HireVue interviews may seem easy at first. However, many investment banking candidates stumble at this stage because they underestimate the preparation needed and aren’t used to the format.

HireVue is the stage gate to the later rounds, so you need to treat it with the same level of prep as a live interview.

Fortunately, we’re here to demystify the entire HireVue process for you.

Below you’ll find a detailed overview of what happens in IB HireVue interviews, example questions sourced from real candidate reports, interview tips on how to answer them, and a preparation plan to help you perform confidently on camera.

- What to expect in IB HireVue interviews

- 5 types of questions asked in IB HireVue interviews

- Tips to ace your interviews

- Prep plan

Click here to practice 1-on-1 with investment banking ex-interviewers

Let’s get started.

1. Overview: Investment banking HireVue interviews

Before we go through the most common questions asked in HireVue investment banking interviews, let’s first take a look at what these interviews are and how they work.

1.1 What are investment banking HireVue interviews?

HireVue interviews are asynchronous assessments that investment banks use early in the recruiting process to evaluate large pools of candidates. They’re designed to assess your delivery, clarity, and alignment to the role, says Geert (ex-valuation specialist at Deutsche Bank).

During the interview, you'll be asked to record your responses to a series of interview questions. A typical HireVue interview includes 3–6 questions. For each question:

- You’ll get 30-120 seconds of prep time,

- 2–3 minutes to record your response, and

- One chance to re-record (if the firm allows it)

In addition, HireVue offers unlimited practice questions that only you can see. According to HireVue’s official guide, these practice questions become available during the actual interview session, right after you complete the tech check and before the actual interview.

We encourage you NOT to skip this step, as it’s extremely helpful for getting comfortable speaking to the camera and for checking your lighting, setup, pacing, and body language.

The HireVue interview mostly contains common behavioral questions like “why investment banking?” and “tell me about a time…” style questions. You’ll also get economy/market awareness questions like “Tell us about a recent M&A deal”. or

In addition, Geert says that “some firms also include role-specific or market-related questions to test awareness, and occasionally curveball questions to assess creativity and thinking.” (More on the question types in Section 2).

1.2 How does HireVue technology work?

HireVue uses artificial intelligence to evaluate data points found in your video responses and predict how well you might perform in the role. This includes verbal delivery (speaking clarity, pacing, tone, word choice) and non-verbal cues (eye contact, facial expressions, micro-gestures).

The goal is to help firms identify candidates who are most likely to meet the expectations and business objectives of the team they’re applying to. That’s why it’s extremely important to treat HireVue like a real interview, says Geert. “Your professional tone, attire, and setting matter.”

Once HireVue’s system has filtered the initial pool of candidates, the strongest interviews are then forwarded to human recruiters or hiring managers for a secondary evaluation before you are endorsed to the next stage of the process (Final interviews/Superday).

Here are some tips to help you present yourself and set up your environment for success, according to HireVue’s official interviewing guide:

- Check your tech: Use a stable camera at eye level, clear audio, and a strong internet connection

- Optimize lighting & background: Face a light source and choose a clean, neutral background; use blur only if necessary

- Dress professionally: Wear what you would to an in-person interview; solid, non-distracting colors work best on camera

- Practice on video: Record yourself or use HireVue’s practice tools to improve pacing, eye contact, and overall delivery

- Stay calm during glitches: If technical issues occur, briefly acknowledge them, reset, and continue with confidence

You can also take a virtual tour here to get a sense of how the HireVue interface works.

