Accounting questions are one of the technical questions you’ll encounter in investment banking (IB) interviews. They test how well you understand accounting fundamentals, the link between financial statements, and how to interpret a company’s financial health in live deals.

To help you prepare, below is a list of accounting questions that have been asked at top investment banking firms. We identified these by analyzing 200+ Glassdoor interview reports specifically for analyst roles at Goldman Sachs, J.P. Morgan, and Morgan Stanley.

From that list, we’ve selected the six most common accounting questions and included tips, a prep plan, and sample answers to help you structure strong responses and feel confident going into your interviews.

- What to expect in IB accounting interviews

- 7 Different topics covered in IB accounting interviews

- 6 most common questions in IB accounting interviews (with answers)

- More IB interview accounting questions (by company)

- Prep plan

Click here to practice 1-on-1 with investment banking ex-interviewers

Let’s get started.

1. Overview

Before we go through the most common topics in investment banking accounting interviews, let’s first take a look at why these questions are asked in the first place.

1.1 What are IB accounting interview questions?

Accounting questions in investment banking interviews assess how well you understand accounting basics and how the financial statements flow together.

Investment banking analysts need to understand how companies measure and report their financial health, as this is fundamental to all valuation and deal-making processes.

But unlike accountants or auditors, you’re not expected to understand financial reporting and audit concepts, such as debits, credits, or general ledgers. What matters is that you can read financial statements, explain business performance, and analyze how specific decisions or transactions impact its financial position.

1.2 When can you expect to be asked them?

IB accounting questions usually come up during the final round of interviews (for entry-level roles, this is known as the “Superday”). This stage takes place after the online assessments and initial HireVue or phone screen interviews and before you receive the final offer.

During Superday, candidates meet with multiple team members in back-to-back interviews. This is when you can expect most of the technical questions, including those on accounting and valuation.

1.3 What skills are they testing for?

Interviewers want to know that you can apply technical concepts to real business problems. According to Hashim (analyst at Lazard, ex-JP Morgan), you’ll be tested on the following skills:

- Core technical skills: understanding how transactions flow through the three financial statements and how key line items interrelate

- Analytical thinking: linking cause and effect (e.g., “What happens to all three statements if depreciation increases?”) and interpreting how business decisions affect a company’s financial position

- Numerical agility: comfort with mental math and quick estimation (e.g., changes in EPS, leverage ratios)

- Business intuition: knowing why the numbers matter by linking accounting mechanics to valuation, financing, and deal dynamics

