Investment banking is intense, and to qualify, you need to show that you can handle the demands of the job. If you’re targeting an analyst role at a top bank, behavioral & fit questions will be a core part of the interview process.

They’re designed to test your work ethic, cultural fit, and ability to handle high-pressure situations, which are just as important as technical skills.

To help you prepare, below is a list of behavioral & fit questions that have been asked at top investment banking firms. We identified these by analyzing 200+ Glassdoor interview reports specifically for analyst roles at Goldman Sachs, J.P. Morgan, and Morgan Stanley.

From that list, we selected the 14 most common behavioral & fit questions and included sample answers to help you structure strong responses, tips, and a prep plan so you can feel confident going into your interviews.

- What to expect in IB behavioral & fit interviews

- 14 most common questions (with answers)

- How to answer IB behavioral & fit questions (STAR vs SPSIL)

- More examples (by company)

- Tips to impress your interviewers

- Prep plan

Click here to practice 1-on-1 with investment banking ex-interviewers

Let’s get started.

1. Overview: Investment banking behavioral interviews ↑

Before we go through the most common questions asked in investment banking behavioral & fit interviews, let’s first take a look at why these questions are asked in the first place.

1.1 What are behavioral & fit questions in investment banking interviews?

Working in investment banking is intense, especially at bulge-bracket firms like Goldman Sachs, J.P. Morgan, and Morgan Stanley. You’ll be working long hours, addressing last-minute emergencies, and communicating with high-profile, demanding clients.

Interviewers ask behavioral & fit questions to understand whether you have the motivation to handle this environment and whether you would work well within their team and culture.

These questions are based on the idea that past behavior is one of the strongest predictors of future performance. They prompt you to share real stories about your experiences, so interviewers can evaluate soft skills, such as problem-solving, leadership, communication, and handling conflict.

1.2 When to expect behavioral questions in the interview process

Behavioral & fit questions come up at every stage of the investment banking interview process, including casual coffee chats and networking with anyone from the company.

“You should treat every interaction as an interview; they are always assessing you, especially for communication skills,” says Jonathan (ex-Wells Fargo managing director, ex–Morgan Stanley).

You can also expect these questions in both the initial HireVue video interviews and during the final round of interviews (for entry-level roles, this is known as “Superday” or Assessment Centre rounds).

In the HireVue interviews, you’ll only have 30 seconds to think before recording a two-minute response, and the final-round interviewers will expect you to have clear and concise answers.

In general, Jonathan says that the more senior the interviewer, the more they will focus on behavioral and fit questions.

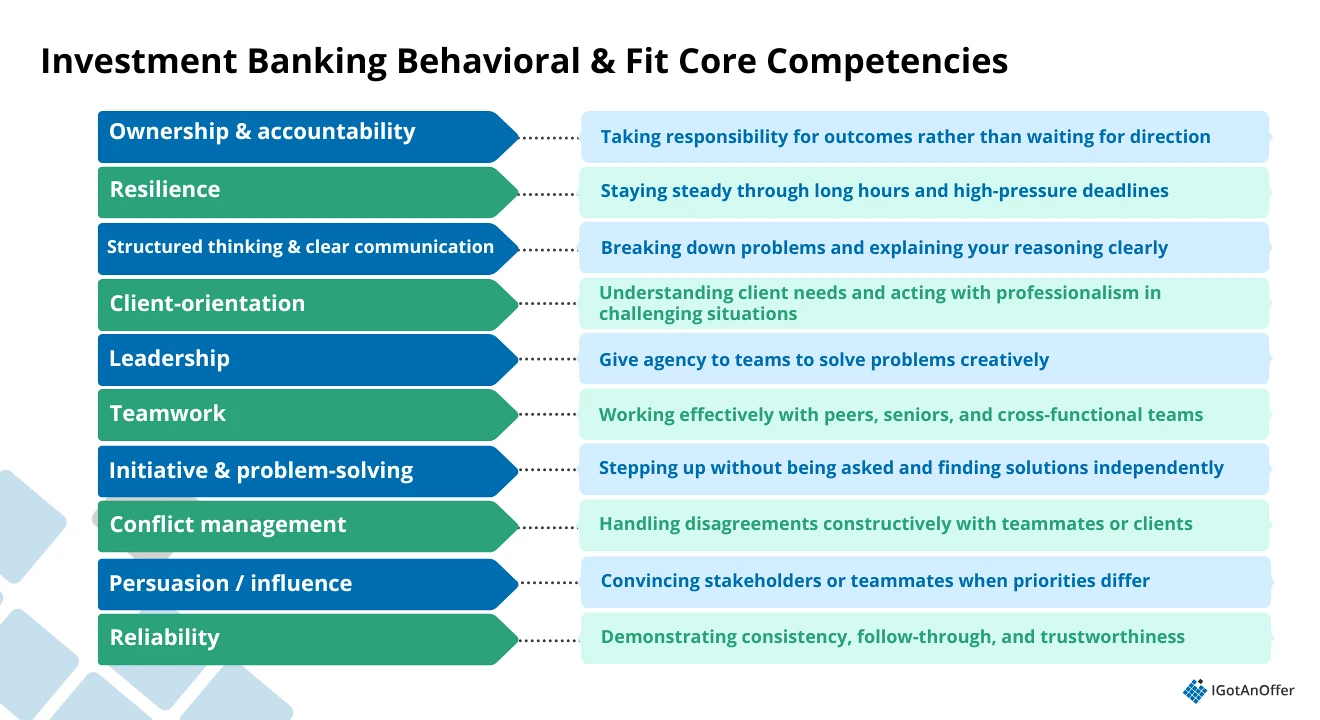

1.3 What core competencies are they testing for?

There are slight differences in the sets of traits and behaviors most companies look for, but you’ll notice that there are universal themes.