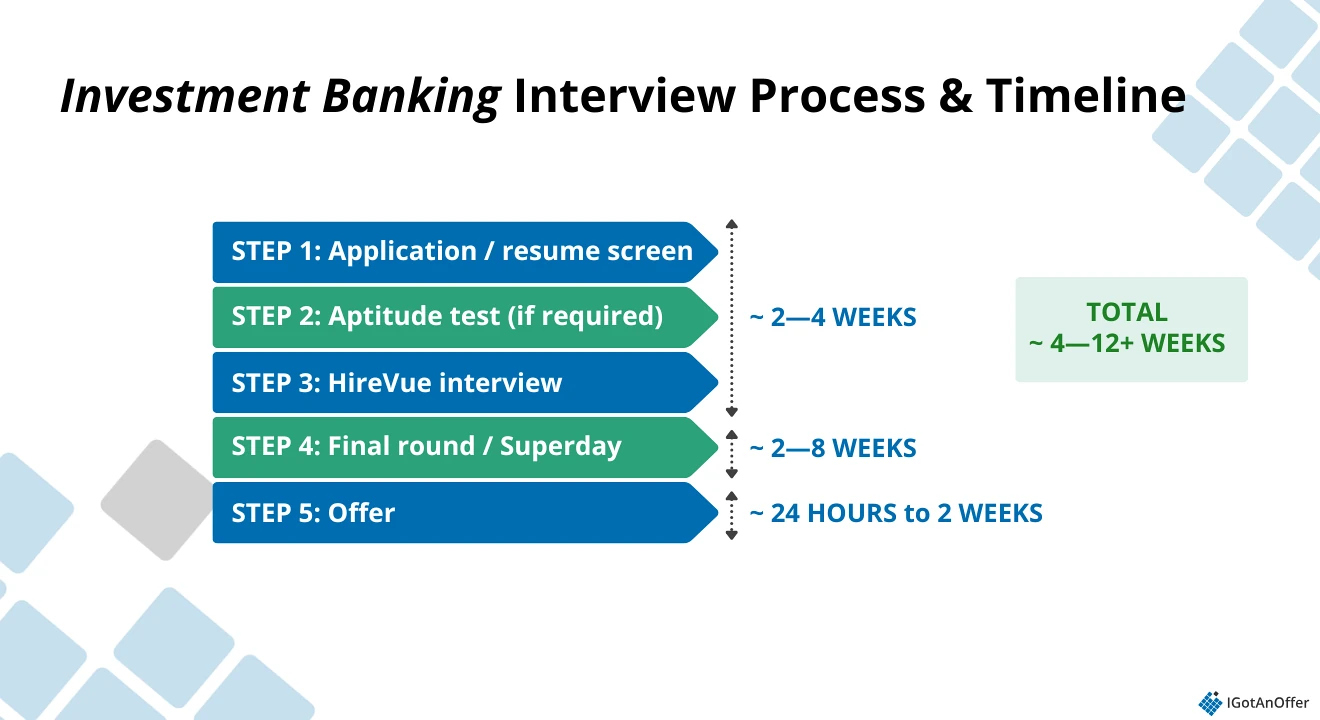

1.3 When to expect HireVue in the interview process

In most recruiting cycles, the HireVue interview is usually the 2nd or 3rd step of the investment banking interview process. It takes place after your application has been reviewed and you’ve passed any required aptitude or screening tests.

In some cases, HireVue can even replace an initial phone screen or the first round of interviews, says Jonathan (ex-Wells Fargo managing director, ex-Morgan Stanley).

Most banks typically give 48 hours to complete the interview from the moment you receive the link. Hence, it’s important to plan your recording time accordingly while ensuring you have enough time to prepare.

1.4 Who can expect HireVue interviews?

You can expect HireVue interviews at most bulge-bracket firms, including Goldman Sachs, JPMorgan, and Morgan Stanley, particularly for Investment Banking Full-Time Analyst and Summer Analyst roles. Associates typically do not get HireVue, as banks prefer to evaluate experienced candidates through live interviews.

In our analysis of Glassdoor reports for analyst roles, most HireVue questions across all three banks are behavioral.

We also found that Goldman Sachs and JPMorgan tend to include more economy/market awareness questions, while Morgan Stanley uses a more balanced mix of behavioral, economy/market, and light technical questions.

Below is the typical HireVue format for both Full-Time Analysts and Summer Analysts:

- 3–6 questions

- 30 to 120 seconds of prep time (Summer Analysts are usually given more prep time)

- ~1.5 to 3 minutes to record each answer (Summer Analysts may receive slightly shorter response times)

- ~1 optional retry per question (except Goldman Sachs, which does not allow retries)

As you can see, Summer Analysts often get longer prep times but shorter response times, likely because the questions are slightly less complex. Our advice is to prepare for the most challenging version of the format so you’re not thrown off by shorter prep or response windows.

For example, expect to only have 30 seconds of prep time before answering each question. Then, if you end up getting more time, it’ll just be a nice bonus for you during the interview.

If you're interviewing for J.P. Morgan specifically, check out our guide to J.P. Morgan HireVue interviews for more company-specific insights.

Does networking influence whether a candidate receives or bypasses a HireVue?

According to Wayne (Sr. Strategy Consultant at Kearney), for junior roles (Analyst and Summer Analyst), networking generally has little to no impact on whether you receive or skip a HireVue. Banks usually send HireVue invitations to candidates whose applications pass the initial resume screen, regardless of their connections.

We currently don’t have information on whether this differs for senior positions, but there’s a good chance the process is similar.

Networking can help you get your resume noticed, but it RARELY allows candidates to bypass the HireVue stage completely.

Another tool to get yourself noticed by recruiters is LinkedIn. See ex-Merill Lynch Director Mike's advice on how to make your LinkedIn profile more visible to investment banking recruiters.