- Attention to detail: Explaining concepts and numbers clearly and accurately

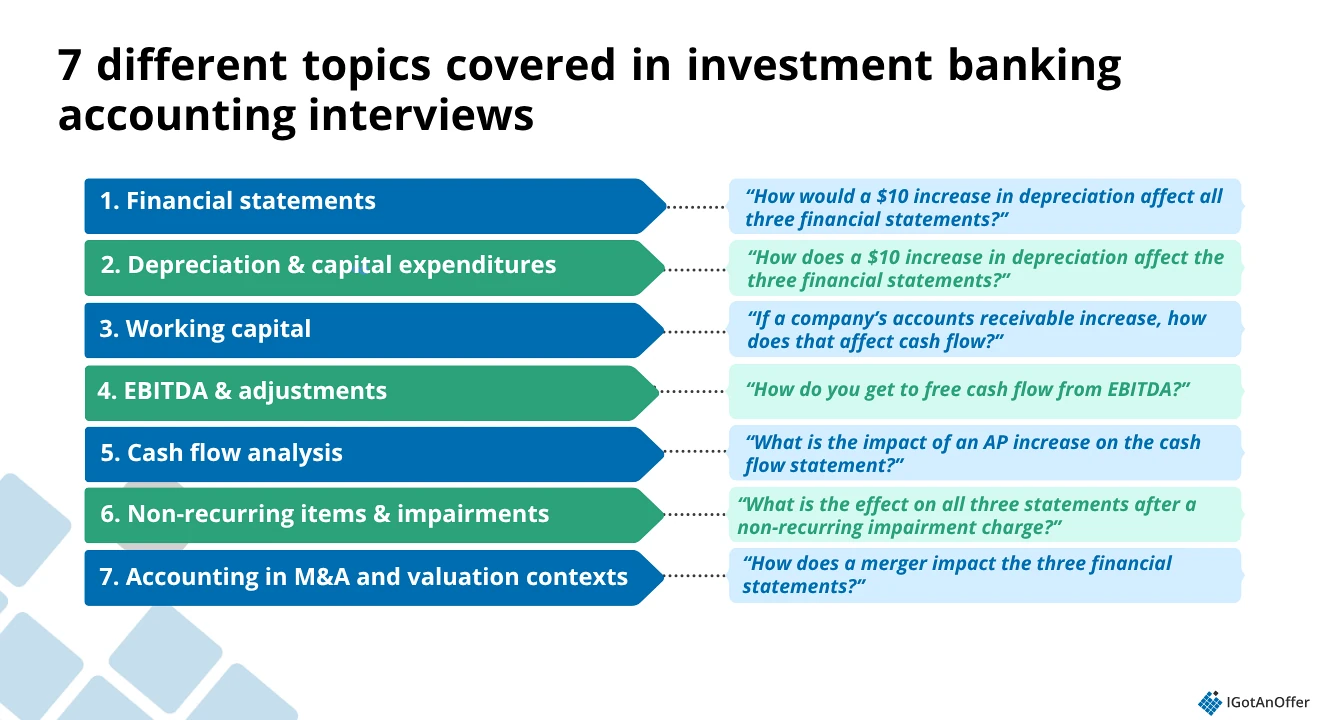

2. 7 Different topics covered in IB accounting interviews ↑

The accounting topics covered in investment banking interviews can be broad and varied.

Based on reports from real candidates at Goldman Sachs, J.P. Morgan, and Morgan Stanley on Glassdoor, as well as insights from Hashim (analyst at Lazard, ex-JP Morgan), we’ve narrowed down the seven areas you should focus on during your prep.

2.1 Financial statements

A large portion of accounting questions in investment banking interviews will focus on the financial statements. These often start with prompts, such as “Walk me through the financial statements,” “How do the three statements link together?”, or “How does x affect the financial statements?”

These questions test whether you understand how the three financial statements (income statement, balance sheet, and cash flow statement) interconnect. You should be able to explain how a change in one statement affects the others and what that means for a company’s financial health.

In rare cases, you might encounter questions around a fourth statement, the Statement of Shareholders’ Equity. However, these are uncommon and usually only come up when discussing retained earnings, share repurchases, or other equity-related adjustments.

Example questions:

“How would a $10 increase in depreciation affect all three financial statements?”

“If a company’s net income increases, how does that change flow through the financial statements?”

Learn more about financial statements on the Investopedia website.

2.2 Depreciation and capital expenditures

Depreciation and capital expenditures (CapEx) have a direct impact on a company’s profitability, cash flow, and valuation.

When a company invests in long-term assets, it reduces cash in the short term but increases assets on the balance sheet. Over time, those assets are depreciated, which lowers reported net income but doesn’t reduce cash flow since depreciation is a non-cash expense.

Interviewers use these questions to test whether you can track these movements across the financial statements and explain how they affect key metrics like free cash flow, EBITDA, and enterprise value.

Example questions:

“How does an increase in depreciation expense affect the three financial statements?”

“Where does CapEx appear on the financial statements, and how does it impact free cash flow?”

Learn more about depreciation and CapEx on the Investopedia website.

2.3 Working capital

Working capital questions test your understanding of a company’s short-term liquidity and cash flow. Interviewers want to see if you can explain how current asset and liability changes affect cash flow and what that means for a company’s operations.

Example questions:

“If a company’s accounts receivable increase, how does that affect cash flow?”

“What might cause a company to have negative working capital, and is it always a bad sign?”

Learn more about working capital on the Investopedia website.

2.4 EBITDA and adjustments

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is used to measure a company’s operating performance and compare profitability across firms. Interviewers often use EBITDA questions to see if you understand how it connects to free cash flow (FCF) and how adjustments can vary by industry.

These questions are common in firms like Goldman Sachs, but you may also encounter them in other bulge bracket and middle-market interviews.