According to investment banking experts Geert (ex-valuation specialist at Deutsche Bank), Raul (ex-investment banker at BNP Paribas), and Jonathan (ex-Wells Fargo managing director, ex–Morgan Stanley), here are some skills you’ll be tested on:

- Ownership and accountability: showing you take responsibility for outcomes rather than waiting for direction

- Resilience under pressure: staying steady during long hours, tight deadlines, and high-stakes situations

- Structured thinking and clear communication: breaking down problems logically and explaining your reasoning clearly

- Client orientation: understanding client needs and acting with professionalism in challenging situations

- Leadership: guiding others, even without formal authority

- Teamwork: working effectively with peers, seniors, and cross-functional teams

- Initiative and problem-solving: stepping up without being asked and finding solutions independently

- Conflict management: handling disagreements constructively with teammates or clients

- Persuasion and influence: convincing stakeholders or teammates when priorities differ

- Reliability: demonstrating consistency, follow-through, and trustworthiness

1.4 Behavioral vs situational judgment questions

In addition to behavioral questions, you may also be asked situational judgment questions.

Instead of asking about past experiences, as behavioral questions do, these prompts evaluate your judgment, ethics, communication style, and ability to handle pressure in hypothetical scenarios.

Interviewers use situational judgment questions to understand how you respond to the unexpected. They want to see whether you can adapt to evolving challenges and unfamiliar problems that may arise in the role you’re applying for, as well as in future positions.

Let’s look at a few examples:

- You have a deliverable due tomorrow, but are missing a critical component, and your team is asleep. What do you do?

- You are working on a major client deal, and the client makes a request that violates firm policy. What would you do, and who would you escalate it to?

- What would you do if a major client’s request were illegal?

If you encounter these types of questions, here’s a simple framework you can use to structure your response:

Tips for answering IB situational judgment questions

- Take a moment before responding. Pause briefly to gather your thoughts so you can answer clearly and confidently.

- Ask clarifying questions. Extract the key details you need and make sure you understand what the scenario is really asking.

- State your assumptions. Because these questions are intentionally vague, outline any reasonable assumptions you’re making before offering your approach.

- Show your work. Talk through your thought process so the interviewer can follow your reasoning step by step.

- Consider the risks and trade-offs. Acknowledge potential downsides, explain how you would mitigate them, and show that you can weigh competing priorities with sound judgment.

- Reference lessons you’ve learned from others. When appropriate, draw on effective practices you’ve seen from managers or teammates and explain how you would apply those insights to the scenario.

- Tie it back to the role and the firm’s values. Connect your approach to what the job requires and link your reasoning to values the firm emphasizes, such as integrity, teamwork, ownership, or client focus.

For a complete list of practice questions, check out our investment banking interview prep guide.

Right, now that you know what to expect, let’s get into the most commonly asked behavioral & fit questions.

2. 14 most common behavioral & fit questions in IB interviews (with sample answers) ↑

The questions below are pretty typical in investment banking interviews at top firms, such as Goldman Sachs, J.P. Morgan, and Morgan Stanley. We analyzed hundreds of behavioral & fit interview questions from these companies and identified the ones that come up most frequently.

We recommend reviewing this list ahead of your interview and using the linked explanations to deepen your understanding of each topic.

To answer scenario-based questions (“Tell me about a time…”), we used IGotAnOffer’s SPSIL (Situation, Problem, Solution, Impact, Lessons) framework, which we’ll explain further in Section 3.

Click on a question if you want to skip straight to it.

- Walk me through your resume

- Tell me about yourself

- Why do you want to work in investment banking?

- Why this firm? (Why Goldman / JP Morgan / Morgan Stanley?)

- What are your strengths and weaknesses?

- What are your career goals?

- What would your co-workers or manager say about you?

- Tell me about a time you handled team conflict. How did you solve it?

- Tell me about a time you demonstrated leadership

- Tell me about a time you failed and how you handled it

- Tell me about a time you faced a challenge / complex problem and how you solved it

- Tell me about a time you faced an ethical dilemma

- Tell me about a time you used data / analysis to make a recommendation

- Tell me about a time you had to work under pressure

Right, let’s get into it!

1. Walk me through your resume ↑

Many interviewers will use this question (along with “Tell me about yourself”) as an ice breaker. That makes this a particularly crucial question, as it establishes the interviewer’s first impression and sets the stage for the rest of the interview.

You’ll want to know your resume inside and out and be prepared to answer follow-up questions on each of the experiences you included. Anything you have put on your resume is fair game for the interviewer to ask about.

There are four ways you can answer this question:

- Chronologically, where you show your career progressions and is the most straightforward to use

- Skills-based, where you highlight relevant competencies, focused on what you can bring to the role

- Project-based approach, where you showcase tangible achievements

- Narrative arc, which is an improved version of the chronological approach, but instead of just going from A to B to C, you make sure to tell your story in a way that is 1) more engaging and 2) best sells you for the role

For the sample answer below, we’ll be using a skills-based approach, where you highlight the competencies you bring to the role.

Example answer:

"My career has been built around strong project management and leadership skills. Starting as a business analyst at YumFoods, I demonstrated proficiency in organizing teams and resources, leading to successful project deliveries and a promotion to project manager.

In this role, I refined my abilities in stakeholder communication and risk assessment, ensuring project objectives aligned with business goals.

My transition to WeSellCars.com as an operations manager allowed me to further elevate my skills in team management and strategic planning. I implemented a more streamlined operations process that resulted in a 30% improvement in project timelines.

Currently, as a program manager at Z-bay e-commerce platform, I lead cross-functional teams and manage complex, multimillion-dollar projects. My ability to effectively navigate project complexities has been instrumental in consistently exceeding client expectations and fostering long-term relationships."

Check out our guide on how to answer “Walk me through your resume” interview question for more information on the other three methods you can use to answer this question.

2. Tell me about yourself ↑

As we mentioned above, ice-breaker questions like this one set the tone for the entire interview.

The interviewer will likely follow up on one or more of the details you share in your answer to question no. 1, so be prepared to elaborate on certain aspects of your experience.

You don’t necessarily have to focus on your academic and professional credentials here. Instead, be more personal and tell a story about yourself beyond what’s on your resume.

You can do this by highlighting your career progression and showing how the skills you’ve built so far connect to the role you’re applying for.

Here’s a sample answer to this question to give you an idea of what to aim for:

Example answer:

“Right now, I’m a few weeks away from finishing my final exams for an MBA at the Ross School of Business at the University of Michigan. Previously, I worked in healthcare consulting for three years.