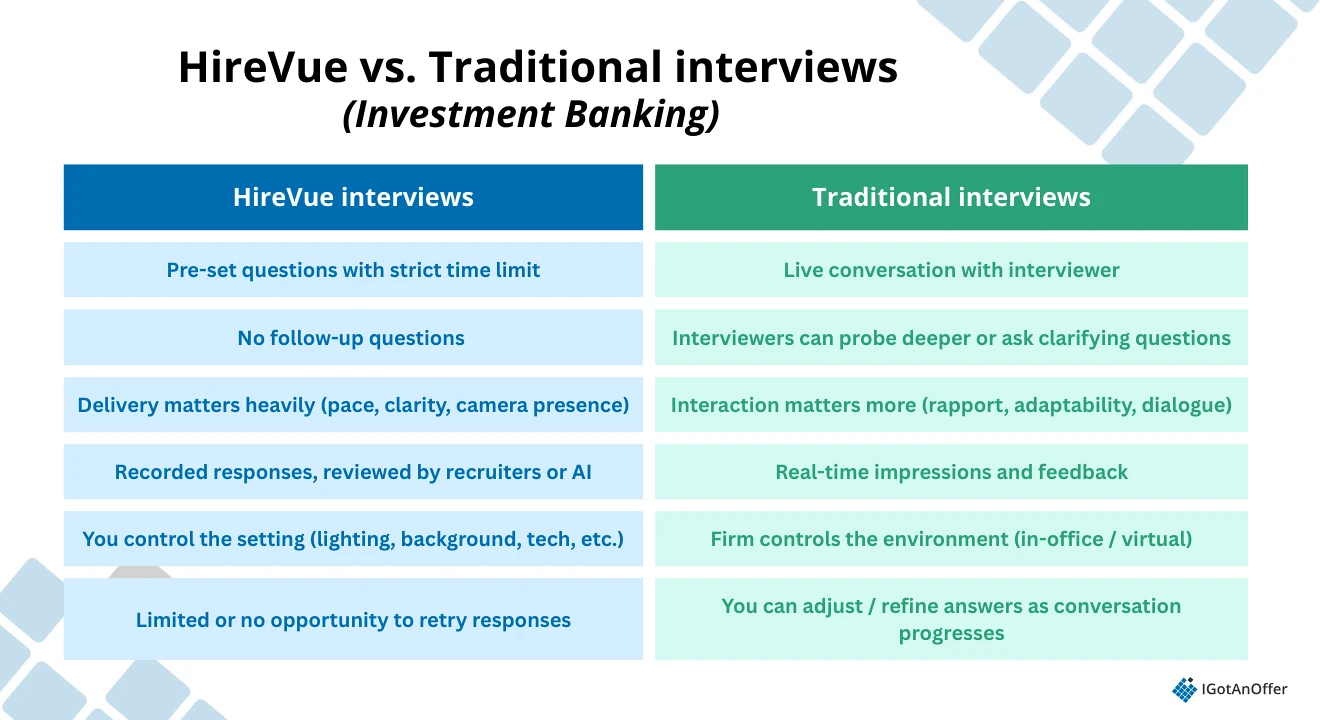

1.5 HireVue interviews vs. traditional interviews

HireVue interviews assess many of the same competencies as a traditional interview, but the experience and expectations are different.

Below is a quick overview to help you understand how the two formats differ and how you can tailor your prep better:

As we’ll continue to emphasize throughout this guide, ALWAYS treat your HireVue exactly like a real interview. Be professional, well-prepared, and present yourself as if a banker were sitting on the other side of the screen.

Right, let’s get into the example questions.

2. 5 types of questions asked in investment banking HireVue interviews ↑

Now that you have an idea of what to expect in IB HireVue interviews, let’s dive into the five types of interview questions you can expect.

Here are the categories:

- Behavioral and fit questions

- Economic / market awareness questions

- “Light” technical questions

- Situational judgement questions

- Brainteasers

Let’s get into the details.

2.1 Behavioral and fit questions ↑

Interviewers ask behavioral and fit questions to understand whether you have the motivation, temperament, and interpersonal skills needed to handle the demands of investment banking. They also want to assess whether you would work well within their team and culture.

These questions are based on the idea that past behavior is one of the strongest predictors of future performance. They prompt you to share real stories about your experiences, so interviewers can evaluate soft skills, such as problem-solving, leadership, communication, and handling conflict.

Below are the most common behavioral and fit questions reported on Glassdoor and Reddit. You’ll want to pay close attention to the first three questions in bold, as these show up the most in IB HireVue interviews.

Example behavioral questions asked at IB HireVue interviews

- Why this company / Why this role?

- Tell me about yourself.

- Walk me through your resume.

- Are you a team player? In what way?