Example questions:

“How do you get to free cash flow from EBITDA?”

“What are the adjustments between EBITDA and adjusted EBITDA in a healthcare company?”

Learn more about EBITDA and adjustments on the Investopedia website.

2.5 Cash flow analysis

Cash flow analysis is central to investment banking because cash determines a company’s ability to operate, invest, and service debt. These questions test whether you can track how cash moves within a business and explain its implications for the company’s financial health and valuation.

Example questions:

“Explain how to create a cash flow analysis.”

“What is the impact of an AP increase on the cash flow statement?”

Learn more about cash flow analysis on the Investopedia website.

2.6 Non-recurring items and impairments

These types of questions test whether you understand how one-time or non-cash charges affect each of the financial statements. Non-recurring items and impairments can distort a company’s reported earnings, so bankers want to see if you can distinguish recurring results from one-time accounting hits.

Example questions:

“What is the effect on all three statements after a non-recurring impairment charge?”

“What happens on the financial statements when goodwill impairment increases by 100?”

Learn more about non-recurring items and impairments on the Investopedia website.

2.7 Accounting in M&A and valuation contexts

To succeed in investment banking, you need to apply accounting principles to real investment deals. This requires a good understanding of how transactions affect a company’s financial position, performance, and valuation.

You should be able to explain how a deal impacts the financial statements, how goodwill and other adjustments are created, and how different deal structures (cash vs. stock) influence earnings, leverage, and ownership.

Example question:

“How does a merger impact the three financial statements?”

“How do these three financial statements relate to X transaction?”