During my time in healthcare consulting, I loved digging into our clients’ operations and pinpointing areas to make them more efficient. However, I realized that I really wanted to be able to work toward meaningful social and environmental change.

A friend of mine who worked on Morgan Stanley’s Investing With Impact Platform told me more about the company, and it sounded perfect. So I devoted my last year at the consulting firm to preparing for the GMAT and getting my application ready for the MBA, on top of my full-time work.

During my studies, I was able to intern as a Sustainable Investing Fellow at Morgan Stanley, which transformed my understanding of capital markets and environmental outcomes. Now that I’m graduating, I’m aiming to return full-time as an analyst in Global Sustainable Finance.”

You can also check out the video below for answering the “Tell me about yourself” interview question. It’s primarily intended for product managers but works just as well for investment banking roles.

3. Why do you want to work in investment banking? ↑

Your interviewers will want to know what made you choose this industry (beyond a high salary).

They also want to see whether you’ve taken time to understand the reality of the job and whether you’re mentally prepared for the pace, pressure, and expectations that come with it.

If you’ve had internships or are transitioning from other fields, you should be prepared to explain why you want to do investment banking rather than one of those.

Here’s one way to structure your answer:

- Cite a specific moment or experience that sparked your interest in investment banking (e.g., a childhood memory, exposure to financial models, deal work, or working with a finance team)

- Lay out the steps you took to explore or transition into the field

- Explain how the role aligns with your long-term goals and how your strengths translate to the role

Below is a sample answer you can reference.

Example answer:

“I actually didn’t always know that I wanted to be an investment banker, having begun my professional life as a data analyst in Silicon Valley.

What I loved about the position was using data to extract useful insights and building accurate models, but I found myself much more interested in the finance team’s projections and reports than what my own team was working on.

So I started to learn more about finance after work and on weekends, taking night classes at a local university, in order to make a career change.

Additionally, I thrive in fast-paced environments, something I’m used to from my previous position, and I’m excited to build my skills from data analysis to financial modeling while working on high-profile transactions.”

4. Why this firm? (Why Goldman / JP Morgan / Morgan Stanley?) ↑

This is one of the most common questions asked in investment banking interviews, and it is likely to come up at every firm you apply to.

Interviewers want to know that you’re genuinely motivated to work specifically at their bank, not just chasing a paycheck. They’re also testing how well you’ve researched the firm.

As you’ll be doing quite a bit of research and analysis on the job, showing a nuanced understanding of the firm in your answer is a good sign to the interviewer that you have the right skills and motivation for the position.

Aim for two to three concise reasons why you want to work at the firm, as well as in the specific team and role. You can make your answer feel more personal by tying it to your own experiences with the company.

If your response sounds generic or pulled from the company website, it can raise a red flag early in the process.

Let’s take a look at a strong example answer for an analyst role at Goldman Sachs.

Example answer: Why do you want to work at Goldman Sachs?

“I want to work at Goldman Sachs for three main reasons.

First, I want to take part in industry-shaping deals, something that I could only do while working for the industry leader in investment banking. I came to this conclusion while researching the leading investment banks, and I was impressed that Goldman had a record M&A year in 2021, earning more in fees than both J.P. Morgan and Morgan Stanley.

Second, as you know, I’m interested in M&A, particularly around activism defense, which is one of Goldman’s strengths. I was inspired by the Allergan vs Valeant deal when we studied it in university, and seeing Goldman’s continued involvement in situations like Sony–Third Point confirmed that this is the right environment for me.

And finally, I’ve had a few conversations with Krish Dixit and Sonia Sanders, associates in the Chicago office, both of whom gave me a great impression of the firm as a whole. Krish in particular encouraged me to apply to the investment banking division, as we share a similar educational background, and he was complimentary of the opportunities he’s been given to succeed.”

Check out our guide to answering the “Why this firm” interview question for tips and more sample answers for different companies.

5. What are your strengths and weaknesses? ↑

A classic in investment banking interviews, this question is used by interviewers to see if you have the self-awareness to give an honest view of your performance.

The key to this question is to list the strengths relevant to the job description and back them up with real-life experience.

Then, pick a weakness that is relevant to the role (but not critical) and follow it up with the steps you plan to take to improve it.

You can also use this answer to show that you’re good at taking on feedback, an important skill and one that your interviewer will be looking for.

Example answer:

“One strength is that I have strong analytical and problem-solving skills. It’s something I’ve had to build over years of working with numbers, starting from tutoring math in high school to taking advanced finance courses in college.

In my current position as an analyst at Morgan Stanley, I’ve been responsible for preparing monthly performance analyses for our leadership team, and several of my recommendations led to cost savings that totaled roughly $450K across the business.

A weakness is that I can be overly detail-oriented. It used to slow me down, especially when working on longer assignments, because I’d spend too much time perfecting small sections of a deliverable.

To manage this, I now set time blocks for each task and use a simple priority filter to help me decide which tasks need deeper review. It’s helped me work faster without sacrificing quality, especially when deadlines are tight.”

6. What are your career goals? ↑

This question helps interviewers see whether you’ve seriously thought about why investment banking is the right place to build your career and whether your long-term plans align with what the role offers.

You don’t need to map out the next decade. Focus on one or two main goals and explain how you plan to reach them and how they fit into your long-term growth. This shows you’ve thought things through and actually know what you want.

After that, connect your goals back to the employer. At the end of the day, it’s a business, and the company wants to know how your growth will benefit the team. Explain how building these skills will make you more effective in the role and support the work they’re hiring you to do.

Example answer:

“My goals became clearer during my internship last summer. I worked on a sell-side project and helped the team build the first version of the buyer list. That meant reviewing filings, tracking outreach, and seeing how the early steps of the process set the tone for everything that followed. Watching how my work fed into the larger project is what made the role feel right for me.

My short-term goal is to become technically strong enough to run full workstreams with minimal oversight. I want to be the analyst the associate trusts for a clean model, accurate materials, and steady communication. Hitting that level helps the team move faster and reduces last-minute fixes.

Long-term, I want to reach a point where I’m guiding parts of a deal. During my internship, the associate showed me how he structured diligence questions and prepared the client for each round of feedback. That kind of ownership is something I’m aiming for because it supports both the client and the team.