- Tell me about a time you worked in a team. (JP Morgan / Morgan Stanley)

- Tell us about a time you had a conflict working on a team. (Goldman Sachs / Morgan Stanley)

- How would you handle a disagreement with someone on your team? (Goldman Sachs)

- What would you do if a teammate wasn’t pulling their weight? (Goldman Sachs)

- Tell me about a time you went out of your way to help someone. (JP Morgan)

- Tell me about a time you showed persistence or dealt with rejection.

- Tell me about a time you failed and what you learned.

- Talk about a time you overcame a challenge / difficult situation. (Goldman Sachs / Morgan Stanley / JP Morgan)

- Tell us about a time a coworker didn’t do their job. (Goldman Sachs)

- Tell us about a time you had to turn down a project due to other deadlines. (Goldman Sachs)

- Describe a time you received negative feedback. (Morgan Stanley)

- Tell me about a time when you encountered something outside your scope and how you handled it. (JPMorgan)

- Tell me about a time you made a connection with someone from a different background.

- Tell me about a time you handled a difficult client. (JPMorgan)

- Tell me about a time you had to collect and analyze data. (JPMorgan)

- Tell me about a recent achievement. (JPMorgan)

- Tell us about a successful presentation you gave. (JPMorgan)

- How do you explain complex things to someone new to them? (JPMorgan)

- Describe a time you were in a leadership position. (Goldman Sachs)

- Describe a time you were successful in meeting a highly challenging goal. (Goldman Sachs)

- Tell me about a time you disagreed with leadership. (Morgan Stanley)

- What is your greatest accomplishment and why? (JPMorgan)

- Explain two things about yourself not mentioned on your résumé. (Morgan Stanley)

- What’s the most valuable advice a mentor has given you? (JPMorgan)

- Pick an athlete you see yourself in. Who is it and why? (JPMorgan)

For a complete list of practice questions, including sample answers and an answer framework, take a look at our guide to investment banking behavioral and fit interview questions.

2.2 Economic / market awareness questions ↑

Economic / market awareness questions in investment banking (IB) interviews assess your understanding of the market, deals, and the fundamental logic behind finance.

To help you prepare effectively, we’ve grouped them into four sub-categories:

- Economy questions – test your knowledge of current events, major market trends, and how these developments impact companies, valuations, and financial markets

- Deals questions – assess whether you understand the industry and the key factors to consider when analyzing real M&A or capital markets transactions

- Industry questions – evaluate your understanding of the investment banking landscape, what IB teams do, and how your target firm is positioned relative to competitors

- Investing questions – gauge your ability to think like an investor by forming a clear thesis, evaluating a company, or explaining where you’d allocate capital

Below, we’ve listed REAL questions that past candidates have reported on Glassdoor and Reddit.

Example economic / market awareness questions asked at IB HireVue interviews

Economy

- What is a recent headline you read in the news? (Goldman Sachs)

- Can you talk about one piece of economic news and its impact on the market? (Goldman Sachs)

- Tell me about a current event that will impact the financial markets. (JPMorgan)

- What is a recent market event that interested you? (Morgan Stanley)

- How will recent tariffs on China impact trade deals? (JPMorgan)

- Where do you see the S&P 500 going over the next 12 months? (Morgan Stanley)

Deals

- What is a recent IB deal you've seen, and what fascinates you about it? (Goldman Sachs)

- Tell me about a deal you’ve been following. (Goldman Sachs)

- Share an M&A deal that interests you. (Morgan Stanley)

- What is a recent transaction that interested you? (Morgan Stanley)

- Walk me through a recent Morgan Stanley deal. (Morgan Stanley)

Industry

- What is something that you recently heard about our company? And why is it important?

- What is investment banking?

- How can an investment bank add value

- What technology will be trendy in the next 6–12 months? (Goldman Sachs)

Investing

- Pitch a stock. (Goldman Sachs / Morgan Stanley)

- Describe [X company’s] business model (Goldman Sachs)

- Discuss a stock you’ve been following. (Morgan Stanley)

- Pitch me a stock where you would invest $1,000,000. (Morgan Stanley)

- What are the requirements for making a good investment?

For more information, check out our guide on business sense IB interview questions. It covers more example questions and insights relevant to this category.

2.3 “Light” technical questions ↑

Light technical questions help your interviewers evaluate whether you have the basic accounting and finance knowledge needed to perform on the job. These won’t be as difficult as the technical questions you’ll face in later interviews, but you should still be ready to explain important concepts in full clarity.

These technical questions can be split into two main categories:

- Valuation questions, which focus on your ability to calculate the value of a business

- Accounting questions, which focus on your knowledge of financial statements and accounting principles

Below is a list of example questions from each category for you to practice with.

