, gives a best-in-class answer to this metric definition question. Pause the video as you go along to construct your own answer.

4. List of sample metrics interview questions ↑

4.1 Practice metrics definition questions

Here is a list of metric definition questions that were asked in PM interviews at Meta, Amazon, Apple, Netflix, Google, and LinkedIn, according to data from Glassdoor and PMExercises:

Meta

- Define success metrics for Facebook Marketplace.

- Imagine you are the PM of the Facebook Feed — how would you measure retention?

- What metrics would you use to measure the success of Facebook’s “Save Item” feature?

- How would you determine post ranking in the Facebook Feed?

- Tell me what metrics you would look at as a product manager for Instagram ads.

Amazon

-

How would you find out if a customer is brand agnostic or not when shopping?

-

What success metrics would you use to measure a payment gateway product?

- What analysis would you use to understand if we should increase the price of an Amazon Prime Membership?

- Amazon just started a pharmacy business. How would you ensure the success of the business?

- You are the PM for Amazon’s cart page. How would you build a dashboard to measure success?

Apple

- How would you measure the success of Apple's Worldwide Developers’ Conference (WWDC) event?

- How would you measure the success of the iPad Pro?

Netflix

- What are the things that Netflix should measure and analyze on a daily basis?

- Define metrics for Netflix Podcasts.

- How would you measure the success of the Netflix recommendation engine?

- What are the key metrics to be captured for a streaming service product?

- How would you measure engagement for Netflix?

- What is the most important metric for Google Docs, and why?

- How would you measure the success of Google Photos?

- What do you think is the most important metric to track in Google Search, and why?

- Define the metrics for YouTube Search.

- How would you measure the success of the new YouTube Player UI?

- What metrics did you use to measure the successful launch of your product?

- How would you determine the negative value of an abusive posting?

4.2 Practice metrics change questions

Here is a list of metric definition questions that were asked in PM interviews at Meta, Amazon, Apple, Netflix, Google, and LinkedIn, according to data from Glassdoor and PM Exercises:

Meta

- There's been a 15% drop in usage of Facebook Groups — how do you fix it?

- The usage of Facebook Event’s “Yes I’m going” dropped 30% overnight — which data would you look at to try to isolate the issue?

- You are the PM of Facebook 3rd Party Login, and you see your numbers are declining 2% week-on-week — what do you do?

Amazon

- How would you change the Amazon Fresh experience and how would you measure it?

- Imagine that in your daily routine of checking conversion funnels, you realized a 20% drop in the checkout funnel. What would you do?

- Around 40% of reviews on Amazon are fake. As an Amazon PM, how will you tackle the problem? Break your answer into 3 parts — 1. How will you identify a review is fake? 2. What action will you take? 3. If the number of fake reviews decreases, what will be the impact?

Apple

- You’re an Apple product manager for Apple Maps. What will you do to regain market share?

Netflix

- A metric for a video streaming service dropped by 80%. What do you do?

- You are looking at YouTube’s Daily Active User data worldwide and notice a 10% jump compared to yesterday in Indonesia — what happened?

- Engagement is going down by 10% month on month for your product. What data /metrics would you look at?

- What are 10 important metrics for Spotify under the engagement category? Which one would you improve? Why?

- Users are no longer signing up for our email list — what would you do?

- You have just localized an e-commerce site in Spain and now see that traffic has reduced — what could be the reasons?

- Reddit traffic went down 5% — how would you report this issue to the executive team?

If you'd like to learn about the other types of questions you may face, you can also visit our ultimate guide to product manager interview questions.

Now that you have a list of sample questions to work with, it’s important to consider how you will practice with these questions.

5. Product metrics mock interviews ↑

It’s useful to watch mock interviews of other candidates or experts answering product metric questions.

You can get pointers on how it should be done as you watch experts answer the mock interview questions. You can also get a sense of how interviews go in real-life settings.

We’ve reviewed product metric mock interview videos and compiled the 10 best examples of how to answer product metric questions here. You can watch and learn from them:

- Foolproof Metrics Answer - Meta Product Manager Metrics Interview: “Engagement Drops 10%)”

- Product Manager Metrics Question with Google PM: YouTube Success Metrics

- PM School: Defining Success Metrics for a Product

- How to Answer: Metrics to Measure Success

- Product Manager Interviews: Success Metrics (Execution and Analytical)

- Product Manager Interviews (Advanced): “What Success Metrics Would You Set for Product X?”

- Product Management Mock Interview: Product Success Metrics for Uber Pickup Experience in 2025

- Meta Product Manager Interview: Analytical Thinking /Execution Interview Response by FB PM

- Meta/Facebook Product Manager Mock Interview: Execution/Analytical Question

- Airbnb Product Manager Mock Interview: “How would you increase bookings?”

6. How to prepare for product metrics questions↑

With a lot to cover, it’s best to take a systematic approach to make the most of your practice time.

Below you’ll find links to free resources and four introductory steps that you can take to prepare for product metric interview questions.

6.1 Study the company you're applying to

Get acquainted with the company you’ve applied to. In many cases, the product questions you’ll be presented with will be based on real-life cases the company is facing. If you’re applying to a specific team, study up on their products, the user, etc.

Take the time to find out which products you’ll most likely be working with, based on the job description, and research them. Look up relevant press releases, product descriptions, product reviews, and other resources in order to discuss what’s most important to the role: the company’s product.

If you'd like to learn more about a specific company's PM interviews, then we'd encourage you to check out our guide for that company below :

6.2 Learn by yourself

Learning by yourself is an essential first step. We recommend you make full use of the free prep resources on this blog and also watch some mock interviews on our product management YouTube channel. That way you can see what an excellent answer looks like.

Once you’re in command of the subject matter, you’ll want to practice answering questions. But by yourself, you can’t simulate thinking on your feet or the pressure of performing in front of a stranger. Plus, there are no unexpected follow-up questions and no feedback.

That’s why many candidates try to practice with friends or peers.

6.3 Practice with peers

If you have friends or peers who can do mock interviews with you, that's an option worth trying. It’s free, but be warned, you may come up against the following problems:

-

It’s hard to know if the feedback you get is accurate

-

They’re unlikely to have insider knowledge of interviews at your target company

-

On peer platforms, people often waste your time by not showing up

For those reasons, many candidates skip peer mock interviews and go straight to mock interviews with an expert.

6.4 Practice with ex-interviewers

In our experience, practicing real interviews with experts who can give you company-specific feedback makes a huge difference.

Find a product manager interview coach so you can::

-

Test yourself under real interview conditions

-

Get accurate feedback from a real expert

-

Build your confidence

-

Get company-specific insights

-

Learn how to tell the right stories, better.

-

Save time by focusing your preparation

Landing a job at a big tech company often results in a $50,000 per year or more increase in total compensation. In our experience, three or four coaching sessions worth ~$500 make a significant difference in your ability to land the job. That’s an ROI of 100x!