These goals fit well with investment banking because the pace forces you to grow quickly, and the feedback you get on every project makes it clear where you’re improving. That’s the environment I want to be in, and it’s where I see myself contributing the most.”

7. What would your co-workers or manager say about you? ↑

This question is a variation of question no. 5, except that instead of focusing only on your self-awareness, the interviewer also wants to understand your team awareness. They want to know how others experience working with you and whether people trust you, rely on you, or consistently notice certain habits in how you work.

When answering, pick one or two things your co-workers or manager have actually said about you that show how you contribute to a group. This helps the interviewer picture how you would fit into their workflow.

Example answer:

“My director often says that I’m someone he can rely on to steady a project when things start moving fast. On a recent buy-side mandate, we hit a snag when the client’s finance team delivered an incomplete data pack. The team was getting pulled in multiple directions, so he asked me to take control of the workstream.

I reorganized the task list, clarified the missing inputs with the client, and set up a short daily check-in with the analysts. He later told me he valued how I kept the team focused and prevented the delay from spreading into other parts of the process.

I’ve also heard from colleagues that I’m effective at making cross-functional work feel smoother. During a carve-out assignment earlier this year, we were working closely with our restructuring and tax teams. Those groups don’t always operate on the same timeline, so I made a habit of sharing concise status updates and calling out what each team needed next.

A VP from the tax group told me afterward that it was one of the cleaner coordination processes they’d been part of. Feedback like that has shown me that consistent communication isn’t just polite, it keeps the overall deal moving.”

8. Tell me about a time you handled team conflict. How did you solve it? ↑

This is a real favorite among interviewers because across all industries, strong differences of opinion are an everyday occurrence. Conflicts can create real problems if they’re not handled well, but they can also be productive when managed constructively.

The interviewer will want to see that you have the empathy to understand both sides of a disagreement and the communication skills to guide the situation toward a solution.

If you’re a manager, you’ll want to show that you put clear processes in place to address conflicts and can bring the team to a resolution quickly and effectively.

If you're still fairly junior, try to choose an example that involved a group rather than just a one-on-one issue.

Showing how you helped a team work through a conflict demonstrates stronger leadership skills than resolving a simple misunderstanding with one person.

Example answer:

(Situation & Problem)

“Sure. In my current role as a financial analyst, I worked on a quarterly earnings model update with two other teammates. Midway through the process, there was a disagreement about the revenue assumptions we should use.

One teammate wanted to rely strictly on management guidance, while another pushed to incorporate more aggressive growth estimates based on recent market activity. The disagreement created tension and stalled our progress, and we were already under a tight deadline to deliver the model to our VP.

(Solution)

I brought the team together and suggested that we walk through the data side by side. I compared guidance, historical trends, and the external market indicators supporting the more optimistic view.

To move us forward, I proposed running two versions of the model, one using management guidance and one using a blended set of assumptions, so we could present both scenarios and let leadership evaluate the trade-offs. This approach helped shift the conversation from personal preferences to objective analysis.

(Impact)

We finalized both models that afternoon and presented them to the VP. He appreciated having a clear comparison and ultimately chose the blended assumptions because they showed both caution and the recent uptick in demand.

By resolving the conflict quickly, we were able to submit the final package on time and avoid delaying the rest of the reporting process.

(Lessons)

This experience taught me the value of grounding discussions in data, especially when opinions differ. I also learned how important it is to keep the team aligned under pressure by focusing on shared goals.

Since then, I’ve made it a habit to bring objective analysis into any disagreement early, which has helped prevent small conflicts from slowing down deliverables.”

Check out our guide to answering the “Tell me about a time you had a conflict” interview question for tips and more sample answers to different scenarios.

9. Tell me about a time you demonstrated leadership ↑

Regardless of whether you’re a manager or in a more junior position, leadership is one of the qualities that interviewers are likely to assess you on. This is because a good leader not only does their job well but also helps others do their job better, which multiplies their impact across the team.

Choose a recent example, ideally within the last two years, that shows how you influenced and impacted both people and projects.

This can include influencing teams that don’t directly report to you, working toward company goals without explicit instruction, showing empathy, and leading by example.

If you’re more junior and haven’t held a formal leadership position, your answer can still come from a situation where you weren’t the official lead but demonstrated leadership through your actions.

Example answer: Junior / mid-level candidate

(Situation)

“In my last position, I was on a team of analysts working on a live deal to try to bring on a new client. We hadn’t worked with them before, and it was a big name, so this was a huge opportunity for the company.

(Problem)

One day before a key meeting with the potential client, the associate taking the lead on the deal got sick. As her symptoms developed, it became clear that she would not be able to attend the meeting and pitch our services to the new client. We had to decide whether to try to reschedule the meeting or to go ahead without her leadership.

(Solution)

I knew that rescheduling the meeting at the last minute would make us appear unreliable to the potential client, so I called the other analysts and persuaded them that we should maintain the meeting and that I could give the pitch. They agreed, and we rehearsed the pitch together that evening.

The next day, I gave the pitch and was able to answer the potential client’s questions, with help from the other analysts. I was able to remember most of what we prepared with the associate, and my teammates were able to support me in the other areas.

(Impact)

The client asked for extra time to consider the deal, but did ultimately come back to us and accept. They are now one of our regular clients, and through that relationship alone, we’ve brought in a little over $200,000 in revenue for the company.

(Lessons)

So I learned how important it is to prepare in advance for all eventualities. Had we set up a contingency plan prior to the pitch, the associate’s illness would not have created such last-minute stress leading up to the meeting. So now I work to stay aware of needs outside of my job description, and to anticipate risks ahead of time.”

Check out our guide to answering the “Tell me about a time you showed leadership” interview question for tips and more sample answers for different scenarios.

10. Tell me about a time you failed and how you handled it ↑

Everybody makes mistakes, but not everyone can own up to them.

In investment banking, especially, you’ll be responsible for high-stakes deliverables. A single mistake can slow down a process, frustrate a client, or create unnecessary work for the team.

The key to acing this question is to demonstrate that you’re someone who takes responsibility, acts quickly, and views failure as a learning opportunity.

When sharing your answer, choose a failure that really stuck with you as a professional. Explain what went wrong, why it went wrong, and how the experience has helped you become better at your job.