Example “light” technical questions asked at IB HireVue interviews

Valuation

- Walk me through a discounted cash flow (DCF). (Morgan Stanley)

- When would an all-equity acquisition be favorable? (JPMorgan)

- If you buy a hotel, what’s the benefit of that investment? (Morgan Stanley)

Accounting

- How are the 3 financial statements linked? (JPMorgan)

- Explain the relationship between the balance sheet and income statement. (Morgan Stanley)

- In layman's terms, explain minority interest. (Morgan Stanley)

- Describe how your skillset supports prudent liquidity management and resource allocation. (Goldman Sachs)

You can learn more about common technical questions in our technical questions guide, and you can also find helpful summaries in our investment banking interview cheat sheet.

If you want more practice specifically with accounting questions, we recommend checking out our investment banking interview accounting questions guide. It includes a list of accounting questions from top firms, along with sample answers and expert tips to help you structure strong responses.

2.4 Situational judgment questions ↑

Situational judgment questions assess how you would handle realistic scenarios you may encounter on the job.

Instead of asking about past experiences, as behavioral questions do, these prompts evaluate your judgment, ethics, communication style, and ability to stay composed under pressure.

You’ll be given a hypothetical scenario involving clients, deadlines, or teamwork and asked to walk through how you would approach it.

Example situational judgment questions asked at IB HireVue interviews

- The guy in front of you during a test starts cheating. How would you deal with this situation? Would you respond right away or wait until after? Justify your decision. (Goldman Sachs)

- You have a deliverable due tomorrow, but are missing a crucial part, and your team is asleep. What do you do? (Goldman Sachs)

- You are working on making a deal with a major client. If this deal succeeds, you have been told that it will be a significant win for the company. The client has recently made some requests that you know violate firm policy. What would you do in this situation, and who would you talk to about it? (Goldman Sachs)

- What would you do if a major client’s request were illegal?

- If you had a lot to do with not enough time, what would you do?

2.5 Brainteasers ↑

Finally, some firms, especially Goldman Sachs, may include a few brainteasers. These curveball questions are designed to measure your logical thinking and problem-solving skills through estimation or market-sizing style prompts.

Let’s look at a few practice questions.

Example brainteaser questions asked at IB HireVue interviews

- How many tennis balls can you fit into a Tesla? (Goldman Sachs)

- Which number is closest to 27 squared: 600, 700, or 800? (Goldman Sachs)

- T-Mobile is planning on placing orders for the new iPhone. How would you estimate how many phones they should order? (Goldman Sachs)

For more guidance on how to answer these types of questions, check out our guides on market sizing interview questions and estimation interview questions. They were written for consulting and product management roles, but they work just as well for IB candidates.

3. Tips for acing IB HireVue interviews ↑

HireVue interviews may look simple, but they’re a “critical stage gate” in the recruiting process, says Wayne (Sr. Strategy Consultant at Kearney). All the more reason to take your preparation seriously.

Now that you understand the types of questions you’ll face, here are eight tips to help you feel confident going into your HireVue interviews.

3.1 Keep your answers concise

Most HireVue platforms give you 1.5 to 3 minutes to record each answer, depending on the firm and the role you’re applying to. For IB Analyst positions, for example:

- Goldman Sachs gives you 2 minutes per question

- JPMorgan typically gives you 2–3 minutes

- Morgan Stanley often gives you 1.5 minutes

If you're applying for a Summer Analyst role, the response time may be shorter, and the questions tend to be more introductory, which makes concise answers even more important.

Because your time is limited, you need to get to the point quickly. Don't spend too much time on the Situation step of SPSIL. Use a timer while you practice to ensure you provide only the necessary context and stay within the allotted time.

3.2 Have a solid ‘about me’ introduction ready

Prepare a strong answer for your “about me” introduction, or the classic “Tell me about yourself” question. Although HireVue utilizes automated screening tools, some candidates report that the top-ranked recordings are later reviewed by third-party assessors or HR for final screening.

This varies by firm, but it’s another reason to treat every response as if a real person will watch it. Your introduction should briefly summarize your background and experience while highlighting what makes you unique as a candidate.

3.3 Center on the company’s culture and values

According to Geert (ex-valuation specialist at Deutsche Bank), you should always align each story to a key competency and tailor your answers to the firm by referencing recent initiatives or cultural values.

Familiarize yourself with the firm’s core values and weave them naturally into your answers. In investment banking, interviewers often look for qualities such as teamwork, client focus, attention to detail, and integrity.

Keep in mind that your cultural alignment will be assessed throughout the entire interview process, not just during behavioral rounds.

For instance, at Goldman Sachs, you could demonstrate their focus on client service by sharing an example of how you supported a project under tight deadlines while ensuring that the quality of your work met client expectations.

3.4 Mix and match

A common mistake we see in IB interviews is that candidates come up with only one story for each question. However, you’ll probably have a lot of overlap with your stories. A story you use to answer a leadership question could easily work for a question on conflict, people management, or handling pressure.