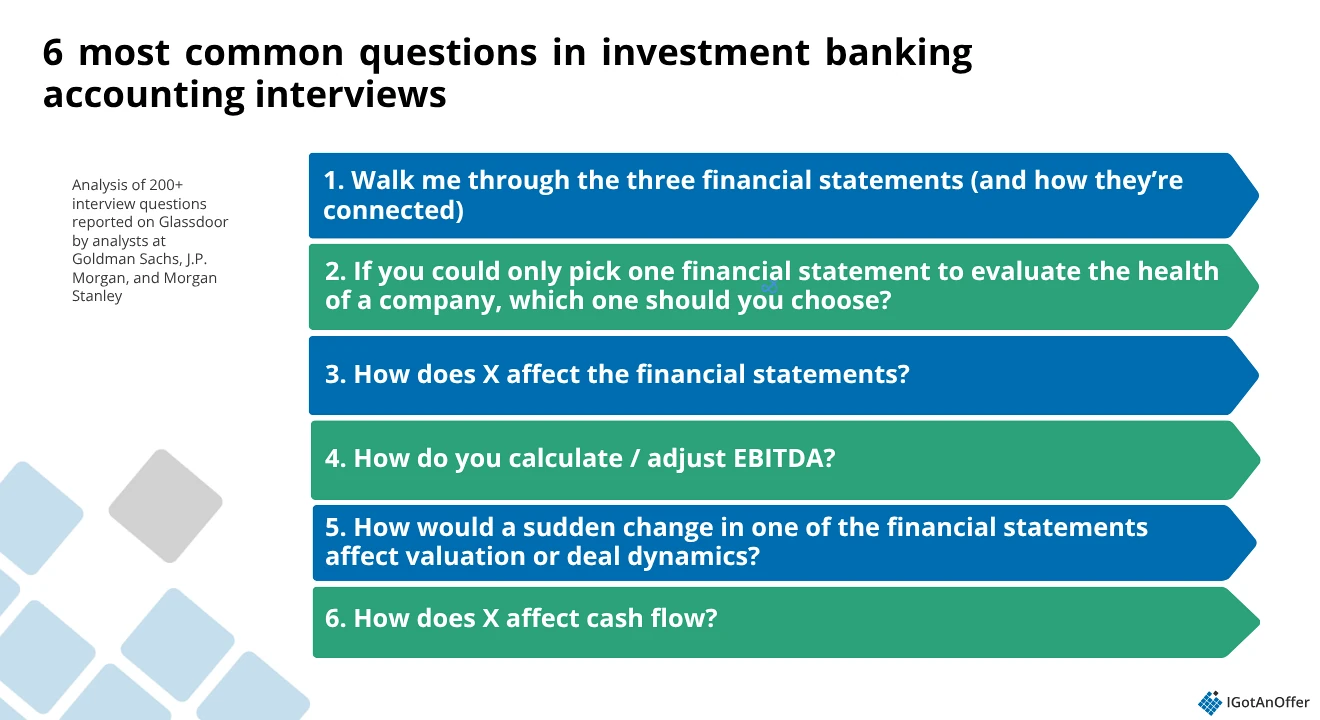

3. 6 most common questions in IB accounting interviews (with answers) ↑

The questions below are pretty typical in investment banking interviews at top firms, such as Goldman Sachs, J.P. Morgan, and Morgan Stanley. We analyzed hundreds of accounting interview questions from these companies and identified the ones that come up most frequently.

We recommend reviewing this list ahead of your interview and using the linked explanations to deepen your understanding of each topic.

Let’s get into each question.

1. Walk me through the three financial statements (and how they’re connected)

This accounting question is almost always guaranteed to come up in any investment banking interview. Interviewers ask it in different ways to test how well you understand the financial statements and the connections between them. The most common versions are:

- “Walk me through the three financial statements.”

- “How are the financial statements linked?”

- “Tell me how the financial statements flow together.”

There are many ways that changes in one statement can affect the others, so there’s really no substitute for a deep understanding of how financial statements work.

A good way to prepare for this type of question is to learn one or two clear “paths” that show how information flows across the income statement, cash flow statement, and balance sheet. Once you understand those links, you’ll be able to give a confident and concise answer every time.

Here’s a nice video overview of how to approach this type of question:

You'll also find our investment banking interview cheat sheet helpful in preparing for this type of question, because it uses arrows to illustrate multiple "paths" that run through the three main financial statements.

2. If you could only pick one financial statement to evaluate the health of a company, which one should you choose, and why?

Assuming you answered question no.1 correctly, this is a common follow-up question you might get.

The most probable answer here is the cash flow statement, because it provides the clearest picture of a company’s liquidity and ability to generate cash, which is essential for paying down debt, funding operations, and investing in future growth.

You can pick a different answer for this question, BUT you’ll need to provide a good justification for your choice. For example:

- You could choose the balance sheet, because assets are the true driver of cash flow.

- Or you could choose the income statement, because it reflects a company’s earning power and profitability on an accrual basis.

If you go with the cash flow statement, here’s a simple way to structure your answer:

- Clearly state which statement you’d pick.

- Explain why it gives the best insight into a company’s financial health.

- Briefly explain why the other two, while useful, might not be the best options.

- Reiterate why you chose your answer.

Sample answer: If you could only pick one financial statement to evaluate the health of a company, which one should you choose, and why?

“I’d choose the cash flow statement because it shows how much actual cash the company generates from its operations, which is the clearest indicator of financial health.

In contrast, the balance sheet provides an overview of assets, liabilities, and equity, but it’s only a snapshot at a single point in time and doesn’t show how cash moves through the business.

The income statement shows profitability, but it includes non-cash items like depreciation and stock-based compensation that can distort how well the company is actually performing.

That’s why I’d go with the cash flow statement; it cuts through accounting noise and shows whether the company can consistently generate cash to fund operations, service debt, and invest in growth.

At the end of the day, cash flow determines whether the business can sustain itself."

3. How does X affect the financial statements?

This question usually comes up early in the technical round, right after basic accounting questions.

Before moving on to this, we recommend perfecting your answer to “Walk me through the three financial statements,” since understanding how the statements connect is the foundation for nearly every accounting question that follows.

This question can be phrased in several ways, but the most common versions focus on depreciation or impairment charges. For example, you might be asked, “How does a $10 increase in depreciation affect the three financial statements?” or “What is the effect on all three statements after a non-recurring impairment charge?”

In any case, your interviewer wants to see whether you can clearly explain how a single change moves through all three statements and what it means for the company’s financial health.

Below is an example of how you can approach this question.

Sample answer: How does a $10 increase in depreciation affect the three statements?

When answering this question, we recommend starting with the income statement, then moving to the cash flow statement, and finishing with the balance sheet.