Beyond the standard “Tell me about a time you failed” questions, interviewers may also give you scenario-based versions, such as this one commonly asked at Goldman Sachs:

Example answer: Imagine you gave your boss paperwork and later realized you made a mistake. How would you handle the situation?

(Situation)

“In my previous role as a financial analyst, I was responsible for preparing supporting documents for client presentations, including valuation outputs and summary schedules.

(Problem)

One evening, after submitting a set of materials to my VP, I realized that one of the reference tabs feeding into the model had not refreshed properly. This caused a small but meaningful error in one of the multiples shown in the appendix. The team was planning to review the materials first thing the next morning, so I needed to fix it quickly.

(Solution)

I reopened the model, corrected the reference, reran every affected output, and rebuilt the relevant page. Once everything was tied out, I sent an updated version to my VP with a brief note explaining the correction. I made it clear that I had already checked the rest of the deck and confirmed that no other numbers were affected.

(Impact)

Because I caught and corrected the mistake early, it didn’t disrupt the team’s review or the client meeting that followed. My VP appreciated the transparency and the fact that I solved the issue before it became a problem.

(Lessons)

That experience taught me two important lessons: first, the significance of doing a final review before submitting anything, and second, that addressing issues early on can prevent small problems from escalating. Since then, I’ve incorporated a quick checklist into my workflow to help avoid similar errors in the future.”

Check out our guide to answering the “Tell me about a time you failed” interview question for more tips and sample answers for different scenarios.

11. Tell me about a time you faced a challenge / complex problem and how you solved it ↑

Employers at competitive firms want to know how you’ll react under difficult circumstances. Your investment banking resume may be full of impressive achievements, but that alone doesn’t show whether you can stay effective when the work becomes demanding.

Don’t make the mistake of spending too long explaining the problem. The interviewer is far more interested in HOW you approached the challenge than the challenge itself. Did you repeatedly perform the same unsuccessful motions until you finally got it right? Or did you try various approaches or just develop muscle memory?

If you can connect how you solved the challenge to how you would approach similar problems in your work, that’s even better.

Succinctly outline the situation and the problem/challenge, then spend the bulk of your answer talking about what you did, the impact your actions had, and what you learned.

Example answer:

(Situation)

“In a previous role, I was responsible for preparing the financial materials for a strategic review for one of our largest clients. It was a high-pressure week, and the team was trying to finalize the valuation work before a major steering committee meeting.

(Problem)

Halfway through the process, I noticed that two business units had been using different revenue recognition methods over the past several reporting periods. This created inconsistencies that flowed through our valuation outputs, and if we presented those numbers as-is, it would have undermined the credibility of the entire analysis. We were less than 24 hours from sending the draft to the client.

(Solution)

I quickly analyzed the issue and reached out to the accounting leads of each unit to identify the exact source of the inconsistencies. Once everything was clear, I rebuilt the historical schedules using one standardized method and documented each adjustment clearly.

To prevent further discrepancies, I also built a quick variance-check model that flagged unusual movements across periods. After fixing everything, I walked my associate through the reconciled schedules so the team could validate the changes without losing time.

(Impact)

The corrected numbers aligned the valuation work across all business units, and we were able to finalize the deck on schedule. The client later mentioned that the improved clarity in the financial reconciliation made the analysis much easier to follow.

My VP also asked me to share the variance-check tool with the rest of the team, since it helped reduce similar issues in later projects.

(Lesson)

That situation reminded me of the importance of pausing to understand the root cause of a problem rather than rushing into more work. Speaking up early and ensuring everyone is aligned makes things easier. Since then, I've made it a habit to ask questions early and verify my assumptions, helping me avoid similar issues and keep things running smoothly.”

12. Tell me about a time you faced an ethical dilemma ↑

In this line of work, you’ll sometimes be faced with situations where your options are limited, and you have to make a judgment call to protect the firm, the client, and your own integrity.

This question helps the interviewer understand how you think in those moments and whether you follow the right process even when the situation feels uncomfortable.

You might also get specific scenarios as part of this question. Goldman Sachs, for example, is known for using prompts like the one below:

Example answer: You are working on a secret project. Your previous manager asks about it and says it’s for an important decision. What do you do?

(Situation)

“I was recently staffed on a confidential project that only a small deal team was cleared to access.

(Problem)

A former manager contacted me and asked for details about the project, explaining that the information would help with an internal decision they were working on. They were still at the firm but not on the cleared list, which put me in a difficult position because sharing anything would breach confidentiality, but declining outright could create tension.

(Solution)

I explained that I couldn’t share any details because the project was restricted to the current team. I offered to help in any way that didn’t involve disclosing confidential information and said I could check with the deal lead or compliance if they believed they should have access.

(Impact)

They appreciated the honesty, and there were no issues moving forward. The deal lead later confirmed that the request was outside the permitted group, so handling it properly avoided a potential breach.

(Lesson)

I learned that maintaining confidentiality sometimes means having direct conversations, even with people you know well. Clear communication and following the proper process protect the firm while keeping the relationship professional.”

13. Tell me about a time you used data / analysis to make a recommendation ↑

Investment banking relies heavily on data. Whether you are reviewing financial statements, building models, or comparing companies across a sector, the expectation is that you can interpret the information and convert it into a recommendation that the team can use.

Choose an example where you used data to guide your decision, explain your reasoning clearly, and show how your analysis led to a recommendation the team could act on.

Example answer:

(Situation)

“In my previous role on an industry coverage team, I was responsible for preparing a quarterly update on a group of mid-cap companies we monitored. One of the companies had recently announced a shift in strategy, and our team needed to decide whether to adjust our outreach plan for them.

(Problem)

The headline announcement sounded positive, but the initial market reaction was mixed. Before the team reallocated time and resources, we needed a clearer view of whether the strategy change actually strengthened the company or introduced new risks.

(Solution)

I pulled three years of historical segment data, compared it to peers with similar restructurings, and built a simple model to test how the new strategy affected margins and cash flow under different scenarios. The analysis showed that while revenue growth might improve, the company’s working-capital needs would rise sharply during the transition, putting pressure on liquidity.

Based on this, I recommended that we keep the company in our coverage rotation but shift our outreach toward potential refinancing and liquidity-related discussions rather than growth-focused materials.