If you practice adapting stories so they can answer various questions, 10-15 strong stories should be enough to get you through even the toughest interview.

3.5 Work on natural delivery

You should know your stories extremely well by interview time. But don't feel that you have to stick rigidly to a script. HireVue software analyzes various vocal and visual cues to assess the naturalness of your delivery, so reading off a script may do more harm than good.

For the same reason, Jonathan (ex-Wells Fargo managing director, ex-Morgan Stanley) strongly advises against reading AI-generated answers during the actual interview.

He also suggests enunciating your words and taking 1-2 seconds before starting your response. Aim for a pace of about 110–130 words per minute, which is slower than normal conversation but ideal for clear video responses.

3.6 Set up your environment and look the part

Some HireVue interviews, like Goldman Sachs, are one-and-done, so it’s important to get it right the first time. Choose a well-lit, quiet space where you won’t be interrupted. Use a ring light if needed.

Make sure your background is clean, your camera is at eye level, and you’re dressed as you would be for an in-person interview. Finally, run a quick tech check to confirm your camera, microphone, and lighting all work properly.

3.7 Don’t skip the practice questions from HireVue

HireVue gives you a few practice questions before the real interview. You’ll be able to record yourself multiple times, replay your answers, and adjust your delivery. These practice clips are visible only to you, so they’re a great way to get comfortable and work out your nerves, especially if this is your first time using the platform.

3.8 Close strong

If you finish your answer before the timer runs out, you can simply click the stop button. "I have seen several candidates turn acceptable answers into red flags by talking after they have answered the question," says Jonathan.

To avoid this, have a clear closing line ready. Don’t end your answer with “That’s it!” or by trailing off awkwardly. A simple way to wrap up is to restate your main point and link it back to the role.

For example, a good closing to the question “What’s your greatest strength?” could be: “So overall, my planning skills are my strongest asset, and I believe they’d be especially valuable in managing deadlines and complex deliverables in this role.”

4. How to prepare for IB HireVue interviews ↑

As you can see from the complex questions above, there is a lot of ground to cover when it comes to IB HireVue interview preparation. So it’s best to take a systematic approach to make the most of your practice time.

Below are links to free resources and a plan to help you prepare for your IB HireVue interviews.

4.1 Learn the company’s culture

In many cases, investment banking HireVue interview questions will be tied to the company’s actual deals, culture, and client base. If you’re applying to a specific team, study their recent transactions, industry coverage, and priorities.

The Investment Banking section of the Financial Times is a great place to track recent transactions and see which banks are advising on what.

Use the job description to identify the types of clients and projects you’d likely work on, then research them thoroughly.

Look up deal announcements, earnings calls, investor presentations, and press releases so you can speak confidently about the firm’s activity and how you would contribute to similar work.

If you want to learn more about your target firm, check out the resources below. We’ve included useful links for the top 8 “bulge bracket” banks, known for their large-scale deals and rigorous hiring processes:

Goldman Sachs

- Goldman Sachs’ purpose and values (By Goldman Sachs)

- Goldman Sachs Briefings newsletter (By Goldman Sachs)

- Goldman Sachs strategy teardown (by CB Insights)

J.P. Morgan

- Who we are (By JP Morgan)

- JP Morgan weekly brief (By JP Morgan)

- JP Morgan strategy teardown (by CB Insights)

Morgan Stanley

- A culture-driven strategy (by Morgan Stanley)

- Insights (by Morgan Stanley)

- Comparison Morgan Stanley vs Goldman Sachs (by Investopedia)

Bank of America

- Bank of America's core values (by Bank of America)

- BofA Insights (by Bank of America)

- BoFa strategy teardown (by Rancord Society)

Citigroup

- About Citi

- Insights (by Citi)

- Citi’s plan to transform its wealth business (by Euromoney)

Barclays Capital

- About Barclays

- Barclays’ three-year plan (by Barclays)

- Barclays’ official interview prep guide (by Barclays)

UBS Investment Bank

- About UBS

- UBS sustainability and impact strategy (by UBS)

- UBS checklist for interview prep (by UBS)

Deutsche Bank

- About Deutsche Bank

- Deutsche Bank strategy (by Deutsche Bank)

- Deutsche Bank interview prep guide (by Deutsche Bank)

4.2 Learn how to answer behavioral & fit questions

You may have noticed that all of the questions in Section 2.1 fall into two basic formats:

- General questions, such as “why investment banking?” or “why should we hire you?”, which require individualized responses

- Scenario questions that typically begin with “Tell me about a time…”, which can be answered using a repeatable framework

For general questions, you’ll need to craft your own individualized responses in advance, since these focus on your motivation and fit rather than a specific scenario. They should sound genuine and not overly structured or rehearsed.