This order follows the natural flow of information among the three statements:

Net income (Income Statement) → Cash (Cash Flow Statement) → Assets and Equity (Balance Sheet).

So, you might say:

“Starting with the income statement, depreciation goes up by $10, which reduces pre-tax income by $10. Assuming a 20% tax rate, net income decreases by $8.

On the cash flow statement, net income is down by $8 under cash flow from operations. However, because depreciation is a non-cash expense, you add back the $10 increase in depreciation. That means cash flow from operations increases by $2. There are no changes to cash flow from investing or financing, so the net change in cash increases by $2.

On the balance sheet, cash increases by $2 under assets, while PP&E decreases by $10 due to the higher depreciation. Total assets are therefore down by $8.

Finally, on the liabilities and equity side, retained earnings decrease by $8 because of the lower net income, and the balance sheet balances.”

You can learn more about how a $10 depreciation flows through the three financial statements in the video below.

4. How do you calculate / adjust EBITDA?

As mentioned in Section 2.4, these questions are typically asked in Goldman Sachs interviews. So, if you’re only interviewing with other firms, then you should prioritize the other questions in this list before preparing for this one.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is sometimes used as an “anchor” for various accounting interview questions.

In other words, you might be asked how to get to EBITDA from revenue. Or you might be asked how to get to free cash flow from EBITDA. Or you may encounter some other variation.

Answering these questions will require a thorough understanding of EBITDA and the financial statements, not necessarily because the specific question is complex, but because it’s difficult to predict which element your interviewer will ask you to focus on.

Let’s look at how to answer the following example.

Sample answer: How do you get from EBITDA to free cash flow?

- First, confirm which version of FCF the interviewer wants. Let’s assume they want FCFF (free cash flow to the firm, also called unlevered cash flow).

- FCFF = EBITDA - Tax - Change in Working Capital - Capital Expenditures

- If you’ve been provided with data, you can then crunch the numbers.

You can learn more about the relationship between EBITDA and cash flow in this short video:

5. How would a sudden change in one of the financial statements affect valuation or deal dynamics?

A sudden change in a company’s financial statements can lead to concerns about its reliability and risk profile, which can, in turn, influence the valuation and negotiation of deals.

Because of this, interviewers want to assess your understanding of both the financial and strategic implications of these changes, as they often impact how deals are priced, structured, and executed.

One approach to this question is to use ‘cause-of-change analysis’. Investment banking professionals use this technique to explain why a company's financial results have changed over different periods by isolating the impacts of different performance drivers.

This analysis allows for more informed decisions regarding the company's valuation or the potential risks associated with a deal.

Here’s an overview:

- Compare periods: Start by comparing the company’s financial statements from two periods (e.g., this year vs. last year) to identify where the biggest changes occurred.

- Identify drivers: Identify the main factors behind those changes (e.g., shifts in revenue, margins, operating expenses, tax rates)

- Isolate impact: Assess how much of the change each factor contributed by holding other items constant

- Quantify results: Break down how much of the total change came from each driver, and link those findings to valuation and deal considerations (e.g., recurring vs. one-off items, impact on cash flow, leverage, or earnings multiples).

Let’s apply this using the sample question below.

Sample question: If a company reports a sudden 20% drop in net income this quarter, how would that affect its valuation and the ongoing deal process?

1. Compare periods

Start by reviewing the company’s financial statements for the current and previous quarters to pinpoint the magnitude and location of the change.

“Net income is down 20% quarter over quarter, mainly driven by lower gross profit and higher SG&A.”

2. Identify drivers

Next, explain what caused the change. Determine whether it was due to lower sales, higher costs, or something non-operational.

“Revenue fell about 5% on softer demand, and SG&A increased due to a one-time restructuring charge.”

3. Isolate the impact of the change

Then, quantify how much each factor contributed to the decline while holding others constant.

“Roughly two-thirds of the decline came from core operations such as sales volume and margins, while the remaining third was due to the one-time restructuring cost.”

4. Quantify results and link to valuation

Finally, translate these findings into their effect on valuation and deal terms.