(Impact)

The team adopted the revised outreach plan, and a few weeks later, the company’s CFO confirmed they were evaluating funding options for the transition period. Our preparation allowed us to position relevant ideas early and improve the relationship with he client.

(Lesson)

This experience showed me that good recommendations start with structuring the data properly. Once the right inputs are in place, it becomes much easier to weigh the trade-offs and present a direction the team can act on.”

14. Tell me about a time you had to work under pressure ↑

As an investment banker, tight timelines and last-minute requests are a normal part of the job. This question helps employers assess your ability to handle time-sensitive projects and manage competing priorities.

You might also hear another version of this, such as “Tell me about a time you had to meet a tight deadline.”

In either case, your answer should show how you prioritize, manage your workload, solve problems, and stay committed to delivering accurate work under pressure.

Use an example from a time when the odds were stacked against you. It will make your answer more compelling and give the interviewer a clearer picture of how you perform when things get difficult.

Example answer:

(Situation)

“In my previous role as a corporate banking analyst, our team was preparing a pitch for a long-standing client who was considering refinancing a large portion of their debt. The presentation was scheduled for Monday morning.

(Problem)

Late Friday afternoon, our associate flagged that we needed a revised set of comps and a refreshed credit analysis because new earnings had been released for several peers. The original analyst responsible for the work was out sick, and the numbers in the deck were now outdated. We didn’t have the option to push the meeting.

(Solution)

I cleared the rest of my queue, booked a conference room, and got to work updating the full set. I pulled the latest filings, rebuilt the comps, checked every formula, and reran the spreads to make sure all the ratios were accurate.

Once the numbers were clean, I rewrote the commentary to reflect the new trends and drafted a short memo for my associate so he could quickly review the changes.

(Impact)

We were able to send the final deck to the MD on Sunday night. The meeting went smoothly, and the client specifically commented on the clarity of the updated analysis. Our team ended up being shortlisted for the refinancing mandate, and my associate later told me that the quick turnaround played a big role in keeping the client confident in our execution.

(Solution)

This experience reminded me of the importance of staying calm when faced with urgent situations. It taught me to break tasks into manageable steps instead of panicking. Additionally, it reinforced the value of double-checking your numbers, especially when working quickly, as it can help the team avoid larger issues later on.”

3. How to answer IB behavioral & fit questions (STAR vs SPSIL) ↑

You may have noticed that all of the questions above fall into two basic formats:

- General questions, such as “why investment banking?” or “why should we hire you?”, which require individualized responses

- Scenario questions that typically begin with “Tell me about a time…”, which can be answered using a repeatable framework

For general questions, you’ll need to craft your own individualized responses in advance, since these focus on your motivation and fit rather than a specific scenario. They should sound genuine and not overly structured or rehearsed.

For scenario-based questions, you'll need to use a repeatable framework. This will help you relay your most relevant achievements and communicate them clearly.

In our example answers in Section 2, you’ll see that we follow the IGAO’s SPSIL framework rather than the traditional STAR framework. We do this because SPSIL offers a better flow for structuring answers and fixes the common issues candidates run into with STAR, which we explain in more detail below:

3.1 STAR method

The STAR method (Situation, Task, Action, Result) is a popular approach for answering behavioral questions because it’s easy to remember. You’ll see it’s recommended by many articles you can find on Google (they tend to copy each other!).

However, the STAR method has two problems:

- We’ve found that candidates often find it difficult to distinguish the difference between steps two and three, or task and action.

- It ignores the importance of talking about WHAT YOU LEARNED, which is often the most important part of your answer.

To correct those two faults, we actually developed our own (very slightly different) framework that many of our candidates have used successfully over the years: IGotAnOffer’s SPSIL method.

3.2 IGotAnOffer’s SPSIL method

IGotAnOffer’s SPSIL (Situation, Problem, Solution, Impact, Lessons) method has a less catchy name, but it corrects both of the STAR method’s faults. You’ll have seen it in action in the example answers in Section 2, but let’s go through the five-step approach:

- Situation: Start by giving the necessary context of the situation you were in. Describe your role, the team, the organization, the market, etc. You should only give the minimum context needed to understand the problem and the solution in your story. Nothing more.

- Problem: Outline the problem you and your team were facing.

- Solution: Explain the solution you came up with to solve the problem. Step through how you went about implementing your solution, and focus on your contribution over what the team / larger organization did.

- Impact: Summarize the positive results you achieved for your team, department, and organization. As much as possible, quantify the impact.

- Lessons: Conclude with any lessons you might have learned in the process.

For a deeper dive into this topic, check out our article on why the STAR method isn’t always the best option for behavioral interviews and how IGotAnOffer’s SPSIL method can be a better alternative. It’s written for product managers but equally useful for answering behavioral & fit questions in IB interviews.

Which method should you use?

Of course, you should practice using whatever method you’re the most comfortable with. By all means, use the STAR method if you prefer, just don’t forget to mention what you learned.

4. More examples of IB behavioral & fit questions (by company) ↑

The questions in Section 2 cover the most commonly asked behavioral & fit interview questions, but investment banks often have their own variations.

Goldman Sachs, for example, focuses on client service, teamwork, and integrity; J.P. Morgan values exceptional client service, operational excellence, and fairness; and Morgan Stanley emphasizes doing the right thing, putting clients first, and leading with extraordinary ideas.

The questions below are organized by company to help you find the most relevant ones for your interviews.

Example of Goldman Sachs IB behavioral & fit questions

- Why do you want to work in investment banking?

- Why Goldman Sachs?

- Tell me about yourself.

- Walk me through your resume.

- Why should we hire you?

- What are your strengths and weaknesses?

- Why did you choose your college major?

- Why would you be a good addition to the team you’ve applied for?

- Which of your skills and experiences make you appropriate for this job?

- Tell me about your experience at your previous employer.

- Name something that your previous bosses would say about you.

- Tell me about a time when you demonstrated leadership.

- Tell me about a time when a team member wasn’t pulling their weight in a project. What did you do?

- Tell me about a difficult time you’ve had working in a team.

- Tell me about a time when you’ve worked with people from different backgrounds.

- How would you counsel an underperforming peer ahead of a performance review?