For scenario-based questions, you'll need to use a repeatable framework. This will help you relay your most relevant achievements and communicate them clearly.

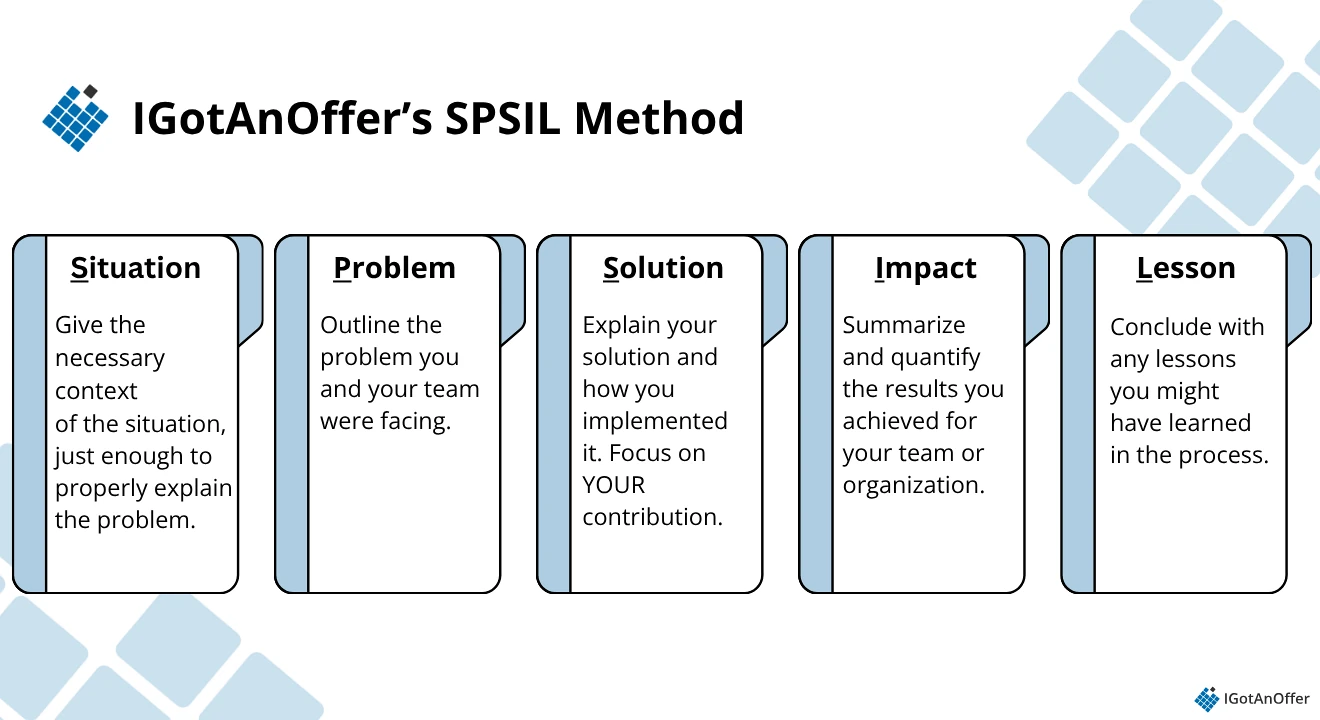

Most articles recommend using the traditional STAR framework. However, STAR has a few issues, which is why we created a better alternative: IGotAnOffer’s SPSIL framework. It provides a better flow for structuring answers and avoids the common pitfalls candidates run into with STAR, which we explain in more detail below:

4.2.1 STAR method

The STAR method (Situation, Task, Action, Result) is a popular approach for answering behavioral questions because it’s easy to remember. You’ll see it’s recommended by many articles you can find on Google (they tend to copy each other!).

However, the STAR method has two problems:

- We’ve found that candidates often find it difficult to distinguish the difference between steps two and three, or task and action.

- It ignores the importance of talking about WHAT YOU LEARNED, which is often the most important part of your answer.

To correct those two faults, we actually developed our own (very slightly different) framework that many of our candidates have used successfully over the years: IGotAnOffer’s SPSIL method.

4.2.2 IGotAnOffer’s SPSIL method

IGotAnOffer’s SPSIL (Situation, Problem, Solution, Impact, Lessons) method has a less catchy name, but it corrects both of the STAR method’s faults. You can see it in action in our IB behavioral & fit interview guide, but let’s go through the five-step approach:

- Situation: Start by giving the necessary context of the situation you were in. Describe your role, the team, the organization, the market, etc. You should only give the minimum context needed to understand the problem and the solution in your story. Nothing more.

- Problem: Outline the problem you and your team were facing.