“Since most of the drop is operational, EBITDA and free cash flow would both fall, which lowers enterprise value under trading multiples and DCF. In a live deal, the buyer might push for a lower price, add an earnout tied to future margin recovery, or extend diligence to verify whether this decline is temporary.”

6. How does X affect cash flow?

Cash flow analysis is one of the most important skills in investment banking. Bankers use it to evaluate a company’s liquidity, assess risk, and determine enterprise value when structuring transactions such as mergers, acquisitions, or capital raises.

The first step to mastering these types of questions is understanding how cash flow statements reflect the movement of cash across operating, investing, and financing activities. That way, you can easily assess and explain to your interviewer how a change in a single line item could affect a company’s liquidity, leverage, and financial health.

Let’s look at how to answer a sample question you might get in interviews at firms like J.P. Morgan or Morgan Stanley.

Sample question: What is the impact of an increase in accounts payable on the cash flow statement?

When answering this type of question, it helps to think through the logic behind working capital changes and how they flow through the financials.

An increase in accounts payable means the company is taking longer to pay its suppliers. Because this delay doesn’t change the company’s revenues or expenses immediately, there’s no direct effect on the income statement in that period.

On the cash flow statement, the change appears in the cash flow from operating activities section. Since the company hasn’t paid out cash yet, the increase in accounts payable represents a source of cash.

As a result, cash flow from operations increases by the same amount, which also increases the company’s ending cash balance.

If you were to extend your answer to the balance sheet for completeness, cash (an asset) would rise by the same amount as accounts payable (a liability), keeping the balance sheet in equilibrium.

In short:

- No change to the income statement

- Operating cash flow increases by the amount of the AP increase

- Ending cash balance rises on the cash flow statement

You can conclude your answer with something like:

“An increase in accounts payable boosts operating cash flow because the company is delaying cash payments to its suppliers. It’s a short-term cash inflow that can improve liquidity in the near term, but sustained increases might indicate potential pressure on supplier relationships or working capital efficiency.”

You can check out this video for a refresher on how cash flow statements work.

4. More IB interview accounting questions (by company) ↑

The questions in Section 3 cover the most commonly asked accounting questions, but each major investment bank tends to have its own variations and focus areas.

For example, our analysis of Glassdoor reports shows that Goldman Sachs tends to ask about accounting adjustments like EBITDA and non-recurring items, J.P. Morgan often focuses on how accounting changes impact a company’s performance, and Morgan Stanley usually asks candidates to connect accounting concepts to valuation and transaction analysis.

Below, you’ll find a longer list of company-specific examples you can practice with from Goldman Sachs, J.P. Morgan, and Morgan Stanley.

Example of Goldman Sachs IB interview accounting questions

- What are the big three financial statements?

- How do the three financial statements connect to each other?

- How does depreciation move throughout the financial statements?

- Walk me through $10 of depreciation and its impact on the firm.

- A company’s depreciation expense increases by $10. Assuming a 20% income tax rate, what is the impact on net income?

- Walk through how depreciation affects the three financial statements.

- What is the effect on all three statements after a non-recurring impairment charge?

- What are the adjustments between EBITDA and adjusted EBITDA in a healthcare company?

- How do you get from EBITDA to free cash flow (FCF)?

- How do I get to levered free cash flow (FCF)?

- If a not-for-profit company raises debt, how does it flow through the financial statements?

Check out our Goldman Sachs interview guide for more company-specific insights and information.

Example of J.P. Morgan IB interview accounting questions

- How are the three financial statements related?

- Describe how the three financial statements are linked by CapEx.

- Walk me through a depreciation expense, in year 0 and then in year 1, of a $100,000 purchase of a building.

- How does a $10 increase in depreciation affect the three financial statements?

- What is the impact of an accounts payable increase on cash flow?

- How do interest rate changes transmit to corporate balance sheets?

- A shoemaker in New York makes shoes for his clients. Give me your scenario of his balance sheet this season. Now link his balance sheet, income statement, and cash flows together.

Check out our J.P. Morgan interview guide for more company-specific insights and information.

Example of Morgan Stanley IB interview accounting questions

- Walk me through the three financial statements.

- Walk me through Profit & Loss.

- Walk me through a balance sheet.