- Tell me about a time you had a problem and how you solved it.

- Tell me about a time your manager questioned your decision.

- Tell me about a time when you worked on a project with a tight deadline.

- Tell me about a time you failed and how you overcame it.

- Tell me about a time you took initiative or ownership of a task.

- Tell me a time you showed independent thinking.

- Imagine your friend steals the answers to an exam and offers them to you. How would you handle the situation?

- Imagine you gave your boss paperwork and later realized you made a mistake. How would you handle the situation?

- You are working on a secret project. Your previous manager asks about it and says it’s for an important decision. What do you do?

- What motivates you to work hard in a team environment?

- Tell us one thing about yourself that we should not know.

Check out our Goldman Sachs behavioral interview guide for more company-specific insights and information.

Example of J.P. Morgan IB behavioral & fit questions

- Why do you want to work in investment banking?

- Why J.P. Morgan?

- Tell me about yourself.

- Walk me through your resume.

- What is it about this role that interests you?

- Why are you a good fit for this position?

- Besides hard work and a high GPA, what expertise will you bring to J.P. Morgan?

- What are your strengths?

- What’s one of your biggest weaknesses?

- What’s your career plan within the next five years?

- What would your co-workers say about you?

- Tell me about a recent achievement.

- Tell me about a time you worked in a team.

- Tell us about a time you faced a disagreement in a group.

- How did the success that you achieved on an individual level help contribute to team goals?

- Tell me about a time during which you had a positive impact on a project, and how you measured your success.

- Provide an example of when you sought out relevant information and used it to develop a plan of action.

- Name a time you had to make a quick decision, then describe your thought process and what the final decision was.

- Tell me about a time when you encountered a difficult client and describe how you handled the situation.

- Tell me about a time you showed resilience.

- What was your greatest challenge?

- What is the biggest challenge you have faced, and how has that made you a better person?

- What has been the hardest career choice you have had to make?

- What is an ethical dilemma you faced, and how did you deal with it?

- Make a sales pitch for something you're interested in.

Check out our J.P. Morgan behavioral interview guide for more company-specific insights and information.

Example of Morgan Stanley IB behavioral & fit questions

- Tell me about yourself.

- Walk me through your resume.

- Why do you want to work in investment banking?

- Why Morgan Stanley?

- Why Morgan Stanley and not Goldman Sachs?

- What is your understanding of the job you will be doing at Morgan Stanley?

- What are your career goals?

- How would your friends and family describe you in 3 words?

- What do you do for fun outside of work?

- What would you major in if the financial services industry didn’t exist?

- Tell me about a time you worked in a team.

- Tell me about when you handled a problem in a team.

- Tell me about a time you had to work with somebody you disliked.

- Tell me about a time you demonstrated superior leadership skills.

- Tell me about a time when you were persuasive.

- Tell me about a time you used data to make a recommendation.

- Tell me about the hardest thing you have experienced in life. How did you overcome it?

- Tell me about a time you did the right thing.

- Describe a time you made a big mistake and how you dealt with it.

- If your sister’s wedding were tomorrow and a live deal were closing tomorrow, which event would you prioritize?

- Why wouldn’t I hire you?

- If you could be any animal, what would it be?

Check out our Morgan Stanley behavioral interview guide for more company-specific insights and information.

5. 10 Tips to ace your IB behavioral & fit interview ↑

As you can see from the complex questions above, there is a lot of ground to cover when it comes to investment banking interview preparation. So it’s best to take a systematic approach to make the most of your practice time.

Below are ten helpful tips to keep in mind when preparing for IB behavioral & fit interviews.

5.1 Get used to setting up the situation in 30 seconds or less

Spending too much time on the Situation step is one of the most common mistakes candidates make. Use a timer while you practice to ensure you provide only necessary information.

5.2 Have a solid ‘about me’ introduction ready

Prepare a strong answer for your “about me” introduction, or the classic “Tell me about yourself” question. This is often the first question in an investment banking interview and sets the tone for the rest of the conversation.

Your introduction should briefly summarize your background and experience while highlighting what makes you unique as a candidate.

5.3 Be concise and data-driven

Interviewers hear a lot of behavioral stories in a day, so avoid unnecessary details that could lose their attention and try to keep your answer to around two minutes.

Then, back up your claims with specific metrics or quantifiable data to make your answer more concrete. For example, instead of saying “I helped the team with a project,” say “I built a three-statement model that improved our pitch turnaround time by 25%.”

It also helps to share your stories with a few different people beforehand, as they can give feedback on which details to keep and which to cut.

5.4 Center on the company’s culture and values

According to Geert (ex-valuation specialist at Deutsche Bank), you should always align each story to a key competency.

Familiarize yourself with the firm’s core values and weave them naturally into your answers. In investment banking, interviewers often look for qualities such as teamwork, client focus, attention to detail, and integrity.

Also, keep in mind that your cultural alignment will be assessed throughout the entire interview process, not just during behavioral rounds.

For instance, at Goldman Sachs, you could demonstrate their focus on client service by sharing an example of how you supported a project under tight deadlines while ensuring that the quality of your work met client expectations.

5.5 Keep clients at the center

A good investment banker always connects their work back to the client.

Show how your decisions improved the client experience, whether that be solving a problem they raised, simplifying a deliverable, or improving the clarity and quality of your analysis.

Companies want to know that you can keep the user front and center when making tough decisions and trade-offs.

5.6 Be proud and talk about YOU

Not talking about YOU enough is another common mistake we see with a lot of candidates. This is not the time to be shy about your accomplishments. Concentrate on your impact, not what “the team” did.

5.7 Be honest and authentic

Interviewers can tell if your answer sounds memorized, says Kent (managing partner at Moser Capital). Be genuine in the way you talk about your experiences. If you’ve faced challenges or setbacks, discuss how you improved and learned from them.

Kent also encourages candidates to think carefully about what they actually want in their next job and what drives their happiness (both at work and outside of work).

When you’ve done that reflection, it comes through in your answers, and interviewers get a clearer sense of who you are and what motivates you.

5.8 Mix and match

A common mistake Raul (ex-investment banker at BNP Paribas) observes in candidates is that they come up with only one story for each question.