- Solution: Explain the solution you came up with to solve the problem. Step through how you went about implementing your solution, and focus on your contribution over what the team / larger organization did.

- Impact: Summarize the positive results you achieved for your team, department, and organization. As much as possible, quantify the impact.

- Lessons: Conclude with any lessons you might have learned in the process.

For a deeper dive into this topic, check out our article on why the STAR method isn’t always the best option for behavioral interviews and how IGotAnOffer’s SPSIL method can be a better alternative. It’s written for product managers but equally useful for answering behavioral & fit questions in IB HireVue interviews.

Which method should you use?

Of course, you should practice using whatever method you’re the most comfortable with. By all means, use the STAR method if you prefer, just don’t forget to mention what you learned.

4.3 Be prepared to talk about the economy and financial markets

Understanding the broader economy is essential for investment bankers. This is because market conditions directly affect a company’s financial performance and, by extension, how its financial statements are interpreted.

You should be ready to explain how changes in global and regional markets might affect a company’s revenue, expenses, financing costs, valuation, etc.

Be ready to give your views on:

- Macroeconomic trends (e.g., inflation, GDP growth, employment data)

- Central bank policy (e.g., rate hikes, quantitative easing, or tightening)

- Market movements (e.g., stock indexes, bond yields, or sector performance)

- Recent transactions that reflect how market shifts are influencing valuations or deal structure

To stay current, you can review market updates and analysis from reliable sources such as The Financial Times, The Wall Street Journal, Bloomberg, Reuters, and CNBC.

4.4 Practice by yourself

Acing IB HireVue interviews can feel intimidating at first. You’ll stand out if you put in the required work to craft concise and direct answers.

We recommend starting with our guides below to prepare for your HireVue interview. You’ll also find a few additional articles that can help you understand the full IB interview process:

General

- Investment banking interview prep guide

- 15 investment banking interview tips

- Investment banking interview cheat sheet

- How to answer “Why X company” question

- Investment banking interview accounting questions guide

- Investment banking behavioral & fit interview questions guide

- Investment banking technical questions guide

- Investment banking Superday interview guide

-

How to make your LinkedIn profile more visible to IB recruiters (by ex-Merrill Lynch director Mike)

- How to network your way into investment banking (by ex-Merrill Lynch director Mike)

Goldman Sachs

J.P. Morgan

- JP Morgan interview prep guide

- JP Morgan behavioral interview guide

- JP Morgan HireVue interview guide

Morgan Stanley

4.4.1 Write down your answers

First, work out which stories you’d like to tell. Make a list of key moments in your career (e.g., accomplishments, failures, team situations, leadership situations, etc.) that you can use to answer one or multiple questions.

Take a look at your target company’s main attributes and their core values, then find at least one story from your past that exemplifies each one.

After you’ve finished your list, write out a story for each key moment in your career using the structure we've laid out in Section 4.2. Be sure to emphasize your impact in each of these examples, quantify the results of your actions, and explain the lessons you learned from the experience.

Once you have a bank of stories, go through the questions in Section 2. Make sure you’d be able to answer all of them either by using one of the stories you’ve written directly or by adapting it on the fly.

If you identify any gaps, add stories to your bank until you’re comfortable that you can cover all the questions listed in this article. For reference, we estimate this will require around 10-15 stories for most candidates.

4.4.2 Practice your answers out loud

After you've written everything down, a great way to practice your answers is to interview yourself out loud. This may sound strange, but it will significantly improve the way you communicate during an interview.

You should be able to deliver each answer naturally, without missing key details or memorizing your stories word-for-word. Use a timer while you practice to simulate the pace of a real interview and keep your answers concise. Recording yourself is also helpful, as it lets you review your delivery, pacing, and presence on camera.

Play the role of both the candidate and the interviewer, asking questions and answering them just like two people would in an interview. Trust us, it works.

4.5 Practice with peers

If you have friends or peers who can do mock interviews with you, that's an option worth trying. It’s free, but be warned, you may come up against the following problems:

- It’s hard to know if the feedback you get is accurate

- They’re unlikely to have insider knowledge of interviews at your target company

- On peer platforms, people often waste your time by not showing up

For those reasons, many candidates skip peer mock interviews and go straight to mock interviews with an expert.

4.6 Practice with ex-investment banking interviewers

In our experience, practicing real interviews with experts who can give you company-specific feedback makes a huge difference.

If you know someone who runs interviews at an investment bank, then that’s amazing! They'll be a great person to practice interviews with.

But most of us don’t, and it can be REALLY tough to make a new connection with an investment banker. And even if you do have a good connection already, it might also be difficult to practice multiple hours with that person unless you know them extremely well.

That’s where mock interviews come in.

Find an investment banking interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Save time by focusing your preparation

Click here to book investment banking mock interviews with experienced finance interviewers.