- What happens on the financial statements when goodwill impairment increases by 100?

- How do these three financial statements relate to a specific transaction?

- Explain how to create a cash flow analysis.

Check out our Morgan Stanley interview guide for more company-specific insights and information.

5. How to prepare for IB accounting interviews ↑

As you can see from the complex questions above, there is a lot of ground to cover when it comes to investment banking interview preparation. So it’s best to take a systematic approach to make the most of your practice time.

Below are links to free resources and a plan to help you prepare for your IB accounting interviews.

5.1 Research the company you’re applying to

In many cases, investment banking accounting interview questions will be tied to the company’s actual deals and client base. If you’re applying to a specific team, study their recent transactions, industry coverage, and priorities.

Take the time to understand which types of clients or projects you’d most likely be working on based on the job description, and research them thoroughly. Look up relevant deal announcements, investor presentations, and press releases so you can speak confidently about the company’s recent activities and how you would contribute to similar transactions.

If you want to learn more about your target firm, or are simply curious about what to expect in an investment banking interview, check out the resources below.

We’ve included useful links for the top 8 firms commonly regarded as “bulge bracket” banks, known for their large-scale deals and rigorous hiring processes:

General

- Investment banking interview prep guide (by IGotAnOffer)

- 15 investment banking interview tips (by IGotAnOffer)

- Investment banking interview cheat sheet (by IGotAnOffer)

- How to answer “Why X company” question (by IGotAnOffer)

Goldman Sachs

- Goldman Sachs interview prep guide (by IGotAnOffer)

- Goldman Sachs behavioral interview guide (by IGotAnOffer)

- Goldman Sachs’ purpose and values (By Goldman Sachs)

- Goldman Sachs Briefings newsletter (By Goldman Sachs)

- Goldman Sachs strategy teardown (by CB Insights)

J.P. Morgan

- JP Morgan interview prep guide (by IGotAnOffer)

- JP Morgan behavioral interview guide (by IGotAnOffer)

- JP Morgan HireVue interview guide (by IGotAnOffer)

- Who we are (By JP Morgan)

- JP Morgan weekly brief (By JP Morgan)

- JP Morgan strategy teardown (by CB Insights)

Morgan Stanley

- Morgan Stanley interview prep guide (by IGotAnOffer)

- Morgan Stanley behavioral interview prep guide (by IGotAnOffer)

- A culture-driven strategy (by Morgan Stanley)

- Insights (by Morgan Stanley)

- Comparison Morgan Stanley vs Goldman Sachs (by Investopedia)

Bank of America

- Bank of America core values (by Bank of America)

- BofA Insights (by Bank of America)

- BoFa strategy teardown (by Rancord Society)

Citigroup

- About Citi

- Insights (by Citi)

- Citi’s plan to transform its wealth business (by Euromoney)

Barclays Capital

- About Barclays

- Barclays’ three-year plan (by Barclays)

- Barclays’ official interview prep guide (by Barclays)

UBS Investment Bank

- About UBS

- UBS sustainability and impact strategy (by UBS)

- UBS checklist for interview prep (by UBS)

Deutsche Bank

- About Deutsche Bank

- Deutsche Bank strategy (by Deutsche Bank)

- Deutsche Bank interview prep guide (by Deutsche Bank)

5.2 Familiarize yourself with deals related to the company

Real-world deals come up frequently in investment banking interviews, as interviewers want to see if candidates really understand the industry and the important things to consider when looking at a deal.

So, you should prepare to discuss a couple of recent IB transactions in depth, particularly in relation to their accounting implications. Be ready to give your opinion on whether the deal was a good (or bad) move, and memorize some key numbers to back up your analysis.

If you’re applying for a particular group within your target firm, make sure you prepare to discuss deals that are relevant to that group.

You can find information about recent deals by reading the Investment Banking section of the Financial Times, which frequently covers stories involving leading firms.

5.3 Be prepared to talk about the economy and financial markets

Understanding the broader economy is essential for investment bankers because market conditions directly affect a company’s financial performance and, by extension, how its financial statements are interpreted.

You should be ready to explain how changes in global and regional markets might affect a company’s revenue, expenses, financing costs, valuation, etc.