However, you’ll probably have a lot of overlap with your stories. A story you use to answer a leadership question could easily work for a question on conflict, people management, or handling pressure.

If you practice adapting stories so they can answer various questions, 10-15 strong stories should be enough to get you through even the toughest interview.

5.9 Adapt to follow-up questions

Don’t be alarmed if your interviewer asks follow-up questions; this is perfectly normal.

Listen carefully to the way your interviewer is asking these questions, as there will often be a subtle clue about the specific skills they’re looking to assess from the next part of your answer.

5.10 Be ready to go off script

You should know your stories extremely well by interview time. But don't feel that you have to stick rigidly to a script. The interview should feel like a conversation, so if the interviewer takes you down an unexpected direction, go with it.

6. How to prepare for IB behavioral & fit interviews ↑

Investment banking is a great career, but it’s also highly competitive. The good news is that “no interview is hard if you prepare in advance,” says Raul.

Jonathan suggests using everything at your disposal to prepare. “These include friends and family network, upper-class students for those in school, your school’s alumni network, school clubs, coaches, mentors, etc.”

For example, you can reach out to an alumnus at your target firm to learn what their interview was like, run peer interviews with classmates, or speak with a mentor to get feedback.

In addition to that, we’d also like to offer some resources to help you prepare.

6.1 Learn about the company’s culture

Most candidates skip this step. But before investing tens of hours preparing for interviews at top firms, take a moment to make sure it’s actually the right fit for you.

This is important for two reasons.

First, most of these firms are prestigious, and it’s easy to assume you should apply without thinking it through. But prestige alone won’t guarantee satisfaction in your day-to-day work. What matters more is the kind of work you’ll be doing and the people you’ll be working with.

Second, having a clear understanding of a specific company's culture will give you an edge in your interviews, because it will help you frame your skills and experiences to align with what the company values.

If you know anyone currently at a firm or who has worked there before, reach out to learn about their experience and the team culture. In addition, we would recommend reading the following:

Goldman Sachs

- Goldman Sachs’ purpose and values (By Goldman Sachs)

- Goldman Sachs Briefings newsletter (By Goldman Sachs)

- Goldman Sachs strategy teardown (by CB Insights)

J.P. Morgan

- Who we are (By JP Morgan)

- JP Morgan weekly brief (By JP Morgan)

- JP Morgan strategy teardown (by CB Insights)

Morgan Stanley

- A culture-driven strategy (by Morgan Stanley)

- Insights (by Morgan Stanley)

- Comparison Morgan Stanley vs Goldman Sachs (by Investopedia)

Bank of America

- Bank of America core values (by Bank of America)

- BofA Insights (by Bank of America)

- BoFa strategy teardown (by Rancord Society)

Citigroup

- About Citi

- Insights (by Citi)

- Citi’s plan to transform its wealth business (by Euromoney)

Barclays Capital

- About Barclays

- Barclays’ three-year plan (by Barclays)

- Barclays’ official interview prep guide (by Barclays)

UBS Investment Bank

- About UBS

- UBS sustainability and impact strategy (by UBS)

- UBS checklist for interview prep (by UBS)

Deutsche Bank

- About Deutsche Bank

- Deutsche Bank strategy (by Deutsche Bank)

- Deutsche Bank interview prep guide (by Deutsche Bank)

6.2 Practice by yourself

Acing behavioral questions is harder than it looks. You’ll stand out if you put in the required work to craft concise and direct answers.

We recommend starting with our guides below to prepare for your behavioral & fit interviews. You’ll also find a few additional articles that can help you understand the full IB interview process:

General

- Investment banking interview prep guide

- 15 investment banking interview tips

- Investment banking interview cheat sheet

- How to answer “Why X company” question

- Investment banking interview accounting questions guide

- Investment banking HireVue interview guide

Goldman Sachs

J.P. Morgan

- JP Morgan interview prep guide

- JP Morgan behavioral interview guide

- JP Morgan HireVue interview guide

Morgan Stanley

6.2.1 Write down your answers

First, work out which stories you’d like to tell. Make a list of key moments in your career (e.g., accomplishments, failures, team situations, leadership situations, etc.) that you can use to answer one or multiple questions.

Take a look at your target company’s main attributes and their core values, then find at least one story from your past that exemplifies each one.

After you’ve finished your list, write out a story for each key moment in your career using the structure we've laid out in Section 3. Be sure to emphasize your impact in each of these examples, quantify the results of your actions, and explain the lessons you learned from the experience.

Once you have a bank of stories, go through the questions in Sections 2 and 4. Make sure you’d be able to answer all of them either by using one of the stories you’ve written directly or by adapting it on the fly.

If you identify any gaps, add stories to your bank until you’re comfortable that you can cover all the questions listed in this article. For reference, we estimate this will require around 10-15 stories for most candidates.

6.2.2 Practice your answers out loud

After you've written everything down, a great way to practice your answers is to interview yourself out loud. This may sound strange, but it will significantly improve the way you communicate during an interview.

You should be able to tell each prepared answer and story from your bank naturally, neither missing key details nor memorizing them word-for-word. Geert also suggests using a timer while you practice to simulate the pace of a real interview and keep your answers concise.

Play the role of both the candidate and the interviewer, asking questions and answering them, just like two people would in an interview. Trust us, it works.

6.3 Practice with peers

If you have friends or peers who can do mock interviews with you, that's an option worth trying. It’s free, but be warned, you may come up against the following problems:

- It’s hard to know if the feedback you get is accurate

- They’re unlikely to have insider knowledge of interviews at your target company

- On peer platforms, people often waste your time by not showing up

For those reasons, many candidates skip peer mock interviews and go straight to mock interviews with an expert.

6.4 Practice with ex-investment banking interviewers

In our experience, practicing real interviews with experts who can give you company-specific feedback makes a huge difference.

If you know someone who runs interviews at an investment bank, then that’s amazing! They'll be a great person to practice interviews with.

But most of us don’t, and it can be REALLY tough to make a new connection with an investment banker. And even if you do have a good connection already, it might also be difficult to practice multiple hours with that person unless you know them extremely well.

That’s where mock interviews come in.

Find an investment banking interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Save time by focusing your preparation

Click here to book investment banking mock interviews with experienced finance interviewers.