Be ready to give your views on:

- Macroeconomic trends (e.g., inflation, GDP growth, employment data)

- Central bank policy (e.g., rate hikes, quantitative easing, or tightening)

- Market movements (e.g., stock indexes, bond yields, or sector performance)

- Recent transactions that reflect how market shifts are influencing valuations or deal structures

To stay current, you can review market updates and analysis from reliable sources such as The Financial Times, The Wall Street Journal, Bloomberg, Reuters, and CNBC.

5.4 Refresh your memory with a cheat sheet

When it comes to technical questions in particular, a cheat sheet is useful for a quick refresher on accounting concepts.

Of course, bringing one to in-person interviews is not the best idea, and even using one for video interviews would not look great. However, it can be useful to reference during initial phone screens (assuming you won’t be on video), while answering practice questions, and as a refresher immediately before an interview begins.

That said, it's important not to become too reliant on it. Hashim (analyst at Lazard, ex-JP Morgan) says that memorizing terms is a common mistake he observes in candidates. You should focus on understanding the connections between concepts so that if one factor changes, you can still confidently adapt and reframe your answer.

You can check out our investment banking interview cheat sheet, with information around DCF, valuation, the financial statements, and a few additional formulas.

5.5 Be comfortable performing quick mental math

Calculators are not usually allowed in investment banking interviews. The good news is that you won’t need to perform complex modeling, only basic mental arithmetic and ratio logic.

If you’re out of practice with doing calculations by hand, start by reviewing the fundamentals. Khan Academy has several helpful resources for refreshing your arithmetic skills. Here are a few we recommend:

Once you're feeling comfortable with the basics, you'll need to regularly exercise your mental math muscle to become as fast and accurate as possible.

You might want to use some of the following resources. We haven't tested all of them, but some of the candidates we work with have used them in the past and found them helpful.

- Preplounge's math tool. This web tool is very helpful to practice additions, subtractions, multiplications, divisions, and percentages. You can both sharpen your precise and estimation math with it.

- Victor Cheng's math tool. This tool is similar to the Preplounge one, but the user experience is less smooth in our opinion.

- Mental math cards challenge app (iOS). This mobile app lets you work on your mental math easily on your phone. Don't let the old school graphics deter you from using it. The app itself is actually very good.

- Mental math games (Android). If you're an Android user, this one is a good substitute for the mental math cards challenge one on iOS.

5.6 Practice with real financial statements

As we’ve established, a great percentage of your IB accounting interview questions will be about the financial statements. Hence, it only makes sense to get hands-on experience by reviewing real company filings.

For example, you can examine Microsoft's financials for free and see how the different statements flow together. This is important for a couple of reasons:

First, the financial statement examples provided in interview prep guides are often simplified for illustration. As a result, you’ll be missing key details unless you also study the details of real-world statements.

Second, by looking at real statements for large publicly traded companies, you can get a better sense of the underlying financials for the kinds of clients you’d be working with at big-name firms like Goldman Sachs.

You can also practice building spreadsheets with the company’s data and manipulating the information yourself. Doing so will help you internalize how accounting movements flow through each statement.

5.7 Catch the hints

Most interviewers have good intentions. They're here to help you perform at your best. During your interviews, they may give you subtle hints about where to take your answer.

If they try to steer you in a direction, follow them, as they're trying to help you. This might sound obvious, but candidates sometimes get so stressed out that they don't pick up on the hints interviewers give them.

Get feedback from ex-investment banking interviewers

In our experience, practicing real interviews with experts who can give you company-specific feedback makes a huge difference.

If you know someone who runs interviews at an investment bank, then that’s amazing! They'll be a great person to practice interviews with.

But most of us don’t, and it can be REALLY tough to make a new connection with an investment banker. And even if you do have a good connection already, it might also be difficult to practice multiple hours with that person unless you know them extremely well.

That’s where mock interviews come in.

Find an investment banking interview coach so you can:

- Test yourself under real interview conditions

- Get accurate feedback from a real expert

- Build your confidence

- Get company-specific insights

- Save time by focusing your preparation

Click here to book investment banking mock interviews with experienced finance interviewers.